MRP & Capacity Constraints: Class Note on Material Management

advertisement

Material Management

Class Note #1-A

MRP – Capacity Constraints

Prof. Yuan-Shyi Peter Chiu

Feb. 2011

1

§ M1: Push & Pull

Production Control System

MRP: Materials Requirements Planning (MRP) ~ PUSH

JIT: Just-in-time (JIT) ~ PULL

Definition (by Karmarkar, 1989)

A pull system initiates production as a reaction to

present demand, while

A push system initiates production in anticipation of

future demand

Thus, MRP incorporates forecasts of future demand

while JIT does not.

2

§ M2: MRP ~ Push

Production Control System

We determine lot sizes based on forecasts

of future demands and possibly on cost

considerations

A top-down planning system in that all

production quantity decisions are derived

from demand forecasts.

Lot-sizing decisions are found for every

level of the production system. Item are

produced based on this plan and pushed

to the next level.

3

§ M2: MRP ~ Push

A production plan is a complete spec. of

The amounts of final product produced

The exact timing of the production lot sizes

The final schedule of completion

The production plan may be broken down into

several component parts

1)

2)

3)

Production Control System ( p.2 )

The master production schedule (MPS)

The materials requirements planning (MRP)

The detailed Job Shop schedule

MPS - a spec. of the exact amounts and timing of

production of each of the end items in a production

system.

4

§ M2: MRP ~ Push

Production Control System ( p.3 )

P.405 Fig.8-1

5

§ M2: MRP ~ Push

The data sources for determining the MPS

include

1)

2)

3)

4)

5)

Production Control System ( p.4 )

Firm customer orders

Forecasts of future demand by item

Safety stock requirements

Seasonal plans

Internal orders

Three phases in controlling of the production

system

Phase 1: gathering & coordinating info to develop MPS

Phase 2: development of MRP

Phase 3: development of detailed shop floor and

resource requirements from MRP

6

§ M2: MRP ~ Push

Production Control System ( p.5 )

How MRP Calculus works:

1.

2.

3.

Parent-Child relationships

Lead times into Time-Phased requirements

Lot-sizing methods result in specific schedules

7

§ M3: JIT ~ Pull

Production Control System

Basics :

1.

2.

3.

4.

5.

WIP is minimum.

A Pull system ~ production at each stage is

initiated only when requested.

JIT extends beyond the plant boundaries.

The benefits of JIT extend beyond savings of

inventory-related costs.

Serious commitment from Top mgmt to

workers.

Lean Production ≈ JIT

8

§ M4: The Explosion Calculus

(BOM Explosion)

Gross Requirements of one level

Push down

Lower levels

9

§ M4: The Explosion Calculus

Eg. 7-1

Valve casing

assembly (1)

Lead time = 2 weeks

b-t-13

Fig.7-5 p.353

Trumpet

( End Item )

Bell assembly (1)

(page 2)

Lead time = 4 weeks

b-t-14

Slide assemblies (3)

Valves (3)

Lead time = 2 weeks

Lead time = 3 weeks

b-t-15

10

§ M4: The Explosion Calculus

(page 3)

=>Steps

1. Predicted Demand (Final Items)

2. Net demand (or MPS)

3.

Push Down to the next level (MRP)

4.

Forecasts

Schedule of Receipts

Initial Inventory

Lot-for-lot production rule (lot-sizing algorithm)

– no inventory carried over.

Time-phased requirements

May have scheduled receipts for different parts.

Push all the way down

11

Eg. 7-1

1

Trumpet

1 Bell Assembly

1 Valve casing Assembly

3 Slide Assemblies

3 Valves

7 weeks to produce a Trumpet ?

To plan 7 weeks ahead

The Predicted Demands:

Week

Demand

8

9

77 42

10 11 12

13 14 15 16 17

38 21 26 112 45 14 76 38

Expected schedule of receipts

Week

Scheduled receipts

8

9

10

11

12

0

6

9

12

Beginning inventory = 23, at the end of week 7

Accordingly the net predicted demands become

Week

Net Predicted

Demands

8

9

10

11

12

13

14

15

16

17

42

42

32

12

26

112

45

14

76

38

Master Production Schedule (MPS) for the end product (i.e. Trumpet)

MRP calculations for the Bell assembly (one bell assembly

for each Trumpet) & Lead time = 2 weeks go-see-10

Week

6

7

8

9

10

11

12

Gross

Requirements

42

42

32

12

Net

Requirements

42

42

32

12

26

112

45

26

13

14

15

16

17

112

45

14

76

38

14

76

38

Time-Phased

Net Requirements

42

42 32 12

26

112

45

14

76

38

Planned Order

Release (lot for lot)

42

42 32 12

26

112

45

14

76

38

13

MRP Calculations for the valve casing assembly (1 valves

casing assembly for each Trumpet) & Lead time = 4 weeks go-see-10

Week

4

5

6

7

8

9

10

11

12

13

14

15

16

17

Gross

Requirements

42 42

32

12

26

112

45

14

76

38

Net

Requirements

42 42

32

12

26

112

45

14

76

38

Time-Phased

Net Requirements 42 42

32 12

26 112 45

14

76

38

Planned Order

Release (lot for lot) 42 42

32 12

26 112 45

14

76

38

b-t-20

b-t-38

14

MRP Calculations for the valves ( 3 valves for each valve casing

assembly) go-see-10

Lead Time = 3 weeks

On-hand inventory of 186 valves at the end of week 3

Receipt from an outside supplier of 96 valves at the start of week 5

MRP Calculations for the valves

Week

2

3

Gross

Requirements

4

126 126

Scheduled Receipts

On-hand inventory

6

7

8

9

10

11

96

36

78 336 135

42

12

13

228 114

96

186

Net

Requirements

Time-Phased

Net Requirements

Planned Order

Release (lot for lot)

