File - STEPHEN TOWNSEND

advertisement

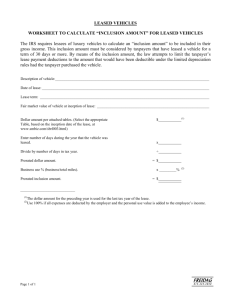

Purchase vs. Leasing Vehicles. Buying vs. Leasing Vehicles Eng120 Stephen Townsend Purchase vs. Leasing Vehicles. The ability to get from point A to point B in our society is extremely important. Due to the size of the United States and lack of reliable or available public transportation in most towns owning a vehicle is an expensive necessity. A vehicle purchase is often the second largest investment that any one person will make in their lifetime. So shouldn’t we make sure that we make a good investment? It’s your hard earned money, so it would be smart to spend it and get the most out of your dollar. When it comes to getting a new vehicle you have two options: purchase a vehicle or lease a vehicle. To purchase a vehicle this means you will be making monthly payments usually up to 5 years. At the end of your payments the vehicle belongs to you to do whatever you want with. To lease a vehicle you still get the same car only you are renting the vehicle for a shorter term. This term is usually between 1-3 years long. So the question remains whether it is a wiser financial choice to lease or purchase a vehicle. Leasing a vehicle is one option available. To lease a vehicle, you are renting a vehicle much like when you rent a vehicle from a rental service on vacation. A typical lease is 2 years on a brand new vehicle. For most manufacturers that would be any new vehicle on the market. A typical lease requires about $2,000 cash due as a lump sum at the signing of the lease. This is a non-refundable payment. In addition to the large initial lump sum payment additional smaller payments are required monthly for the full term of the lease. These payments are usually lower than a purchase payment but not always. The smaller payment is what the automobile industry uses to encourage people to lease rather than purchase. This means for a nice BMW that costs $50,000 you may have a Purchase vs. Leasing Vehicles. monthly payment of $450 a month where the purchase payment at 0% interest is in the upper $800 range depending upon down payment. If a decision is being made strictly initial cost then it seems a lease is a great idea however the drawbacks to a lease are significant. Because this is a lease that means you do not own the car. In most leases you are not allowed to make any changes to the vehicle include changing the wheel and tires or adding performance upgrades. In the majority of lease agreements there is fine print outlining mileage limits and the steep cost to the signee should the vehicle be driven past the agreed upon limits. Lease mile packages usually come in 3 sets: 10,000, 12,000 and 15,000 mile deals (Car buying Basics, Consumer Reports, 2014). The higher the mileage you choose the higher the payment will be. For example if you hear an advertisement on the radio saying lease this brand new BMW for only $399 a month. The fine print in this advertisement might say that this price is calculated over a 2 year lease at 10,000 miles a year with about $2000 down, due at signing. Other things that many do not know is when they skip the fine print is that insurance is also higher. As the driver of that vehicle you are required to maintain that vehicle. Because new vehicles are under a factory warranty. Most, if not all, repairs are free up to a certain mileage. Not all warranties cover regular maintenance such as tires, brakes, oil changes, periodic service appointments and other wearable items. At the end of the two year lease. The vehicle is expected to be turned into the dealer in the same condition that is was when it was new but is allowed expected wear and tear to an extent. This would include brakes being above a certain thickness, tires are above a certain thickness and are an approved tire by the manufacture and the mileage is at or below the lease agreement number. If items such as these are not within specification then you can find additional Purchase vs. Leasing Vehicles. costs to have these items replaced by the dealer. If you have gone over your mileage, it is not uncommon to be charged as much as $.20 per mile over your agreed limit. For example if you have gone 1500 miles over your 10,000 mile limit you could find additional charges around $300 more due when you drop off the car. For most consumers. Leasing a vehicle a new vehicle