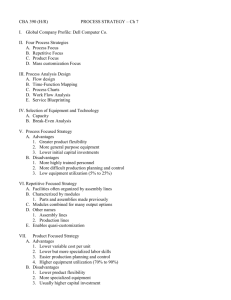

Chapter 1, Heizer/Render, 5th edition

advertisement

Operations Management Process Strategy and Capacity Planning Chapter 7 7-1 Outline Four Process Strategies. Process Focus. Repetitive Focus. Product Focus. Mass Customization Focus. Service Process Design. Process Reengineering. Capacity. Break-Even Analysis. Net Present Value. 7-2 Process Strategy How to produce a product or provide a service. Objective: Meet or exceed customer requirements. Achieve competitive advantage. Has long-run effects: Product & volume flexibility. Costs & quality . 7-3 Four Process Strategies Four process strategies: 1. Process focused. 2. Product focused. 3. Repetitive focused. 4. Mass customization. Several strategies may be used within one facility. Process strategies follow a continuum. 7-4 Fit of Process, Volume, and Variety High Volume Low Volume PROCESS FOCUS Small production runs (job shops, printing) High Variety MASS CUSTOMIZATION (Dell Computer) (allows customization) REPETITIVE FOCUS (autos, motorcycles) Low Variety Long production runs (standardization) PRODUCT FOCUS (steel, chemicals) POOR STRATEGY 7-5 1. Process Focus Facilities organized by process. Similar processes or equipment grouped together. (Example: All drill presses are together.) Low volume, high variety products. 75% of all global products. Products follow many different paths. Other names: Intermittent process. Job shop. 7-6 1 2 3 4 Process Focus Examples Hospital Machine Shop 7-7 Bank Process Focus - Pros & Cons Advantages: Greater product flexibility. More general purpose equipment. Lower initial capital investment. Disadvantages: High variable cost per unit. More highly trained personnel. More difficult production planning & control. Low equipment utilization (5% to 25%). 7-8 2. Product Focus Facilities organized by product. High volume, low variety products. Long, continuous production runs. Discrete unit manufacturing. Continuous process manufacturing. Other names: Line flow production. Continuous production. 1 7-9 2 3 4 Product Focus Examples Soft Drinks (Continuous, then Discrete) Light Bulbs (Discrete) . Paper (Continuous) 7-10 Product Focus: Steel Plant 7-11 Product Focus - Pros & Cons Advantages: Lower variable cost per unit. Lower but more specialized labor skills. Easier production planning and control. Higher equipment utilization (70% to 90%). Disadvantages: Lower product flexibility. More specialized equipment. Higher capital investment. 7-12 3. Repetitive Focus Facilities often organized by assembly lines. Characterized by modules. Parts & assemblies made previously. Modules combined for many output options. Other names: Assembly line. Production line. 7-13 Repetitive Focus - Examples Fast Food Clothes Dryer McDonald’s over 95 billion served Truck 7-14 Repetitive Focus - Harley Davidson 7-15 Repetitive Focus - Considerations More structured than process focus, less structured than product focus. Enables quasi-customization. Has advantages and disadvantages of process focus and product focus. 7-16 Process Continuum Process Focused (intermittent process) Repetitive Focus (assembly line) Product Focused (continuous process) Continuum High variety, low volume Low utilization (5% - 25%) General-purpose equipment Modular Flexible equipment 7-17 Low variety, high volume High utilization (70% - 90%) Specialized equipment Increasing Product Variety Early 1970s Item Vehicle models Vehicle styles Bicycle types Software titles Web sites Movie releases New book titles TV channels Breakfast cereals Items in supermarkets 140 18 8 0 0 267 40,530 5 160 14,000 7-18 Late 1990s 260 1,212 19 380,000 9,865,982 458 77,446 851 340 20,000 4. Mass Customization Rapid, low-cost production to fulfill unique customer desires. Distinctions between process, repetitive and product focus blur, making variety and volume issues less significant. Very hard to achieve! 7-19 Mass Customization at Dell Computer Company Sells custom-built PCs directly to consumer. Builds computers rapidly, at low cost, and only when ordered. Integrates the Web into every aspect of business. Operates with six days inventory. Research focus on software to make installation and configuration of PCs fast and simple. 7-20 Process Analysis and Design Process should: Be designed to achieve competitive advantage - differentiation, response, or low cost. Eliminate steps that do not add value. Maximize customer value, as perceived by the customer. 7-21 Tools for Process Design Flow Diagrams - Figures 7.2, 7.3, 7.4 Process Charts - Figure 7.7 Time-Function/Process Mapping - Figure 7.6 Service Blueprint - Figure 7.8 7-22 Process Design for Services Consider customization and labor intensity. Degree of customization. High: Focus on specialization and uniqueness (equipment, training, etc.). Low: Focus on standardization and automation. Degree of labor intensity. High: Focus on personalization & human resources (selection, training, etc.) Low: Use technology and automation. 