5

60

30

0

0

66

36

78

336 135

66

36 78

336 135

42 228 114

66

36 78

336 135

42 228 114

42 228 114

15

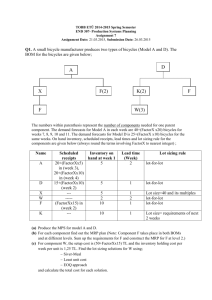

§. M4.1: Class Work

# CW.1

What is the MRP Calculations for the slide assemblies ?

( 3 slide assemblies for each valve casing )

Lead Time = 2 weeks

Assume On-hand inventory of 270 slide assemblies at the end of week

3 & Scheduled receipts of 78 & 63 at the beginning of week 5 & 7

Show the MRP Calculations for the slide assemblies !

Preparation Time : 25 ~ 35 minutes

Discussion : 20 minutes

◆1g-s-62

16

To Think about …

Lot-for-Lot may not be feasible ?!

e.g. 336 Slide assemblies required at week 9 may exceeds

plant’s capacity of let’s say 200 per week.

Lot-for-Lot may not be the best way in production !?

Why do we have to produce certain items (parts) every week?

why not in batch ? To minimize the production costs.

17

§. M4.2: Class Problems

Discussion

Chapter 7 :

( # 4, 5, 6 )

( # 9 (b,c,d) )

p.356-7

p.357

Preparation Time : 25 ~ 35 minutes

Discussion : 20 minutes

18

§ M5: Alternative Lot-sizing schemes

Log-for-log : in general, not optimal

If we have a known set of time-varying demands

and costs of setup & holding, what production

quantities will minimize the total holding & setup

costs over the planning horizon?

19

(1) EOQ Lot sizing ?

439/10=43.9

(page 2)

h ? ($141.82* 22%) / 52 $0.6 per piece

k ? 2 3 $22 $132

2k

139

h

(1) MRP Calculation for the valve casing assembly when applying E.O.Q.

lot sizing Technique instead of lot-for-lot (g-s-14)

Q

Week

4

Net

Requirements

Time-Phased

Net Requirements 42

Planned order

release (EOQ)

Planned deliveries

Ending inventory

139

5

6

42

32

0

0

7

8

9

10

11

12

13

42

42

32

12

26

112 45

26

112

45

14

76

38

0 139

0

139

0

0

139

139

0

0

0

139

97

55

23

12

11 124

14

0 139

15 16 17

14

76 38

0

0 139

12 106 92 16 117

20

Ending =

Inventory

Beginning

Inventory

+

Planning

Deliveries

Total ordering ( times ) = 4 ;

Total ending inventory =

Net

Requirements

cost = $132 * 4 = $528

17

= 653 ;

j

j 8

cost = ($0.6) (653) = $391.80

Total Costs

= Setup costs + holding costs

= 4*132+$0.6*653 = $919.80

vs. lot-for-lot 10*132 = $1320 (setup costs)

g-b-41

21

§ M5: Alternative Lot-sizing schemes

(page 3)

(2) The Silver-Meal Heuristic (S-M)

Forward method ~ avg. cost per period (to span)

Stop when avg. costs increases.

c(1) k

c(2) (k hr2 ) / 2

c(3) (k hr2 2hr3 ) / 3

:

c( j ) (k hr2 2hr3 ... ( j 1)hrj ) / j

i.e. Once c(j) > c(j-1) stop

Them let y1 = r1+r2+…+rj-1 and begin again starting at period j

22

§ M5: Alternative Lot-sizing schemes

The

silver-meal heuristic Will Not Always result in an

optimal solution (see eg.7.3; p.360)

Computing

Technology enables heuristic solution

● S-M example 1 :

Suppose demands for the casings are r = (18, 30, 42, 5, 20)

Holding cost = $2 per case per week

Production setup cost = $80

Starting in Period 1 :

C(1) = $80

C(2) = [$80+$2(30)] /2 = $70

C(3) = [$80+$2(30)+$2(2)(42)] /3 =308/3 = $102.7

∵ C(3) >C(2)

∴ STOP ; Set

y1 r1 r2 48

23

Starting in Period 3 :

r = (18, 30, 42, 5, 20)

C(1) = 80

C(2) = [80+2(5)] /2 = 45

C(3) = [80+2(5)+$2(2)(20)] /3 = 170/3 = 56.7

∵ C(3) >C(2)

∴ STOP ; Set

y3 r3 r4 47 & y5 20

∴ Solution = (48, 0, 47, 0, 20) cost = $310

● S-M example 2 : (counterexample)

Let r = (10, 40, 30) , k=50 & h=1

Silver-Meal heuristic gives the solution y=(50,0,30)

but the optimal solution is (10,70,0)

Conclusion of Silver-Meal heuristic

It will not always result in an optimal solution

The higher the variance (in demand) , the better the

improvement the heuristic gives (versus EOQ)

24

§ M5: Alternative Lot-sizing schemes (page 4)

(3) Least Unit Cost (LUC)

Similar to the S-M except it divided by total

demanded quantities.

c(1) k / r1

c(2) ( k hr2 ) /( r1 r2 )

:

c( j ) [k hr2 ... ( j 1)hrj ]/( r1 r2 ... rj )

Once c(j) > c(j-1) stop and so on.

