WyWallet WyWallet SMS Payment API Version 0.4 Issued 2012

advertisement

WyWallet

WyWallet SMS Payment API

Version 0.4

Issued 2016-03-22

2016-03-22

WyWallet SMS Payment API v0.4

Page 1 (37)

Table of contents

1

Introduction ............................................................................................................... 5

1.1

1.2

1.3

2

API - Overview ........................................................................................................... 7

2.1

2.2

2.3

2.4

3

Purpose .......................................................................................................................... 5

Requirements ................................................................................................................. 5

Definitions and abbreviations .......................................................................................... 6

WSDL URL ....................................................................................................................... 7

Method overview ........................................................................................................... 7

Synchronous Payment overview ...................................................................................... 8

Asynchronous Payment overview .................................................................................... 9

API – details ............................................................................................................... 9

3.1 General........................................................................................................................... 9

3.1.1

Header ............................................................................................................................... 9

3.1.2

Status ............................................................................................................................... 10

3.1.3

Footer .............................................................................................................................. 11

3.2 Status codes ................................................................................................................. 12

3.2.1

Transaction status codes ................................................................................................. 12

3.2.2

Operation status codes.................................................................................................... 15

3.3 SmsPaymentService ...................................................................................................... 16

3.3.1

Purchase .......................................................................................................................... 16

3.3.2

Reversal ........................................................................................................................... 19

3.3.3

Credit ............................................................................................................................... 21

3.3.4

CheckOrder ...................................................................................................................... 22

3.3.5

Ping .................................................................................................................................. 24

3.4 Postback service ........................................................................................................... 25

3.4.1

PostbackRequest ............................................................................................................. 25

4

ProductID ................................................................................................................. 27

5

Appendix A ............................................................................................................... 28

5.1 Hash description ........................................................................................................... 28

5.1.1

SHA1 Hash .Net ............................................................................................................... 28

5.1.2

SHA1 Hash – JAVA............................................................................................................ 28

5.2 Postback service examples ............................................................................................ 32

5.2.1

Java JSP postback ............................................................................................................. 32

5.2.2

ASP.net postback service ................................................................................................. 33

6

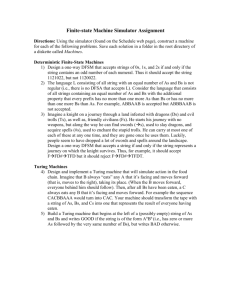

Appendix C: Simulator for API development ............................................................. 34

2016-03-22

WyWallet SMS Payment API v0.4

Page 2 (37)

6.1

6.2

6.3

6.4

6.5

URL............................................................................................................................... 34

Valid request parameters .............................................................................................. 34

Response codes ............................................................................................................ 35

Frequently asked questions ........................................................................................... 36

Merchant support ......................................................................................................... 37

2016-03-22

WyWallet SMS Payment API v0.4

Page 3 (37)

Version history

Version

0.1

0.2

Date

2012-07-25

2012-07-27

0.3

2012-08-28

0.4

2012-11-13

2016-03-22

Comment

First draft

General updates, added

payment sequence diagrams

Updated simulator and

postback examples

Fixed error in MAC calculation

for credit/reversal.

Updated transaction statuses.

Name

Jonas Jansson

Jonas Jansson

Jonas Jansson

Jonas Jansson

WyWallet SMS Payment API v0.4

Page 4 (37)

1 Introduction

1.1 Purpose

This document (WyWallet SMS Payment API) describes how merchants, content providers and

aggregators can implement the functionality for premium SMS (and other CPA services) payments via

the end-user WyWallet account.

This API is a Server-to-Server API built on the operating system independent technology webservices

and the API is very similar to the WyWallet Online Payment API which is more targeted for

Web/Mobile Web and “in-app” payments. Online payments have higher security and therefor also has

higher amount limits. There are also some technical differences between the interfaces:

SMS payments only supports 1 phase billing and Authorize / Capture are combined in the

same request, purchase().

The SMS API only requires MSISDN (phone number) to identify the account and no end-user

interaction is needed to authorize the payment.

Only the SMS API allows end-customers to use the mobile invoice or prepaid subscription as

payment method.

There are two different merchant account types (configured by WyWallet), synchronous and

asynchronous payments.

Synchronous (Default)

o Payments are accepted and processed immediately

o All received payment statuses are final.

Asynchronous

o Asynchronous requests are used for merchants with very high performance

requirements

o All payments requests are accepted but set in an unconfirmed payment status and put

in an internal queue for further processing.

o When the payments are processed the final status of the payment is sent in a XML to

the merchant using HTTPS POST to the postbackURL set in the initial request.

o The post-back requires the merchant to implement online receiver / listener..

o Please not that all post-backs are sent via HTTPS/SSL and that you therefore need a

SSL certificated installed (from a trusted CA e.g. www.thawte.com or others)

The MAP service will perform a lookup and identify the operator and preferred account.

This service is based upon an asynchronous design.

This means users of the API must implement a “postback service”, in order to receive the final

transaction status. The “postback service” is based on HTTP POST and XML.

In periods of high load and lengthy operations, the response is asynchronous.

1.2 Requirements

2016-03-22

WyWallet SMS Payment API v0.4

Page 5 (37)

1.3 Definitions and abbreviations

Terms, acronyms,

abbreviations

IP

MAC

MSISDN

Portal

SHA1

SOAP

UTF8

VAT

WSDL

MAP

PSP

SSL

2016-03-22

Definition/Description

Internet Protocol

Message Authentication Control

Mobile Subscriber ISDN Number (Mobile phone number)

In this context, the website where end users can manage their WyWallet

Account

A cryptographic hash function designed by the National Security Agency

(NSA)

Simple Object Access Protocol

A multi byte character encoding for Unicode

Value Added Tax (Moms)

Web Services Description Language

Mobile payment Access Point

Payment Service Provider.

