2006 - About TELUS

Investor Tour

March 2007

Darren Entwistle

President & Chief Executive Officer

Forward looking statements

This session and answers to questions contain forward-looking statements that require assumptions about expected future events including 2007 targets, competition, financing, financial and operating results, and regulation that are subject to inherent risks and uncertainties. There is significant risk that predictions and other forward looking statements will not prove to be accurate so do not place undue reliance on them.

Factors that could cause actual results to differ materially include but are not limited to: competition; capital expenditure levels (including possible spectrum purchases); financing and debt requirements (including share repurchases, debt redemptions and refinancing plans); tax matters (including deferral of payment of significant cash taxes); regulatory developments (including local forbearance, local price cap regulation, spectrum auction, and wireless number portability); process risks

(including conversion of legacy systems and billing system integrations); and other risk factors discussed herein and listed from time to time in TELUS’ reports.

There are many factors that could cause actual results to differ materially. For a fuller listing and description of the potential risk factors and assumptions, please refer to the TELUS 2006 annual management’s discussion and analysis, 2007 targets news release issued on Dec. 14, 2006 and other filings with securities commissions in Canada (sedar.com) and the United States (sec.gov).

All dollars in C$ unless otherwise specified

2

Table of contents

Strategy

Operational update

Financial update

Investor considerations

Appendix slides starting

6

11

39

46

58

3

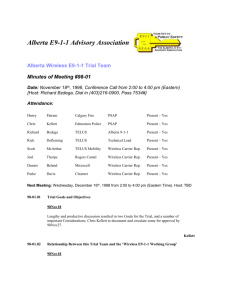

About TELUS

Executing national growth strategy focused on data, IP & wireless

2006 consolidated results:

Revenues

EBITDA

EPS 1

Capex

Free cash flow

$8.7B

$3.6B

$3.27

$1.6B

$1.6B

7%

9%

67%

23%

9%

Enterprise value: $26B (equity $19B)

Avg. daily trading: ~2.2M (recent 90 day avg.)

Listings: Common: TSX T; non-voting: TSX T.A; NYSE TU

Reporting segments: wireless and wireline

1 2006 EPS includes $0.48 of positive tax-related adjustments

Top performing Canadian telecommunications company

4

Going to market as one team

How we are organized

Consumer

Solutions

Technology

Strategy

Human

Resources

Business

Solutions

Network

Operations

Finance

& Strategy

Partner Solutions

& TELUS Québec customer facing business units

Business

Transformation enabling business units

Corporate &

Government

Affairs supporting business units

Office of CEO

Customer facing structure since 2001

5

Leading the way with a proven strategy

Strategic imperatives

Focusing on growth markets of data and wireless

Building national capabilities

Providing integrated solutions

Investing in internal capabilities

Partnering, acquiring and divesting as necessary

Going to market as one team strategic intent … to unleash the power of the Internet to deliver the best solutions to Canadians at home, in the workplace and on the move.

Consistent strategy and execution 2000 2007

6

Strategic journey highlights

purchase of Quebec Tel ($0.7B) and Clearnet ($6.6B) - 2000

divestiture of non-core assets - $1.1B (real estate and directories)

completion of national IP backbone & fibre network

first in N.A. to launch Next Generation Network, enabling IP based solutions for customers - 2003

2000

awarded national managed data solutions contract for TD Bank valued at $160M over 7 years - 2003

Verizon divested 20.5% ($2.2B) equity interest – Dec 2004

five year (2010) progressive collective agreement ratified – Oct 2005

staged launch of TELUS TV

® in certain western markets – 2005-07

wireless merger into customer facing business units – Dec 2005-06

won landmark Government of Ontario managed network contract valued at $140 million over 5 years – Sept 2006

2007

7

National transformation

Wireless

• PoPs covered (millions)

• Mike (iDEN) (millions)

• Generation

Jan 2000

7

-

1G

Wireline

• Ont/Que cities

•

Co-locations

• Customer POPs

• Fibre lit (km)

