nyc-bubble-seminar - Federal Appraisal & Consulting, LLC

advertisement

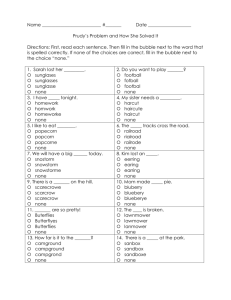

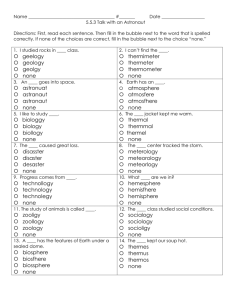

“Exuberant Bubble” or “Fundamentally Sound” Where are Real Estate Prices Going? Presented Jointly by: The Metro NY Chapter Appraisal Institute Mark Pomykacz, MAI President Steven L. Newman Institute Baruch College Barry Hersh, AICP Associate Director With Guest Speakers: Peter F. Korpacz, MAI Robert A. Knakal Frank Nothaft, Ph.D. Friday, September 30, 2005 The Panelists Peter F. Korpacz, MAI, Director of the Global Strategic Real Estate Research Group of PricewaterhouseCoopers (PwC), Robert A. Knakal Founding Partner of Massey Knakal Realty Services. Frank E. Nothaft Chief Economist for Freddie Mac Introduction Mark Pomykacz, MAI President of the Metro NY Chapter of the Appraisal Institute Managing Partner of Federal Appraisal & Consulting LLC Real estate and business appraisal and advisory firm Member of the National Board of Directors of the Appraisal Institute Teaches Income Capitalization, USPAP and Seminars for the Appraisal Institute and New York University State certified general real estate appraiser in six states Published several articles on appraisal and property taxes Specializes in the appraisal of complex issues, such as IRS, SEC and other financial reporting, and in the appraisal of complex properties and assets such as utilities, power plants and telecommunications assets Background “Exuberant Bubble” “Fundamentally Sound” PRECEPTION vs REALITY Just the facts, Ma’am Talking about it, can make it happen "That greater tendency toward self-correction has made the cyclical stability of the economy less dependent on the actions of macroeconomic policymakers, whose responses often have come too late or have been misguided,“ the Man, Tuesday, Sept 27, 2005 New York Times Articles Articles with the Phrases "Real Estate" and "Bubble" in the New York Times 25 20 "Real Estate" and "Bubble" . "Real Estate" and "Bubble" in Real Estate Section Number of Articles per Month 15 10 5 Ja n98 M ay -9 8 Se p98 Ja n99 M ay -9 9 Se p99 Ja n00 M ay -0 0 Se p00 Ja n01 M ay -0 1 Se p01 Ja n02 M ay -0 2 Se p02 Ja n03 M ay -0 3 Se p03 Ja n04 M ay -0 4 Se p04 Ja n05 M ay -0 5 Se p05 0 Month Ja n98 M ay -9 8 Se p98 Ja n99 M ay -9 9 Se p99 Ja n00 M ay -0 0 Se p00 Ja n01 M ay -0 1 Se p01 Ja n02 M ay -0 2 Se p02 Ja n03 M ay -0 3 Se p03 Ja n04 M ay -0 4 Se p04 Ja n05 M ay -0 5 Se p05 Number of Articles per Month . Wall Street Journal Articles Articles with the Phrases "Real Estate" and "Bubble" in the Wall Street Journal 20 18 16 14 12 10 8 6 4 2 0 Month New York Times vs. Wall Street Journal Articles with the Phrases "Real Estate" and "Bubble" New