25

● LUC example:

r = (18, 30, 42, 5, 20)

h = $2

K = $80

Solution : in period 1

C(1) = $80 /18 = $4.44

C(2) = [80+2(30)] /(18+30) = 140/48 = $2.92

C(3) = [80+2(30)+2(2)(42)] /(18+30+42) = 308/90 = $3.42

∵ C(3) >C(2)

∴ STOP ; Set

y1 r1 r2 48

Starting in period 3

C(1) = $80 /42 = 1.90

C(2) = [80+2(5)] /(42+5) = 90 /47 = 1.91

∵ C(3) >C(2)

∴ STOP ; Set

y3 r3 42

26

r = (18, 30, 42, 5, 20)

Starting in period 5

C(1) = $80 /5 = 16

C(2) = [80+2(20)] /(5+20) = 120 /25 = 4.8

∴ Set

y4 r4 r5 25

∴ Solution = ( 48, 0, 42, 25, 0)

cost = 3(80)+2(30)+2(20) = $340

27

§ M5: Alternative Lot-sizing schemes (page 5)

(4) Part Period Balancing (PPB)

More popular in practice

Set the order horizon equal to “# of periods”

~ closely matches total holding cost closely with the setup

cost over that period.

Closer rule

Eg. 80 vs. (0, 10, 90) then choose 90

Last three : S-M, LUC, and PPB are heuristic methods

~ means reasonable but not necessarily give

the optimal solution.

28

● PPB example :

r = (18, 30, 42, 5, 20)

h = $2

K = $80

Starting in Period 1

Order

Horizon

Total Holding

cost

1

2

3

0

60 (2*30)

228 (2*30+2*2*42)

K=80

∵ K is closer to period 2

∴ y r r 48

1

1

2

29

Starting in Period 3 :

Order

Horizon

1

2

3

Total Holding

cost

0

10

90

r = (18, 30, 42, 5, 20)

h = $2

K = $80

(2*5)

(2*5+2*2*20)

K=80

∵ K is closer to period 3

∴ y3 r3 r4 r5 67

∴ Solution = (48, 0, 67, 0, 0)

cost = 2(80)+2(30)+2(5)+2(2)(20) = $310 #

30

§. M5.1: Class Problems

Discussion

Chapter 7 :

( # 14, 17 )

p.363

Preparation Time : 25 ~ 40 minutes

Discussion : 15 minutes

31

§ M6: Wagner – Whitin Algorithm

~ guarantees an optimal solution to the production

planning problem with time-varying demands.

Eq.

r (52,87, 23,56)

y1 52 ;

y1 (52 ... 56) 218

y1 [52, 218] ~ 167 values ;

( y1, y2 ) ~ 10200 values

~ Enormous ~

y1 r1 ; or y1 r1 r2 ...; or y1 r1 r2 ... rn

y2 0; or y2 r2 ; or y2 r2 r3 ...;

or y2 r2 r3... rn

:

yn 0; or yn rn ~ much smaller set of solutions

2(n-1) distinct exact solutions

32

§ M6: Wagner – Whitin Algorithm

(page 2)

Eg. A four periods planning

y1 r1 y2 r2 y3 r3 , y4 r4

(1)

y3 r3 r4 , y4 0 (2)

y 2 =r2 +r3 y3 =0, y 4 =r4

(3)

y 2 =r2 +r3 +r4 y3 =0, y 4 =0 (4)

y1 =r1 +r2 , y 2 =0 y3 =r3 ,

y 4 =r4 (5)

y3 =r3 +r4 , y 4 =0

(6)

y1 =r1 +r2 +r3 , y 2 =0, y3 =0, y 4 =r4

(7)

y 1 =r1 +r2 +r3 +r4 ,

(8)

y 2 =y3 =y 4 =0

~2

(4-1)

2 8

3

◆2g-t-63

33

§ M6: Wagner – Whitin Algorithm

(page 3)

Enumerating vs. dynamic programming

◆ Dynamic Programming

f k min c f ( j 1) for k = 1, 2, ... , n

j k

j

k

j = k, k+1, ... , n

34

§ M6: Wagner – Whitin Algorithm

See ‘ PM00c6-2 ‘

(page 4)

for Example

35

§ M6.1: Dynamic Programming

Eq 7.2

c5 $80

r =(18,30,42,5,20) h=$2

k=$80

c35 80 80 10 170 #

c45 $80 40 120 #

4

c4 4

c3 c3 c5 80 10 80 170 #

3

c4 c5 $160

c3 c4 80 120 200

5

c

1 80 60 168 30 160 498

5

c2 80 84 20 120 304

4

4

c1 c5 80 60 168 30 80 418

c2 c5 80 84 20 80 264

c2 3

c1 c13 c4 80 60 168 120 428

c2 c4 80 84 170 334

2

c 2 c 80 170 250 #

c1 c3 80 60 170 310 #

2 3

c1 c 80 250 330

1 2

c12c35 (48, 0, 67, 0, 0)

solution 2 4

c1 c3 c5 (48, 0, 47, 0, 20)

