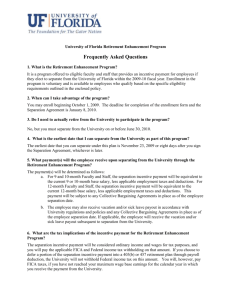

Voluntary Separation Incentive Program

advertisement

Voluntary Separation Incentive Program Presented by: Mary Kay Sankey Staff Benefits Manager UW-Stout Human Resources Voluntary Separation Incentive Program Eligibility Criteria • Faculty member; academic staff member with an indefinite, rolling horizon or fixed-term renewable contract; unclassified limited appointee; or classified permanent staff member • At least 55 years old before July 1, 2015 • Are vested with the Wisconsin Retirement System (WRS) as of July 1, 2015 and are eligible to receive an annuity under the Wisconsin Retirement System (WRS) • Have an UW-Stout original start date on or before July 1, 2010 Effective dates of Separation will be determined by the Chancellor in the best interest of the University Dates of separation will be as follows: • Faculty and instructional academic staff: • Between 7/3/2015 and 1/31/2016, unless authorized by the Chancellor because of exigent circumstances • All other eligible appointment types: • Between 7/3/2015 and 8/31/2015, unless authorized by the Chancellor because of exigent circumstances Dates to Remember! Deadline to submit completed application for consideration in the Voluntary Separation Incentive Program: • No later than Wednesday, May 20, 2015 • Not a binding agreement Chancellor’s decisions on who will be offered Voluntary Separation Incentives will be communicated to applicants: • No later than Friday, June 5, 2015. VSIP Benefit Amount • Your benefit amount is arrived at by taking 50% of your base pay, prorated for your FTE • Base Pay does not include: • Overloads • Winterim, Summer Service / Summer Session amounts • Overtime • Standby pay • Weekend, night, shift differentials, etc. • Any other payments above base salary • Your Incentive is highlighted on Calculation #2 in your packet after Your Employer Additional Contribution Balance Example Classified Staff: Hourly Rate (no add ons): $17.623 X 2080 (x FTE if Part-time) = 36655.84 X 50% = $18,327.92 Separation Incentive Amount Example Unclassified Staff: Academic Year/Annual Base Salary (x FTE if Part-Time) $60,000 X 50% $30,000 Separation Incentive Amount VSIP Distribution Options Employees are able to have the one-time 50% base salary separation payment distributed by any one or a combination of the following: • Lump Sum Payment • Contributions to • Health Savings Account (must have HDHP) • 403(b) • 457 (subject to established plan limits) • Additional Employer Contribution to WRS Account Note: ETF Actuarial Reduction Program option has been removed since the Additional Employer Contribution to WRS Account option became available and provides the same benefit and is available to all employees Employee Responsibility When Selecting Payment Option(s) Employees are responsible for consulting with a tax advisor as to potential tax consequences of choices of separation payment methods. Option 1: Lump Sum Payment Lump sum cash payment at employment end (payment will be processed within 60 days of separation date) Points to consider: • Change withholding exemptions • Complete a new W-4 and return the form to HR • Work with HR on the date to use for your form. • Seek counsel from a tax advisor as to potential tax consequences Option 2: Pre-Tax Investment Options Employee may choose to use any of the pretax investment options we offer: • 403(b) Tax Sheltered Annuity Program • 457 Deferred Compensation Plan (WDC) • Health Savings Accounts (must have a HDHP) Option 2 Pre-Tax Investment Options: Points to consider: • 2015 Plan Limit for Employee age 50 and over • 403(b) TSA Program - $24,000 • Employees with 15 or more years of service with the UW may have an additional catch-up opportunity (check with HR) • 457 WI Deferred Compensation - $24,000 Employees can contribute the maximum to both programs! • HSA contributions limits for 2015 (must have HDHP): • Individual = $3,350 • Family = $6,650 • HSA “catch-up” contributions for 55+ = $1,000 Option 3: WRS Employer Additional Contributions • Credited to the employee account and increases employee’s monthly annuity at retirement • Payable only as a life annuity • Benefit purchased by Additional Contributions is not subject to the formula benefit maximum - 70% of Final Average Salary (65% for Protective Occupations) • The amount added as Employer Additional Contributions has the same effect as using the amount to purchase the Actuarial Age Reduction Actuarial Reduction Benefit (WRS) No longer an option since we have learned the Additional WRS Employer Contributions provide exactly the same benefit and is much easier to calculate and make payment for. Also, the Additional WRS Employer Contribution option is available to all employees (not just those with a higher formula benefit). The option reviews your WRS retirement annuity amount now and compares it to what it would be at the point you reach an unreduced formula benefit. ETF uses a formula to determine the cost associated with funding that higher monthly annuity payment amount. The Unreduced formula amount provides a higher benefit than the estimate using your current age and service Actuarial Reduction Benefit (WRS) Example: Employee is Age 56 with 32.36 YOS Estimate #1 (Based on retirement date of 7/03/2015*) 3 Highest Years of Earnings WRS Creditable Years of Service through 07/03/2015* Reflects Age Reduction Factor Normal Retirement Age (NRA) = 65, or age 57 or more with 30 years of WRS creditable Service * Date may vary based on your actual retirement date Actuarial Reduction Benefit (WRS) Example: Employee is Age 56 with 32.36 YOS Estimate # 2 - Retirement date based on the date eligible for unreduced formula benefit (Age 65 or time at which