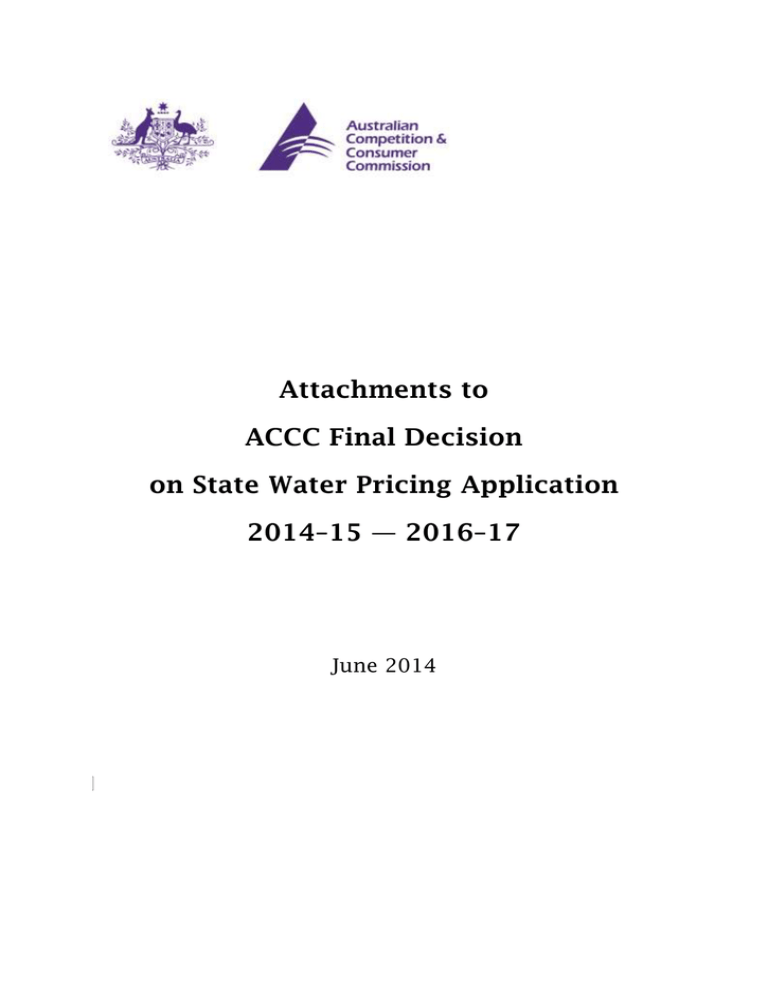

Final decision - Australian Competition and Consumer Commission

advertisement