36

§. M6.2: Class Problems Discussion

#1: Inventory model when demand rate λ is

not constant

1 2 3 4

300 200 300 200

K=$20

C=$0.1

h=$0.02

Find C1 Min

C

1 Cj 1 ?

1 j 4

(j)

#2:

( Chapter 7:

# 18(a),(b) )

p.363

Preparation Time : 10 ~ 15 minutes

Discussion : 10 minutes

37

§ M7: Incorporating Lot-sizing Algorithms into

the Explosion calculus

▓ From Time-phased net requirements applies algorithm

Example 7.6

p.364

g-s-14

from the time-phased net requirements for the valve casing assembly :

Week

Time-Phased

Net Requirements

4

5

6

7

8

9

10

11

12

13

42

42

32

12

26

112

45

14

76

38

Setup cost = $132 ; h= $0.60 per assembly per week

Silver-Meal heuristic :

38

Starting in week 4 :

C(1) = $132

C(2) = [132+(0.6)(42)] /2 = 157.2/2 = $78.6

C(3) = [132+(0.6)(42)+(0.6)(2)(32)] /3= 195.6/3 =$65.2

C(4) = [195.6+(0.6)(3)(12)] /4 = 217.2/4 = $54.3

C(5) = [217.2+(0.6)(4)(26)] /5 = 279.6/5 = $55.9 (STOP)

∴

y4 r4 r5 r6 r7 42 42 32 12 128

Starting in week 8 :

C(1) = $132

C(2) = [132+(0.6)(112)] /2 = 199.2/2 = $99.6

C(3) = [199.2+(0.6)(2)(45)] /3= 253.2/3 =$84.4

C(4) = [253.2+(0.6)(3)(14)] /4 = 278.4/4 = $69.6

C(5) = [278.4+(0.6)(4)(76)] /5 = 460.8/5 = $92.2 (STOP)

∵ C(5) >C(4)

∴

y8

11

r

i 8

i

r8 r9 r10 r11 197

39

Starting in week 12 : C(1) = $132

C(2) = [132+(0.6)(38)] /2 = $77.4

y12 r11 r12 76 38 114

∴ y = (128 , 0 , 0 , 0 , 197 , 0 , 0 , 0 , 114 , 0)

∴

MRP Calculation using Silver-Meal lot-sizing algorithm :

Week

4

5

6

7

Net

Requirements

42

Time-Phased

Net Requirements 42 42

Planned Order

Release (S-M)

Planned deliveries

Ending inventory

8

128

0

32 12

0

9

10

11

12

26

13

42

32

12

112

26 112

45

14

76

38

14

15

16 17

45

14

76 38

0 197

0

0

0

114

0

128

0

0

0

197

0

0

0

114

0

86

44

12

0

171

59

14

0

38

0

40

▓ Compute the total costs

S-M : Total cost = 132(3)+(0.6)(86+44+12+171+59+14+38) = $650.4

Lot-For-Lot : $132*10 = $1320

g-s-14

E.O.Q : 4(132)+(0.6)(653) = $919.80

g-t-20

for optimal schedule by Wagner-Whitin algorithm it is

y4=154 , y9=171 , y12=114 ; Total costs= $610.20

▓ push down to lower level…

41

§. M7.1: Class Work # CW.2

Applies Least Unit Cost in MRP Calculation for

the valve casing assembly.

Applies Part Period Balancing in MRP Calculation

for the valve casing assembly.

◆3g-t-64

Applies Wagner-Whitin algorithm in MRP for the

valve casing assembly.

Preparation Time : 25 ~ 35 minutes

Discussion : 20 minutes

42

§. M 7.2: Class Problems

Discussion

Chapter 7 :

( # 24, 25 )

( # 49 )

p.365-6

p.393

Preparation Time : 15 ~ 20 minutes

Discussion : 10 minutes

43

§ M8:

Lot sizing with Capacity Constraints

▓ Requirements vs production capacities.

’’realistic’’~more complex.

◇

▓ True optimal is difficult, time-consuming and probably not practical.

▓ Even finding a feasible solution may not be obvious.

▓ Feasibility condition must be satisfied

j

j

C

i 1

i

i 1

i

for j 1, 2,

e.g. Demand r = ( 52 , 87 , 23 , 56 )

Capacity C= ( 60 , 60 , 60 , 60 )

,n

Total demands = 218

Total capacity = 240

though total capacity > total demands ;

but it is still infeasible (why?)