employee is 57 or older and has at least 30 years of WRS Creditable Service) 3 Highest Years of Earnings Creditable years of service up through 7/03/2015* Reflects Age Reduction Factor - should say NONE since at unreduced benefit * Date will vary dependent upon your actual retirement date Actuarial Reduction Benefit Example Continued Determine if an Actuarial Reduction Exists: 1. If calculation #2 is </= Calculation #1 - there is no actuarial reduction to purchase This happens when the Money Purchase benefit is greater than the Formula benefit in Calculation #1, or if no Age Reduction exists in the formula calculation 2. If calculation #2 is > Calculation #1, an actuarial reduction exists Meaning the unreduced benefit is greater than the current benefit from Calculation #1 Actuarial Reduction Benefit Example Continued Determine the Cost of the Actuarial Reduction: 1. Calculation 2 For Annuitant Life Only Amount: $1,812.41 2. Subtract Calculation 1 For Annuitants Life Only Amount: (1732.66) 3. Result: 79.75 4. Divide by Calculation 1 Money Purchase Factor: ÷ 0.005610 5. Cost of Actuarial Reduction: $14,215.68 Review WRS Estimates Provided Calculations #1 and #2 • Both Calculations use information from your 1/1/2015 WRS Annual Statement of Benefits, provided in packet • Adds earnings and service through 7/3/2015 (Does Not include Military Service, if Applicable) • Money Purchase Amount updated for those with a higher Money Purchase Calculation Estimate Calculation #1: • Regular Retirement Benefit calculated for a retirement date of 7/3/2015 Review WRS Estimates Continued Estimate Calculation #2: • Voluntary Incentive Amount is highlighted after the Your Employer Additional Contribution Balance • Calculation #2 results reflect your retirement benefit amount assuming the entire incentive is applied as Employer Additional Contributions to increase your monthly annuity for your lifetime • You are not required to select Employer Additional Contributions for your incentive disbursement, it is just an option • Use the Department of Employee Trust Funds online WRS Benefit Calculator: http://etf.wi.gov/calculator.htm to determine your benefit amount if you choose not use Employer Additional Contributions or use a different amount • WRS Calculator Instructions are posted on the HR website Health Insurance Retiree pays full premium cost Converted Sick Leave Credits pay premiums until exhausted, available to spouse/DP/dependent child(ren) upon death of annuitant if family plan is in effect Can be escrowed if you have comparable coverage After credits are exhausted, premium taken from annuity check if large enough, otherwise health plan bills retiree –CANCEL coverage if you don’t want it to continue Annual It’s Your Choice Open Enrollment Opportunity Premium reduces when retiree/spouse/DP are eligible for Medicare, age 65 or disability. Must apply for Medicare B when first eligible if retired Change Plans - move from area 3 or more months Sick Leave Conversion Highest Rate X Hours of Sick Leave including supplemental hours, if eligible UW System Sick Leave Calculator: https://www.wisconsin.edu/ohrwd/benefits/sle/ Supplemental Sick Leave Must have 15 years of State Adjusted Continuous Service Will match up to 52 hours for each year, 1– 24 Will match up to 104 hours for each year 25 + 500 hours restored for catastrophic illness If 500 hours are used within 3 years of retirement for one catastrophic illness Restored hours are not matched Craftsworkers not eligible for Supplement Sick Leave Conversion Credit Program Brochure: http://etf.wi.gov/publications/et4132.pdf PAID LEAVE Personal Holidays are not pro-rated upon retirement Vacation is given up front in assuming you will work the entire calendar or fiscal year. If you retire prior to the end of the calendar year (Classified) or fiscal year (Unclass) vacation is pro-rated Unclassified: Jen Schermitzler, schermitzlerj@uwstout.edu All Unclassified leave reports must be in to certify sick leave and payout any used leave Classified: Annette Koleno, kolenoa@uwstout.edu PAID LEAVE, Continued Applicants will not be permitted to use accrued leave balances to extend a Voluntary Separation Incentive Program approved date of separation (i.e. vacation, ALRA, termination sabbatical, personal holiday, compensatory time) However, the last day physically working at UWStout may be before the Voluntary Separation Incentive Program approved date of separation and remaining paid leave may be used to reach the separation date. Return to work After Separation? Participants will not be eligible to be employed by UW-Stout for two years from the date of separation unless authorized by the Chancellor because of exigent circumstances after all break of employment rules and requirements are met NEXT STEPS • Order Official WRS Estimates if seriously considering retirement -- No Obligation to Retire • Packet is good for one year • Takes 3-4 weeks to receive • Order on-line from ETF website • Contact HR to order on your behalf • Request form available on HR website • Call ETF toll-free at 877-533-5020 ETF Additional Resources Webinars: ETF has many webinars available. You can find them on their website under the Webinar tab: http://etf.wi.gov/member_education.htm#tab2 Group Appointments: ETF also has many group appointments for members who have a retirement packet from ETF. It is listed under the Face to Face tab. You will need to click on the West Central district or you can use this link. http://etf.wi.gov/members/westcentral.htm Videos: ETF also has videos available 24/7 listed on the Video/Media tab. You are encouraged to contact ETF, your tax advisor attorney, and/or financial planner to discuss your individual situation! QUESTIONS? Thank you!