Lecture 2

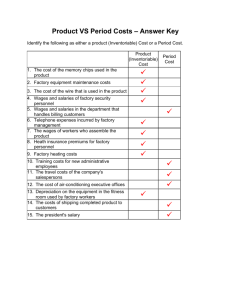

advertisement

ACCT 2302 Fundamentals of Accounting II Spring 2011 Lecture 2 Professor Jeff Yu Review: what do managers do and how MA can help Formulating long-and short-term plans Begin (Planning) Comparing actual to planned performance (Controlling) Decision Making Implementing plans (Directing and Motivating) Measuring performance (Controlling) MA provides information that help managers make decisions throughout the planning and control cycle. Review: Managerial vs. Financial Accounting Financial Accounting Users Time Focus Emphasis Verifiability and Precision Subject The whole Organization Requirement Follow GAAP Managerial Accounting Chapter 2: Today’s Agenda Introduce cost terms, concepts and classifications I organize our discussions according to the three major course themes: How costs behave? How accounting system reports costs? Economic costs vs. Accounting costs How costs behave? Cost is a sacrifice; In accounting, a measurable cost is typically the relinquishment of a measurable asset or the creation of a measurable liability. Cost Behavior: how a cost will react to a change in activity level. Cost Driver: The activity causing a cost to change. e.g., units produced, units sold, hours worked, etc. Total Variable Cost Total cost of wheels Consider the Rollerblade manufacturer: Each rollerblade produced requires one set of wheels. If rollerblade production increases 10%, how will that affect the total cost of wheels required for production? Rollerblades produced Total Fixed Cost Total cost of factory rental Suppose the Rollerblade manufacturer rents a factory in which to produce the rollerblades. How will the monthly factory rental cost change as the number of rollerblades produced increases? Rollerblades produced Variable Cost Per Unit Pairs of Rollerblades produced 1 10 400 500 Per unit wheel cost $5 $5 $5 $5 Total wheel cost $5 $50 $2,000 $2,500 Per unit wheel cost Consider again the Rollerblade manufacturer: If rollerblade production increases 10%, how much will the cost per unit cost of wheels change? Rollerblades produced Fixed Cost Per Unit Pairs of Rollerblades produced 1 10 400 500 Monthly rental cost $1,000 $1,000 $1,000 $1,000 Per unit rental cost $1,000 $100 $3 $2 Per Unit Rental Cost How does the factory rental cost per unit of rollerblade change as the number of rollerblades produced increases? Rollerblades produced Quick Check Fixed costs are usually characterized by: a. Unit costs that remain constant. b. Total costs that increase as activity decreases. c. Total costs that increase as activity increases. d. Total costs that remain constant. Variable costs are usually characterized by: a. b. c. d. Unit costs that decrease as activity increases. Total costs that increase as activity decreases. Total costs that increase as activity increases. Total costs that remain constant. Relevant Range The range of activity within which the assumptions about cost behavior are valid. Total cost curve Total cost Relevant range Activity Volume Summary: Cost Behavior Within the Relevant Range, how will each of the following cost change as activity level increases (decreases)? In Total Variable Cost Fixed Cost Per Unit Practice Problem Luxor Company’s relevant range is 500 to 4000 units. The cost information for producing 1500 units is as follows: Total Fixed Cost $120,000 Total Variable Cost $360,000 Total production cost $480,000 Calculate: 1) per unit variable cost if 3,000 units are produced; 2) per unit fixed cost if 2,500 units are produced; 3) Per unit production cost if 1,000 units are produced; 4) The total cost if 4,000 units are produced. What if 5,000 units are produced? Practice Problem Nale company’s relevant range is from 200 to 2000 units. In the past it produced 400 units with a total cost of $2200, and 500 units with a total cost of $2700. Now if it want to produce 800 units, what will be the expected total cost? How accounting system reports costs? Costing: In accounting, costing is largely a matter of assigning costs to products or services. Absorption Costing: The costing method used to value inventories and cost of goods sold for financial reporting purposes. Under absorption costing, all manufacturing costs are treated as product costs, all non-manufacturing costs are treated as period costs, regardless of whether they are fixed or variable. Product vs. Period Costs Absorption costing differentiates product and period costs based on the timing with which various costs are recognized as expenses on the income statement (according to GAAP). Product Costs (Manufacturing Costs): Recognized as expense (cost of good sold) when the product is sold Period Costs (Non-Manufacturing Costs): Recognized as expense in the period incurred, no matter the product is sold or not. Accounting for manufacturing firm The production process: Purchase materials Use Materials, Labor, Overhead to make a product Ready to sell to customer Accounting: Raw Materials Inventory Work-in-Process Inventory Finished goods Inventory Cost of Goods Sold Manufacturing Costs Direct Labor Direct Material Product Cost Manufacturing Overhead Direct Material Materials that become an integral part of