Financial Proforma: Analysis of practice revenue and

advertisement

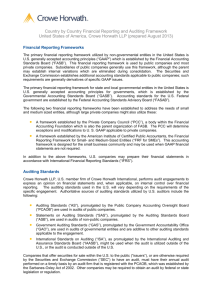

Mergers & Acquisitions for Physician Practices The Unique Alternative to the Big Four® Provider/Hospital Perspective The ever-changing healthcare environment has lead to an increased number of physician practice mergers and acquisitions. Provider Perspective Healthcare Environment Technology requirements for meaningful use dollars, future cuts Medicare professional fees reduction potential each year Management care contracting challenges Increased number of physician/hospital acquisitions and mergers Audit | Tax | Advisory | Risk | Performance • • • • • • Increased administrative time for billing and collecting Payment reductions with additional anticipated Advanced clinical integration Electronic medical record implementation Potential feeling of loss of ownership/control Salary security for self and employees Hospital Perspective • • • • • • • Continuity of care for patients Improved physician relationships and integration Mission/Vision/Values and strategic fit Research mission advancement Competition differentiation Market share opportunities Daily operations evaluation with potential changes © 2010 Crowe Horwath LLP 2 The Unique Alternative to the Big Four® Physician/Hospital Alignment Opportunities Payment Changes: • • • Quality impact (value based purchasing, readmissions, HACs) o Quality improvements cannot increase overall costs Bundled payments o Care coordination role expanded EMR implementation o Establishing and reporting meaningful use Data Transparency: • • 1.) Physician leadership development 4.) Outcome Reporting Physician / Hospital Alignment 2.) Physician lead initiatives for quality, safety, and satisfaction goals Patient satisfaction surveys Quality outcomes Physician Alignment Importance: • • • Physician leadership key in clinical integration Physician lead quality and satisfaction initiatives EMR usage and adoption Audit | Tax | Advisory | Risk | Performance 3.) Clearly defined accountability areas © 2011 Crowe Horwath LLP 3 The Unique Alternative to the Big Four® Antitrust Issues “Deals that involve specialists tend to invite more scrutiny than those involving primary-care doctors because there are fewer providers” James Grimes, Antitrust Law Practice Leader at Bass, Berry Sims, LLP, quoted in Modern Healthcare, November 26, 2012 Audit | Tax | Advisory | Risk | Performance © 2011 Crowe Horwath LLP 4 The Unique Alternative to the Big Four® Antitrust Issues in the News Pending in Appeals Court – ProMedica (OH) appeal on acquisition of hospital November - Reading (PA) Health System cancels acquisition of Surgical Institute of Reading November – 4 ASCs sue HCA, Centura Health and state ASC trade association. August – FTC settlement with Renown Health, Reno (NV) required suspension of noncompetes April – OSF HealthCare (IL) and Rockford Health System abandon merger plans Audit | Tax | Advisory | Risk | Performance © 2011 Crowe Horwath LLP 5 The Unique Alternative to the Big Four® Business Decision - Financial Proforma Financial Proforma: Analysis of practice revenue and expenses Before private practices and healthcare organizations align in employment agreements, hospitals need to complete the exercise in examining the practice revenue versus expense structure. Through a financial proforma analysis, opportunities can often be found in either revenue cycle improvements or practice expense reductions. This exercise helps to ensure a successful financial alignment once the employment opportunity is in place. Financial Proforma sample: Year 1 Year 2 Year 3 Revenue Professional Fees Total Revenue Expenses Physician Salaries Staff Salaries Fringe Other Expenses Malpractice Rent Utilities Supplies Drug Costs Total Expenses NET INCOME Audit | Tax | Advisory | Risk | Performance © 2010 Crowe Horwath LLP 6 The Unique Alternative to the Big Four® Financial Proforma Approach 1) 2) 3) 4) 5) 6) 7) 8) Development of an estimated financial pro-forma depicting projected revenue and expenses associated with the employment of the current private group for the next three year period. Revenue, including direct and indirect, as well as expenses will be estimated to establish a cost benefit relationship for the employment of the private practice. Volumes for any of the applicable areas for the private practice will be projected based on office visits (new and established), in-office procedures, hospital visits, and surgical cases. The current payor mix for the private practice based on charge information will be determine. The projected reimbursement for the private practice is based on the projected volumes as well as the payor contracts for the physician group which the practice may join. Indirect revenue and expenses will be obtained from the hospital including any applicable