44

§ M8:

Lot sizing with Capacity Constraints

◇

(page 2)

▓ Lot-shifting technique to find initial solution

▓ Eg. #7.7 (p.376) γ=(20,40,100,35, 80,75,25)

C =(60,60, 60,60, 60,60,60)

◆ First tests for Feasibility condition → satisfied

◆ Lot-shifting

C = (60,60, 60,60,60,60,60)

γ = (20,40,100,35,80,75,25) demand

(C-γ) = (40,20,-40,…)

(C-γ)’ =(20, 0, 0,…)

(production plan) γ’= (40,60,60,35,80,75,25)

[γ’=C- (C- γ)’]

(C-γ’)’ = (20,0,0,25,-20,…)

(C-γ’)’ = (20,0,0,5,0,…)

γ’ = (40,60,60,55,60,75,25) [γ’=C- (C- γ’)’]

45

§ M8:

Lot sizing with Capacity Constraints

(C-γ’)’ = (20,0,0,5,0,-15,…)

(C-γ’)’ = (10,0,0,0,0,0,…)

γ’ = (50,60,60,60,60,60,25)

(C-γ’)’ = (10,0,0,0,0,0,35)

(production plan)

(page 3)

◇

[γ’=C- (C- γ’)’]

γ’= (50,60,60,60,60,60,25)

∴ lot-shifting technique solution (backtracking)

gives a feasible solution.

▓ Reasonable improvement rules for capacity constraints

◆ Backward lot-elimination rule

46

§ M8:

Lot sizing with Capacity Constraints

(page 4)

◆ Eg. 7.8

◇

Assume k=$450 , h=$2

C = (120,200,200,400,300,50,120, 50,30)

γ= (100, 79,230,105, 3,10, 99,126,40)

from lot-shifting γ’=?

γ’ = (100,109,200,105,28,50,120,50,30) [ How ? ]

costs = (9*$450)+2*(216)=$4482

◆ Improvement

Find Excess capacity first.

C = (120,200,200,400,300,50,120, 50,30)

γ’ = (100,109,200, 105, 28, 50,120, 50,30)

(C - γ’) = ( 20, 91, 0, 295,272, 0, 0, 0, 0)

47

§ M8:

Lot sizing with Capacity Constraints

(page 5)

◇

◆ Is there enough excess capacity in prior periods to

consider shifting this lot?

excess capacity: (C –γ’) = (20,91,0,295,272,0,0,0,0)

242

192

142

γ’ = (100,109,200,105,28,50,120,50,30)

58

108

158

∵ 30 units shifts from the 9th period to the 5th period

increases holding cos t by $2*4*30 $240

decreases setup by $450 (i.e.$k ) '' okay ''

48

§ M8:

Lot sizing with Capacity Constraints

(page 6)

◇

∵ 50 units shifts from the 8th period to the 5th

increases holding cos t by $2*3*50 $300

decreases setup by $450 '' okay ''

∵ 120 units shifts from the 7th period to the 5th [not Okay]

increases holding cos t by $2* 2*120 $480

not K ( $450) " Not okay "

∵ okay to shift 50 from the 6th period to the 5th

increases holding cos t by $2 *50 $100

decreases setup by $450 '' okay ''

Result :

→ γ’ = (100,109,200,105,158,0,120,0,0)

49

∵ Furthermore, it is okay to shift 158 from the 5th period to

the 4th period

increases holding cos t by $2 *158 $316

decreases setup by $450 '' okay ''

263 0

→ γ’ = (100,109,200,105,158,0,120,0,0)

•

(C-γ’) = (20,91,0,295,142,50,0,50,30)

•

Excess capacity

137 300

∵ 158 units shifts from the 5th period to the 4th

increase holding cost by $2*158=$316 < $K “ okay ’’

→ final γ’ = (100,109,200,263,0,0,120,0,0)

50

§ M8:

Lot sizing with Capacity Constraints

(page 7)

◇

◆ after improvement;

total cost = [ 5*$450+ $2*(694) ] = $3638

vs { $4482 (before improvement)

where γ’ = (100,109,200,105,28,50,120,50,30) }

◆ improvement save 20% of costs

51

§. M 8.1: Class Problems

Discussion

Chapter 7 :

# CW.3 ; # 28 (a) (b)

# CW.5 ; #CW.4

p.369

Preparation Time : 25 ~ 30 minutes

Discussion : 15 minutes

52

# CW.5

Consider problem #28 (a), suppose the setup cost for the

construction of the base assembly is $200, and the holding cost is

$0.30 per assembly per week, and the time-phased net requirements

and production capacity for the base assembly in a table lamp over

the next 6 weeks are:

Week

Time-Phased Net

Requirements r

Production

Capacity

=

c=

1

2

3

4

5

6

335

200

140

440

300

200

600

600

600

400

200

200

(a) Determine the feasible planned order release

(b) Determine the optimal production plan

53

§ M 9: Shortcoming of MRP

■ Uncertainty

◆ forecasts for future sales

◆ lead time from one level to another

■ Two implication in MRP

all of the lot-sizing decisions could be incorrect.

former decisions that are currently being implemented

in the production process may be incorrect.

■ Safety stock to protect against the uncertainty of

demand

◆ not recommended for all levels

◆ recommended for end products only, they will be

transmitted down thru the explosion calculus.

54

§ M 9: Shortcoming of MRP

( page 2 )

■ Applies the coefficient variation σ/μ

◆ obtain σ, find → ratio =

◆ obtain safety stock σx z

∴ σ=μx ratio

(e.g. z = 1.28 → 90%)

◆ obtain (μ+σ*z ) as planned production schedule.