the product and that can be conveniently traced directly to the product Example: Steel used to manufacture the automobile. Direct Labor Cost of wages for people who work directly on products. In other words, those labor costs that can be easily traced to individual units of product. Example: Wages paid to an automobile assembly worker. Manufacturing Overhead All other manufacturing costs that cannot be traced directly to specific units produced. It includes any other costs that is related to the manufacturing process or production facility (factory). Indirect Material Indirect Labor Other manufacturing Costs Examples of other manufacturing costs: Depreciation, maintenance and repairs of production equipment; Utilities, insurance, property tax of the production facility (factory) Examples of Manufacturing Overhead Indirect Labor Wages paid to employees who are not directly involved in production work but is associated with operating the factory. Examples: wages for production supervisors, maintenance workers, janitors and security guards for the factory Indirect Material Materials used to support the production process. Examples: lubricants and cleaning supplies used in the automobile assembly plant. Cost Classification - Manufacturing Firms Manufacturing costs are often combined as follows: Direct Labor Direct Material Prime Cost Manufacturing Overhead Conversion Cost Nonmanufacturing Costs Marketing and Selling Costs Administrative Costs Costs necessary to get the order and deliver the product. e.g. advertising, shipping, sales commissions. All executive, organizational, and clerical costs. Summary: Costs under Absorption Costing Direct Material Direct Labor Manufacturing Overhead Manufacturing Costs = Product Costs Marketing/ Selling Costs Administrative Costs NonManufacturing Costs = Period Costs Quick Check For each of the following costs, answer whether it is: DM, DL, MOH or Nonmanufacturing cost? Prime and/or Conversion cost? Product or Period cost? 1). Manufacturing equipment depreciation. 2). Property taxes on corporate headquarters. 3). Wages paid to the production supervisor. 4). Electrical costs to light the production facility. 5). Wages paid to the factory machine operators. 6). The cost of a hard drive installed in a computer. 7). Sales commissions. Cost Behavior: Accounting Costs For each of the following costs, please specify whether it is a fixed cost or variable cost within the relevant range? Assume the cost driver is units of product produced: 1). Direct Material 2). Direct Labor 3). Property tax of the factory building 4). Electricity consumed to make the product Assume the cost driver is units of product sold: 1). Sales Commission 2). Cost of one advertising campaign. Economic Costs vs. Accounting Costs Cost classification for decision making: Differential Cost/Differential Revenue – Costs and revenues that differ between two (or more) alternatives Opportunity Cost – the potential benefit given up when one alternative is selected over the next best alternative. Sunk Cost – a cost that has already been incurred and cannot be changed by any decision now or later. Relevant costs for decision making Every decision involves a choice between at least two alternatives. Only differential costs and benefits are relevant in a decision. All other costs and benefits can and should be ignored. Is Opportunity Cost a differential cost? Is Sunk Cost a differential cost? Practice Problem: Equipment Replacement Decision A manager at White Co. is deciding whether to replace an old machine with a new machine. White’s sales are estimated to be $200,000 per year for the next 5 years. Fixed expenses, other than depreciation, are estimated to be $70,000 per year. Purchasing the new machine costs $90,000 and will save variable expenses of $20,000 per year during its 5-year useful life. The old machine was purchased at $72,000 and carry a remaining book value of $60,000 on the balance sheet. The disposal value of the old machine is $15,000. The old machine, if not used, could also be leased to another company for $4,000 per year for the next 5 years. Question: for this equipment replacement decision (1) what are differential costs and revenues over the next 5 years? (2) What is the opportunity cost for keep using the old machine? (3) Is there any sunk cost? For Next Class Read Chapter 2, focus on product cost flows Complete the assigned HW problems Home Work: Q1 Answer Yes or No to each of the following question: Wage paid to factory machine operators at $10 per unit of product would be a: (1) Period Cost? (2) Conversion Cost? (3) Fixed Cost? (4) Prime Cost? Home Work: Q2 Karvel Co.’s relevant range is 100 to 5000 units. Last year 2,000 units were produced with total production cost of $240,000, among which total fixed cost is $60,000 and total variable cost is $180,000. Q: What will be the per unit production cost if 1,000 units are produced this year? Home Work: Q3 Mastang Co.’s relevant range is 0 to 1000 units. In April it produced 400 units with a total production cost of $3,000. In May it produced 900 units with a total production cost of $5,500. Q: What will be the total production cost for June if 800 units are expected to be produced?