Secure Socket Layer

WyWallet SMS Payment API v0.4

Page 6 (37)

2 API - Overview

2.1 WSDL URL

Test URL MAP SmsPaymentService:

https://mpaymenttest.payex.com/MAP/SmsPaymentService?wsdl

Simulator URL MAP SmsPaymentService:

https://mpaymenttest.payex.com/MAP/PaymentServiceTest?wsdl

Production URL MAP SmsPaymentService:

https://mps.payex.com/MAP/SmsPaymentService?wsdl

See also section 6.1

2.2 Method overview

General

Header

Status

Footer

SmsPaymentService

Purchase

Reversal

CheckOrder

Credit

Ping

2016-03-22

WyWallet SMS Payment API v0.4

Page 7 (37)

2.3 Synchronous Payment overview

WyWallet SMS Payement API

End-customer

Merchant

PurchaseRequest (e.g. SMS via shortcode)

Primary Input Parameters

ClientID (MSISDN)

Amount

CurrencyISOString

VatAmount

OrderID

ProductID

Description

MAC

WyWallet API

Purchase()

Debit WyWallet account

PurchaseResponse

Deliver content / service

2016-03-22

Primary Return Parameters

TransactionID

OperationStatus

TransactionStatus

WyWallet SMS Payment API v0.4

Page 8 (37)

2.4 Asynchronous Payment overview

WyWallet SMS Payement API

End-customer

Merchant

PurchaseRequest (e.g. SMS via shortcode)

Primary Input Parameters

ClientID (MSISDN)

Amount

CurrencyISOString

VatAmount

OrderID

ProductID

Description

MAC

PostBackURL

WyWallet API

Webservice - Purchase()

WebService - PurchaseResponse

Queue transaction

Primary Return Parameters

TransactionID

OperationStatus

TransactionStatus (preliminary)

Debit WyWallet account

XML HTTPS POST - PostBackURL

Verify MAC

Primary PostBack Parameters

TransactionID

ProductID

Amount

OperationStatus

TransactionStatus (final)

MAC

Deliver content / service

3 API – details

3.1 General

3.1.1

Header

Name

Data type

Description

AcquirerID

String

AgreementID

String

This ID is provided by WyWallet and

identifies the application using the

API.

The AcquirerID and MAC key in the

footer are linked.

This ID is provided by WyWallet and

describes the link between merchant /

acquirer / product / merchant account

2016-03-22

WyWallet SMS Payment API v0.4

Mandatory /

Optional

Mandatory

Mandatory

Page 9 (37)

TransmissionTime

String

ClientIP

String

PostbackURL

String

PostbackTimeout

int

number etc.

Format: yyyy-MM-dd HH:mm:ss

e.g. 2010-12-04 14:45:53

Must be UTC

IP address of end-customer/client.

This can be used as an additional

option for fraud detection and other

security issues.

See chapter 3.4 for further details

Desired max number of seconds

between initial request and the

postback. Should be set to at least a

few minutes for operations that

require user confirmation / pin code

etc.

Mandatory

Optional

Mandatory but

only for

asynchronous

accounts

Optional

If set to 0, the MAP system default

timeout is used (e.g. 15 minutes).

3.1.2

Status

Name

Data type

Description

TransactionsStatus

Int

0 is general OK

Mandatory /

Optional

Mandatory

See specific list for each operation for

other statuses.

TransactionStatusDesc

OperationStatus

String (200)

String (30)

OperationStatusDesc

String (200)

2016-03-22

This parameter reports the technical

status of the request.

Short description of status

This parameter states the logical

status of the request, may also be a

3rd party error code.

Short Description of OperationStatus.

WyWallet SMS Payment API v0.4

Mandatory

Optional

Optional

Page 10 (37)

3.1.3

Footer

Name

Data type

Description

MAC

String (256)

Message Authentication Control.

This is a calculated field. WyWallet

provides the key (shared secret) used

when generating this field.

2016-03-22

WyWallet SMS Payment API v0.4

Mandatory /

Optional

Mandatory

Page 11 (37)

3.2 Status codes

3.2.1

Transaction status codes

TransactionStatus

0

1

2

3

5

Description

OK

Technical error

Input error

Wrong AgreementID

Unauthorized action

5

Unauthorized action

6

Client account not found

7

8

Client account blocked

Insufficient funds

11

Client account is expired

53

Connection limit exceeded

Notes

One or more of the input parameters

is missing or has the wrong format or

value.

Comment: This is an implementation

error.

AgreementID not found

Comment: This is a configuration

error or implementation error (e.g.

sending request to the wrong

system)

The merchant/aggregator is not

permitted to perform the requested

operation.

Comment: This is a implementation

error. The provided AgreementID is

not allowed to execute this action.

The merchant/aggregator is not

permitted to perform the requested

operation.

Comment: The end user has no

account in this system.

The end user has not enough money

on the selected account to perform

the purchase.

Comment: This will rarely occur.

Must be treated the same way as

status 7.

The number of allowed concurrent

active requests has been exceeded.

This is implemented to prevent a single

acquirer to use 100% of the API capacity.

The request may be retried later. Avoid

this problem by reducing traffic and/or

implement flow control in your

2016-03-22

WyWallet SMS Payment API v0.4

Page 12 (37)

application.

60

Acknowledge

61

Deprecated

62

Deprecated

63

Generic decline

Comment: Try again.

Valid request received and queued

for processing. Final response will be

sent to the PostbackURL.

Comment: Only used for

asynchronous payments.

Replaced with status code 63

(Generic decline).

Replaced with status code 63

(Generic decline).

This status code is returned when a

payment transaction is rejected and

the system either cannot or will not

specify the exact reason.

Examples of conditions that causes

this status code to be returned

include:

- A purchase amount limit has been

exceeded

- Accumulated transaction amount

has been exceeded

- Suspected fraud

- Generic errors returned by external

(3rd party) payment instruments

99

Rejected by business rule

105

107

110

Deprecated

Deprecated

Order not found

114

Third party error.

