click here to view a PDF

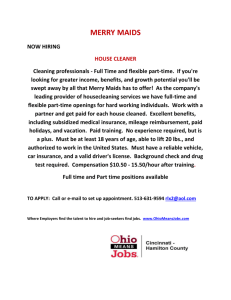

advertisement

Top 100 UK Insurers: Roundtable: Women in Insurance: The gender debate An illustrious group of women discuss the huge strides the industry has made on gender issues and the obstacles that still remain Just as Barack Obama’s election as the first black president of the US led some to claim America was now a ‘post-racial’ society, so Inga Beale’s appointment as the first Lloyd’s of London female chief executive vindicated those who believe the insurance industry’s historic diversity problem is no longer an issue. But while the breaching of that illustrious ceiling was a landmark moment, the decision to appoint the former Canopius chief executive took place against a backdrop of continued under-representation of women in the industry’s upper ranks, and in financial services more widely. According to figures from the Cranfield Institute of Management, women accounted for 20.7% of overall board directorships within the FTSE 100 as of 3 March 2014, up from 17.3% in April 2013. However, of this figure 25.5% were non-executive directorships, with women comprising only 6.9% of executive directorships. The trend was reflected across the FTSE 250, where women accounted for 15.6% of overall board directorships, but only 5.3% of executive directorships. With that in mind, Post gathered six of the industry’s most influential women, and three British Insurance Awards Young Achiever finalists, to discuss whether the apparent progress is reflective of a wider cultural shift – and what obstacles are still preventing women working in insurance from realising their potential. Delegates first tackled the subject of whether the industry has improved in the last two decades, with AIG’s UK managing director Jacqueline McNamee expressing the belief that the industry has made “huge strides” with gender diversification over the last few years. “The level of awareness is improving with the sheer level of appointments that are starting to be made. I’m the first female managing director of AIG UK in 60 years, and we have our first regional chief executive in Seraina Maag running the EMEA region too,” she said. While there is still “a substantial way to go” companies are learning “the benefits of diverse thinking,” she added. Barbara Merry, former chief executive at Hardy Underwriting and chair of the Independent Women in Insurance Network, which launched this year, agreed improvements had been made but said there were still “a lot of young women in our industry who feel they’d like some help as regards how they take steps to move ahead”. She also questioned whether attitudes in all parts of the industry were evolving at the same rate. “I don’t think the Lloyds market, for example, has changed much. In fact, if you look at some of the statistics, I’d say that you might think the position has regressed since I originally joined the marketplace,” she said. Sam Hovey, chief financial officer at Besso, said Lloyd’s brokers had a particularly poor record. “In three out of my four jobs I’ve been either the most senior woman, or the first woman on the board. I was the first woman on the board at Cooper Gay, the first [female] chief executive of Cooper Gay, and at Besso I was the first woman on the board.” Hovey said she believed part of her own success was down to attitude. “I’m very direct. I don’t present any challenges to [men] because I basically act the same as the rest of the guys on the board. There’s a certain reluctance to promote women to the board because [the current members] worry it’s going to change the dynamic,” she said. While a small number of very successful women have made it to the top level, opportunities for women to work their way through the ranks remain limited, Hovey said. “It is very difficult to get to senior positions in Lloyds brokers, particularly [those] of a certain size. [At] bigger ones such as HSBC Insurance Brokers there are many women in very senior positions but that’s part of a bank so there’s a clear career progression. In smaller brokers, you don’t really have that career progression opportunity so you either have to be extremely good at your job and go in at the top [or you don’t make it].” Cause for optimism Despite the attitudes of certain members of the old guard making the path to the boardroom more difficult for women, McNamee said she believed there was cause for optimism, as companies are starting to realise the benefit of having divergent perspectives represented. “I certainly think that on boards we’re on the cusp of an opportunity because people are looking for greater diversity [in terms of] gender, age and ethnic background.” Merry agreed that there was a move to source more female non-executive directors but suggested that there was an element of tokenism to this trend. “For once, I’m the right gender because people want nonexecs who count towards their gender balance. But I don’t personally think that that’s the answer. What we really need is to see more executive women coming through.” The benefits women bring specifically because they are women should not be overlooked, Merry added. “Typically women bring quite a lot of different skills to the party and a lot more right-brained thinking in the way they handle problems. But because that isn’t as tough and aggressive as the way that men do it’s not thought to be as effective.” One area where significant strides have been made is around maternity leave and childcare. Those who had been in the industry for 20 years or more said they had seen huge changes in attitudes towards mothers, and family life more generally. Candy Holland, immediate past president of the Chartered Institute of Loss Adjusters and managing director at Echelon Claims Consultants said she had felt pressure to return to work quickly, which had led to her having only four months and then five months maternity leave after giving birth to her children in the 1990s. Julia Graham, president of the Federation of European Risk Management Association president and director of risk management and insurance at DLA Piper, echoed these sentiments, saying she had given birth to her second child in her holidays, something she said she would “not recommend to anyone”. Holland added that she had deliberately not spoken about her children at work when they were young for fear of being deemed “unprofessional”. But these days, particularly with men starting to share more of the childcare responsibilities, workplaces are more accepting of the fact “you have a life”, she said. While working mothers often feel under scrutiny to show they can still fulfil their work responsibilities after starting a family, Clare White, engineering