Audited Accounts for KG

advertisement

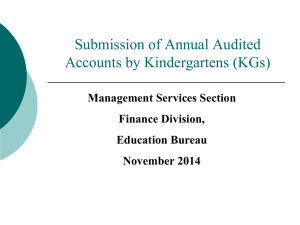

Submission of Annual Audited Accounts by Kindergartens (KGs) Management Services Section Finance Division, Education Bureau November 2013 Agenda − Submission of audited accounts 2–3 − Preparation of audited accounts 4–6 − Requirements to be observed by KGs joining PEVS 7–9 − Issues identified during the examination of audited accounts 10 − Appointment of auditors 11 – 13 − Electronic submission of audited accounts 14 – 20 − Late submission/submission of incomplete /incorrect audited accounts 21 1 KGs Required to Submit Annual Audited Accounts KGs joining the Pre-primary Education Voucher Scheme (PEVS) [EDBC No. 6/2011 – Pre-primary Education Voucher Scheme] KGs receiving subsidies under the Child Care Centre Subsidy Scheme [EDBC No. 3/2008 – Child Care Centre Subsidy Scheme] KGs receiving rent reimbursement [EDBC No. 2/2004 – Reimbursement of Rent for Non-profit-making Kindergartens] 2 Submission of Annual Audited Accounts A circular memorandum was issued earlier this month to request KGs to submit the 2012/13 audited accounts. Major contents include: Points to note in preparing the annual audited accounts Formats of 2012/13 audited accounts Points to note for schools’ auditors Deadline for submission: 10 February 2014 3 Points to Note in Preparing Audited Accounts In preparing the 2012/13 audited accounts, KGs should note the following: Observe the list of items to be covered by school fees as set out in relevant EDB guidelines, for which parents should not be charged separately. Follow the relevant EDB circulars/guidelines to properly classify their incomes (i.e. “School Fees”, “Income from Trading Operations” and “Other Income”) and report them in the audited accounts accordingly. Disclose related party transactions in the audited accounts (which should match with the relevant disclosure made by schools in their fee revision applications). 4 Formats of Audited Accounts The formats of 2012/13 audited accounts are more or less the same as previous years with slight revisions as follows: KGs have to provide breakdowns for “Other Income” and “Other Expenditure” reported in their audited accounts. KGs have to properly classify the related party transaction(s) disclosed (i.e. “Amount due from related party(ies)”, “Amount due to related party(ies)”, “Receipt from related party(ies)” and “Payment to related party(ies)”. KGs have to list out all their trading operations and put each activity under separate columns in the “Statement of Trading Operations”. 5 Points to Note When Submitting Audited Accounts Audited accounts in the prescribed format should be submitted promptly on or before the deadline 2010/11 Audited Accounts --- 54% submitted before the deadline 2011/12 Audited Accounts --- 66% submitted before the deadline Audited accounts must be signed by the School Supervisor and stamped with the school chop. Each statement to the accounts should be stamped with the identification chop of the auditor as well. 6 Requirements to be Observed by KGs Joining PEVS(1) KGs joining PEVS shall not transfer the surplus, in whatever form, to any of their sponsoring bodies or other organisations. [EDBC No. 6/2011 – Pre-Primary Education Voucher Scheme, para. 2(g) in Appendix I] 7 Requirements to be Observed by KGs Joining PEVS(2) No profit on sale of textbooks. [EDBC No. 16/2013 – Collection of Fees, Sale of School Items and Provision of Paid Services in Kindergartens, para. 5(e)] Profits from the sale of other school items and provision of paid services should not exceed 15% of the total cost. [EDBC No. 16/2013 – Collection of Fees, Sale of School Items and Provision of Paid Services in Kindergartens, para. 5(f) ] 8 Requirements to be Observed by KGs Joining PEVS(3) School are not recommended to place surplus funds in any form of speculative investment because of the risk of financial loss. The liability for any such loss shall strictly fall on the school management responsible for incurring such a loss and shall not be allowed to be recovered as a charge against the income of the school. [EDBC No. 2/2003 – The Choice of Bank Counterparties in the Investment of Public Assets] 9 Issues Identified During the Examination of Audited Accounts Schools failed to comply with the requirements and had made transfer of surplus (e.g. donation expenses), profits from trading operations exceeding the relevant limits and incurred investment loss in their accounts. Auditors did not certify whether the schools had used government subsidies according to the EDB requirements. Schools did not put each activity of trading operations under separate columns. Schools did not report the income from the sale of school items or provision of paid services in the Statement of Trading Operations. 10 Appointment of Auditors The accounts of KGs should be audited by Certified Public Accountants (practising) registered under the Professional Accountants Ordinance. Besides the cost for the audit services, schools should also take into account other factors in the selection of auditors, e.g. relevant experience of the auditors and potential conflict of interest (e.g. business relations with the members of the School Management Committee, School Supervisor and staff of the school), etc. 11 Appointment of Auditors (cont’d) An engagement letter should be signed when appointing the auditor and it should generally include the following: the objective and scope of the audit of financial statements; the respective responsibilities of the school and the auditors; the right of access to records, documentation and other information requested in connection with the audit; the form of any reports or other communication of results of the audit; and fees. [EDBC No. 17/2008 – Appointment of Auditors and Audit Engagement Letter] 12 Matters to be Followed Up with the Auditors Auditors should draw the attention of the School Management Committees or School Supervisors on weaknesses in internal controls discovered during the course of their audits with recommendations for improvement. KGs should discuss with auditors and rectify the problems as soon as possible. 13 Electronic Submission of Audited Accounts (1) To facilitate schools in the preparation of their audited accounts, the relevant pro-formas in Excel format have been uploaded for use. Using the Excel template to prepare the audited accounts is very convenient . Automatic linkage Cross reference Correct format Annex 1.xls 14 Electronic Submission of Audited Accounts (2) Guide to completing the audited accounts Complete Annex 1 first, the school’s basic information will be shown in other statements automatically. Fill in the cells shaded in light blue, the relevant data in other statements will be calculated automatically to minimize input errors. Schools may follow the sequence below in completing the statements: - Statement 7_FA and Statement 7_Others - Statements 4, 5 and 6 - Statement 1/1A - Statement 2 - No input is required for Statement 3 15 Electronic Submission of Audited Accounts (3) The Excel template can be downloaded from the following addresses for the preparation of the audited accounts. For School Portal users: https://kgac.edb.gov.hk For non-School Portal users: http://www.edb.gov.hk/circular/adhocforme/2013fdkg-e.xls Schools are advised to provide the softcopy* of their audited accounts on or before the deadline: - electronically via the School Portal Account; or - by submitting a CD. [*Submission of softcopy of the audited accounts is on a voluntary basis, i.e. schools may make their own choices.] Should your school choose to provide the softcopy of the audited accounts, please ensure that it is identical to the 16 hardcopy. Electronic Submission of Audited Accounts (4) KGs may download the Excel template and submit the softcopy of the audited accounts via the School Portal. 17 Electronic Submission of Audited Accounts (5) 18 Electronic Submission of Audited Accounts (6) 19 Electronic Submission of Audited Accounts (7) 20 Late Submission/Submission of Incomplete/Incorrect Audited Accounts Late submission of the audited accounts may cause delay or suspension in the processing of the applications for school fee revisions. Incomplete/incorrect audited accounts may be returned to the schools for amendment. 21 Thank You 22