7-23 Process Design for Services Low Degree of Customization Degree of Labor Intensity High Low Mass Service High Professional Service Personal banking Commercial Banking General purpose law firms Boutiques Retailing Service Factory Warehouse and catalog stores Law clinics Service Shop Fine dining restaurants Fast food restaurants Vending machines 7-24 Improving Service Productivity Table 7.3 Separation: Different services in different places. Self-service: Customers serve themselves. Postponement: Customize at delivery. Focus: Restrict offerings. Automation: Automate where appropriate. Scheduling: Precise personnel scheduling. 7-25 Process Reengineering Fundamental rethinking and radical redesign of business processes. To produce dramatic improvements in performance. Re-examine the basic process and its objectives: Re-evaluate the purpose of the process. Question underlying assumptions. Focus on activities that cross boundaries. 7-26 Facility Planning Facility planning answers: How much long-range capacity is needed? When more capacity is needed? Where facilities should be located? Location - Chapter 8. How facilities should be arranged? Layout - Chapter 9. 7-27 Definition and Measures of Capacity Capacity: The maximum output of a system in a given period. Design Capacity: The maximum capacity that can be achieved under ideal conditions. Example: 200/day Effective capacity: The expected capacity given the current operating environment and constraints; may be viewed as a percentage of design capacity. Example: 180/day or 90% 7-28 Utilization & Efficiency Utilization = Percent of design capacity achieved. Utilization = Actual output Design capacity Efficiency = Percent of effective capacity achieved. Actual output Efficiency = Effective capacity 7-29 Utilization & Efficiency Example Design capacity = 120/day. Effective capacity = 100/day. Actual output = 80/day. Utilization = Actual output = 80/120 = 67% Design capacity Actual output = 80/100 = 80% Efficiency = Effective capacity 7-30 Anticipated Output Anticipated output = Design Capacity x Effective Capacity % x Efficiency Example: Design capacity = 150 units per day Effective capacity = 80% Efficiency = 90% Anticipated output = 150 x 0.80 x 0.90 = 108 per day. Efficiency = 90%; Utilization = 108/150=72% 7-31 Capacity Planning Process Forecast Demand. Compute Needed Capacity. Develop Alternative Plans. Evaluate Capacity Plans. Quantitative & Quantitative factors. Select Best Capacity Plan. Implement Best Plan. 7-32 Managing Existing Capacity To make capacity match demand, either: Adjust demand = Demand management. Adjust capacity = Capacity management. Demand Management Capacity Management Vary prices. Vary promotion. Backorder. Offer complementary products. Vary staffing. Change equipment & processes. Change methods. Redesign the product/service for faster processing. 7-33 Complementary Products Sales (Units) 5,000 4,000 3,000 2,000 1,000 0 Total Snowmobiles Jet Skis J M M J S N J M M J S N J Time (Months) 7-34 Capacity Expansion Options – Capacity Leads Demand Advantages: Expected Demand Demand Add new capacity in advance of increasing demand. Can capture market. Discourage competition. Time in Years Small expansions Disadvantages: Expensive and risky. Demand may not materialize. Size of needed expansion relies on forecast. Demand New Capacity New Capacity Time in Years Large expansion 7-35 Expected Demand Capacity Expansion Options – Capacity Lags Demand Add new capacity after demand materializes. Expected Demand Advantages: Lower cost. Less risk. Size of expansion known. Disadvantages: Demand New Capacity Time in Years May be too late to market. 7-36 Small expansions Break-even Analysis To evaluate process & equipment alternatives. Objective: Find the point ($ or units) at which total cost equals total revenue, -or Find the range of output over which different alternatives are preferred. Assumptions: Revenue & costs are related linearly to volume. All information is known with certainty. No time value of money. 