Chapter 3

advertisement

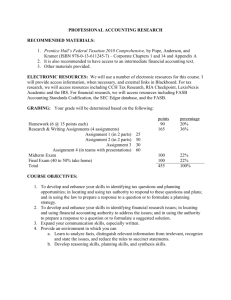

Chapter 3 The Environment of Accounting Research The accounting environment Accounting standards are influenced by: Federal bodies Tax laws Specialized industries Inconsistencies in practice Disagreements among constituents Professional organizations International influences Litigation concerns Public concerns The Securities and Exchange Commission (SEC) Established by the Securities and Exchange Act of 1934 Ensure public companies fully and fairly disclose all material facts SEC has statutory authority to issue rules and regulation SEC’s Office of the Chief Accountant (OCA) establishes accounting policies followed by the SEC and is divided into three groups. Accounting Professional Practice International Affairs The SEC - continued Five SEC divisions consulted by the OCA groups: Corporate finance Trading and markets Enforcement Investment management Risk, Strategy, and Financial Innovation The SEC - continued SEC delegated accounting standard setting to the FASB, but has an oversight function SEC rules and regulations Definitions Regulations – compilations of rules – solicitation of proxies Procedural matters- proceedings The Financial Accounting Standards Board (FASB) Develop high quality financial reporting standards (GAAP) Many entities involved: Financial Accounting Foundation (FAF) FASB – members from CPA firms, corporations, academia, and industry. FASB staff- approximately 70 professionals with various backgrounds. Emerging Issue Task Force (EITF) Financial Accounting Standards Advisory Council (FASAC) – guides FASB on which projects to pursue and on task forces to be organized The FASB - continued Pronouncements: Statement of Financial Accounting Standards (SFAS’s) A summary, a table of contents, introduction, the standard, the list of members voting, basis for decision or dissention, appendices. Interpretations of Financial Accounting Standards – interpret SFAS’s and AICPA Accounting Research Bulletins (ARB’s) and APB Opinions. The FASB- continued Technical Bulletins – provide timely guidance on implementation issues Emerging Issues Task Force – established in 1984 – addresses issues not covered in pronouncements Usually involve industry specific issues FASB Staff Positions (FSP) – application guidance – posted on the website and remain until incorporated into Staff Implementation Guides FASB Due Process 1. identify problem while considering legal pressures 2. consider interested party input to determine if issue is worthy of consideration 3. establish a task force 4. have research staff investigate issue 5. issue discussion memo 6. hold public hearings 7. analyze results of investigation, communicate responses and conduct additional public hearings 8. if appropriate, issue an exposure draft 9. request additional comments and hold additional public hearings. 10. issue final SFAS after analyzing comments. Conceptual Framework Statements of Financial Accounting Concepts (SFAC’s) – describe concepts and relationships that underlie financial accounting standards Elements of financial statements – measurement, recognition, display Capital maintenance Unit of measure Criteria for measurement Qualitative characteristics Concept Statements Have not gone through due process SFAC1 – Objectives of financial reporting (Chpt 1 of SFAC 8 – Conceptual Framework for Financial Reporting) SFAC 2 – qualitative characteristics (Chpt 3 of SFAC 8) SFAC 3 – replaced by 6 SFAC 4 – objectives of financial reporting of nonbusiness organizations SFAC 5 – recognition and measurement in financial statements SFAC 6 – elements of financial statements SFAC 7 – using cash flow information and present value in accounting measurement American Institute of Certified Public Accountants (AICPA) Was the standard setting body before the FASB AICPA’s Committee on Accounting Procedures issued ARB’s (Accounting Research Bulletins) from 1939 to 1959 – some still apply The Accounting Principles Board (APB) issued APB’s from 1959 until 1973. The Accounting Standards Division previously through the Accounting Standards Executive Committee (AcSEC), now known as the Financial Reporting Executive Committee (FinREC) influences standard setting through comment letters and Issue papers Statement of Positions were previously issued by AICPA, but currently are issued by the FASB. Other publications – Accounting Research Monographs, US GAAP Financial Statements Best Practices and Disclosure The Governmental Accounting Standards Board (GASB) Sets financial and reporting standards for the public sector Established in 1984 by the Financial Accounting Foundation (FAF), seven members Created the Government Finance Officers Association (GFOA) and the National Association of State Auditors, Comptrollers, and Treasurers The GASB - continued Due process similar to the FASB Advisory council is the Governmental Accounting Standards Advisory Council (GASAC) Publications – GASB Codification of Government Accounting & Financial Reporting Studies, the US Comptroller General’s “Yellow Book” (codification of audit standards for government organizations), US Congress’s “Single Audit Actof 1984” Other organizations influencing accounting standard setting Cost Accounting Standards Board (CASB) Income tax laws Securities Industry Associates (SIA)- represents investment bankers and financial analysts National Association of State Auditors, Controllers, and Treasurers Financial Executives Institute (FEI) – active committees, research, conferences Institute of Management Accountants (IMA) – committees, foundation, research American Accounting Association (AAA) – theoretical research, publications Institute of Internal Auditors (IIA)- research, committees Generally accepted accounting principles (GAAP) The conventions, rules, and procedures necessary to define accounting practice at a particular time. Two functions Measurement Disclosure Financial statements must be in conformity with GAAP in order for CPA’s to express an opinion on them Pre-Codification Hierarchy of GAAP Level A Level B AcSEC practice bulletins, EITFs, SEC speeches Level D AICPA Industry guides, SOPs, FASB technical bulletins Level C FASB statements, APBs, ARBs, SEC Rules (10K, 8K) AICPA interpretations, FASB implementation guides, industry practices, uncleared SOPs Level E APB statements, AICPA issue papers, FASB concepts statements, IASB statements, journal articles, textbooks Post-Codification GAAP Two levels (Figure 3-5) Authoritative Non-authoritative Most prior levels A-D, some level E Most level E and some level D If a non-governmental source is not found in the Codification, it is not GAAP Accounting Authoritative SupportFigure 3-7 Primary Support General Application and Special Application (FASB standards, AICPA SOPs) Secondary Support Official publications of bodies and other sources (SEC staff bulletins, FASB technical bulletins) Reading a pronouncement Introduction Background Board’s conclusion Opinion or statement Effective date Illustrations Required disclosures