Creating Value beyond Borders

Dr. Shalini R Tiwari

IMT Ghaziabad

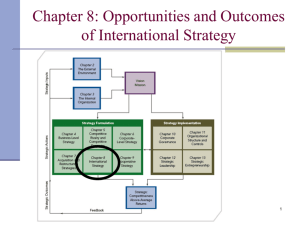

Opportunities and Outcomes of

International Strategy

2

Identifying International Opportunities:

Incentives to Use an International Strategy (IS)

International Strategy (IS): firm sells its goods or services outside the domestic market

Reasons for an IS

International markets yield potential new opportunities

International diversification: innovation occurs in homecountry market, especially in an advanced economy, and demand for product develops in other countries, so exports provided by domestic organization

Multinational strategy: Secure need resources

Other motives exist (i.e., pressure for global integration, borderless demand for globally branded products)

3

Identifying International Opportunities: Incentives to Use an International Strategy (IS)

(Cont’d)

Four primary reasons

1. Increased market size

Domestic market may lack the size to support efficient scale manufacturing facilities

2. Return on Investment (ROI)

Large investment projects may require global markets to justify the capital outlays

Weak patent protection in some countries implies that firms should expand overseas rapidly in order to preempt imitators

4

Identifying International Opportunities: Incentives to Use an International Strategy (IS)

(Cont’d)

Four primary reasons

(Cont’d)

3. Economies of Scale and Learning

Expanding size or scope of markets helps to achieve economies of scale in manufacturing as well as marketing, R&D, or distribution

Costs are spread over a larger sales base

Profit per unit is increased

4. Location advantages: Low cost markets may…

… aid in developing competitive advantage

… achieve better access to critical resources:

i.e., raw materials, lower cost labor, key customers, energy

5

International Strategies (IS)

Firms choose one or both of two basic type of IS: Business level and/or corporate level

International business-level strategy

Follows generic strategies of cost-leadership, differentiation, focused or broad

International corporate-level strategy (N=3)

Home country usually most important source of competitive advantage

Resources and capabilities frequently allow firm to pursue markets in other countries

The determinants of national advantage includes 4 factors

6

Determinants of National Advantage

7

International Corporate-Level Strategies

8

International Strategies (IS)

(Cont’d)

International corporate-level strategies (N=3)

(Cont’d)

1. Multidomestic

Decentralized strategic & operating decisions by strategic business-unit (SBU) in each country allows units to tailor products to local markets

Focuses on variations of competition within each country

Customized products to meet local customers’ specific needs and preferences

Takes steps to isolate the firm from global competitive forces

Establish protected market positions

Compete in industry segments most affected by differences among local countries

Deals with uncertainty due to differences across markets

9

International Strategies (IS)

(Cont’d)

2. Global

Firm offers standardized products across country markets, with the competitive strategy being dictated by the home office

Emphasizes economies of scale

Facilitated by improved global reporting standards (i.e., accounting and financial)

Strategic & operating decisions centralized at home office

10

International Strategies (IS)

(Cont’d)

2. Global

(Cont’d)

Involves interdependent SBUs operating in each country

Home office attempts to achieve integration across SBUs, adding management complexity

Produces lower risk

Is less responsive to local market opportunities

Offers less effective learning processes (pressure to conform and standardize)

11

International Strategies (IS)

(Cont’d)

3. Transnational

Firm seeks to achieve both global efficiency and local responsiveness – these are competing goals!

Requires both global coordination and local flexibility with this strategy/structure combination

Flexible Coordination: Building a shared vision and individual commitment through an integrated network

Challenging, but becoming increasingly necessary to compete in international markets

Growing number of global competitors heightens need to keep costs down while greater information flow and desire for specialized products pressures firms to differentiate and even customize products – nonetheless,

Increasingly used as a strategy

12

Environmental Trends

Transnational strategy hard to implement

Two new trends

1. Liability of foreignness

Increased after terrorists’ attacks and Iraq War

Global strategies not as prevalent today, still difficult to implement even with Internet-based strategies

Regional focus allows firms to marshal resources to compete effectively in regional markets

2. Regionalization

Focus to a particular region of the world

Increases understanding of market

Trade agreements (I.e., EU, OAS, NAFTA) promote flow of trade across country boundaries with their respective regions

13

International Entry Modes (N = 5)

Follows the selection of an IS

Five main entry modes

1. Exporting

2. Licensing

3. Strategic Alliances

4. Acquisitions

5. New Wholly-Owned Subsidiary

14

International Entry Modes (N = 5)

(Cont’d)

1. Exporting

Involves low expense to establish operations in host country

Often involves contractual agreements

Involves high transportation costs

May have some tariffs imposed

Offers low control over marketing and distribution

15

International Entry Modes (N = 5)

(Cont’d)

