(PPTX, Unknown) - Committee on Public Finance and

advertisement

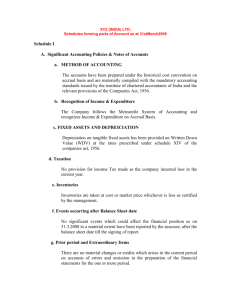

Committee on Public Finance & Government Accounting The Institute of Chartered Accountants of India (ICAI) The Institute of Chartered Accountants of India (ICAI) is a statutory body established under the Chartered Accountants Act, 1949 for the regulation of the profession of Chartered Accountants in India. During its more than six decades of existence, ICAI has achieved recognition as a premier accounting body not only in the country but also globally, for its contribution in the fields of education, professional development, maintenance of high accounting, auditing and ethical standards. ICAI is a founder member of International Accounting bodies namely the International Federation of Accounts (IFAC), Confederation of Asian and Pacific Accountants (CAPA), South Asian Federation of Accounts (SAFA), International Innovation Network (IIN), and is a member of Asian Oceanian Standard Setters Group (AOSSG) and XBRL International. ICAI now is the second largest accounting body in the world. The ICAI have around 2.17 lakh members at present, a total of 10 lakh students are currently pursuing the course in various centres across the country. Besides 21 chapters in foreign countries, this apex body of chartered accountants had five regional head quarters, 146 branches making it one of the largest organisation. ICAI Vision To be World’s leading accounting body: ICAI envisions becoming the world’s leading accounting body by playing a predominant role in setting world class standards in identified service areas developing thought leadership and research that addresses concerns of countries, developed, developing and under-developed. World’s leading accounting body, a regulator and developer of trusted and independent professionals with world class competencies in accounting, taxation, finance and business advisory services. About the Committee on Public Finance & Government Accounting The Committee on Public Finance and Government Accounting is a non-standing technical Committee of the Institute of Chartered Accountants of India formed under the regulatory provisions of the Chartered Accountants Act. The committee review the existing Government Accounting System and that basis suggest improvement along with creating awareness regarding Public Finance & Government Accounting to the stakeholders including employees of the Government, members of the profession, media, NGO’s and the society at large. The committee collaborates with various ministries and professional bodies to draw synergies in enhancing accountability and transparency including public service delivery mechanism and uploading the public interest. It endeavors towards increasing the role of ICAI and its member in the various financial inclusion initiatives of the Governments. Cont… The Committee suggest reforms in Government Accounting System, such as Cash to Accrual Accounting System, Single Entry to Double Entry Accounting system. It collaborates with International Financial Institutions / Universities / research and training institutes for undertaking collaborative research and exchange of information and publication. It aims to provide training with in Government bodies, to evolve methods which would enable in use of present day information technology in assisting the accounting reform process, collaboration and coordination with Comptroller & Auditor General of India (CAG) and Controller General of Accounts (CGA) to bring improvements in the framework of Government Accounting System. The Committee on Public Finance & Government Accounting plays an important role in providing policy inputs to the Government in the areas of fiscal reforms, financial sectors reforms and Public Finance. Cont… Shifting from Single Entry to Double Entry/Cash to Accrual Accounting Development of Accounting Manual, Training on Finance for Non-Finance professionals Deliverables Financial Literacy, Energy Audit, Sector specific training, Internal Audit and Stock Audit Accounting and Public Finance Reforms, Professional Opportunity for members. Terms of Reference of the Committee on Public Finance & Government Accounting for the year 2014-15 To study, review and suggest reforms in Government Accounting System to ensure proper utilization and control over Public Finance. To review, analyze, assist, recommend and suggest measures to the Central, State & Local Government, Public Sector Undertakings and other organizations including Municipal Corporation, Blocks, Gram Panchayats in the areas of Policy assessment, planning and execution in public finance. Collaboration and coordination with Comptroller & Auditor General of India (CAG), Controller General of Accounts (CGA) and various Ministries/Government