2016-03-22

Payment is currently not available to

the requested

payee/client/subscriber/ on the

current payment channel.

Comment: This is a general error,

and should be treated as status 6.

The customer is not allowed to use

this payment instrument.

Replaced with status code 6

Replaced with status code 1

The order search for with the

CheckOrder function could not be

found

Third party error for external account.

WyWallet SMS Payment API v0.4

Page 13 (37)

116

117

118

119

120

121

No suitable payment instrument found

Max number of purchases for Easy

Registration exceeded

Max purchase amount for Easy

registration exceeded

Deprecated

User not identified by mobile operator,

MNO billing disabled

MSISDN does not belong to a WyWallet

operator

Comment: This should be treated as

“host down”, meaning that the

account provider is not responding

for the time. This is not a permanent

error and retries are possible.

The user does not have a payment

instrument / account that is permitted

in this scenario.

Comment: Should be treated as

status 6.The customer may have an

account, but cannot use the account

in this scenario.

The user needs to register on the

portal to continue using the system

Comment: This is a customer error

response. Due to anti fraud

restrictions, the payment will not be

approved. Should be treated as

status 6.

The purchase amount is higher than

permitted amount for users that are

not fully registered.

Comment: This is a customer error

response. Due to anti fraud

restrictions, the payment will not be

approved. Should be treated as

status 6.

Replaced with status code 6

Cannot charge to phone bill because

the mobile operator could not identify

the user of the given MSISDN

Comment: This is a customer error

response. Should be treated as

status 6.

The MSISDN / phone number does

not belong to a 4T telecom operator

(Telia, Telenor,Tele2 or 3.)

Comment: This is a customer error

response. Should be treated as

status 6.

2016-03-22

WyWallet SMS Payment API v0.4

Page 14 (37)

3.2.2

Operation status codes

OperationStatus

0

1

<others>

2016-03-22

Description

OK

Technical error

Description is contained in

OperationStatusDesc

Action

WyWallet SMS Payment API v0.4

Page 15 (37)

3.3 SmsPaymentService

This API is used for financial transactions.

3.3.1

Purchase

This method will perform a normal sales transaction, transferring a specified amount from the micro

account to a merchant account. This is a one-phase transaction.

PurchaseRequestWrapper

Header -> see section 3.1.1

SalesRequest -> see section 3.3.1.1

Footer -> see section 3.1.3

PurchaseResponseWrapper

Header -> see section 3.1.1

SalesResp -> see section 3.3.1.2

Status -> see section 0

3.3.1.1

SalesRequest

SalesRequest is used in Purchase and Credit operations. It has the following parameters:

Name

Type

Description

Amount

VatFormat

Int

String (9)

VatAmount

Int

CurrencyISOString

ClientIdType

String (3)

String (30)

ClientId

String (50)

AccountName

String (20)

Price in cent/öre, including VAT

Specifies format of VatAmount . One of

o Amount: VAT is specified in cent/öre

o Percent: VAT is specified as VAT

percent*100, e.g. 25% VAT is

specified as 2500.

Default format is Amount.

VAT (Moms) in percent or cent/öre,

according to VatFormat

One of DKK, EUR, GBP, NOK, SEK or USD

SMS Payments only supports only supports

one type of clientID which is MSISDN.

Identifies the account owner by id type

specified by ClientIdType, e.g. MSISDN if

ClientIdType =MSISDN.

Format of MSISDN is

00<country code><phone number without 0>

Example 0046701234567

Currently not used in this context

2016-03-22

WyWallet SMS Payment API v0.4

Mandatory /

Optional

Mandatory

Optional

Mandatory

Mandatory

Mandatory

Mandatory

Optional

Page 16 (37)

OrderId

String (60)

ReconciliationTime

String (19)

Unique ID identifying the Sale.

Can be used in multiple transactions of the

same Sale (E.g. the same OrderId is used in

both Authorize and Capture).

Max length 50 characters.

Timestamp stored with the transaction both

in WyWallet system and merchant. Used for

reconciliation.

Mandatory

Mandatory

Format: yyyy-MM-dd HH:mm:ss

ProductId

String (50)

Description

String (35)

CustomParameters

String

(2048)

2016-03-22

UTC

Merchant product number/reference for this

specific product.

Max 50 characters.

See chapter 4 for detailed description.

Merchant’s description of the purchase.

Max 35 characters.

URL encoded ‘QueryString’: Name/value

pairs separated with ‘&’

(param1=value1&param2=value2…)

WyWallet SMS Payment API v0.4

Mandatory

Mandatory

Optional

Page 17 (37)

MAC implementation:

Create a UTF8 encoded SHA1 hash of the following string.

AcquirerID+AgreementID+TransmissionTime+ PostbackURL+

Amount+VatAmount+CurrencyISOString+ClientIdType+ClientId+

OrderId+ReconciliationTime+ProductId+Description+CustomParameters+

SharedSecret

Return the first half.

If a field does not contain content, do not send the content (null / “ “ / ) in MAC.

See 5.1Hash description.

3.3.1.2

SalesResp

This response definition is primarily for Purchase() requests.

Name

Type

Description

TransactionID

String (60)

BatchID

Int

Unique id that must be used in reversal

operations

ID used for reconciliation, stored on all

financial transaction. The batch ID is

changed on regular intervals, typically once

per day.

2016-03-22

WyWallet SMS Payment API v0.4

Mandatory /

Optional

Mandatory

Mandatory

Page 18 (37)

3.3.2

Reversal

This operation will reverse all or part of a Purchase or Capture operation

ReversalRequestWrapper

Header -> see section 3.1.1

ReversalRequest

Footer -> see section 3.1.3

ReversalResponseWrapper

Header -> see section 3.1.1

ReversalResp

Status -> see section 3.1.2

3.3.2.1

Name

ReversalRequest

Type

Description

TransactionID

String (60)

OrderId

String (60)

Amount

Int

VatFormat

String (9)

VatAmount

Int

ReconciliationTime

String (19)

Description

String (160)

3.3.2.2

Name

ReversalResp

Type

TransactionID

BatchID

2016-03-22

String (60)

Int

Must match the TransactionID returned in

the Purchase operation.