• Platform

• Network

1 as of December 31, 2006

3

2

5

0

Stentor

Circuit-based today 1

31

26

3G

46

96

1067

15,600

TELUS

Next Generation (NGN)

8

TELUS infrastructure today

BC

Alberta

Wireline

87%

13%

Ontario

Wireline

49%

Wireless

Quebec

51%

Wireless coverage

9

Backbone optical and IP network

TELUS’ strategic focus on data and wireless

Revenue

$5.7B

$8.7B

LD

23%

Wireline local

49%

Wireless

18%

Data

2000¹

¹12 mos ending June

10%

LD

10%

Voice

27%

Wireless

Voice

41%

Wireline

Data

19%

2006²

²12 mos ending December

Data and wireless now represent 63% of TELUS revenue

10

Wireless

Data

3%

Operational update

2007 corporate priorities

1.

Advancing TELUS’ leadership position in consumer market

Combining our suite of data applications with deregulated heritage services

Attaining best-in-class customer loyalty and growth through unparalleled customer experiences

Achieving customer addition targets by expanding our distribution channels and addressing key market segments with new service offerings

Unleashing the power of the Internet

12

2007 corporate priorities

2.

Advancing TELUS’ leadership position in business market

Progressing further in key industry verticals with specific applications that provide non-price-based differentiation

Leveraging wireless number portability to expand our business market share in Central Canada

Focusing on small business customer loyalty and growth with innovative solutions

Business . . . backed by TELUS

13

2007 corporate priorities

3.

Advancing TELUS’ leadership position in wholesale market

Growing in domestic and international markets through recognition that TELUS is Canada’s IP leader

Achieving excellence in customer service to support local forbearance in key incumbent markets

Expanding our markets, channels and products by focusing on strategic relationships with our partners

Enhancing our IP leadership and partnerships

14

2007 corporate priorities

4.

Driving TELUS’ technology evolution and improvements in productivity and service excellence

Implementing technology roadmaps for Future Friendly Home and wireless service offerings that simplify our product portfolio and improve service development and execution

Rolling out consolidated customer care systems to replace multiple legacy systems in Alberta and B.C.

Accelerating customer service delivery dates

Striving for customer service excellence

15

2007 corporate priorities

5.

Strengthening the spirit of the TELUS team and brand, and developing the best talent in the global communications industry

Growing our business ownership culture with a team philosophy of “our business, our customers, our team, my responsibility” thereby attracting, developing and retaining great talent

Leading the way in corporate social responsibility as we strive to be Canada’s premier corporate citizen

Our business, our customers, our team, my responsibility

16

Framework for long term growth wireline growth opportunities

Non-ILEC

Growth

+

Future

Friendly

Home

+

Organization

Effectiveness

Price Cap

Regulatory

Framework challenges

Technological

Substitution

+

Competitive

Intensity

Short-term dilutive

Strive to hold wireline EBITDA (before restructuring) flat over medium term

Growth in revenues and EBITDA from wireless business

=

Continued improvements in consolidated results

17

7.2

Q2-00

TELUS total subscriber connections

10.7

9.7

10.2

(millions)

Res NALs

Bus NALs

Dial-up Internet

High-speed Internet

Wireless

Q4-04 Q4-05 Q4-06

1 million new connections due to wireless and Internet growth

18

924

TELUS track record of wireless subscriber additions

Gross additions (000s)

Net additions (000s)

1,279

1,293

1,121

1,017

985

987

535

550+

474

512

584

418 418 431

2000 2001 2002 2003 2004 2005 2006

2006: Record gross additions / net 2 nd best in 7 years

Net additions > 500K for third consecutive year

19

2007E

Wireless subscriber growth

Total wireless subscribers (M)

5.1

4.5

3.9

3.4

Wireless subscribers mix

Prepaid

Prepaid

19%

977K

4.1M

2003 2004 2005 2006

5.1 million

Continued wireless growth with strong postpaid mix

20

review of operations – wireless

Industry ARPU comparison

$62

$63

$52

$56

$49

$51

2005

2006

TELUS Rogers Wireless BCE Wireless

Data driving positive industry trend

21

review of operations – wireless

Wireless data growth opportunity

Q4-05

Q4-06

$6.16

$5.05

$6.54

$3.17

TELUS Rogers Wireless

TELUS Q4 data ARPU up 94%

22

Wireless data growth opportunity

Rolling out wireless high speed (EVDO)