York Times vs Wall Street Journal 25 20 . New York Times Wall Street Journal Poly. (New York Times) Poly. (Wall Street Journal) Number of Articles per Month 15 10 5 Ja n98 M ay -9 8 Se p98 Ja n99 M ay -9 9 Se p99 Ja n00 M ay -0 0 Se p00 Ja n01 M ay -0 1 Se p01 Ja n02 M ay -0 2 Se p02 Ja n03 M ay -0 3 Se p03 Ja n04 M ay -0 4 Se p04 Ja n05 M ay -0 5 Se p05 0 Month Ja n98 M ay -9 8 Se p98 Ja n99 M ay -9 9 Se p99 Ja n00 M ay -0 0 Se p00 Ja n01 M ay -0 1 Se p01 Ja n02 M ay -0 2 Se p02 Ja n03 M ay -0 3 Se p03 Ja n04 M ay -0 4 Se p04 Ja n05 M ay -0 5 Se p05 Number of Articles per Month . New York Times and Wall Street Journal Articles with the Phrases "Real Estate" and "Bubble" in the New York Times and Wall Street Journal 40 35 30 25 20 15 10 5 0 Month New York Times vs. Wall Street Journal Articles with the Phrases "Real Estate" and "Bubble" New York Times vs Wall Street Journal 9.0 The Annual High Month 8.0 New York Times Wall Street Journal Poly. (New York Times) Poly. (Wall Street Journal) 6.0 5.0 4.0 3.0 2.0 1.0 De c em be r r em be No v ct O m be te Se p Month ob er r t us Au g ly Ju ne Ju ay M il Ap r ar ch M ry ua Fe br nu ar y 0.0 Ja Number of Articles per Month . 7.0 1s tQ 2n tr, d 19 Q 9 3r tr, 1 8 d 9 Q 98 4t tr , 1 h 9 Q 9 1s tr, 1 8 tQ 9 9 2n tr, 8 d 19 Q 99 3r tr, 1 d Q 99 4t tr , 9 1 h Q 99 1s tr, 1 9 t Q 99 2n tr, 9 d 20 Q 00 3r tr, 2 d Q 000 4t tr , 2 h Q 00 1s tr, 2 0 tQ 0 0 2n tr, 0 d 20 Q 01 3r tr, 2 d Q 001 4t tr , 2 h Q 00 1s tr, 2 1 tQ 0 0 2n tr, 1 d 20 Q 02 3r tr, 2 d 0 02 Q 4t tr , 20 h Q 0 1s tr, 2 2 tQ 0 0 2n tr, 2 d 20 Q 03 3r tr, 2 d 0 Q 03 4t tr , 2 h 0 Q 0 1s tr, 2 3 tQ 0 0 2n tr, 3 d 20 Q 04 3r tr, 2 d 0 04 Q 4t tr , 20 h Q 0 1s tr, 2 4 t Q 00 2n tr, 4 d 20 Q 0 3r tr, 2 5 d 0 Q 0 tr , 5 20 05 Number of Articles per Quarter . New York Times vs. Wall Street Journal Articles with the Phrases "Real Estate" and "Bubble" New York Times vs Wall Street Journal 50 45 40 New York Times Wall Street Journal Poly. (New York Times) Poly. (Wall Street Journal) 35 30 25 20 15 10 5 0 Quarter Appraisers in Action Survey of Members of the Metropolitan Chapter of the Appraisal Institute Housing Bubble Survey – Chart 1 How confident are you that prices in the NYC residential real estate market are over valued? Very confident prices are too low 1 Confident prices are too low 0 Unsure 17 35 Modestly confident prices are too high 13 Very confident prices are too high 0 5 10 15 20 25 30 35 40 Housing Bubble Survey – Chart 2 How much evidence have you seen of excessive market euphoria or that a bubble exists in the residential real estate market? No such evidence 10 Only moderate evidence 35 Strong and substantial evidence 23 0 5 10 15 20 25 30 35 40 Housing Bubble Survey – Chart 