Normally the OrderId sent with the original

Purchase request, but a new unique OrderId

is permitted. A blank (zero length) string will

Amount of money (cent/øre) to reverse,

including VAT

Amount: VAT is specified in cent/øre

Percent: VAT is specified as VAT

percent*100, e.g. 25% VAT is specified as

2500.

Default format is Amount.

VAT (MVA) in cent/øre or percent, according

to VatFormat

Timestamp stored with the transaction both

in PayEx system and merchant. Used for

reconciliation.

Format: yyyy-MM-dd HH:mm:ss

Used for logging

Description

ID of the reversal transaction

ID used for reconciliation, stored on all

WyWallet SMS Payment API v0.4

Mandatory /

Optional

Mandatory

Mandatory

Mandatory

Optional

Mandatory

Mandatory

Optional

Mandatory /

Optional

Mandatory

Mandatory

Page 19 (37)

financial transaction. The batch ID is

changed on regular intervals, typically once

per day.

MAC implementation:

Create a UTF8 encoded SHA1 hash of the following string:

AcquirerID+AgreementID+TransmissionTime+ PostbackURL+

TransactionID+ Amount+VatAmount+ReconciliationTime+SharedSecret

Return the first half.

If a field does not contain content, do not send the content (null / “ “ / ) in MAC.

See 5.1Hash description.

2016-03-22

WyWallet SMS Payment API v0.4

Page 20 (37)

3.3.3

Credit

This method can be used as an alternative to the Reversal operation to undo a sales transaction and

transfer a specified amount from the merchant account to the client account. The main difference from

Reversal is that reference to the original sales transaction is not required.

This is the opposite of a purchase.

Note: Access to this API may be restricted to specific merchants/aggregators. Use the

Reversal operation when possible.

CreditRequestWrapper

Header -> see section 3.1.1

SalesRequest -> see section 3.3.1.1

Footer -> see section 3.1.3

CreditResponseWrapper

Header -> see section 3.1.1

CreditResp

Status -> see section 3.1.2

3.3.3.1

Name

CreditResp

TransactionID

BatchID

Type

Description

String (60)

Int

ID of the credit transaction

ID used for reconciliation, stored on all financial

transaction. The batch ID is changed on regular

intervals, typically once per day.

Mandatory /

Optional

Mandatory

Mandatory

MAC implementation:

Create a UTF8 encoded SHA1 hash of the following string:

AcquirerID+AgreementID+TransmissionTime+ PostbackURL+

Amount+VatAmount+CurrencyISOString+ClientIdType+ClientId+

ReconciliationTime+ProductId+Description+CustomParameters+SharedSecret

Return the first half.

If a field does not contain content, do not send the content (null / “ “ / ) in MAC.

See 5.1Hash description.

2016-03-22

WyWallet SMS Payment API v0.4

Page 21 (37)

3.3.4

CheckOrder

This operation can be used to check the status of a sale in case a network communication error or

timeout prevents the caller/merchant to receive a response from the API. The merchant / API user can

then perform actions/cleanups according to the status of the order.

CheckOrderRequestWrapper

Header -> see section 3.1.1

CheckOrderRequest

Footer -> see section 3.1.3

CheckOrderResponseWrapper

Header -> see section 3.1.1

CheckOrderResp

Status -> see section 3.1.2

3.3.4.1

Name

CheckOrderRequest

Type

Description

OrderId

ClientIdType

String (60)

String (30)

ClientId

String (50)

3.3.4.2

Name

CheckOrderResp

Type

Description

TransactionID

String (60)

AmountAuthorized

Int

AmountCaptured

AmountCancelled

AmountReversed

Int

Int

Int

LastBatchId

Int

LastTransactionID

String (60)

2016-03-22

OrderId of the transaction(s) to check.

Specifies what ClientId refers to. For Sms

payment service value must be MSISDN

Format of MSISDN is 00+<country code>+

phone number, for example

0046123456789

Same value as in response from the

original purchase operation. The string will

be empty if the order cannot be found

The amount authorized. If the original

authorize failed, this value will be 0.

The amount captured.

The amount cancelled

The amount reversed using the Reverse

operation

Batch ID of the most recent transaction of

the order. (Will be > 0 only for successful

financial transactions)

TransactionID of the most recent

transaction of the order.

WyWallet SMS Payment API v0.4

Mandatory /

Optional

Mandatory

Mandatory

Mandatory

Mandatory /

Optional

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Page 22 (37)

LastTransactionStatus

Int

LastTransactionType

Int

Transaction status code of the last

transaction of the sale.

0=Purchase, 2=Reversal, 3=Authorize,

4=CancelAuth, 6=Capture

Mandatory

Optional

MAC implementation:

Create a UTF8 encoded SHA1 hash of the following string:

AcquirerID+AgreementID+TransmissionTime+ PostbackURL+

OrderId+ClientIdType+ClientId+SharedSecret

Return the first half.

If a field does not contain content, do not send the content (null / “ “ / ) in MAC.

See 5.1Hash description.

2016-03-22

WyWallet SMS Payment API v0.4

Page 23 (37)

3.3.5

Ping

This operation can be used to check connectivity to the AdminService API. It can be used for

test/development. Applications may also want to call this once after startup before sending

transactions to ensure that the communication is working.

PingRequestWrapper

Header -> see section 3.1.1

Footer -> see section 3.1.3

PingResponseWrapper

Header -> see section 3.1.1

Status -> see section 3.1.2

MAC implementation:

Create a UTF8 encoded SHA1 hash of the following string:

AcquirerID+AgreementID+TransmissionTime+ PostbackURL+

SharedSecret

Return the first half.

