Merchandise Sales

advertisement

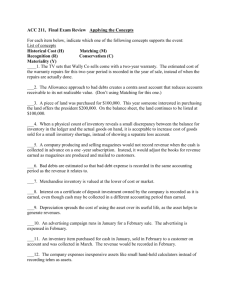

Chapter 4 Intercompany Sales Typical intercompany transactions Merchandise for resale Land Fixed assets Long-term construction contracts Notes receivable/ payable C4 2 Merchandise sales: No inventories Outside Co. S Co. P Outside $80 S buys $100 P buys $125 to outside Separate statements Co. S Co. P Sales $100 $ 125 CofGS 80 100 Consolidated statement for Company SP Sales $125 Cost of Goods Sold 80 The “intercompany sale” of $100 is eliminated on the worksheet. C4 3 Intercompany price Does the intercompany price matter? Yes: If there is a NCI. If S was 80% owned by P, NCI gets $4 (20% x $20) and controlling interest gets $41(80% x $20 + $25) C4 4 Merchandise sales: Unsold goods Outside Co. S Co. P Outside $80 $100 [in end inv] Separate statements: S has sales of $100, C of GS of $80 P has inventory with cost of $100 Consolidated Statements: SP has inventory with a cost of $80 • The “intercompany sale” of $100 is eliminated • The inventory is restated to $80 • The $20 profit is not recognized until the goods are sold by P to the outside world C4 5 The normal merchandise procedures IS Eliminate intercompany “middle sale” - no impact on income but overstates sales and cost of goods BI Restore beginning inventory (included in C of GS) to cost and correct beginning Retained Earnings - this shifts profit from last year to this year EI Restore ending inventory to cost and adjust C of GS - this defers profit to next year IA Eliminate intercompany trade debt and interest (if any) C4 6 Mark-up confusion Mark-up on cost is not the same as gross profit! Marking a $10 cost unit up 25% $10.00 125% = $12.50 provides a gross profit of 20% $2.50 $12.50 = 20% C4 7 Merchandise example S (P owns 80%) buys goods for $80,000 and sells them to P for $100,000, all sales are at 20% GP P had $10,000 of intercompany goods in beginning inventory and $15,000 of such goods in its ending inventory P owed S $8,000 for intercompany goods at year end C4 8 Consolidation Procedures Needed IS - eliminate sale from subsidiary to parent BI - reduce cost of goods sold for profit in beginning inventory and correct beginning retained earnings (allocated 20/80 because sale was by subsidiary) EI- reduce ending inventory and increase cost of goods sold (deduct for ending inventory was too great) IA - Eliminate intercompany trade balance C4 9 Worksheet eliminations Partial Worksheet Ending inventory Accounts receivable Accounts payable RE - Co. S RE - Co. P Sales Cost of goods sold C4 Trial Balances Co P Co S 15,000 8,000 8,000 50,000 120,000 130,000 100.000 95,000 80,000 Eliminations Dr Cr EI 3,000 IA 8,000 IA 8,000 BI 400 BI 1,600 IS 100,000 EI 3,000 IS 100,000 BI 2,000 10 Adjustments on the IDS End Inv profit (EI) SUB 3,000 Int Generated Inc Beg Inv profit (BI) Adjusted Inc NCI % NCI 20,000 2,000 19,000 20% 3,800 PARENT Int Generated Inc 35,000 80% of $19,000 Co. S’s adjusted inc 15,200 Controlling Interest 50,200 C4 11 Worksheet 4-3 The 4 eliminations are IS, IA, BI, EI RE split for beginning inventory because sub sold it. If parent was seller, adjustments only to parent RE Seller’s profit is adjusted through IDS. In this case the adjustments went to the sub (seller). They would go to Parent if parent was seller C4 12 Worksheet 4-3 (continued) If there is an LCM adjustment, only the remaining profit is eliminated Phony losses (sales below market value) are also eliminated Worksheet 4-4 shows the same adjustments for a periodic inventory C4 13 Intercompany land sales Gain is deferred until land is sold to outside company Year of sale: LA Gain of seller Land Run adjustment through seller’s IDS 20,000 Later years: LA 20,000 RE (split?) Land Adjustment is split only if seller was Sub 20,000 20,000 Year of outside sale: LA RE (split?) 20,000 Gain (loss) on land sale 20,000 Seller may finally recognize gain; credit to seller’s IDS C4 14 Intercompany fixed asset sale: Year of sale Sold 5 year machine, cost $20,000, for $30,000 on 1/1/x1 Theory - Defer gain and earn it back over period of use. The allocation method matches the depreciation method (straight-line for this example) Year of sale: F1 Gain (seller) 10,000 Machine 10,000 F2 Accum depr 2,000 Dep Expense 2,000 defer gain on sale return asset to cost reduce to depr. on cost recognize 1/5 profit IDS - deduct original profit from seller and add profit equal to depreciation adjustment C4 15 Intercompany fixed asset sale: Year subsequent to inter-company sale End of second year: Adjust asset at start of year F1 RE (split?) 8,000 deferred gain on 1/1/2 Accum Depr 2,000 adjust prior year’s depr. Machine 10,000 return asset to cost RE adjustment is split only when sub is seller Adjust current year depreciation F2 Accum Depr 2,000 reduce to depr on cost Depr Expense 2,000 recognize 1/5 profit IDS - seller gets profit equal to depreciation adjustment C4 16 Fixed asset worksheets WS 4-5 (year of sale) (F1) removes $10,000 profit from machinery, defers $10,000 gain (F2) adjusts depreciation and realizes $2,000 gain IDS takes away $10,000 from P [seller], gives back $2,000 WS 4-6 (end of second period after sale) (F1) removes profit from machinery, corrects last year's depreciation and defers $8,000 profit as of 1/1/2 (F2) adjusts depreciation and realizes $2,000 gain IDS just gives back $2,000 currently realized gain to P C4 17 Fixed asset worksheets, continued WS 4-7 (Asset sold to outside party at end of second year) Machinery and accumulated depreciation are not there to adjust The $6,000 remaining gain at the start of the year is now earned - sale to outside occurred Adding the $6,000 deferred gain to the recorded $4,000 loss created a gain on the consolidated statement of $2,000. Entry is F3 C4 18 Long-term construction contracts Completed - like any other fixed asset sale Not Complete - Completed Contract Method: Eliminate seller’s Billings and Cost of Construction in Progress; adjust buyer’s Asset Under Construction for unbilled costs incurred by seller Eliminate intercompany debt balance Not Complete - Percentage of Completion: Key is to defer profit recorded by builder and restore asset under construction to cost Eliminate intercompany debt balance C4 19