CMA - Athens State University IMA Student Chapter / FrontPage

advertisement

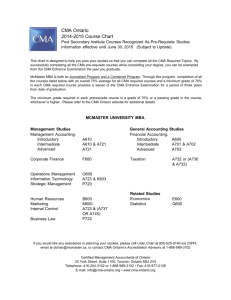

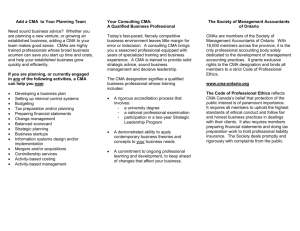

CMA Awareness Athens State University Student Chapter IMA Stacie Hughes, CPA, CMA, CFM What is the CMA? Certified Management Accountant designation granted by the ICMA (administered by IMA) Must pass two-part exam and meet education and experience requirements CMA’s generally provide services to employers rather than to the public CMA – CPA Comparison CMA Credentials: International recognition Targeted to corporate financial professionals Broad-based, industryrelated content CPA Designation: Limited to U.S.; a state designation Targeted to public accounting Content for public practice CMA – CPA Comparison CMA Knowledge-Based Professional Preparer/User of accounting information Concept based “Inside” corporate professionals Higher quality, lower costs Forward-looking Player CPA Skills-Based Professional Auditor of accounting information Rule based Public practice licensure Attesting to the accuracy of financial records Historical Referee CMA – CPA Comparison CMA Appropriate for a career in managerial finance and accounting professionals inside organizations. Over 80% of accounting professionals in U.S. work inside organizations. Focus on decision support, planning, and control over the organization’s value-creating operations. CPA Appropriate for a career in public accounting Why the CMA? Expanded career options and greater earning potential – IMA’s 20th Annual Salary Survey found that CMA-certified professionals earned 24% more in salary and 31% more in total compensation than those without certification (Strategic Finance magazine, June 2009) Demonstrate substantial knowledge – Required to pass rigorous exam to obtain CMA. Passing the exam demonstrates the ability to work across the breadth and depth of the entire accounting process within organizations. Why the CMA? Professional development and lifelong learning – Maintain professional competence through annual continuing professional education (30 hours with at least 2 in ethics) Committed to a code of ethics – – Must comply with the IMA Statement of Ethical Professional Practice Maintain 2 hours of ethics education per year Why the CMA? Competitive Advantage – – – Companies can identify motivated professionals for hiring, recognition, and advancement. Companies such as 3M, Boeing, DaimlerChrysler, GE, Hewlett-Packard, and IBM specifically search for individuals with the CMA certification to help improve company performance. Multi-national corporations are incorporating the CMA certification as part of their professional development programs for employees Who are CMAs? CFO, Foundations Behavioral Health CFO/Treasurer, First Savings Bank Director of Finance & Accounting, Marriott International Director of Technical Accounting & Reporting, Microsoft Finance Manager, Habitat for Humanity Financial Controller, Johnson & Johnson VP of Finance, Southeast Corporate Federal Credit Union CMA Certification Requirements Membership in the IMA Payment of Entrance Fee Satisfaction of Education Qualification Satisfaction of Experience Qualification Passing scores for all required examination parts Compliance with the IMA Statement of Ethical Professional Practice Examination Fees Certification Entrance Fee – Student Entrance Fee Examination Fee Per Part – $75 $350 $300 per part if taken in same window Student Exam Fee Per Part $200 One-time 50% discount $175 Education Qualification Must have a Bachelors Degree, in any area, from an accredited college or university. Experience Qualification Two continuous years of professional experience in management accounting, financial management, public accounting, or academia Experience may be completed prior to application or within seven years of passing the examination. Qualifying experience examples: financial analysis, budget preparation, MIS analysis, auditing, teaching, research, etc. CMA Exam – Part 1 Financial Planning, Performance, and Control (4 hours – 100 multiple choice questions and two 30-minute essay questions) – Planning, Budgeting and Forecasting 30% – Performance Management 25% – Cost Management 25% – Internal Controls 15% – Professional Ethics 5% CMA Exam – Part 2 Financial Decision Making (4 hours – 100 multiple choice questions and two 30-minute essay questions) – Financial Statement Analysis 25% – Corporate Finance 25% – Decision Analysis and Risk Management 25% – Investment Decisions 20% – Professional Ethics 5% Other CMA Exam Info Passing score is 72% You have 3 years from the date of entry into the program Computer-based tests given at Prometric Testing Centers Parts 1 and 2 will be given during three testing windows: January/February, May/June, and September/October Prometric Screen Shot Performance Review Score Reports – Detail of Performance Report – Sent to anyone who does not pass the multiple choice portions of parts 1or 2. Measures your performance by each major topic area on the exam. Advanced Performance Report – Scores will be mailed approximately 6-8 weeks after the end of the month in which you took the test Includes performance on subtopics in addition to the major topic areas. Must specifically request Advanced Report Exam Retake Policy – In order to retake, must register and repay the full exam fee IMA Study Resources CMA Exam Support Package – CMA Q&A Publications – Included in the Certification Entrance Fee. Included in this package are downloadable and printable Q&A books, 1,000 recently retired questions, and an online assessment tool with multiple choice exams and sample essay questions. Books of “retired” questions IMA’s CMA Learning System – – Comprehensive student textbooks and online prep tools. www.learncma.com Gleim CMA Review Books Audio CD lectures Test prep CD-roms Online Course (money back guarantee) www.gleim.com Gleim – Create Study Session Gleim–Test Prep Study Session Gleim – Test Prep Preferences Gleim – Online Updates Convenient updates, delivered electronically to your computer. For Additional Information IMA www.imanet.org 1-800-638-4427 Gleim Website www.gleim.com Stacie Hughes, CPA, CMA, CFM stacie.hughes@athens.edu