If a field does not contain content, do not send the content (null / “ “ / ) in MAC.

See 5.1Hash description.

2016-03-22

WyWallet SMS Payment API v0.4

Page 24 (37)

3.4 Postback service

Please note that the Postback service only is activated (manually by WyWallet) when the merchant

needs high performance (e.g. tv voting) and the merchant account is configured as an Asynchronous

account. The default setting for a merchant account id Synchronous where postbacks are not used.

In order to receive a receipt from an asynchronous request (transaction), each merchant (or

aggregator/PSP) must implement a Postback service.

The WyWallet MAP system will send out payment status as soon as the transaction is processed.

The system will send an ordinary XML over HTTP POST over SSL with a single parameter named

PostbackRequestWrapper that contains an XML document (se example below).

We strongly recommend you to verify the MAC code in the XML using your shared key and the

submitted data to authenticate the request before delivering the purchased service/goods.

PostbackRequestWrapper

Header -> see section 3.1.1

PostbackRequest ->

Footer -> see section 3.1.3

PostbackResponseWrapper

Header -> see section 3.1.1

Status -> see section 3.1.2

3.4.1

PostbackRequest

Name

Type

Description

Operation

String (30)

Specifies the operation. One of

o Purchase

o Reversal

o Credit

OrderID

TransactionID

BatchID

String (60)

String

Int

Amount

Int

OrderID of the original request

Payment transaction ID

ID used for reconciliation, stored on all

financial transaction. The batch ID is

changed on regular intervals, typically

once per day.

Amount of money (cent/öre) to reverse,

including VAT

2016-03-22

WyWallet SMS Payment API v0.4

Mandatory /

Optional

Mandatory

Mandatory

Optional

Optional

Optional

Page 25 (37)

MAC implementation:

The MAC sent in the footer of the XML document is computed the same way as in the requests. The

following parameters are used to compute the hash:

AcquirerID+AgreementID+TransmissionTime+ PostbackURL+ Operation+ OrderID+SharedSecret

The post back service should validate the MAC sent by the MAP service to protect against fraud.

Sample PostbackWrapper XML sent by MAP:

<?xml version="1.0" encoding="utf-8"?>

<PostbackRequestWrapper>

<Header>

<AcquirerID>string</AcquirerID>

<AgreementID>string</AgreementID>

<TransmissionTime>string</TransmissionTime>

<ClientIP>string</ClientIP>

<PostbackURL>string</PostbackURL>

</Header>

<PostbackRequest>

<Operation>string</Operation>

<BatchID>int</BatchID>

<OrderID>string</OrderID>

<TransactionID>string</TransactionID>

<Amount>int</Amount>

</PostbackRequest>

<Status>

<TransactionStatus>int</TransactionStatus>

<TransactionStatusDesc>string</TransactionStatusDesc>

<OperationStatus>string</OperationStatus>

<OperationStatusDesc>string</OperationStatusDesc>

</Status>

<Footer>

<MAC>string</MAC>

</Footer>

</PostbackRequestWrapper>

The Postback service should return an XML document in the HTTP BODY in the response to

acknowledge that the postback XML has been received. Sample reply message:

<?xml version="1.0" encoding="utf-8"?>

<PostbackResponseWrapper>

<Header>

<AcquirerID>string</AcquirerID>

<AgreementID>string</AgreementID>

<TransmissionTime>string</TransmissionTime>

<ClientIP>string</ClientIP>

<PostbackURL>string</PostbackURL>

</Header>

<Status>

<TransactionStatus>0</TransactionStatus>

<TransactionStatusDesc>OK</TransactionStatusDesc>

<OperationStatus>0</OperationStatus>

<OperationStatusDesc>OK</OperationStatusDesc>

</Status>

</PostbackResponseWrapper>

2016-03-22

WyWallet SMS Payment API v0.4

Page 26 (37)

4 ProductID

This is the list of valid productID:s that needs to specified for each purchase. The productID are used

for end-customer that has selected payment method is via the operator subscription and these

productID will render specific descriptions on the invoice.

Product id Description

Lottery

1

2

3

WiFi

Personal Ring Back Tone

4

Tickets

5

Business

6

Charity

7

Parking

8

Ring Back Tone

10

Charging

12

Auction

13

Vending machine

14

Adult content (All adult content regardless of type)

15

Positioning

16

Security product

17

18

19

Mobile Entertainment (Music, Music videos, Games, Wallpapers, animations, Themes,

Videos)

News (Access to news sites or content bought on a news site)

Mobile TV (Mobile TV services)

20

Applications (software for mobile, any applications that don’t fall under any other

categories. Includes content bought through a free application, for example an

audiobook client)

21

Voting (Voting for TV shows or other competitions)

22

Betting & gambling

23

Classified ads

24

Mobile marketing

25

Internet Portals (Access to Internet portals that is not news, community or adult)

26

Chat (Chatting services, for example dating chats)

27

Personal ad (Dating ads, contact ad, dating-sites)

28

29

30

31

32

Location Based Services

2016-03-22

Information Service (Charging for weather services,snow reports etc)

Coupons (For example mobile gift vouchers (ice cream, magazines etc))

M-Payment (For example e-school, mobile dictionaries etc)

Physical goods (Physical goods like, books, drinks, food etc)

WyWallet SMS Payment API v0.4

Page 27 (37)

5 Appendix A

5.1 Hash description

Returns only the first half of the generated Hash. This is to make brute force attack harder.

It’s easier to guess the MAC key for a single request, but harder to know if this is the correct key since

many keys can generate the first half of the output.