2. Licensing

Involves low cost to expand internationally

Allows licensee to absorb risks

Has low control over manufacturing and marketing

Offers lower potential returns (shared with licensee)

Involves risk of licensee imitating technology and product for own use

May have inflexible ownership arrangement

16

International Entry Modes (N = 5)

(Cont’d)

3. Strategic Alliances

Involve shared risks and resources

Facilitate development of core competencies

Involve fewer resources and costs required for entry

May involve possible incompatibility, conflict, or lack of trust with partner

Are difficult to manage

17

International Entry Modes (N = 5)

(Cont’d)

4. Acquisitions

Allow for quick access to market

Involve possible integration difficulties

Are costly

Have complex negotiations and transaction requirements

18

International Entry Modes (N = 5)

(Cont’d)

5. New Wholly-Owned Subsidiary

Is costly

Involves complex processes

Allows for maximum control

Has the highest potential returns

Carries high risk

19

International Entry Modes (N = 5)

(Cont’d)

Dynamics of Mode of Entry: Use the best suited to the situation at hand; affected by several factors

Export, licensing and strategic alliance: good tactics for early market development

Strategic alliance: used in more uncertain situations

Wholly-owned subsidiary may be preferred if

IP rights in emerging economy not well protected

Number of firms in industry is growing fast

Need for global integration is high

Acquisitions or greenfield ventures: secure a stronger presence in international markets

20

Strategic Competitive Outcomes (N = 3)

International diversification: firm expands sales of its goods or services across the borders of global regions and countries into different geographic locations or markets

Implementation follows selection of international strategy and mode of entry (N=3)

1. International diversification and returns

2. International diversification and innovation

3. Complexity of managing multinational firms

21

Strategic Competitive Outcomes (N = 3)

(Cont’d)

1. International diversification and returns

As international diversification increases, firms’ returns

initially decrease, but the increase quickly as firm learns to manage international expansion

2. International diversification and innovation

Exposure to new products and markets

Opportunity to integrate new knowledge into operations

Generation of resources to sustain innovation efforts

22

Strategic Competitive Outcomes (N = 3)

(Cont’d)

3. Complexity of managing multinational firms

Geographic dispersion

Costs of coordination

Logistical costs

Trade barriers

Cultural diversity

Host government

23

Risks in International Environment

2 major risks

1. Political

2. Economic

Limits to international expansions: management problems

24

Risk in the International Environment

25

Risks in International Environment

(Cont’d)

1. Political risks

Government instability

Conflict or war

Government regulations

Conflicting and diverse legal authorities

Potential nationalization of private assets

Government corruption

Changes in government policies

26

Risks in International Environment

(Cont’d)

2. Economic risks

Differences and fluctuations in currency values

Investment losses due to political risks

Limits to international expansions: management problems

Geographic dispersion

Trade barriers

Logistical costs

Cultural diversity

Other differences by country

Relationship between organization and host country

27

The Quest for Competitive

Advantage in Foreign Markets

Three ways to gain competitive advantage

1.

Locating activities among nations in ways that lower costs or achieve greater product differentiation

2.

Efficient/effective transfer of competitively valuable competencies and capabilities from company operations in one country to company operations in another country

3.

Coordinating dispersed activities in ways a domestic-only competitor cannot

Locating Activities to Build a

Global Competitive Advantage

Two issues

Whether to

Concentrate each activity in a few countries or

Disperse activities to many different nations

Where to locate activities

Which country is best location for which activity?

Concentrating Activities to Build a Global Competitive Advantage

Activities should be concentrated when

Costs of manufacturing or other value chain activities are meaningfully lower in certain locations than in others

There are sizable scale economies in performing the activity

There is a steep learning curve associated with performing an activity in a single location

Certain locations have

Superior resources

Allow better coordination of related activities or

Offer other valuable advantages

Dispersing Activities to Build a

Global Competitive Advantage

Activities should be dispersed when

They need to be performed close to buyers

Transportation costs, scale diseconomies, or trade barriers make centralization expensive

Buffers for fluctuating exchange rates, supply interruptions, and adverse politics are needed

Transferring Valuable Competencies to Build a Global

Competitive Advantage

Transferring competencies, capabilities, and resource strengths across borders contributes to

Development of broader competencies and capabilities

Achievement of dominating depth in some competitively valuable area

Dominating depth in a competitively valuable capability is a strong basis for sustainable competitive advantage over

Other multinational or global competitors and

Small domestic competitors in host countries

Coordinating Cross-Border Activities to Build a

Global Competitive Advantage

Aligning activities located in different countries contributes to competitive advantage in several ways

Choose where and how to challenge rivals

Shift production from one location to another to take advantage of most favorable cost or trade conditions or exchange rates

Use online systems to collect ideas for new or improved products and to determine which products should be standardized or customized

Enhance brand reputation by incorporating same differentiating attributes in its products in all markets where it competes

What Are Profit Sanctuaries?