7-37 Break-even Analysis - Costs Fixed costs: Costs independent of the volume of units produced. Depreciation, taxes, debt, mortgage payments, etc. Variable costs: Costs that vary with the volume of units produced. Labor, materials, portion of utilities, etc. 7-38 Break-even Chart Dollars Total revenue line Profit Variable cost Loss Total cost line Fixed cost Volume (units/period) Breakeven point Total cost = Total revenue 7-39 Break-even Equations F = Fixed cost per unit time. V = Variable cost per unit produced. x = Number of units produced per unit time. P = Revenue (price) per unit TC = Total costs per unit time = F + Vx TR = Total revenue per unit time = Px Profit = TR - TC At break-even point: Total Cost = Total Revenue 7-40 Break-even Example 1 A firm produces radios with a fixed cost of $7,000 per month and a variable cost of $5 per radio. If radios sell for $8 each: 1a) What is the break-even point? TR = TC so 8x = 7000 + 5x x = 7000/3 = 2,333.333 radios per month 1b) What output is needed to produce a profit of $2,000/month? Profit = 2000/month so TR - TC = 8x - (7000 + 5x) = 2000 x = 9000/3 = 3,000 radios per month 7-41 Break-even Example 1 - continued 1c) What is the profit or loss if 500 radios are produced each week? First, get monthly production: 50052/12 = 2,166.6667 radios per month Then calculate profit or loss TR - TC = 82166.6667 - (7000 + 52166.6667) = $-500 per month ($500 loss per month) 7-42 Break-even Example 2 A firm produces radios with a fixed cost of $7,000 per month and a variable cost of $5 per radio for the first 3,000 radios produced per month. For all radios produced each month after the first 3,000 the variable cost is $10 per radio (for added overtime and maintenance costs). If radios sell for $8 each: 2a) What are the break-even point(s)? Now TC has two parts depending on the level of production: For x 3000/month: TC = 7000 + 5x For x > 3000/month: TC = 7000 + 5(3000) + 10(x-3000) = -8000 + 10x For any x: TR = 8x 7-43 Break-even Example 2 - continued For x 3000/month: TC = 7000 + 5x For x > 3000/month: TC = -8000 + 10x For any x: TR = 8x For x 3000/month: 7000 + 5x = 8x so x = 2,333.33/month This is < 3000/month, so it is a valid break-even point. For x > 3000/month: -8000 + 10x = 8x so x = 4000/month This is > 3000/month, so it is also a valid break-even point. 7-44 Dollars (Thousands) Break-even Example 2 40 Total revenue line 32 24 Total cost line 16 Break-even points 8 1000 2000 3000 4000 Volume (units/month) 7-45 Break-even Example 3 A firm produces radios with a fixed cost of $7,000 per month and a variable cost of $5 per radio for the first 2,000 radios produced per month. For all radios produced each month after the first 2,000 the variable cost is $10 per radio (for added overtime and maintenance costs). If radios sell for $8 each: 3a) What are the break-even point(s)? Again TC has two parts depending on the level of production: For x 2000/month: TC = 7000 + 5x For x > 2000/month: TC = 7000 + 5(2000) + 10(x-2000) = -3000 + 10x For any x: TR = 8x 7-46 Break-even Example 3 - continued For x 2000/month: TC = 7000 + 5x For x > 2000/month: TC = -3000 + 10x For any x: TR = 8x For x 2000/month: 7000 + 5x = 8x so x = 2,333.33/month This is not < 2000/month, so it is not a break-even point!! For x > 2000/month: -3000 + 10x = 8x so x = 1500/month This is not > 2000/month, so it is not a break-even point!! THERE ARE NO BREAK-EVEN POINTS! 7-47 Dollars (Thousands) Break-even Example 3 40 32 24 Total cost line Total revenue line 16 8 1000 2000 3000 4000 Volume (units/month) 7-48 Dollars (Thousands) Other Break-even Possibilities 40 32 24 Total cost line Total revenue line 16 8 1000 2000 3000 4000 Volume (units/month) 7-49 Crossover Chart Process A: Low volume, high variety Process B: Repetitive Process C: High volume, low variety Process A Process B Process C 7-50 Lowest cost process Crossover Example Process A: FA = $5000/week VA = $10/unit Process B: FB = $8000/week VB = $4/unit Process C: FC = $10000/week VC = $3/unit Over which range of output is each process best? 1. At x = 0 A is best (FA is smallest fixed cost). 2. As x gets larger, either B or C may become better than A: B < A for x > 3000/6 or x > 500/week C < A for x > 5000/7 or x > 714.28/week so B is best for x > 500/week 3. Eventually, C will become better than B (VC< VB). C < B for x > 2000/week 7-51 Crossover Example Summary: A is best for output of 0-500 units per week. B is best for output of 500-2000 units per week. C is best for output greater than 2000 units per week. 0 2000 500 714 A<B A<C B<C A<B B<A A<C A<C B<C B<C A<B<C B<A<C B<A C<A B<C B<C<A 7-52 B<A C<A C<B C<B<A Time Value of Money - Net Present Value Future cash receipt of amount F is worth less than F today. F = Future value N years in the future. P = Present value today. i = Interest rate. F P(1 i ) N F P (1 i ) N 7-53 Annuities An annuity is a annual series of equal payments. R = Amount received every year for N years. S = Present value today. S = RX where X is from Table 7.5 (page 264). Example: What is present value of $1,000,000 paid in 20 equal annual installments? For i=6%/year, S = 5000011.47 = $573,500 For i=14%/year, S = 500006.623 = $331,150 7-54 Limitations of Net Present Value Investments with the same NPV will differ: Different lengths. Different salvage values. Different cash flows. Assumes we know future interest rates! Assumes payments are always made at the end of the period. 7-55