5.1.1 SHA1 Hash .Net

public static String GetMAC(String generatedString)

{

Encoding enc = Encoding.UTF8;

Byte[] rawMessage = enc.GetBytes(generatedString);

SHA1 sha1 = new SHA1CryptoServiceProvider();

Byte[] result = sha1.ComputeHash(rawMessage);

string mac = Convert.ToBase64String(result);

//split the string in 2 and return the first half

mac = mac.Substring(0, mac.Length / 2);

return mac;

}

5.1.2

SHA1 Hash – JAVA

public class Sha1Hash {

/** Creates a new instance of Sha1Hash */

public Sha1Hash() {

}

/**

* @param inputData

* @return

*/

public String getHashedValue(String inputData) {

String sResp = null;

try {

byte byteHash[];

MessageDigest sha1 = MessageDigest.getInstance("SHA-1");

sha1.update(inputData.getBytes("utf-8"));

byteHash = sha1.digest();

sha1.reset();

// see code snippet below..

String hash = Base64Util.encode(byteHash);

return hash.substring(0, (hash.length()/2));

} catch (Exception e) {

2016-03-22

WyWallet SMS Payment API v0.4

Page 28 (37)

System.err.println("getHashedValue failed: " + e.getMessage());

return null;

}

}

private String toHexString(byte[] array) {

StringBuilder sb = new StringBuilder ();

for (int i=0; i< array.length; i++) {

String hex = "0"+Integer.toHexString(array[i]);

String end = hex.substring(hex.length()-2);

sb.append(end.toUpperCase());

}

System.err.println("HASH:"+sb.toString());

return sb.toString();

}

}

/**

* Freeware from:

* Roedy Green

* Canadian Mind Products

* #208 - 525 Ninth Street

* New Westminster, BC Canada V3M 5T9

* tel: (604) 777-1804

* mailto:roedy@mindprod.com

*/

/**

* Encode arbitrary binary into printable ASCII using BASE64 encoding.

* very loosely based on the Base64 Reader by

* Dr. Mark Thornton

* Optrak Distribution Software Ltd.

* http://www.optrak.co.uk

* and Kevin Kelley's

*http://www.ruralnet.net/~kelley/java/Base64.java

*/

public class Base64Util

{

/**

* how we separate lines, e.g. \n, \r\n, \r etc.

**/

static String lineSeparator = System.getProperty( "line.separator");

/**

* max chars per line. A multiple of 4.

**/

private static int lineLength = 72;

/**

* determines how long the lines are that are generated by encode.

* Ignored by decode.

* @param length 0 means no newlines inserted.

*/

public static void setLineLength(int length)

{

lineLength = length;

}

/**

2016-03-22

WyWallet SMS Payment API v0.4

Page 29 (37)

* letter of the alphabet used to encode binary values 0..63

**/

static final char[] valueToChar = new char[64];

/**

* binary value encoded by a given letter of the alphabet 0..63

**/

static final int[] charToValue = new int[256];

/**

* Marker value for chars we just ignore, e.g. \n \r high ascii

*/

static final int IGNORE = -1;

/**

* Marker for = trailing pad

*/

static final int PAD = -2;

static

{

// build translate valueToChar table only once.

// 0..25 -> 'A'..'Z'

for ( int i=0; i<=25; i++ )

valueToChar[i] = (char)('A'+i);

// 26..51 -> 'a'..'z'

for ( int i=0; i<=25; i++ )

valueToChar[i+26] = (char)('a'+i);

// 52..61 -> '0'..'9'

for ( int i=0; i<=9; i++ )

valueToChar[i+52] = (char)('0'+i);

valueToChar[62] = '+';

valueToChar[63] = '/';

// build translate charToValue table only once.

for ( int i=0; i<256; i++ )

{

charToValue[i] = IGNORE; // default is to ignore

}

for ( int i=0; i<64; i++ )

{

charToValue[valueToChar[i]] = i;

}

charToValue['='] = PAD;

}

/**

* Encode an arbitrary array of bytes as Base64 printable ASCII.

* It will be broken into lines of 72 chars each. The last line

* is not

* terminated with a line separator.

*/

public static String encode(byte[] b)

{

// Each group or partial group of 3 bytes becomes four chars

int outputLength = ((b.length + 2) / 3) * 4;

// account for embedded newlines

outputLength += (outputLength / lineLength) *

lineSeparator.length();

2016-03-22

WyWallet SMS Payment API v0.4

Page 30 (37)

// must be local for recursion to work.

StringBuffer sb = new StringBuffer( outputLength );

// must be local for recursion to work.

int linePos = 0;

// first deal with even multiples of 3 bytes.

int len = (b.length / 3) * 3;

int leftover = b.length - len;

for ( int i=0; i<len; i+=3 )

{

// Start a new line if next 4 chars won't fit on the current line

// We don't encapsulate so that linePos and sb will work recursively

{

linePos += 4;

if ( linePos > lineLength )

{

linePos = 0;

if ( lineLength != 0) {sb.append(lineSeparator);}

}

}

// get next three bytes in unsigned form lined up,

// in big-endian order

int combined = b[i+0] & 0xff;

combined <<= 8;

combined |= b[i+1] & 0xff;

combined <<= 8;

combined |= b[i+2] & 0xff;

// break those 24

// working LSB to

int c3 = combined

combined >>>= 6;

int c2 = combined

combined >>>= 6;

int c1 = combined

combined >>>= 6;

int c0 = combined

bits into a 4 groups of 6 bits,

MSB.

& 0x3f;

& 0x3f;

& 0x3f;

& 0x3f;

// Translate into the equivalent alpha character

// emitting them in big-endian order.

sb.append( valueToChar[c0]);

sb.append( valueToChar[c1]);

sb.append( valueToChar[c2]);

sb.append( valueToChar[c3]);

}

// deal with leftover bytes

switch ( leftover )

{

case 0:

default:

// nothing to do

break;

case 1:

// One leftover byte generates xx==

// Start a new line if next 4 chars won't fit on the current line

// We don't encapsulate so that linePos and sb will work recursively

{

2016-03-22

WyWallet SMS Payment API v0.4

Page 31 (37)

linePos += 4;

if ( linePos > lineLength )

{

linePos = 0;

if ( lineLength != 0) {sb.append(lineSeparator);}

}

}

// Handle this recursively with a faked complete triple.