55

Example 7.9

(p.381)

[ Using a Type 1 service lever of 90 %]

Consider example 7.1 (p.362) Demands for Trumpets

If analyst finds that the ratio σ/μ (coefficient of variation) is 0.3

Harmon co. decided to produce enough Trumpets to meet

all weekly demand with probability 0.90

0.90 for Normally Distributed demand has a Z = 1.28

Week

8

9

10

11

12

13

14

15

16

17

77

42

38

21

26

112

45

14

76

38

Standard

23.1 12.6 11.4

Deviation ( σ= μ*0.3 )

Mean demand

107 58 53

Plus safety stock

( μ+ z σ )

[ i.e. μ+(1.28) σ ]

6.3

7.8

33.6 13.5

4.2 22.8 11.4

29

36

155

19 105

Predicted

Demand ( μ )

62

53

56

§ M 9: Shortcoming of MRP

(page 3)

■ Capacity Planning

◆ Feasible solution at one level may result in an

‘’ infeasible ’’ requirements schedule at a lower level.

◆ CRP – Capacity requirements planning by using MRP

planned order releases.

~ If CRP results in an ‘’ infeasible ’’ case then to

correct it by

◇ schedule overtime, outsourcing

◇ revise the MPS

~ Trial & Error between CRP and MRP until fitted.

57

§ M 9: Shortcoming of MRP

(page 3)

▓ Rolling Horizons and System Nervousness

◆ MRP is not always treated as a static system.

~ may need to rerun each period for

1st period decision

▓ Other considerations

◆ Lead times is not always dependent on lot sizes

~ sometimes lead time increases

when lot size increases

◆ MRP Ⅱ:Manufacturing Resource Planning

◇ MRP converts an MPS into planned order releases.

◇ MRP Ⅱ:Incorporate Financial , Accounting ,

& Marketing functions into the production

planning process

58

§ M 9: Shortcoming of MRP

(page 4)

Ultimately, all divisions of the company would work

together to find a production schedule

consistent with the overall business plan and

long-term financial strategy of the firm.

◇ MRP Ⅱ:~ incorporation of CRP

◆ Imperfect production Process

◆ Data Integrity

59

§. M 9.1: Class Problems

Discussion

Chapter 7 :

( # 33 )

p.376

Preparation Time : 15 ~ 20 minutes

Discussion : 10 minutes

60

§ M 10: J I T

◆ Kanban

◆ SMED (Single minute exchange of dies)

‧IED (inside exchange of dies )

‧OID (out side exchange of dies )

◆ Advantages vs. Disadvanges (See Table 6-1)

§ M 11: MRP & JIT

36 distinct factors to compare JIT, MRP, & ROP

(reorder point) [Krajewski et al 1987]

61

The End

62

◆1

# CW.1

Solution: MRP Calculations for the Slide assemblies ( 3 )

Lead Time = 2 weeks

On-hand inventory of 270 valves at the end of week 3

Receipt from an outside supplier of 78 & 63 at the start of week 5 & 7

MRP Calculations for the valves

Week

Gross

Requirements

2

3

4

126 126

Net

Requirements

Time-Phased

Net Requirements

Planned Order

Release (lot for lot)

6

7

8

10

11

96

36

78 336 135

42

78

63

270 144

96

27

0

0

Scheduled Receipts

On-hand inventory

5

0

51

0

51

336 135

9

336 135

12

13

228 114

42 228 114

42 228 114

g-b-16

51

336 135

42 228 114

63

◆2

2 41 23 8

(1) (1,0,0,0)

(2) (1,1,0,0)

(3) (1,0,1,0)

(4) (1,0,0,1)

(5) (1,1,1,0)

(6) (1,1,0,1)

(7) (1,0,1,1)

(8) (1,1,1,1)

g-b-33

64

# CW.2

◆3 Solution: Applies Part Period Balancing in MRP Calculation

for the valve casing assembly.

MRP Calculation using Part Period Balancing lot-sizing algorithm :

Week

4

5

6

7

Net

Requirements

9

42

Time-Phased

Net Requirements 42 42

Planned Order

Release (PPB)

8

32 12

10

11

42

32

12

26 112

45

14

12

26

76

13

112

14

45

15

16 17

14

76 38

38

?

Starting in Period 4:

Order Horizon

1

2

3

4

5

K=132

Total Holding cost

0

$25.2

$63.6

$85.2

$147.6

(0.6)*(42)

∵ K is closer to period 5

$25.2+2(0.6)(32)

∴ y4 r4 ... r8 154

$63.6+3(0.6)(12)

$85.2+4(0.6)(26)

65

# CW.2

◆3 Starting in Period 9:

Order Horizon

1

2

3

4

Total Holding cost

K=132

0

$27

$43.8

$180.6

∵ K is closer to period 4

(0.6)*(45)

$27+2(0.6)(14) ∴ y9 r9 ... r12 247

$43.8+3(0.6)(76)

y13 38

MRP Calculation using Part Period Balancing lot-sizing algorithm :

Week

4

5

6

7

Net

Requirements

8

42

9

10

11

12

15

16 17

45

14

76 38

32

12

26 112

45

14

76

38

0

247

0

0

0

38

Planned deliveries

154

0

0

0

0

247

0

0

0

Ending inventory

112 70

38

26

0

135

90

76

0

P.O.R. (PPB)

154

0

32 12

0

0

112

14

42

Time-Phased

Net Requirements 42 42

26

13

38

66

0

# CW.2

◆3

▓ Compute the total costs

PPB : Total cost = $132(3)+(0.6)(547) = $724.2

S-M :