3 How much is the market for NYC residential property over-priced? Under-priced by more than 20% 0 Under-priced by 5% to 20% 0 Priced about right, between -5% to +5% 17 Over-priced by 5% to 20% 35 Over-priced by more than 20% 16 0 5 10 15 20 25 30 35 40 Housing Bubble Survey – Chart 4 In the last 12 months, how much has the NYC residential market prices appreciated in value? The market is declining 0 Between 0 and 5% 0 Between 5 and 10% 5 Between 10 and 15% 15 Between 15 and 25% 32 Between 25 and 35% 12 More than 35% 1 0 5 10 15 20 25 30 35 Housing Bubble Survey – Chart 5 In the next 12 months, how much will the NYC residential market price appreciate in value? Depreciate by more than 15% 0 Depreciate by 10 to 15% 0 Depreciate by 5 to 10% 2 6 Depreciate by 0 to 5% No change in the market 3 Appreciate by 0 to 5% 16 Appreciate by 5 to 10% 26 13 Appreciate by 10 to 15% Appreciate by 15% or more 0 0 5 10 15 20 25 30 Housing Bubble Survey – Chart 6 Is the NYC commercial market similarly over priced? Under priced by more than 20% 0 Under priced by 5 to 20% 0 Priced about right from -5% to +5% 26 Over priced by 5 to 20% 31 Over priced by more than 20% 8 0 5 10 15 20 25 30 35 2n d -1.00% 2n d 4t h 2n d 4t h 2n d 4t h 2n d 4t h 2n d Q 20 03 tr, 20 05 20 04 tr, 20 04 Q tr, Q 20 02 tr, 20 03 Q tr, Q 20 01 tr, 20 02 Q tr, Q 20 00 tr, 20 01 Q tr, Q 19 99 tr, 20 00 Q tr, Q 19 98 tr, 19 99 Q tr, Q 19 97 tr, 19 98 Q tr, Q 19 96 tr, 19 97 Q tr, Q 19 95 tr, 19 96 Q tr, Q Q tr, tr, 19 95 NCREIF Property Index 4t h 2n d 4t h 2n d 4t h 2n d 4t h 2n d 4t h 2n d 4t h Q NCREIF vs. CPI – Chart 1 Quarterly Value and Cost Changes NCREIF vs CPI 6.00% CPI, All Urban Consumers 5.00% 4.00% 3.00% 2.00% 1.00% 0.00% Q 2n tr, 1 d Q 998 t 3r r, 1 d 99 Q 8 t 4t r , 1 h 99 Q 8 1s tr, 1 t Q 99 8 2n tr, 1 d 99 Q 9 t 3r r, 1 d 99 Q 9 4t tr , 1 h 9 99 Q t 1s r, 1 t Q 99 9 2n tr, 2 d 0 00 Q t 3r r, 2 d 00 Q 0 t 4t r , 2 h 00 Q 0 1s tr, 2 t Q 00 2n tr, 2 0 d Q 001 t 3r r, 2 00 d Q 1 4t tr , 2 h Q 00 1 t 1s r, 2 t Q 00 1 2n tr, 2 d Q 002 t 3r r, 2 d 00 Q 2 t 4t r , 2 h 00 Q 2 1s tr, 2 t Q 00 2n tr, 2 2 d Q 003 t 3r r, 2 00 d Q 3 4t tr , 2 h 0 03 Q 1s tr, 2 t Q 00 3 2n tr, 2 d 00 Q 4 t 3r r, 2 d 00 Q 4 t 4t r , 2 h 00 Q 4 1s tr, 2 t Q 00 2n tr, 2 4 d Q 005 tr, 20 05 1s t NCREIF vs. CPI – Chart 2 Quarterly Value and Cost Changes NCREIF vs CPI 250.00 200.00 Both Indices set at 100 in 1st Quarter 1998. 150.00 100.00 50.00 NCREIF Property Index CPI, All Urban Consumers 0.00 Are we in a bubble? “History cautions that extended periods of low concern about credit risk have invariably been followed by reversal” Are we in a bubble? Translation – “What! Where yous been livin? In a bubble! And Don’t touch my hair” I got a bridge to sell