9 Capacity Design

advertisement

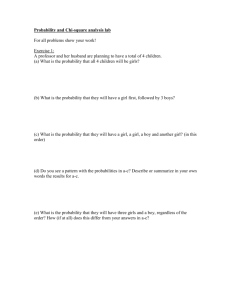

Operations Management Capacity Design 1 Types of Planning Over a Time Horizon Long Range Planning Intermediate Range Planning Add Facilities Sub-Contract Add Equipment Add Shifts Add Personnel Build or Use Inventory Schedule Jobs Schedule Personnel Allocate Machinery Short Range Planning Modify Capacity Use Capacity 2 Definition and Measures of Capacity Design Capacity: The maximum “throughput,” or number of units a facility can produce in a period of time. Effective capacity: Capacity a firm can expect to achieve given its product mix, methods of scheduling, maintenance, and standards of quality. Utilization: Actual output as a percent of design capacity. Efficiency: Actual output as a percent of effective capacity. 3 Utilization Measure of planned or actual capacity usage of a facility, work center, or machine Utilization = Actual Output Design Capacity 4 Efficiency Measure of how well a facility or machine is performing when used Efficiency Actual output = Effective Capacity 5 Example Facility produces breakfast rolls Last week, produced 148,000 rolls Effective capacity is 175,000 rolls Line operates 7 days a week with three 8-hour shifts per day Line designed to produce 1200 rolls per hour Determine Design Capacity Utilization Efficiency 6 Calculating actual output Same facility adding one more line due to increase in demand for deluxe rolls Effective capacity is 175,000 rolls of this line Efficiency of this second line will be 75% What is the expected output? 7 Managing Demand Demand exceeds capacity – curtail demand by raising prices, scheduling long lead times, etc Capacity exceeds demand – stimulate demand through price reductions, aggressive marketing, etc Adjusting to seasonal demands – offer products with complementary demand patterns – pdts for which demand is high for one when low for the other 8 Managing Capacity Making staffing changes (increasing or decreasing the number of employees) 2. Adjusting equipment and processes – which might include purchasing additional machinery or selling or leasing out existing equipment 3. Improving methods to increase throughput; and/or 4. Redesigning the product to facilitate more throughput 1. 9 Breakeven Analysis Technique for evaluating process & equipment alternatives Objective: Find the point ($ or units) at which total cost equals total revenue Assumptions Revenue & costs are related linearly to volume All information is known with certainty 10 Break-Even Analysis Fixed costs: costs that continue even if no units are produced: depreciation, taxes, debt, mortgage payments, salaries, etc Variable costs: costs that vary with the volume of units produced: labor wages, materials, portion of utilities 11 Breakeven Chart Total revenue line Cost in Dollars Breakeven point Total cost = Total revenue Profit Profit Total cost line Variable cost Loss Fixed cost Volume (units/period) 12 Crossover Chart Process A: low volume, high variety Process B: Repetitive Process C: High volume, low variety Fixed cost - Process C Fixed cost - Process B Fixed cost - Process A Process A Process B Process C Lowest cost process 13 Break Even Contd.. BEPx= FC (units) P-V BEPrs.= FC (amount) 1-(V/P) BEPrs.= FC (multi product) ∑[(1-Vi/Pi)*(Wi)] P=Selling price, V=variable cost FC=fixed cost BEP Calc. A company has fixed costs of 10000/- this period. Direct costs are 1.5/- per unit and material cost is 0.75/- per unit. The selling price is 4/- per unit. Calculate the BEPs. BEP Calc. in multi product case ITEM PRICE COST Sandwich 2.95 1.25 FORECASTED SALES ANNUALLY 7000 Cola 0.80 0.30 7000 Burger 1.55 0.47 5000 Tea .75 0.25 5000 Salad 2.85 1.00 3000 Item P sandwich V V/P 1-(V/P) Foreca % of sted sales sales wghtd. contrib ution 2.95 1.25 .42 .58 20650 .446 .259 Cola 0.80 .30 .38 .62 5600 .121 .075 Burger 1.55 .47 .30 .70 7750 .167 .117 Tea 0.75 .25 .33 .67 3750 .081 .054 Salad 2.85 1.0 .35 .65 8550 .185 .120 46300 1.00 .625 If the fixed costs are 3500, BEPrs.= FC ∑[(1-Vi/Pi)*(Wi)] 3500*12 0.625 = 67200 Decision trees application A company is considering capacity expansion. it has 3 alternatives. the new facility would produce new type of product and currently the marketability of the product is unknown. Types of plant favorable mkt. unfavorable mkt. Large plant 100 k -90k Medium plant 60k -10k Small plant40k -5k The probability of fav and unfav. Markets are 0.4 and 0.6 respectively. EMV (large plant)=0.4(100k)+(.6)(-90k)=-14k EMV (medium plant)=0.4(60k)+(.6)(-10k)=18k EMV (small plant)=0.4(40k)+(.6)(-5k)=13k Based on Expected market value, the company should build a medium plant Net Present value A co. having two capacity expansion alternatives A and B have useful lives of 4 years. Initial outlay for A is 25k and that for B is 26k. The cost of capital is 8%.the cash flow pattern is as follows. year A B 1 10k 9k 2 9k 9k 3 8k 9k 4 7k 9k