$650.4

Lot-For-Lot : $132*10 = $1320

E.O.Q :

$919.80

for optimal schedule by Wagner-Whitin algorithm it is

y4=154 , y9=171 , y12=114 ; Total costs= $610.20

g-s-42

67

# CW.3

Consider the example presented previously for the scheduling of

the valve casing assembly. Suppose that the production capacity in

any week is 50 valve casings. Determine the feasible planned order

release for the valve casings. Recall that the time phased net

requirements for the valve casings as followed:

Week

4

5

6

7

Net

Requirements

42

Time-Phased Net

Requirements

Production

Capacity

8

r=

c=

9

10

11

42

32

12

12

26

13

112

42 42

32 12

26 112

45

14

76

38

50 50

50 50

50

50

50

50

50

50

14

45

15

16 17

14

76 38

68

# CW.3

[1]

First test for:

j

j

C

i

i 1

i 1

i

for j 1, 2,

,n

It is okay!

[2] Lot-shifting technique (back-shift demand from rj > cj):

Week

4

5

6

7

Net

Requirements

42

Time-Phased Net

Requirements

Production

Capacity

excess (c-r)

Capacity

8

r=

c=

=

(c-r)’ =

(c-r)’ =

final r ’ =

9

10

11

42

32

12

12

13

26

112

42 42

32 12

26 112

45

14

76

38

50 50

50 50

50

50

50

50

50

50

8

8

18 38

24 (62)

5

36

(26)

12

8

8

18 38

24 (62)

5

36

(26)

12

8

8

18

0

0

0

5

10

0

12

32 50

50

50

45

40

50

38

42 42

14

45

15

16 17

14

76 38

69

# CW.4 ( continues on #CW.3)

Suppose that with overtime work on 2nd shifts, the company could

increase the weekly production capacity to 120 valve casings,

however, extra cost per week = $105. Where K=$100, is the regular

setup cost. The holding cost per valve casing per week is estimated

to be $0.65. Determine the optimal production plan.

Week

4

Time-Phased Net

5

6

7

8

9

10

11

12

13

42 42

32 12

26 112

45

14

76

38

50 50

50 50

50

50

50

50

50

120 120 120 120 120 120 120 120

120

Requirements

Production

Capacity

r=

c=

Production

Capacity (O-T)

c= 120

50

14

15

16 17

70

# CW.4 ( continues on #CW.3)

Suppose that with overtime work on 2nd shifts, the company could

increase the weekly production capacity to 120 valve casings,

however, extra cost per week = $105. Where K=$100, is the regular

setup cost. The holding cost per valve casing per week is estimated

to be $0.65. Determine the optimal production plan.

Week

4

Time-Phased Net

Requirements

Production

Capacity

r=

c=

final r ’ =

Ending Inventories =

5

6

7

8

9

10

11

12

13

14

15

16 17

42 42

32 12

26 112

45

14

76

38

50 50

50 50

50

50

50

50

50

50

42 42

32 50

50

50

45

40

50

38 (using regular shift)

0 38

62

0

0

26

0

0

0

0

Σ= 126

[1] First, the cost for using regular shift is $100(10) + $0.65 (126)

= $1,081.9

[ lot for lot ]

71

# CW.4

[1] First, the cost for using regular shift is $100(10) + $0.65 (126)

= $1,081.9

Week

Time-Phased Net

Requirements

Production

Capacity (O-T)

excess (c-r)

Capacity

4

5

42

42

r=

c= 120

=

r=

excess (c-r)’=

Capacity

final r ’ =

6

7

8

12

13

76

38

120 120 120 120 120 120 120 120

120

32 12

9

10

26 112

45

78

78

88 108 94

42

42

32 12

78

78

88 108 94

35

77

0

42

42

32 12

26 112

45

85

43 120 89

77 120

59

85

8

11

[ lot for lot ]

26 112

31 43

0

0

0

0 120

0

0

8

14

75 106

44

82

45

14

76

38

75 106

44

0

14

15

16 17

6

14

76

38

0 114

0

0 114

0

0

120

0

72

# CW.4

Week

Time-Phased Net

r=

final r ’ =

Requirements

Ending Inventories =

4

5

42

42

6

7

32 12

85

0 120

43

1

0

8

9

26 112

10

45

11

14

12

13

76

38

0

120

0

0 114

0

89 77 51

59

14

0

0

[2] The cost for using Overtime shift is $205(4) +

38

14

15

16 17

$0.65(372) = $1061.8

Less than the cost for using regular shift $1,081.9, Saved $ 20.10

73

# CW.4

[3] To think about the following solution:

Week

Time-Phased Net

4

5

42

42

32 12

0

0 50

r=

Suppose r ’= 116

Requirements

Ending Inventories = 74

6

32

7

8

9

10

11

12

13

26 112

45

14

76

38

50

50

45 40

50

38

0 38 62

0

0 26

0

0

14

15

16 17

[ One OT, 7 regular ]

Σ= 232

The cost for using only one Overtime shift on week 4

is $205(1) + $100(7) + $0.65(232) = $1055.8

Less than the cost for using regular shift $1,081.9, Saved $ 26.1

Less than the cost for using all Overtime shift $1061.8 Saved $ 6.0

WHY ?