More than 50 regions

Now covers 2/3 of Cdn population

Cool applications

Music downloads and video games

Watch 15 channels on Mobile TV

Five times faster

Fostering continued data growth

23

Exclusive arrangement and investment

Amp’d is high-speed EVDO driven service – Spring 2007

Amp’d Mobile responsible for marketing, freshest and exclusive entertainment content, and optimized handsets

TELUS manages sales, distribution, billing, client care, network options and pricing

Targeting 18 to 35 age demographic and lifestyle

Exclusive licensing and service agreement – not an MVNO

Amp’d Mobile is a premium brand with high ARPUs focused on mobile media (not traditional voice) and postpaid

TELUS Ventures invested US $7.5M in Amp’d Mobile, Inc.

24

Amp’d Is Mobile Media

2006 wireless churn (%)

1

3.1

2.6

2.4

2.3

1.9

1.6

1.5

1.33

1.2

1.2

Source: Company reports; Merrill Lynch

1 Q3 churn where annual not available

Low churn relative to global peers

26

TELUS wireless EBITDA & cash flow growth

1,975

1,751

1,443

EBITDA ($M)

EBITDA less Capex ($M)

1,142

1,427

1,038

1,324

815

788

535

455

356

173

2000

¹

2001

²

75

2002 2003 2004 2005 2006

(288)

(360)

¹ Pro forma acquisition of Clearnet

² EBITDA (excluding restructuring) for 2001 & 2002

3 Midpoint of 2007 targets normalized for pre-tax option expense of $30 to $50 million.

27

2007E 3

Wireless profitability comparison

2006

EBITDA margin

(total rev.)

Capex intensity

(total rev.)

Cash flow 1 yield

(total rev.)

TELUS

45%

11%

34%

Other

Cdn avg.

43%

US avg.

32%

12% 18%

31% 14%

1 EBITDA less capex

Source: Company reports

North American leader in wireless profitablity

28

36

2006 wireless cash flow yield

1

comparison (%)

34

32 32

30

28

25

19 19

17

TELUS*

135% 56% 56% 102% 82% 104% 56%

population penetration

76% 76% 88%

1 EBITDA less capital expenditures divided by revenue

Source: Merrill Lynch, UBS. TELUS actual results. Other wireless carriers estimated.

High cash flow yield, with attractive penetration opportunity

29

Canadian industry subscriber growth

Net subscriber adds

TELUS share of adds

Population penetration

Penetration gain

2003

1.5M

28%

42.3%

4.1pts

2004

1.6M

33%

46.7%

4.4pts

2005

1.8M

2006*

1.7M

32% 32%

51.8% 56.4%

5.1pts

4.6pts

Source: Company reports, CWTA

* Does not include wholesale figures

Growth of 4 - 5 points per year for past 4 years

30

review of operations

Increasing Canadian industry wireless penetration

2009E* 2003

Penetration:

42%

Subscribers:

13.4M

2006

56%

18.5M

~70%

~23M

Source: Industry analysts * See forward looking statement caution

4 to 5 million net additions expected in Canada over 3 years

31

financial review

Wireline update

Data growth largely offsetting declining local and LD

Strong high-speed Internet net additions

TELUS TV provides long-term opportunity riding on broadband platform

Making inroads in Central Canadian business market

e.g. Government of Ontario $140 million 5 year contract

Improving regulatory situation

Comparative resiliency in wireline

32

High-speed Internet subscriber growth

Total Internet subscribers

562

High-speed Internet subscribers (000s)