underwriting account manager at Allianz, said the onus was also on managers to work with talented individuals within their business to ensure that they continued to thrive post-children. “In a leadership role I have a responsibility to help females that work for me that are juggling childcare [and work]. If you’ve got the passion to do it and you’re talented then it’s just as much on me as your manager as it is on you to find a way to make it work,” she said. Being flexible With new technology enabling more flexible working this is becoming easier in logistical terms, but it necessitates a different approach to measuring performance, McNamee suggested. “It’s about training people who manage people that just because you’re not in the office every day, it doesn’t mean the performance [need] suffer. We need different metrics to measure performance.” One problem which transcends the insurance industry is that improvements in the position of women are not always communicated to the younger generation, according to Helen-Clare Pope, head of insurable risk for Tesco and the current chair of the Association of Insurance and Risk Managers. Pope cited a survey from Girl Guiding UK, which found that 60% of women still think that men are more likely to succeed. “That’s quite worrying when you’ve got a huge amount of talent there, a huge amount of girls with lots of potential, and their perception of the workplace is it’s male dominated and men are going to get on” she said. “We’ve got a real education problem with enabling young women to see they’ve got the same potential as men have,” she added. Holland said the lack of visibility of successful women in the industry may lead younger women to perceive a lack of role models, even where many exist. “Women are in really good positions but people don’t know about it. I think more [publicity] of what women have done and achieved will help the confidence of young people coming through.” Louise Jones, business development executive at Thomas Carroll Group, agreed that for some women earlier in their career more contact with successful senior women would be helpful. “I’ve always been of the mindset that if I want to achieve something then I’ll find a way of doing it and proving that I’m good enough to do it. But more needs to be done to show [there are] influential ladies who can help inspire people, especially [when they] are starting out.” With women facing such an uphill struggle to reach the boardroom the idea of mandatory quotas was raised, but viewpoints differed on the effectiveness, and fairness, of this proposition. Circle Insurance Services branch manager Keri-Ann Egan suggested quotas were a form of discrimination. “There are bound to be people that go through [because of their gender] that actually aren’t up to the job,” she said. White added that they were unnecessary and that a focus on good leaders who would nurture talent was more important than targeting a specific gender. “If you put the best leaders in senior jobs they will bring the right talent through. The best person for that job might be a man but if he’s the right person at developing talent then he will bring the right women through in future.” However, others around the table expressed less faith in the current system. Pope suggested that in certain male-dominated environments “a quota may be the only way you can get women in”. “Take the Lloyd’s market. If there’s no other way to get women in do you go for a quota because it forces them to do it and then from that you can develop the best talent?” she asked. Unconscious bias Merry highlighted the issue of unconscious bias, a factor which has been shown to have major implications when it comes to selecting individuals to promote. She refuted the idea that quotas would lead to underqualified individuals holding positions of power. “My sense is that if [a woman] gets to senior management level, she has almost certainly worked as hard as the equivalent male and has probably had to work a lot harder. If she makes that final step to get on to a board because of a quota I don’t actually have a problem with that because then you introduce different thinking and different decision makers around the table,” she said. But Egan suggested that women’s historic underrepresentation on boards was due to a dearth of adequately qualified and experienced individuals. “Maybe previously there haven’t been women good enough to do the job. If we keep doing that and keep working hard and do everything to make the best of ourselves then we will succeed because there are laws to protect us if we don’t,” she said. Graham said she believed the diversity agenda was linked to another key agenda – that of professionalism – and that focusing on the latter could actually help to secure improvements in the former. “I find it weird that we call insurance an industry rather than a profession. It’s a profession and we are professionals,” she said. “One of the ways you earn positions is to be the best qualified. When I started out, the first thing I did was qualify and it was the best thing I ever did because it opens doors.” “Women can be confident in themselves when they are well qualified, which goes back to [the fact that] you will then get diversity if people earn the position.” While cultural and logistical obstacles may mean it is still harder for women to hold senior positions in the insurance industry than their male counterparts, the attendees concluded that the biggest factors in whether women succeeded or not today were hard work and self-belief. “Hard work – that’s the message, whether you’re male, female, young or old. If you want to get somewhere you’ve got to put the goods in and not expect it to be given to you,” said Egan. While Holland concluded: “Understand what you enjoy doing, what you’re good at and where you want to be in this profession because there are so many opportunities. If you decide what you want to be you can go out and get it.” Roundtable attendees Keri-Ann Egan, branch manager, Circle Insurance Services Julia Graham, president, Federation of European Risk Management Association and director of risk management and insurance, DLA Piper Candy Holland, immediate past president, Chartered Institute of Loss Adjusters and managing director, Echelon Claims Consultants Sam Hovey, chief financial officer, Besso Louise Jones, business development executive, Thomas Carroll Group Barbara Merry, BJM Associates company director and chair, Independent Women in Insurance Network Jacqueline McNamee, managing director, AIG UK Helen-Clare Pope, head of insurable risk, Tesco and, chair of Association of Insurance and Risk Managers Claire White, engineering underwriting account manager, Allianz