// Throw away last two chars and replace with ==

sb.append(encode(new byte[] {b[len], 0, 0}

).substring(0,2));

sb.append("==");

break;

case 2:

// Two leftover bytes generates xxx=

// Start a new line if next 4 chars won't fit on the current line

// We don't encapsulate so that linePos and sb will work recursively

{

linePos += 4;

if ( linePos > lineLength )

{

linePos = 0;

if ( lineLength != 0) {sb.append(lineSeparator);}

}

}

// Handle this recursively with a faked complete triple.

// Throw away last char and replace with =

sb.append(encode(new byte[] {b[len], b[len+1], 0}

).substring(0,3));

sb.append("=");

break;

} // end switch;

if ( outputLength != sb.length() ) System.out.println("oops");

return sb.toString();

}// end encode

}

5.2 Postback service examples

5.2.1

Java JSP postback

<%@page

import="org.w3c.dom.*,javax.xml.xpath.*,javax.xml.parsers.*,java.io.IOException,org.xml.sax.SAXException"

%>

<%@page import="javax.servlet.ServletInputStream,javax.servlet.http.HttpServletRequest"%>

<%@page import="java.io.BufferedReader,java.io.InputStreamReader"%>

<%@page import="java.io.*" %>

<%@page import="org.xml.sax.InputSource" %>

<%

try

{

DocumentBuilderFactory domFactory = DocumentBuilderFactory.newInstance();

domFactory.setNamespaceAware(true);

DocumentBuilder builder = domFactory.newDocumentBuilder();

//Load the XML document in the parser

Document doc = builder.parse(new

InputSource(newStringReader(request.getParameter("PostbackRequestWrapper"))));

XPath xpath = XPathFactory.newInstance().newXPath();

// XPath Query for showing all nodes value

XPathExpression expr;

//Set the filter to find the elements

//Header parameters

2016-03-22

WyWallet SMS Payment API v0.4

Page 32 (37)

expr = xpath.compile("//PostbackRequestWrapper/Header/AcquirerID/text()");

String AcquirerID = (String) expr.evaluate(doc, XPathConstants.STRING);

expr = xpath.compile("//PostbackRequestWrapper/Header/AgreementID/text()");

String AgreementID = (String) expr.evaluate(doc, XPathConstants.STRING);

expr = xpath.compile("//PostbackRequestWrapper/Header/MerchantID/text()");

String MerchantID = (String) expr.evaluate(doc, XPathConstants.STRING);

expr = xpath.compile("//PostbackRequestWrapper/Header/TransmissionTime/text()");

String TransmissionTime = (String) expr.evaluate(doc, XPathConstants.STRING);

expr = xpath.compile("//PostbackRequestWrapper/Header/ClientIP/text()");

String ClientIP = (String) expr.evaluate(doc, XPathConstants.STRING);

expr = xpath.compile("//PostbackRequestWrapper/Header/PostbackURL/text()");

String PostbackURL = (String) expr.evaluate(doc, XPathConstants.STRING);

//PostbackRequest parameters

expr = xpath.compile("//PostbackRequestWrapper/PostbackRequest/Operation/text()");

String Operation = (String) expr.evaluate(doc, XPathConstants.STRING);

expr = xpath.compile("//PostbackRequestWrapper/PostbackRequest/Amount/text()");

String Amount = (String) expr.evaluate(doc, XPathConstants.STRING);

expr = xpath.compile("//PostbackRequestWrapper/PostbackRequest/BatchID/text()");

String BatchID = (String) expr.evaluate(doc, XPathConstants.STRING);

expr = xpath.compile("//PostbackRequestWrapper/PostbackRequest/OrderID/text()");

String OrderID = (String) expr.evaluate(doc, XPathConstants.STRING);

expr = xpath.compile("//PostbackRequestWrapper/PostbackRequest/TransactionID/text()");

String TransactionID = (String) expr.evaluate(doc, XPathConstants.STRING);

//Status parameters

expr = xpath.compile("//PostbackRequestWrapper/Status/TransactionStatus/text()");

String TransactionStatus = (String) expr.evaluate(doc, XPathConstants.STRING);

expr = xpath.compile("//PostbackRequestWrapper/Status/TransactionStatusDesc/text()");

String TransactionStatusDesc = (String) expr.evaluate(doc, XPathConstants.STRING);

expr = xpath.compile("//PostbackRequestWrapper/Status/OperationStatus/text()");

String OperationStatus = (String) expr.evaluate(doc, XPathConstants.STRING);

expr = xpath.compile("//PostbackRequestWrapper/Status/OperationStatusDesc/text()");

String OperationStatusDesc = (String) expr.evaluate(doc, XPathConstants.STRING);

expr = xpath.compile("//PostbackRequestWrapper/Footer/MAC/text()");

String MAC = (String) expr.evaluate(doc, XPathConstants.STRING);

}

catch (Exception e) {

throw e;

}

%>

5.2.2

ASP.net postback service

// Read the incoming HTTPS stream

StreamReader reader = new StreamReader(Request.InputStream, Encoding.Default);

if (!reader.EndOfStream)

{

string xmlString = reader.ReadToEnd();

xmlString = HttpUtility.UrlDecode(xmlString.Replace("PostbackRequestWrapper=", ""));

XmlDocument xmlDoc = new XmlDocument();

xmlDoc.LoadXml(xmlString);

