Cost Behavior

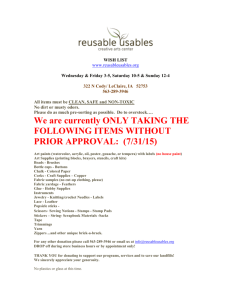

advertisement

Cost Behavior Rick Stephan Hayes, Ph.D., CPA California State University at Los Angeles Based on MANAGEMENT ACCOUNTING CONCEPTS AND TECHNIQUES By Dennis Caplan, Oregon State University CHAPTER 4: Cost Behavior – Understanding Cost behavior is important for making decisions • Fixed costs– remain constant – i.e. rent • Variable costs – dollar amount varies in direct proportion to changes in activity level – i.e. cost of Battery in car • Mixed costs– contains both variable and fixed elements – caterer license fee of $10,000/year plus $3/dinner party • Stepped costs – variable but increases in big chunks – i.e. Wages of maintenance workers Fixed Costs • Fixed costs do not vary with the production level. Total fixed costs remain the same, within the relevant range. However, the fixed cost per unit decreases as production increases, because the same fixed costs are spread over more units. The following two charts depict this relationship between fixed costs and output volume. Fixed Cost Example • In this example, fixed costs are $50,000. The first chart shows that fixed costs remain $50,000 at all production levels from 100 units to 1,000 units. The second chart shows that the fixed cost per unit decreases as production increases. Hence, when 100 units are manufactured, the fixed cost per unit is $500 ($50,000 ÷ 100). When 500 units are manufactured, the fixed cost per unit is $100 ($50,000 ÷ 500). Total Fixed Costs Total fixed cost 60000 50000 40000 30000 20000 10000 0 100 500 900 Production level (units produced) Fixed Cost Per Unit Fixed cost per unit 1000 800 600 400 200 0 50 100 150 200 250 300 350 400 450 500 Production level (units produced) Variable Costs • Variable costs vary in a linear fashion with the production level. However, when stated on a per unit basis, variable costs remain constant across all production levels within the relevant range. The following two charts depict this relationship between variable costs and output volume. Variable Cost Example • A good example of a variable cost is materials. If one pair of pants requires $10 of fabric, then every pair of pants requires $10 of fabric, no matter how many pairs are made. The fabric cost is $10 per unit at every level of production. If one pair is made, the total fabric cost is $10; if two pairs are made, the total fabric cost is $20; and if 1,000 pairs are made, the total fabric cost is $10,000. Hence, the total cost is increasing and linear in the production level Total Variable Costs 10000 8000 6000 4000 2000 90 0 50 0 0 10 0 Total variable cost 12000 Production level (units produced) Variable Costs Per Unit variable cost per unit 12 10 8 6 4 2 0 100 500 900 Production Level (units produced) Mixed Costs • If, within a relevant range, a cost is neither fixed nor variable, it is called semi-variable or mixed. Following are two common examples of mixed costs. – Initial Fixed cost and then variable cost. – Step cost 14000 12000 10000 8000 6000 4000 2000 90 0 50 0 0 10 0 Total cost In this example, fixed and then variable, although the total cost line increases in production, it does not pass through the origin because there is a fixed cost component. An example of a cost that fits this description is electricity. A fixed amount of electricity is required to run the factory air conditioning, computers and lights. There is also a variable cost component related to running the machines on the factory floor. The fixed component in this example is $3,000 per month. The variable cost component is $10 per unit of output. Hence, at a production level of 500 units, the total electric cost is $8,000 [$3,000 + ($10 x 500)]. Production level (units produced) 7000 6000 5000 4000 3000 2000 1000 0 10 0 20 0 30 0 40 0 50 0 60 0 70 0 80 0 90 0 10 00 Total cost The mixed cost illustrated below is called a step function. An example of such cost behavior would be the total salary expense for shift supervisors. If the factory runs one shift, only one shift supervisor is required. In order for the factory to produce above the maximum capacity of a single shift, the factory must add a second shift and hire a second shift supervisor, so that total shift supervisor salary expense doubles. If the factory runs three shifts, three shift supervisors are required. Production level (units produced)