917

763

690

Dial-up

17%

194K

917K

High-speed

83%

1.1 million

2003 2004 2005 2006

Continued strong net addition growth

33

financial review

Staged roll out TELUS TV

Offering customers differentiated entertainment

Choice of 200+ digital stations

Customized channel packaging

Interactive programming guide

Video on demand

myTELUS channel

Call display

Operating on ADSL2+ platform

Launched in Edmonton, Calgary and Vancouver

34

TELUS TV

35

Incoming call from Kim Smith (604) 555-1234 Close

Year-over-year NAL declines

Trailing six quarters ended Q4-06 (%)

TELUS BCE AT&T (SBC) Verizon BellSouth

-2.2

-2.4

-2.7

-2.6

-2.8

-3.0

-2.0

-2.5

-3.2

-3.3

-3.7

-4.2

Q3 Q4 Q1 Q2 Q3 Q4

2005 2006

Source: Merrill Lynch, Company reports

-5.1

-5.6

-6.0

-6.1

-6.2

-6.3

-6.2

-6.7

-6.9

-7.4

-7.5

-7.6

-5.0

-5.8

-6.1

-7.0

-6.9

-6.4

37

Non-ILEC

(Ontario and Quebec)

revenue & EBITDA

EBITDA ($M)

555

Revenue ($M)

657

632

561

2003 2004 2005 2006

2003 2004

(29)

(22)

32

21

2005 2006

Continued focus on profitable, long-term growth in Central Canada

38

Financial update

TELUS Consolidated

Revenue

EBITDA 1

EPS 2

2005

$8.14B

$3.30B

$1.96

EPS (excl. non-recurring items)

Capex

$2.07

$1.32B

2006

$8.68B

$3.59B

$3.27

$2.79

$1.62B

Change

6.6%

9.0%

67%

35%

23%

9.2% Free cash flow $1.47B

$1.60B

1 2005 EBITDA includes $133M net expenses, excluding any revenue or indirect impacts, from labour disruption. EBITDA includes restructuring and workforce reduction costs of $54M and $68M, for

2005 and 2006, respectively

2 2005 EPS includes negative impact of $0.25 from labour disruption and $0.06 from early bond redemption. EPS includes favourable tax related adjustments of $0.20 and $0.48, for 2005 and 2006, respectively.

Strong growth in revenue driven by data and wireless

40

2007 Consolidated targets summary

Revenue

2007 targets

$9.175 to 9.275B

Normalized EBITDA 1,2 $3.725 to 3.825B

Normalized EPS 2,3

Capex

$3.25 to 3.45

approx. $1.75B

change

6 to 7%

4 to 7%

17 to 24%

8%

1 EBITDA includes r restructuring and workforce reduction costs, estimated to be approx. $50M in 2007.

2 EBITDA excludes $150 to $200M of non-recurring, non-cash expenses associated with cash settlement of options.

EPS impact of $0.30 to $0.40.

3 EPS year over year growth rate normalized for $0.48 of positive tax-related adjustments in 2006.

2007 targets reflect healthy performance expected in wireless

41

2007 Wireline targets

Revenue

Normalized EBITDA 1

Capex

High-speed net adds

2007 targets

$4.85 to 4.9B

$1.775 to 1.825B

approx. $1.2B

> 135,000

change

1 to 2%

(3) to (1)%

-

(12)% or better

Con’t strong growth

1 EBITDA excludes $120 to $150 million of non-recurring, non-cash expenses associated with cash settlement of options.

42

2007 Wireless targets summary

Revenue

Normalized EBITDA 1

Capex

Wireless sub. net adds

2007 targets

$4.325 to 4.375B

$1.95 to 2.0B

approx. $550M

> 550,000

change

12 to 13%

11 to 14%

29%

>3%

1 EBITDA excludes $30 to $50 million of non-recurring, non-cash expenses associated with cash settlement of options.

43

2007 EPS continuity

$3.27

48¢

$2.79

35 to

55 ¢

9¢

10 to

15¢

11 ¢

$3.25 to

3.45

2006 Taxrelated adjust.

2006 normal.

EBITDA growth

Lower fin.

costs

Decr. in avg o/s shares

Higher dep.

2007E 1 normal.

