FRA - v1a

advertisement

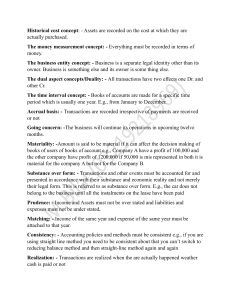

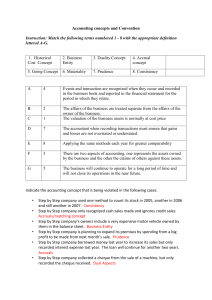

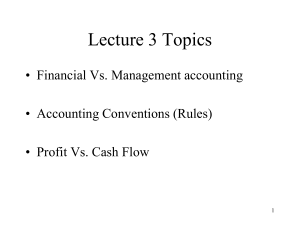

Introduction 1 KAMAL MUSTAFA ACCA (UK), MSC (University of Leicester -UK, MBA University of Hull –UK, DMS University of Hull -UK, DEM The Institute of Export - UK 2 Financial Reporting And Analysis 1. 2. 3. 4. 5. 6. Course Outlines A conceptual and regulatory framework Introduction to published accounts Accounting concepts and policies Tangible non-current assets Intangible assets Impairment of assets 3 Financial Reporting And Analysis Course Outlines 7. Reporting financial performance 8. Leases 9. Substance over form 10. Financial assets and financial liabilities 11. Inventories and construction contracts 12. Provisions, contingent liabilities and contingent assets 4 Financial Reporting And Analysis Course Outlines 13. EPS 14. Interpretational of financial statements 15. Statement of cash flows 16. Principles of consolidated 17. FS Consolidated 18. SFP Consolidated IS 5 Financial Reporting And Analysis Core areas of the syllabus • • • • • A conceptual framework for financial reporting A regulatory framework for financial reporting Financial statements Business combinations Analysing and interpreting financial statements 6 Financial Reporting And Analysis Student’s Previous Knowledge • Financial Accounting • Management Accounting 7 Financial Reporting And Analysis What I expect from you in this course? • • • • • Reading topic from relevant text book Reading articles from internet Clear your concept through group discussions Revise my lecture at home twice Before attending my new lecture revise the last lecture 8 Financial Reporting And Analysis Introduction of FRA Financial reporting is presenting financial data of a company's position, operating performance, and funds flow for an accounting period. Financial statements together with related information may be contained in various forms for external party use such as in the annual reports. It is basically financial information that companies give about their activities, including how they prepare and show it. 9 Financial Reporting And Analysis Objectives of FRA • • • • • • -Usefulness -Understandability -Target audience: investors and creditors -Assessing future cash flows -Evaluating economic resources -Primary focus on earnings 10 Financial Reporting And Analysis Meaning of the following accounting concepts; 1. 2. 3. 4. 5. Going concern Prudence Materiality Consistency Accruals 11 Financial Reporting And Analysis Going Concern • The assumption that the business will continue in operation for the foreseeable future without significantly curtailing its activity. 12 Financial Reporting And Analysis Prudence • Prudence is the inclusion of a degree of caution when making estimates under conditions of uncertainty. • It ensures that assets and income are not overstated and liabilities are not understated. 13 Financial Reporting And Analysis Materiality • Materiality is a threshold quality that is demanded of all information given in the financial statements, i.e. information that is material should be given in the FS but information that is not material need not be given. 14 Financial Reporting And Analysis • Information is material if its omission or misstatement might reasonably be expected to influence the economic decisions of users. • Whether or not information is material will depend on the size and nature of the item and the size of the business 15 Financial Reporting And Analysis Consistency Items should be treated in the same way year on year. This will enable valid comparisons to be made. However, if circumstances change then a business is allowed to change policies to give a fairer representation of the financial statements. 16 Financial Reporting And Analysis Accruals / Matching • To calculate the profit for the period, one must include all the revenue and expenditure relating to the period, whether or not the cash has been received or paid. • This concept also states that income and expenses should be matched against each other within an accounting period as far as possible 17