Profit sanctuaries are country markets where a firm

Has a strong, protected market position and

Derives substantial profits

Generally, a firm’s most strategically crucial profit sanctuary is its home market

Profit sanctuaries are a valuable competitive asset in global industries!

Fig. 7.3: Profit Sanctuary Potential of Domestic-Only,

International, and Global Competitors

What Is Cross-Market Subsidization?

Involves supporting competitive offensives in one market with resources/profits diverted from operations in other markets

Competitive power of cross-market subsidization results from a global firm’s ability to

Draw upon its resources and profits in other country markets to mount an attack on single-market or one-country rivals and

Try to lure away their customers with

Lower prices

Discount promotions

Heavy advertising

Other offensive tactics

Thank you!

Global Strategic Offensives

Three Options

Attack a foreign rival’s profit sanctuaries

Approach places a rival on the defensive, forcing it to

Spend more on marketing/advertising

Trim its prices

Boost product innovation efforts

Take actions raising its costs and eroding its profits

Employ cross-market subsidization

Attractive offensive strategy for companies competing in multiple country markets with multiple products

Dump goods at cut-rate prices

Approach involves a company selling goods in foreign markets at prices

Well below prices at which it sells in its home market or

Well below its full costs per unit

Achieving Global

Competitiveness via Cooperation

Cooperative agreements with foreign companies are a means to

Enter a foreign market or

Strengthen a firm’s competitiveness in world markets

Purpose of alliances

Joint research efforts

Technology-sharing

Joint use of production or distribution facilities

Marketing / promoting one another’s products

Strategic Appeal of Strategic Alliances

Gain better access to attractive country markets from host country’s government to import and market products locally

Capture economies of scale in production and/or marketing

Fill gaps in technical expertise or knowledge of local markets

Share distribution facilities and dealer networks

Direct combined competitive energies toward defeating mutual rivals

Take advantage of partner’s local market knowledge and working relationships with key government officials in host country

Useful way to gain agreement on important technical standards

Pitfalls of Strategic Alliances

Overcoming language and cultural barriers

Dealing with diverse or conflicting operating practices

Time consuming for managers in terms of communication, trust-building, and coordination costs

Mistrust when collaborating in competitively sensitive areas

Clash of egos and company cultures

Dealing with conflicting objectives, strategies, corporate values, and ethical standards

Becoming too dependent on another firm for essential expertise over the long-term

Characteristics of Competing in Emerging Foreign Markets

Tailoring products for big, emerging markets often involves

Making more than minor product changes and

Becoming more familiar with local cultures

Companies have to attract buyers with bargain prices as well as better products

Specially designed and/or specially packaged products may be needed to accommodate local market circumstances

Management team must usually consist of a mix of expatriate and local managers

Strategic Options: How to Compete in Emerging Country Markets

Prepare to compete on the basis of low price

Be prepared to modify aspects of the company’s business model to accommodate local circumstances

Try to change the local market to better match the way the company does business elsewhere

Stay away from those emerging markets where it is impractical or uneconomic to modify the company’s business model to accommodate local circumstances

Fig. 7.4: Strategy Options for Local Companies in Competing Against Global Challengers

Strategic Options for Local Companies:

Use Home-Field Advantages

Concentrate on advantages enjoyed in the home market

Cater to customers who prefer a local touch

Accept loss of customers attracted to global brands

Astutely exploit its local orientation based on

Familiarity with local preferences

Expertise in traditional products

Long-standing customer relationships

Cater to the local market in ways that pose difficulties for global rivals

Strategic Options for Local Companies:

Transfer Expertise to Cross-Border Markets

When a local company trying to defend against a global challenger has resource strengths and capabilities suitable for competing in other country markets, then it should consider

Launching initiatives to transfer its expertise to cross-border markets

Becoming more of an international competitor

Such a move to enter foreign markets can help

Build a bigger customer base (to offset any losses in its home market)

Grow sales and profits

Put in a stronger position to contend with global challengers in its home market

Strategic Options for Local Companies: Dodging Rivals by Shifting to a New Business Model or Market Niche

When industry pressures to globalize are high, viable strategic options for a local company trying to defend against global challengers in its home market include

Shifting the business to a piece of the industry value chain where the firm’s expertise/resources provide a defendable position or maybe even a competitive advantage

Entering a joint venture with a globally competitive partner

Selling out to a global entrant into its home market

Strategic Options for Local Companies:

Contend on a Global Level

If a local company has resources and capabilities that it can transfer to operations in other countries, it can launch a strategy aimed at

Entering markets of other countries as rapidly as possible

Shifting to a more globalized strategy

Building brand recognition and a brand image that extends to more and more countries

Gradually establishing the resources and capabilities to go head-to-head against large global rivals