1 EPS excludes $0.30 to $0.40 of non-recurring, non-cash expenses associated with move to cash settlement of options.

Strong normalized EPS growth of 16 to 24%

44

($ billions)

Consolidated free cash flow

1

trend

1.45

1.57

1.525 to 1.625

1.29

.

2004 2005 2006 2007E 2

1 2007 definition. Calculated as EBITDA adding Restructuring and workforce reduction costs, cash interest received and excess of share compensation expense over share compensation payments, less cash interest paid, cash taxes, capital expenditures and cash restructuring payments, subtracting cash payments related to Other expenses such as charitable donations and A/R securitization expense

2 Normalized for expected cash impact due to option cash settlement of approximately $100M midpoint

Increased EBITDA and lower financing costs lead to FCF growth

45

Investor considerations

Return of capital summary

Renewed 24M share repurchase program in Dec. 2006

Authorized to repurchase up to 12M common and 12M non-voting (up to 7% of total shares outstanding)

Introducing cash settlement for vested options - mitigates shareholder dilution

Dividend increased by 36% to 37.5 cents per quarter for

Jan 1, 2007, consistent with dividend growth approach

Annualized dividend in line with targeted payout ratio guideline of 45 to 55% of sustainable net earnings

Annualized dividend now at all time high of $1.50

47

Strong record of returning capital

$ per share

4

Share repurchases

Dividends

3.43

3.30

3

3.90

2.40

2.50

2.33

2

1

0.60

0.82

0.22

0.60

0.80

1.10

1.50

2003 2004 2005 2006 2007E 1,2

1 Annualized dividend, plus share repurchases in 2006 as estimate for 2007. Assumes lower average shares outstanding of 330 million to 335 million in 2007.

2 See forward looking statement caution. Assumes continuation of share repurchase program

48

Cash settled options program update

Introduced cash settlement for vested options

Mitigates share dilution by avoiding treasury issuance

Expect non-recurring, non-cash pre-tax operating expense of $150M to $200M in Q1-07

$120M to $150M in wireline, $30M to $50M in wireless

Reported EPS impact of $0.30 to $0.40

Cash payments deductible for tax purposes when options exercised and cash paid out

Cash tax savings of up to $70M over 3 years

Limits dilution and creates cash tax savings

49

Financial update – March 2007

Closed $2B credit facility to 2012

Can be utilized for commercial paper issuance

Announced and priced issue of $1B 5 and 10 year Notes

$300M at 4.5% to 2012

$700M at 4.96% to 2017

Part of refinancing 7.5% $1.5B due in June 2007

TELUS liquidity position very strong

50

Credit profile

Pro forma debt structure - maturities

C$ millions

3500

3000

2500

2000

1500

1000

500

0

2008 2009 2010 2011 2012 2013 2014 2015 2016 20172018+

Existing debt Deferred FX hedge liability

New issuance

Pro forma maturity structure post-2007 note refinancing

51

Investing capital in 2007 for long-term growth

Wireless capex increase of $125 million to approx. $550 million

Within 11-13% intensity range

Wireline capex unchanged at approx. $1.2 billion

Strong housing formation in West

Broadband network enhancement program

Implementing IT customer system consolidation

Success based capex for contracts such as Govt. of Ontario

Investing to create future value

52

Regulatory developments

Wireless local number portability effective Spring 2007

Opportunity in business market in Central Canada

Deregulation by federal government

Local forbearance decision likely effective April 2007

Based on competitive choice

Directive to CRTC now in force

Rely on market forces to maximum extent feasible

Ensure competitive and technological neutrality

Wireless spectrum auction likely by early 2008

Regulation increasingly based on competitive realities

53

Leading global telecom performance

Growth in

Revenue

EBITDA

EPS

2003 top 25% top 25%

-

2004

#1

#1

2005 2006 top 25% top 25% top 25% top 25% top 25% top 25% top 25%

Source: Bloomberg and TD Securities, for major global incumbent telecoms

TELUS performing well relative to global telecom peers

54

Excellence in disclosure and governance

Annual Report on Annual Reports

TELUS 2005 AR ranked 1st in world e.