areas such as inpatient admissions, surgical cases and ancillary revenues. Current staffing levels and pay ranges for the private practice will be examined to see if they fit the model of other employed groups within your organization. Additional valuation: If the private practice currently is affiliated with the medical center: • • 9) An analysis of the current revenue to the hospital from the private group will be examined to estimate the impact of the loss if the private practice was no longer affiliated with the hospital due to employment by a competing health system. This includes an analysis of hospital admissions, cases, and ancillary revenue. If referral source information is available from the private practice: • • An analysis to examine if any current referral sources may decrease or eliminate due to a potential employment by the organization. An analysis to show current referral sources which are affiliated with your organization Audit | Tax | Advisory | Risk | Performance © 2011 Crowe Horwath LLP 7 The Unique Alternative to the Big Four® Provider/Practice Integration Process Provider/Practice Integration: Eight step integration process Once a provider signs an employment agreement, there are many complex and movable components which need to be synchronized and completed for a successful transition into employment. If these components are managed correctly, the provider can begin seeing patients and billing for those services on the first day of employment. If delays in any of the tasks occur, then healthcare organizations are at risk for lost productivity and revenue while expenses will begin to accrue on day one. Crowe’s 8 Step Process for a Successful Provider On-boarding: Organizational Goals Provider Involvement Communication Roadmap Accountability Acknowledge Success Support Structure Monitor / Reports The establishment of a process for provider on-boarding can have the following benefits: Better alignment with the new provider and healthcare organization Increase awareness and communication with critical departments within your healthcare organization. Enhanced feedback of “lessons learned” for continual process improvements Improved coordination between departments involved in the on-boarding process Strengthened teamwork between the new provider, organizational leaders, and departments Audit | Tax | Advisory | Risk | Performance © 2010 Crowe Horwath LLP 8 The Unique Alternative to the Big Four® What is the Integration Approach? Eight step process for a successful provider /practice integration: 1) Organizational Goal: Ensure that the creation and successful on-going provider transitioning is known throughout the healthcare organization as one of the overall goals and priorities. 2) Provider Involvement: A successful on-boarding will involve key input and feedback from the provider during the course of transition. 3) Communication: Developing a communication structure and frequency of communication and is essential for the success of the on-boarding. Communication can be in the forms of updates or identification of potential problems or roadblocks. 4) Roadmap: At the initial notice of the provider’s signing of the employment agreement, a roadmap needs to be developed showing all of the necessary pieces needing completion before the provider’s official first day of employment. 5) Accountability: Each team member needs to have a clear set of expectations of their accountable components within the roadmap. During the course of the transition, team members will need to report on their process and any potential issues for each component which are their responsibilities. Audit | Tax | Advisory | Risk | Performance 6) Acknowledge Success: Many of the team members involved in the on-boarding may have duties outside of the transition and the work they complete on the project will be on top of their regular duties. A simple acknowledge of a job well done keeps the team motivated and engaged for next provider on-boarding. 7) Support Structure: Once a new provider starts employment, a structure must be in place to maintain the established relationship between the provider and the healthcare organization for continued success. 