Chapter Two: Corporate Governance, Serving Client and Public

advertisement

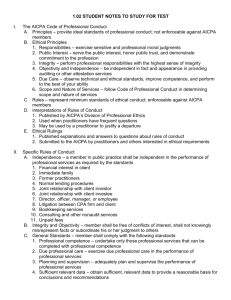

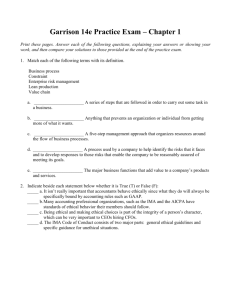

Chapter 2 Corporate Governance, Serving Client and Public Interests, and Audit Professionalism Corporate Governance: Serving Client and Public Interests Roles of Interested Parties •Objective of financial reporting •Corporate governance •Management functions Who is the Audit Client? The board of directors and its audit committee. What is an Audit Committee? Subcommittee of the board of directors. Oversight responsibility for the outside reporting of the company; risk monitoring and control processes; and both internal and external audit functions. Acts as an independent check on management. Also, advocate for outside users of financial statements. Serving the Public’s Interests A profession hold itself out as having higher standards of conduct than society at large. An audit opinion has value only if third parties believe that the auditor is competent, uses due care, and acts independently. A professional must earn trust every day. A profession is no better than what it can do in the future; it cannot rest on what it has done in the past. Assuring Quality Users need the assurance that publicly available information is timely and accurate. Why are CPA’s better at providing this assurance? The answer: Professionalism Framework for Quality Three components comprise the framework for assuring quality: •Standards •Ethics •Internal and external quality reviews Maintaining Professionalism: Standards Need for Professional Standards AICPA standards for attestation services: •General or individual standards •Fieldwork standards •Reporting standards Generally Accepted Auditing Standards 10 Generally Accepted Auditing Standards •General Standards (three) •Criteria guiding auditor qualifications •Fieldwork Standards (three) •Guiding the audit process •Reporting Standards (four) •Clarifying the communication process General Standards 1. The examination is to be performed by a person or persons having adequate technical training and proficiency. 2. In all matters relating to the assignment, an independence in mental attitude is to be maintained by the auditor or auditors. 3. Due professional care is to be exercised in the performance of the examination and the preparation of the report. Standards of Fieldwork 1. The work shall be adequately planned and assistants, if any, shall be properly supervised. 2. A sufficient understanding of internal control is to be obtained to plan the audit and to determine the nature, timing, and extent of tests to be performed. 3. Sufficient competent evidential matter is to be obtained through inspection, observation, inquiries, and confirmations to afford a reasonable basis for an opinion regarding the financial statements under examination. Standards of Reporting 1. The report shall state whether the financial statements are presented in accordance with GAAP. 2. The report shall identify those circumstances in which such principles have not been consistently observed in the current period in relation to the preceding period. 3. Informative disclosures in the financial statements are to be regarded as reasonably adequate unless otherwise stated in the report. 4. The report shall contain either an expression of opinion regarding the financial statements, taken as a whole, or an assertion to the effect that an opinion cannot be expressed. When an overall opinion cannot be expressed, the reasons therefore should be stated. In all cases in which an auditor’s name is associated with financial statements, the report should contain a clear-cut indication of the character of the auditor’s examination, if any, and the degree of responsibility the auditor is taking. Standards for Other Audit Engagements Attestation Standards •Very similar to GAAS with the exception of: •Assertions are specific to the area on which the attestation is performed. •On specific provisions related to evaluating internal control. •The attestor’s competence is related to the specific area. •The report provides assurance related to the specific assertion. Governmental Auditing Standards The standards are applicable to audits of governmental organizations, programs, activities,and functions. May apply to audits of: •State, city, county,and Indian tribal governments. •Real estate joint ventures or partnerships that receive financial assistance from HUD. •Finance companies with federally insured mortgages. •Manufacturing companies selling to the government. •Universities with student loans guaranteed by the federal government. Maintaining Professionalism: Ethical Framework Importance of Ethical Conduct AICPA Code of Professional Conduct •Four Components •Principles •Rules of conduct •Interpretations of the Rules •Ethical Rulings AICPA Principles of Professional Conduct •Responsibilities •Public Interest •Integrity •Objectivity and independence •Due care •Scope and nature of services AICPA Rules of Conduct Rule 101: Independence Rule 102: Integrity and Objectivity Rule 201: General Standards Rule 202: Compliance with Standards Rule 203: Accounting Principles Rule 301: Confidential Client Information Rule 302: Contingent Fees AICPA Rules of Conduct (continued) Rule 501: Acts Discreditable Rule 502: Advertising and Other Forms of Solicitation Rule 503: Commissions and Referral Fees Rule 505: Form of Organization and Name Enforcement of the Code Compliance depends primarily on the voluntary cooperation of the AICPA members and: •public opinion •reinforcement by peers •ultimately on disciplinary proceeding by the Joint Ethics Enforcement Program (JEEP), sponsored by the AICPA and state CPA societies. Ethical Theories: Resolving Issues that are not Black or White •Ethical Problems •Ethical Dilemmas •Utilitarian theory •Rights theory An Ethical Framework •Identify the ethical issue(s). •Determine the affected parties and identify their rights. •Determine the most important rights. •Determine alternative courses of action. •Assess the possible consequences of each action. •Decide on the appropriate course of action. Maintaining Professionalism: Ensuring Quality WHO AUDITS THE AUDITORS? •External peer reviews •Concurring partner reviews •Interoffice reviews Quality Control Standards and External Peer Reviews Sound quality controls •independence, integrity, and objectivity •personnel management •acceptance and continuance of clients and engagements •engagement performance •monitoring Internal Peer Review Programs •Concurring partner review •Interoffice review