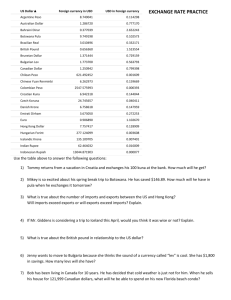

Determinants of International Trade

advertisement

Determinants of Trade AG BM 102 Introduction • Trade - an integral part of food system • Major market for our products – corn, cotton, soybeans, chicken • Major source of products for our diet – bananas, coffee, cocoa, vegetables, spices • Issues to be examined – Demand and supply of traded products – Exchange rates and trade policy Key concept - excess demand Excess demand is the amount by which quantity demanded exceeds quantity supplied at a particular price An example – beef demand Price/lb Price/lb $5.00 Quantity lbs/cap 50 $3.75 Quantity lbs/cap 75 $4.75 55 $3.50 80 $4.50 60 $3.25 85 $4.25 65 $3.00 90 $4.00 70 $2.75 95 An example – beef supply Price/lb Price/lb Quantity lbs/cap $3.00 Quantity lbs/cap 60 $4.25 72.5 $3.25 62.5 $4.50 75 $3.50 65 $4.75 77.5 $3.75 67.5 $5.00 80 $4.00 70 $5.25 82.5 Excess beef demand Price Q Demand Q Supply E Demand $5.00 $4.75 $4.50 $4.25 $4.00 $3.75 $3.50 $3.25 $3.00 50 55 60 65 70 75 80 85 90 -30 -22.5 -15 -7.5 0 7.5 15 22.5 30 80 77.5 75 72.5 70 67.5 65 62.5 60 Some points about excess demand • Much more elastic than regular demand since it reflects simultaneous changes in domestic supply and demand • Excess demand defines the demand curve for imports by a country Excess supply • Opposite of excess demand • Excess Supply = Quantity Supplied – Quantity Demanded Notes on excess supply • Much more elastic than regular supply since reflects changes in both domestic supply and demand • Defines the potential supply of exports by a country Excess supply of Mexican beef Quantity Price Dollars 30 $4.00 Price Pesos 10 pesos/$1 40 22.5 $3.75 37.5 15 $3.50 35 7.5 $3.25 32.5 0 $3.00 30 Beef Market $5.00 ESMexico $4.00 P* EDUS $3.00 $2.00 $1.00 $0.00 0 7.5 15 Qtrade 22.5 30 37.5 45 Notes about trade • At $3.50, amount that US is short (in deficit) is exactly the amount that rest of world (Mexico) is long (willing to supply) • No coincidence, based on excess demand for US and excess supply for ROW • With trade - price is lower in the United States than without trade for what we import Exports • When our price is lower than the world price, we will export – corn • This removes corn from our market – raises our price • It puts U.S. corn in other markets – lowers their price Exchange Rates • Suppose the Dollar rises in value compared to Peso, $1 buys more Pesos – it bought 10 before, now it buys 20 • This means that something priced at 40 pesos costs a U.S. buyer less than before when paid for in dollars • Take the case where $1 now buys 20 Pesos • Mexican beef priced at 40 pesos now costs $2.00 per pound, not $4.00 • Everything we buy from Mexico is now on sale Excess supply of Mexican beef Quantity Price Pesos 30 Price Dollars 10/1 $4.00 40 Price Dollars 20/1 $2.00 22.5 $3.75 37.5 $1.875 15 $3.50 35 $1.75 7.5 $3.25 32.5 $1.625 0 $3.00 30 $1.50 Beef Market Cheap Peso $5.00 ESMexico $4.00 P* EDUS $3.00 P** $2.00 ESMexico' $1.00 $0.00 0 7.5 15 22.5 Qtrade 30 37.5 45 52.5 Q**trade 60 More on exchange rates • If Peso falls in value (dollar rises in value = strong dollar) everything we buy from Mexico costs less and everything Mexico buys from us costs more • If Peso rises in value (dollar falls in value – weak dollar) everything we buy from Mexico costs more and everything Mexico buys from us costs less More on exchange rates • Strong dollar shifts supply curve for U.S. imports down (to the right) and rotates the curve clockwise • Weak dollar shifts the supply curve for U.S. imports up (to the left) and rotates the curve counterclockwise • Strong dollar shifts supply curve for U.S. exports up (to the left) and rotates the curve counterclockwise • Weak dollar shifts supply for U.S. exports down (to the right) and rotates the curve clockwise Yugoslavian Banknote Conclusions • Excess supply and demand curves are the basis for determining the volume of trade • The position and shape of the curves are affected by currency values (exchange rates) in addition to all the factors that affect the underlying domestic and foreign supply and demand curves