8) Monitors/Reports: Appropriate monitors and reports will need to be established for not only the feedback that the provider may have requested but also to convey to the provider their performance relative to any established organizational goals. © 2010 Crowe Horwath LLP 9 The Unique Alternative to the Big Four® Integration Considerations What communication structures are in place to ensure the on-boarding goes smoothly? Will the physicians roles remain the same as a result of the on-boarding? Have roles and responsibilities been discussed and clearly delineated? What are some of the potential impacts of shifted physician leadership if they are to take place? Does any technology need to be updated or changed to comply with the organization? Will the physical space occupied change with the on-boarding? If so, what arrangements need to be made? What are the private physicians standards for quality and how do those compare to those of the organization? What steps can be taken to avoid interruption in services while improving the quality of care for the patients? What interruption in billing could be caused by the on-boarding? How can they be mitigated? What training needs exist to be met before the on-boarding goes live? Will the steps could be added to anticipate challenges on the backend? (improved copayment remittance, precertification, insurance verification, etc.) Audit | Tax | Advisory | Risk | Performance © 2010 Crowe Horwath LLP 10 The Unique Alternative to the Big Four® Provider Compensation Modeling Base Salary Components that should be considered as a part of a provider compensation model include: Cost Reduction Quality Practice Revenue vs. Expense Productivity (wRVUs) Patient Satisfaction Citizenship The key to developing the right model for a provider group includes considerations for using outside benchmarking data, examining and selecting the right mix of components, building scenarios to measure success, and ending up with a standardized approach for use into future years. Audit | Tax | Advisory | Risk | Performance Base Salary – in line with fair market value, but should not be 100% guaranteed, allowing for performance indicators to reflect in total physician compensation. Productivity (wRVUs) – rewarding physicians who are increasing productivity each year and are in the higher percentile brackets when comparing to specialty benchmarks. Quality – rewarding providers who meet or exceed quality standards (through Physician Quality Reporting System). Patient Satisfaction – rewarding providers who have high satisfaction scores as healthcare organizations evaluate consumer choice, transparent patient satisfaction data, and reimbursement. Practice Revenue vs. Expense – rewarding providers when their practices reach or exceed their budgeted revenue and/or expense. Citizenship – rewarding providers for partnering with organization including membership on committees, implementation of organizational initiatives, publishing, presenting, and teaching the next generation of medical providers. Cost Reduction – collaboration with providers on reducing unnecessary orders, yet not compromising the quality of care delivered to patients. © 2012 Crowe Horwath LLP 11 The Unique Alternative to the Big Four® Provider Retention After the merger or acquisition occurs, there are several items to consider for the successful integration and retention of the provider. During the course of the recruitment, the institutional and department goals along with expectations are first discussed and should continue once employed. Participation in current project, committees, hospital/department initiatives can strengthen the provider integration into the hospital culture while continuing to build the practice and referral base. Physician involvement with reviewing reporting metrics for improvement opportunities offers a clinical perspective for the continual evolution of the practice. Begins in the early states of the interviewing process, setting the tone with first impressions Shifts toward practice building and monitoring phase for growth and engagement in overall success Audit | Tax | Advisory | Risk | Performance 1 Recruit 4 Build/ Monitor 2 Onboard 3 Integrate Continues into onboarding phase where quick-wins can be gained by support staff and administration Moves to integration phase where culture buy-in and assimilation into committees and groups is key © 2012 Crowe Horwath LLP 12 The Unique Alternative to the Big Four® Typical Physician Practice Valuation Process Valuation engagement is defined Valuation date Standard of value Discussion with Clients and Advisors related to approach and methodology Relevant data is gathered Gain understanding of business/interests to be valued Nature of the enterprise Services, products and markets Competitive situation Management Financial data is analyzed Historical Prospective Identify appropriate financial metrics specific to valuation assignment Valuation methodologies are considered from Income, Market and Cost Approaches Valuation conclusion reached and draft reports submitted Concluding conversations with Clients and Advisors to finalize analysis Appropriate documentation completed Gain understanding of the economic and industry environment Audit | Tax | Advisory | Risk | Performance © 2011 Crowe Horwath LLP 13 The Unique Alternative to the Big Four® Valuation Methodologies The three generally accepted valuation methods will be considered in our appraisal of the business interests and assets. These