every two or three years would be more expensive than buying one and keeping it after the final payment (How to lease a car, How stuff works 2006, para 2). Purchase vs. Leasing Vehicles. The second option when acquiring a vehicle is to purchase. To purchase a vehicle this vehicle would belong to you. Whether you pay cash out of pocket or make monthly payments you are free to do as you please with the vehicle. When purchasing a vehicle a typical payment plan is about 5 years should the financing option be taken. Over the next 5 years, payments are made toward the purchase price. With purchasing you are also able to negotiate more on the price to ensure you get a better deal. For a Purchase vs. Leasing Vehicles. $50,000 vehicle over a 5 year term you monthly payment may be around $800 a month. To help calculate your rate you can also use online calculators to determine how much a month you would pay for any amount. A popular online site would be Auto Loan Calculator. Your insurance also tends to be at a lower rate and while you have the vehicle you are free to put as many miles on it as you need with no restrictions (Is it smarter to buy or lease a car, How stuff works, 2007). This is usually a good choice for those who drive or commute far for work or travel a lot. At the end of 5 years you now own the vehicle. This is where you benefit the most. Because you now own the vehicle you now have equity. Equity is a stock or any other security representing an ownership of interest. This would help if buying a new house or another large investment. You can use your vehicle as collateral to help ensure you get a better credit rate. Or use your old car as a trade in for a new vehicle. Let’s look at this now over a 5 year term for both leasing and purchasing. We will break down the payments to determine which option you get a better return for your money. For this exercise I chose a popular vehicle, a 2015 Toyota Camry Automatic right off the showroom floor. The Price as advertised is $25,000.(Hendricks Toyota of Apex, Internet advertisement 2014) Base Options Manufacture, Delv, Proc & Hndlg Admin Total Series: Invoice $23,840 $299 $860 $24,999 Toyota Camry Purchase vs. Leasing Vehicles. Model: Model Year: Transmission: VIN: Color: Interior: Available: 2546 - SE (6 Spd Auto) 2015 6 Speed Automatic 4T1BF1FK8FU474278 Creme Brulee Mica Black Fabric Immediately 60 Months Purchase Assumes 10.0% down payment, 3%APR $435 24 Months Lease Assumes 10.0% down payment 60 Months Lease Assumes 10.0% down payment $357 $285 For this vehicle you may either lease or choose to purchase. For this exercise we will not take into account that most vehicle prices are negotiated and a buyer would hope to pay several thousand below list price. The lease price as advertised is $285 for a 5 year lease (60 months) with 10% down due at signing at 10,000 miles. To purchase the vehicle as advertised is $435 per month over a 5 year term (60 months) with 10% down at a 3% interest rate. So let’s look at leasing. At a 10% of $25,000 you are required to pay $2,500 due at signing. For purchasing this vehicle this would contribute toward the total price. So you now owe $22,500 for monthly payments. Using our Auto Loan Amortization Calculator this brings our payments down to around $400 a month. Purchase vs. Leasing Vehicles. Payment Principal Interest Balance Payment Principal Interest Balance 1 $348.05 $56.25 $22,151.95 31 $375.12 $29.18 $11,296.03 2 $348.92 $55.38 $21,803.04 32 $376.06 $28.24 $10,919.98 3 $349.79 $54.51 $21,453.25 33 $377.00 $27.30 $10,542.98 4 $350.66 $53.63 $21,102.59 34 $377.94 $26.36 $10,165.04 5 $351.54 $52.76 $20,751.05 35 $378.88 $25.41 $9,786.16 6 $352.42 $51.88 $20,398.63 36 $379.83 $24.47 $9,406.33 7 $353.30 $51.00 $20,045.33 37 $380.78 $23.52 $9,025.55 8 $354.18 $50.11 $19,691.15 38 $381.73 $22.56 $8,643.82 9 $355.07 $49.23 $19,336.08 39 $382.69 $21.61 $8,261.13 10 $355.96 $48.34 $18,980.13 40 $383.64 $20.65 $7,877.49 11 $356.85 $47.45 $18,623.28 41 $384.60 $19.69 $7,492.89 12 $357.74 $46.56 $18,265.54 42 $385.56 $18.73 $7,107.33 13 $358.63 $45.66 $17,906.91 43 $386.53 $17.77 $6,720.80 14 $359.53 $44.77 $17,547.38 44 $387.49 $16.80 $6,333.31 15 $360.43 $43.87 $17,186.96 45 $388.46 $15.83 $5,944.84 16 $361.33 $42.97 $16,825.63 46 $389.43 $14.86 $5,555.41 17 $362.23 $42.06 $16,463.40 47 $390.41 $13.89 $5,165.00 18 $363.14 $41.16 $16,100.26 