Departments/Local Bodies for developing a mechanism of improving the Government Accounting System. Cont… Providing awareness of Government Accounting to the society at large and specifically to the stakeholders including inter–alia to employees of the government, C&AG, members of the profession, media, NGOs and to citizens generally. To review budgets, circulars, notifications and other matters on public finance & policies and to send suitable memorandum/ representation containing suggestions for improvements and/or rationalization in the legislation or revenue/expenditure of Central/ State Government keeping in view the overall development of the Nation. To assist in developing Public Finance structure and a robust mechanism for channelising adequate resources to ensure appropriate sectoral allocation for inclusive growth and economic development. Enhancing the accountability and transparency in public service delivery mechanism. To study and suggest ways and means of broadening the tax base and increasing tax mobilization. To suggest checks and balances for monitoring periodical review/ audit of end use of funds. To bring out newsletters, publications, and other useful inputs in areas of contemporary issues related to public finance and government accounting. Cont… To form taskforce as required at Regional / State level for attainment of objectives of the Committee. To undertake and organize training courses, seminars, workshops and policy dialogue with a view to enhance understanding of issues concerning public finance and government accounting. To increase the role of ICAI and its members in the various “Financial Inclusion” initiatives of the Government which would mainly emphasis on: Assisting government in bringing appropriate regulatory and educational policy framework in place. Collaborating intensively with different chambers and associations of industry. Enhancing the role of members of the Institute of Chartered Accountants of India in Public Finance and Government Accounting. To provide appropriate support to the Council and its Committees on the matters related to Public Finance and Government Accounting. Committee on Public Finance & Government Accounting Endeavours ADVISORY Technical inputs provided to C&AG, CGA, RBI, SEBI, CBDT, CBEC, IRDA etc… Observation Report on Convergence of Resources of the State Meghalaya Offered ICAI services on Tax Administration Reform Commission. Expert Group advisory to Dept. of Public Enterprise, Govt. of India on The Revised Schedule-VI under the Companies Act. Spearheaded XBRL revolution in the country with active participation of Ministry of Corporate Affairs (MCA), SEBI, IRDA and RBI. Submitted the inputs to Ministry of Finance, Govt. of India on the Economic Survey 2012-13. Nodal agency for facilitating wide dissemination of converged accounting standards. Implementation of an Accrual Based Double Entry Accounting System in Kerala State Insurance Department (KSID)…… Cont… INPUTS ON ACCRUAL ACCOUNTING Provided to: Staff in the Postal Accounts Offices in PAN India basis Officials of Municipal Corporation Greater Mumbai Govt. officials of UT of Lakshadweep Officials of Agartala Muncipal Council, Tripura Officials of Kohima and Dimapur Muncipal Council, Nagaland Officials of Finance Department, Govt. of Mizoram Officials of Employees of State Insurance Corporation (ESIC) Officials of Survey of India, Hyderabad… Cont… TRAINING PROGRAMES Joint State Summit with Centre for Taxation Studies, Govt. of Kerala Officials of the Dept. of PE, Ministry of Heavy Industries & Public Enterprises Vat officials of Trade & Taxes Department of Government of Delhi Senior officers of C&AG of India Officers of Superintendent of taxes, Govt. of Mizoram Officials of Survey of India, Officers of Public Enterprises Department, Govt. of Assam and Officials of Finance Dept., Govt. of Tamil Nadu State level Public Enterprises (SLPES) of Andhra Pradesh/ Madhya Pradesh/ Himachal Pradesh/ Karnataka Panchayat Secretaries Autonomous Bodies…. Thrust Areas of the State Level Task Force To help in Conversion from single accounting system to double accounting system. To understand the debt management policy of State govt., including refinancing of existing debts and to give suggestions whatever necessary. To increase the revenue of the state by maximum utilization of resources available in the state. To help in Budgetary Control Framework To help in development of Accounting Manual. To help in Reforms and Control over Public Finance & Government Accounting Mechanism. To help in Conversion from Cash to Accrual Accounting Training of finance for Non-finance professionals To help in proper utilization of funds. To conduct Research and Development in the field of Public Finance and Government Accounts. Thank You