methods include the income approach, market approach, and asset/cost approach. The application of the approaches differs slightly depending on the type of business or asset being valued. Income Approach The value of the business or asset is estimated based on the estimated future cash flows expected to be generated. The process includes analysis of a multi-period cash flow projection based on gaining an understanding of the assumptions used by management to develop the projections. Value is determined by discounting these cash flows and the residual value at the end of the projection period, if any, at an appropriate discount rate that accounts for the relative risk of realizing the estimated cash flows and the time value of money. If a forecast is not available or if stable earnings are anticipated, value is based on capitalizing some measure of financial performance such as earnings or dividends, using a capitalization rate that reflects both the risk and long-term growth prospects of the subject firm or asset. Audit | Tax | Advisory | Risk | Performance © 2011 Crowe Horwath LLP 14 The Unique Alternative to the Big Four® Valuation Methodologies (cont’d) Market Approach The value of the business or asset is determined by comparison to either: Comparable companies or assets that have been bought or sold during a reasonably recent period of time (guideline transaction method); or Comparable companies that are publicly traded on organized capital markets (guideline company method). Appropriate capital market multiples are determined from a sample of comparable data points. These multiples could include: price/revenue multiple, price/cash flow multiple, price/equity multiple, etc on a historical or forward looking basis. Value is determined by applying relevant multiples to the corresponding financial metrics of the business or asset. Asset/Cost Approach The value of the business or asset is estimated based on an analysis of the market value of its underlying assets, both tangible and intangible. Under the adjusted net asset method, a method within the asset approach, the values are totaled, and the business’ liabilities are subtracted to derive the total value of the enterprise. The enterprise value indicator is the sum of the values of the individual assets and liabilities of the business. In real and personal property valuation, this approach estimates the replacement cost new (“RCN”) for each property and related improvements under the premise of “in continued use”. From RCN, allowances for physical depreciation, functional obsolescence, and if applicable, economic obsolescence are subtracted. Audit | Tax | Advisory | Risk | Performance © 2011 Crowe Horwath LLP 15 The Unique Alternative to the Big Four® Typical Valuation Report Content Overview History and Nature of the Business Overview of the company Current operations Overview of financial results Valuation of Business Income approach Market approach Asset approach Conclusion of Value General Economic Outlook Summary & highlights Global outlook Industry Outlook Valuation Approaches & Methodologies Determination of the Rate of Return Rate of return on debt capital Rate of return on equity capital Capital structure & conclusion Audit | Tax | Advisory | Risk | Performance © 2011 Crowe Horwath LLP 16 The Unique Alternative to the Big Four® Negotiating and Closing the Deal – General Key Terms Compensation valuation Business Valuation Stock v. asset sale Equipment Succession planning Employee retention Restrictive covenants Future terms / renegotiating future compensation Audit | Tax | Advisory | Risk | Performance © 2011 Crowe Horwath LLP 17 The Unique Alternative to the Big Four® For more information, contact: Christian Heuer Direct 615.360.5572 Mobile 615.584.8056 christian.heuer@crowehorwath.com Pat A. Sorrentino Direct 630.990.4448 Mobile 630.514.9226 pat.sorrentino@crowehorwath.com Crowe Horwath LLP is an independent member of Crowe Horwath International, a Swiss verein. Each member firm of Crowe Horwath International is a separate and independent legal entity. Crowe Horwath LLP and its affiliates are not responsible or liable for any acts or omissions of Crowe Horwath International or any other member of Crowe Horwath International and specifically disclaim any and all responsibility or liability for acts or omissions of Crowe Horwath International or any other Crowe Horwath International member. Accountancy services in Kansas and North Carolina are rendered by Crowe Chizek LLP, which is not a member of Crowe Horwath International. This material is for informational purposes only and should not be construed as financial or legal advice. Please seek guidance specific to your organization from qualified advisers in your jurisdiction. © 2011 Crowe Horwath LLP Audit | Tax | Advisory | Risk | Performance © 2011 Crowe Horwath LLP 18