48 $391.38 $12.91 $4,773.62 19 $364.04 $40.25 $15,736.22 49 $392.36 $11.93 $4,381.26 20 $364.95 $39.34 $15,371.26 50 $393.34 $10.95 $3,987.92 21 $365.87 $38.43 $15,005.39 51 $394.33 $9.97 $3,593.59 22 $366.78 $37.51 $14,638.61 52 $395.31 $8.98 $3,198.28 23 $367.70 $36.60 $14,270.91 53 $396.30 $8.00 $2,801.98 24 $368.62 $35.68 $13,902.29 54 $397.29 $7.00 $2,404.69 25 $369.54 $34.76 $13,532.75 55 $398.28 $6.01 $2,006.40 26 $370.46 $33.83 $13,162.29 56 $399.28 $5.02 $1,607.13 27 $371.39 $32.91 $12,790.90 57 $400.28 $4.02 $1,206.85 28 $372.32 $31.98 $12,418.58 58 $401.28 $3.02 $805.57 29 $373.25 $31.05 $12,045.33 59 $402.28 $2.01 $403.29 30 $374.18 $30.11 $11,671.15 60 $403.29 $1.01 $0.00 At the end of the 60 months you now fully own that vehicle. You now have no more payments and can now have a vehicle payment free vehicle. Since this vehicle belongs to you it can be used as equity toward a house or in case of emergency you may sell Purchase vs. Leasing Vehicles. the vehicle and liquidate it to cash. Now let’s look at a lease. At $25,000, 10% down over a 5 year term. At signing you pay $2,500. Each month for 60 months you pay $285 as per the lease deal. Each year you will pay $3,420. That’s $17,100 over a 5 year lease that you rent the vehicle. Then add $2,500 that you have already paid at signing. Total you have paid $19,600 for this vehicle. For a vehicle that is only worth $25,000 you have paid almost 3/4 of the total cost already toward the vehicle. Remember this was a 10,000 mile a year lease. We are assuming the vehicle has not exceeded 50,000 miles. If the vehicle has not been maintained well and has not followed the terms of the lease this price could go up. Also if the vehicle has been modified or is not in acceptable shape for return. In the lease agreement you may be forced to buy the vehicle at the full market value (Leasing vs. Buying, DMV.org). So now at the end of 5 years you have paid $19,600. You have nothing to show for it and that money is gone. But now let’s look at another common lease. Let’s say you did a 2 year lease (24 month). According to the advertisement your payment would be $357 per month. A 10% down payment $2,500 is still required due at signing. This is also with 10,000 mileage driving limit. After 2 years of payments and the down payment due at signing you have paid $11,068 for that 24 month lease. Now let’s say you leased the same vehicle again for another 2 years. Using the same data, since to 2019 prices are unavailable, you have now paid $22,136. This is almost the total cost of the vehicle you could have purchased. Now we have one year left to reach a 5 year median between purchasing and leasing. Since a 12 month lease is not offered. For another 24 month lease that you are looking to spend another $11,068. Assuming 10% down at signing and 10,000 mile limit. We have a total of $27,444. This is now more than the vehicle costs. Yes you may have had a new Purchase vs. Leasing Vehicles. vehicle every two years but are you willing to pay more for a vehicle you can’t keep. Remember most people will need a vehicle their whole life and we start buying vehicles at a young age. Now we have a better understanding on the big differences of purchasing vs. leasing. For a short term we have found that leasing is a better option. But like majority of Americans we need a vehicle for long term. So hopefully the question no longer remains on whether you should lease your next vehicle or you should purchase your next vehicle. Purchase vs. Leasing Vehicles. References Auto Loan Amortization Calculator. (n.d.). Retrieved December 5, 2014, from http://www.myamortizationchart.com/auto-loan-amortization-calculator/ Buying vs. Leasing Basics | New Car Buying Guide - Consumer Reports. (2014, October 1). Retrieved December 5, 2014, from http://www.consumerreports.org/cro/2012/12/buying-vs-leasing-basics/index.htm Pros and Cons of Car Leasing and Buying a New or Used Car at DMV.org: The DMV Made Simple. (n.d.). Retrieved December 5, 2014, from http://www.dmv.org/buysell/new-cars/leasing-vs-buying.php Leasing a Car Overview - HowStuffWorks. (n.d.). Retrieved December 5, 2014, from http://auto.howstuffworks.com/buying-selling/how-to-lease-a-car.htm Is it smarter to buy or lease a car? - HowStuffWorks. (2007, December 21). Retrieved December 5, 2014, from http://auto.howstuffworks.com/buying-selling/buy-or-lease.htm