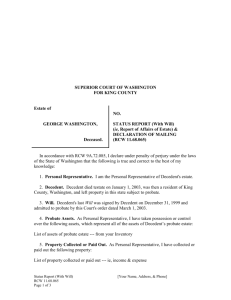

Co-ownership of Real Property

advertisement

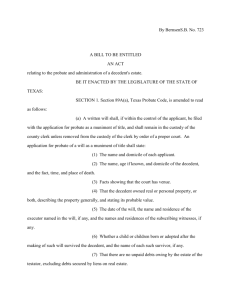

Preneed Preplanning Advance Funeral Planning Terms Prearranged vs. Prefunded Guaranteed vs. Nonguaranteed Revocable vs. Irrevocable Funding Methods Trust Accounts: P.O.D. account Pooled Trust 100 % Trusting Less than 100% Trusting Commingling: NJ 13:36-11.12 PA 13.266 Funding Methods (cont’d) Insurance Products: Whole Life Newly Issued Funeral Insurance Qualifications of Provider SSI vs. Medicaid Co-ownership of Real Property Tenancy by the Entirety Joint Tenancy Tenancy in Common Tenancy by the Entirety Held only by a husband and wife. Husband and wife are regarded as one. Surviving spouse owns the entire estate. Does not require probate. Divorce: tenancy by the entirety no longer exists. Joint Tenancy 2 or more persons own real property Single estate with multiple ownership. Each tenant owns the entire estate. All joint tenants’ interests in the property are equal. Upon death, ownership does not pass to the heirs or devisees of deceased tenant. Does not require probate. Tenancy in Common 2 or more persons own real property Each person owns an undivided share. Upon cotenant’s death, share passes to the heirs of the cotenant. No right of survivorship. Probate required. Insurance Policies Named beneficiaries: primary and contingent Upon death, beneficiary receives the benefit without a need for probate. Insurance company will require: 1) death certificate 2) completed claim form 3) insurance policy If beneficiary(ies) is/are dead, policy must go through the estate. Gifts May avoid probate: Gifts in Causa Mortis ( Gift in Contemplation of Death) May avoid NJ Transfer Inheritance Taxes May avoid Federal Estate Taxes Trust May be created by an agreement or a Will. Subject matter is given to a third person (trustee) for the benefit of the beneficiary. Beneficiary is not the sole and absolute owner. The ownership is divided into 2 parts: 1) trustee is the legal owner 2) beneficiary is the beneficial owner Reasons to Establish a Trust 1) mental/physical incapacitation 2) beneficiary is a minor 3) subject matter 4) save estate and/or income taxes Creator of the trust determines how the trust will be managed. (income & principal) Probate may not be necessary. Intestate Succession Statutes provide for the distribution of property. Separately owned property: 1) surviving spouse and children (of that union) and their descendants 2) surviving spouse and children (not all of the union) and their descendants 3) surviving spouse and no other descendents 4) surviving spouse and mother and father 5) no surviving spouse, but lineal descendents NJ Inheritance Taxes Gifts greater than $500. Subtracted from the gift before it is received. State Tax that ranges from 11-16% Classes of Beneficiaries Class A: totally exempt from tax father, mother, grandparents, spouse, child or children of the decedent, adopted child or children of the decedent, issue of any child or legally adopted child of the decedent and step-child of the decedent Class B was eliminated 07/1/63 Class C Beneficiaries Brother or sister of decedent, including half brother and half sister, wife or widow of a son of the decedent, or husband or widower of a daughter of the decedent Class D Beneficiaries All others who are not included in A,C, or E Stepbrother, or stepsister of the decedent, wife or widow of a stepchild of the decedent, husband or widower of a step-child of the decedent, wife or widow of a mutually acknowledged child of the decedent, and husband or widower of a mutually acknowledged child of the decedent Class E Beneficiaries The State of New Jersey or any political subdivision thereof, any educational institution, church, hospital, orphan asylum, public library etc…..basically “nonprofit” institutions Estate (Transfer ) Tax June 7, 2001, President Bush signed the repeal of the federal estate tax a phased-in repeal of the estate tax Timeline for Repeal of Estate Tax 2002: exemption increased to $1 million and estate tax rate lowered to 50% 2003: estate tax rate lowered to 49% 2004: exemption increased to $1.5 million and estate tax rate lowered to 48% 2005: estate tax rate lowered to 47% 2006: exemption increased to $2 million and estate tax rate lowered to 46% 2007-2008: estate tax rate lowered to 45% 2009: exemption increased to $3.5 million 2010: estate tax is repealed Personal Representatives Executor/ix or Administrator/ix Commissions paid from the corpus of the estate If 2 reps. 2% can be added to corpus commissions. Personal representative must send beneficiaries a copy of the will within 60 days from the date of probate. Claims must be made within 6 months. Duties of the Personal Representatives Safeguard assets. Inventory assets. Payment of taxes, claims and debts. Reasonable Funeral Expenses Cost of funeral in relation to the value of the total estate. Allowable items: Disallowed items: Liability for Payment of Funeral Expenses In common law, an estate is primarily liable for funeral expenses. In common law a husband/father is responsible to provide necessities for a spouse and children. Anyone can volunteer to pay the funeral expenses. Prepaid arrangements are not impacted. Divorce decrees: Safety Deposit Boxes Automatically sealed upon a person’s death. PR may obtain will, life insurance policies etc. in presence of bank officer. Contents may only be released after they are inventoried in the presence of the PR, bank officer and rep. from NJIT Bureau. Probate “the process where the estate of a decedent is administered” Not always necessary. It is a crime to conceal a valid Will. Adopted children have equal rights to biological children. Step-children must be written into the Will. Illegitimate children will inherit from their mother.