// Create a Hashtable to store values

Hashtable values = new Hashtable();

values.Add("AcquirerID", xmlDoc.GetElementsByTagName("AcquirerID").Item(0).FirstChild.InnerText);

values.Add("AgreementID", xmlDoc.GetElementsByTagName("AgreementID").Item(0).FirstChild.InnerText);

values.Add("MerchantID", xmlDoc.GetElementsByTagName("MerchantID").Item(0).FirstChild.InnerText);

values.Add("TransmissionTime",xmlDoc.GetElementsByTagName("TransmissionTime").Item(0).FirstChild.InnerText);

values.Add("ClientIP", xmlDoc.GetElementsByTagName("ClientIP").Item(0).FirstChild.InnerText);

values.Add("PostbackURL", xmlDoc.GetElementsByTagName("PostbackURL").Item(0).FirstChild.InnerText);

values.Add("PostbackRequest",xmlDoc.GetElementsByTagName("PostbackRequest").Item(0).FirstChild.InnerText);

values.Add("Operation", xmlDoc.GetElementsByTagName("Operation").Item(0).FirstChild.InnerText);

values.Add("Amount", xmlDoc.GetElementsByTagName("Amount").Item(0).FirstChild.InnerText);

values.Add("BatchID", xmlDoc.GetElementsByTagName("BatchID").Item(0).FirstChild.InnerText);

values.Add("OrderID", xmlDoc.GetElementsByTagName("OrderID").Item(0).FirstChild.InnerText);

values.Add("TransactionID", xmlDoc.GetElementsByTagName("TransactionID").Item(0).FirstChild.InnerText);

values.Add("TransactionStatus", xmlDoc.GetElementsByTagName("TransactionStatus").Item(0).FirstChild.InnerText);

values.Add("TransactionStatusDesc",xmlDoc.GetElementsByTagName("TransactionStatusDesc").Item(0).FirstChild.InnerText);

values.Add("OperationStatus", xmlDoc.GetElementsByTagName("OperationStatus").Item(0).FirstChild.InnerText);

values.Add("OperationStatusDesc", xmlDoc.GetElementsByTagName("OperationStatusDesc").Item(0).FirstChild.InnerText);

values.Add("MAC", xmlDoc.GetElementsByTagName("MAC").Item(0).FirstChild.InnerText);

}

2016-03-22

WyWallet SMS Payment API v0.4

Page 33 (37)

6 Appendix C: Simulator for API

development

The API provides a simulator returning predefined transaction status codes depending on input

parameters in the request. Developers using the API can use this simulator to force errors and test

error handling in their application. The WSDL (service description) is identical to the actual API to be

used in production. The simulator tries to emulate the behavior of the real service by maintaining a

transaction history of the last 200 transactions and return an appropriate response code, but does not

guarantee 100% compatibility.

6.1 URL

URL for MAP PaymentService simulator:

https://mpaymenttest.payex.com/MAP/PaymentServiceTest?wsdl

6.2 Valid request parameters

Parameter

AquirerID

AgreementID

ClientType

ClientID

MAC

2016-03-22

Value

WyWallet

One of 99990095, 99990096

or 99990097

MSISDN

004699999nnn

Remarks

nnn is a number in the range 000…999.

Other values will return transaction status 6

(Account not found)

Shared secret = map123

WyWallet SMS Payment API v0.4

Page 34 (37)

6.3 Response codes

The API will return a non-zero transaction status or timeout for the following combinations of Operation

and ClientID:

Operation

Transaction status

Remarks

CheckOrder

CheckOrder

Purchase

ClientID

/MSISDN

0046999994nn

004699999499

0046999995nn

nn

Timeout

nn

Purchase

004699999599

Timeout

Reversal

Reversal

0046999996nn

004699999699

nn

Timeout

Credit

Credit

0046999997nn

004699999799

nn

Timeout

nn = 01..20

Takes 1 minute to complete

nn = 01..20

ClientID is fetched from original

Purchase transaction

Takes 1 minute to complete

nn = 01..20

ClientID is fetched from original

Purchase

nn = 01..20

Takes 1 minute to complete

nn = 01..20

nn = 01..20

Takes 1 minute to complete

2016-03-22

WyWallet SMS Payment API v0.4

Page 35 (37)

6.4 Frequently asked questions

Question

I have problems calculating

the MAC Key for my request.

Answer

The most common problem is that there are missing

parameters in the concatenated string.

Please see our source code examples for examples on how

to generate the MAC. If you are using another programming

language or still have problems you can try and use our

Online MAC generator to get help and compare your

calculations with a verified source.

Why do I get the error code 3

“Agreement not found”?

https://shop.wywallet.se/mac-generator.aspx

Most probably this is due to the fact that the payment

request is sent to the wrong payment system / URL. Please

see section for relevant systems and URL:s

If you still get the same error code after confirming that the

correct system is used it could be a misconfiguration in our

system. Please contact merchant support for further

assistance.

I’ve submitted my

PostbackURL in the payment

request but I’ve waited and

there is no HTTP POST to my

URL.

Most merchant accounts are configured to be synchronous

where you receive the payment status immediately and

postbacks aren’t used. If you have a synchronous account

you can ignore to set the PostbackURL parameter in your

request.

If you have service with high performance requirements

(e.g. TV & event votings) you should ask WyWallet

merchant support (re)configure your account to

asynchronous.

Is there a time limit for

requesting a reversal on a

transaction?

Do you provide mobile short

codes or SMS services?

2016-03-22

If you have an asynchronous account and you don’t receive

and callbacks please check that you have entered a HTTPS

url (we only allow postbacks via SSL port 443 due to

security restrictions) and that your firewall accepts incoming

traffic on this IP & port.

There are no technical time limit implemented and reversals

are always accepted as long as the end user still has a

WyWallet account.

No, WyWallet is a dedicated payment service and only

handle the actual payment. Short codes and SMS services

can either be ordered via each MNO/Operator or by using a

SMS aggregator. If you don’t have

WyWallet SMS Payment API v0.4

Page 36 (37)

6.5 Merchant support

For questions regarding the integration please contact our helpdesk merchant-support@wywallet.se

2016-03-22

WyWallet SMS Payment API v0.4

Page 37 (37)