Com

Report

Watch

Canadian Institute of Chartered Accountants (CICA)

Best Corporate Governance Disclosure in Canada for second year

2005 Annual Report received Award of Excellence

Corporate Reporting - Communications & Media sector

12 consecutive years of recognition

IR Magazine (Canada) awards

• 2007: Best Communications with retail market

2006: Best annual report & disclosure policy

2005: Best Sr. mgmt. communications & web site

Dow Jones Sustainability Index

Only North American telco in global index

55

Investor considerations

Consistent and proven strategy

Strong revenue and earnings growth, high exposure to wireless

Continued strong wireless and Internet subscriber growth

Focus on investment in growth areas

Robust free cash flow generation

Track record of returning capital to investors

Excellence in reporting, transparency and governance

Creating value with on strategy performance

56

Investor Relations

1-800-667-4871 telus.com

ir@telus.com

Appendix

Share repurchase programs

Total cost ($M)

Total shares (M)

% of total program

2004

$78

2.2

2005

$892

20.8

85% 1

2006

$800

16.4

73% 2

Total

$1,770

39.4

79%

Total end of period shares outstanding (M)

358.5

350.1

337.9

20.6

1

Twelve month 25.5 million share repurchase program to Dec. 19, 2005

2

Twelve month 24 million share repurchase program to Dec. 19, 2006

Track record of share repurchases leading to 6% reduction in shares outstanding

59

2007 free cash flow detail ($B)

normalized

Free cash flow

(2007 definition 1 )

1.6

1.525 to 1.625

2006 2007E 2

1 2007 definition of FCF subtracts cash payments related to Other expenses

2 Expected cash impact due to option cash settlement of approximately $100M midpoint

2007 Free Cash Flow expected to remain high

60

2007E free cash flow detail

($M)

EBITDA

2007E

$3,525 to 3,625

Add back: cash settled option expense ~200

EBITDA normalized

Capex

$3,725 to 3,825

~(1,750)

Net Cash Interest

Other 1 :

~(430)

~(20)

Free Cash Flow (before cash settled option pmt.) $1,525 to 1,625

Cash settled options paid 2

(75) to (125)

Free Cash Flow $1,425 to 1,525

1

Includes restructuring expense (net of cash payments), net cash taxes, other share based compensation (net of cash payments) and cash payments related to Other expenses

2 Cash settled option payments are tax deductible and reduce treasury share issuance

61

Definitions

EBITDA : Earnings, after restructuring and workforce reduction costs, before interest, taxes, depreciation and amortization

Capital intensity: capex divided by total revenue

Cash flow: EBITDA less capex

Free Cash Flow (2006): EBITDA, adding Restructuring and workforce reduction costs, cash interest received and excess of share compensation expense over share compensation payments, subtracting cash interest paid, cash taxes, capital expenditures, and cash restructuring payments

Free Cash Flow (2007): Consistent with FCF above and subtracting cash payments related to Other expenses such as charitable donations and A/R securitization expense

TELUS definitions for non-GAAP measures

62

Credit rating overview

TELUS Corporation

Agency

DBRS

S&P

Fitch

Moody’s

Rating

A (low)

BBB+

BBB+

Baa1

Outlook

Stable trend

Stable outlook

Stable outlook

Stable Outlook

TELUS at targeted credit rating with all 4 rating agencies

63

Darren Entwistle

President & Chief Executive Officer

Darren Entwistle was appointed President and CEO in July 2000

Before joining TELUS, Darren held a number of leadership positions in the

UK at Cable & Wireless from 1995 to 2000, culminating in being appointed

President of the European business market in 1999. Prior to that he served in a number of leadership positions at Mercury Communications (UK), including Strategy Director and General Manager of Corporate Finance.

Board of Governors of the International Institute of Telecommunications .

Board of Directors of TD Bank Financial Group, and McGill University; and

Chair of the Conservatory of Music's Capital Campaign .

Bachelor of Economics (Honours) degree in Economics from Concordia

University, an MBA in finance from McGill University and a diploma in

Network Engineering from the University of Toronto

64