74

# CW.4

[4] A Better Solution :

Week

Time-Phased Net

4

5

42

42

32 12

0

0 39

0

32

0 27

1

r=

Suppose r ’= 116

Requirements

Ending Inventories = 74

6

7

8

9

10

26 112

11

12

13

45

14

76

38

120

50

0

114

0

9

14

0

38

0

14

15

16 17

Σ= 195

The cost for using the above solution

is $205 (3) + $100 (2) + $0.65(195) = $ 941.75

Less than the cost for using regular shift $1,081.9, Saved $ 140.05

Wow !

42

113

0

0

0

120

50

0

114

0

$944.35

75

§. M4.2: Class Problems

Discussion

Chapter 7 :

( # 4, 5, 6 )

( # 9 (b,c,d) )

p.356-7

p.357

Preparation Time : 25 ~ 35 minutes

Discussion : 20 minutes

p.18

76

§. M5.1: Class Problems

Discussion

Chapter 7 :

( # 14, 17 )

p.363

Preparation Time : 25 ~ 40 minutes

Discussion : 15 minutes

p.31

77

§. M6.2: Class Problems Discussion

#1: Inventory model when demand rate λ is

not constant

1 2 3 4

300 200 300 200

K=$20

C=$0.1

h=$0.02

Find C1 Min

C

1 Cj 1 ?

1 j 4

(j)

#2:

( Chapter 7:

# 18(a),(b) )

Preparation Time : 10 ~ 15 minutes

Discussion : 10 minutes

p.363

p.37

78

§. M7.1: Class Work # CW.2

Applies Least Unit Cost in MRP Calculation for

the valve casing assembly.

Applies Part Period Balancing in MRP Calculation

for the valve casing assembly.

◆3g-t-64

Applies Wagner-Whitin algorithm in MRP for the

valve casing assembly.

Preparation Time : 25 ~ 35 minutes

Discussion : 20 minutes

p.42

79

§. M 7.2: Class Problems

Discussion

Chapter 7 :

( # 24, 25 )

( # 49 )

p.365-6

p.393

Preparation Time : 15 ~ 20 minutes

Discussion : 10 minutes

p.43

80

§. M 8.1: Class Problems

Discussion

Chapter 7 :

# CW.3 ; #CW.5 ; #CW.4

Preparation Time : 25 ~ 30 minutes

Discussion : 15 minutes

81

# CW.5

Consider problem #28 (a), suppose the setup cost for the

construction of the base assembly is $200, and the holding cost is

$0.30 per assembly per week, and the time-phased net requirements

and production capacity for the base assembly in a table lamp over

the next 6 weeks are:

Week

Time-Phased Net

Requirements r

Production

Capacity

=

c=

1

2

3

4

5

6

335

200

140

440

300

200

600

600

600

400

200

200

(a) Determine the feasible planned order release

(b) Determine the optimal production plan

p.53

82

# CW.5 Solution

Week

Time-Phased Net

Requirements r

Production

Capacity

=

c=

1

2

3

4

5

6

335

200

140

440

300

200

600

600

600

400

200

200

(a) Determine the feasible planned order release

(c-r) =

265 400 460 -40 -100 0

Adj.(c-r)

=

265

400

320

0

0

0

r’ =

335

200

280

400

200

200

(b) Determine the optimal production plan

r’ =

(c-r’) =

335

200

280

400

200

200

265

400

320

0

0

0

p.53

83

# CW.5 Solution (b)

Production

Capacity

c=

600

600

600

400

200

200

(b) Determine the optimal production plan

r’ =

(c-r’) =

r’’ =

335

200

280

400

200

200

265

400

320

0

0

0

65

600

120

0

200

0

0

480

400

0

535

200

Increase holding cost = $0.3*(200) + $0.3*2*(200)=$180

Saving setup cost = 2*K = 2*$200= $400

Overall savings = $220

Final production plan r’’ =

535

0

480

400

0

200

84

§. M 9.1: Class Problems

Discussion

Chapter 7 :

( # 33 )

Preparation Time : 15 ~ 20 minutes

Discussion : 10 minutes

p.376

p.60

85

# CW.3

Consider the example presented previously for the scheduling of

the valve casing assembly. Suppose that the production capacity in

any week is 50 valve casings. Determine the feasible planned order

release for the valve casings. Recall that the time phased net

requirements for the valve casings as followed:

Week

4

5

6

7

Net

Requirements

42

Time-Phased Net

Requirements

Production

Capacity

8

r=

c=

9

10

11

42

32

12

12

26

13

112

42 42

32 12

26 112

45

14

76

38

50 50

50 50

50

50

50

50

50

50

14

45

15

16 17

14

76 38

p.68

86

# CW.4 ( continues on #CW.3)

Suppose that with overtime work on 2nd shifts, the company could

increase the weekly production capacity to 120 valve casings,

however, extra cost per week = $105. Where K=$100, is the regular

setup cost. The holding cost per valve casing per week is estimated

to be $0.65. Determine the optimal production plan.

Week

4

Time-Phased Net

5

6

7

8

9

10

11

12

13

42 42

32 12

26 112

45

14

76

38

50 50

50 50

50

50

50

50

50

120 120 120 120 120 120 120 120

120

Requirements

Production

Capacity

r=

c=

Production

Capacity (O-T)

c= 120

50

14

15

16 17

p.70

87