Brand Category - WordPress.com

advertisement

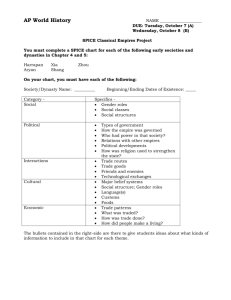

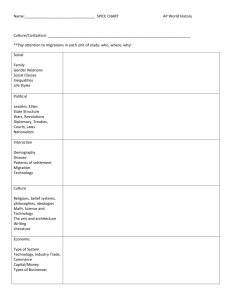

The Old Spice brand was brought in to this world by the handsome founders of Shulton Inc. way back in 1937, right around the time your grandfather met your grandmother. They’re married now. Coincidence? We think not. Old Spice was initially only a women’s deodorant; the men’s deodorant, after tedious performance training and table etiquette lessons, wasn’t released until 1938. It wasn’t until 1990, that Old Spice was brought under the care of the equally handsome owners of Proctor & Gamble. P&G owns over 50 brands including some of the world’s most recognizable brands such as Gillette, Duracell, and Tide. Proctor and Gamble Chieftains of Smellf Headquarter Locale: Cincinnati, Ohio Founded: 1837 Hub Locations: U.S., Mexico, Brazil, England, Switzerland, Brussels, China, Singapore, South Africa Purpose: “To touch consumers’ lives with brands that make life a little better every day.” A.G. Lafley – P&G Chairman of the Board/ President Werner Geissler – P&G Vice Chairman Deborah Henretta – Global Beauty Department President Below is the financial summary the “Finance Wizards” of Proctor and Gamble have brought down to us from their Castles of Commerce. You can see that in the last five years, P&G has increased their earnings by %15. mounts in millions, except per share amounts 2012 2011 2010 2009 2008 2007 Net Sales $ 81,104 $ 77,567 $ 75,295 $ 77,714 $ 71,095 $ 83,680 Gross Profit 41,245 40,525 37,644 39,534 36,607 41,289 Operating Income 15,495 15,732 15,188 15,743 14,236 13,292 Net Earnings from Continuing Operations 11,698 10,851 10,645 11,224 9,562 9,317 Net Earnings from Discontinued Operations 229 1,995 2,877 930 847 1,587 Net Earnings attributable to Procter & Gamble 11,797 12,736 13,436 12,075 10,340 10,756 Net Earnings Margin from Continuing Operations 14.4% 14.0% 14.1% 14.4% 13.4% 11.1% Basic Net Earnings per Common Share (1): Earnings from continuing operations Earnings from discontinued operations $ 3.24 0.58 $ 4.04 0.08 $ 3.63 0.69 $ 3.51 0.98 $ 3.56 0.30 $ 2.95 0.27 Basic Net Earnings per Common Share Diluted Net Earnings per Common Share (1): Earnings from continuing operations Earnings from discontinued operations 3.82 4.12 4.32 4.49 3.86 3.22 3.12 0.54 3.85 0.08 3.47 0.64 3.35 0.91 3.36 0.28 2.79 0.25 Diluted Net Earnings per Common Share 3.66 3.93 4.11 4.26 3.64 3.04 Dividends per Common Share 2.14 1.97 1.80 1.64 1.45 1.28 $ 2,029 9,345 132,244 3,964 21,080 64,035 $ 1,982 9,210 138,354 3,306 22,033 68,001 $ 1,931 8,475 128,172 3,067 21,360 61,439 $ 1,844 7,453 134,833 3,238 20,652 63,382 $ 1,927 8,426 143,992 3,046 23,581 69,784 $ 1,809 7,714 138,014 2,945 23,375 67,012 Research and Development Expense Advertising Expense Total Assets Capital Expenditures Long-Term Debt Shareholders' Equity Source: http://www.sec.gov/Archives/edgar/data/80424/000008042412000063/fy2012financialstatementsf.htm Below here is a chart depicting the percentage of sales from each segment, with almost a quarter due to Beauty. Reportable Segment % of % of Net Net Sales* Earnings* Beauty 24% 22% Grooming 10% 16% Health Care 15% 17% Fabric Care and Home Care Baby Care and Family Care 32% 26% 19% 19% Categories Antiperspirant and Deodorant, Cosmetics, Hair Care, Hair Color, Personal Cleansing, Prestige Products, Salon Professional, Skin Care Blades and Razors, Electronic Hair Removal Devices, Hair Care Appliances, Pre and Post Shave Products Feminine Care, Gastrointestinal, Incontinence, Rapid Diagnostics, Respiratory, Toothbrush, Toothpaste, Other Oral Care, Other Personal Health Care, Vitamins/Minerals/Supplements Bleach and Laundry Additives, Air Care, Batteries, Dish Care, Fabric Enhancers, Laundry Detergents, Pet Care, Professional, Surface Care Baby Wipes, Diapers and Pants, Paper Towels, Tissues, Toilet Paper There is a constant world-wide struggle; a war raged on every front, in every continent, in every country, in every college dormitory bathroom. This is of course the War on Smell. Only a select few have the bravery and the self-confidence to fight the Smell. Only the warriors of Men’s Beauty and Hygiene products stand between us and total social quarantine. In almost every retail store, department store, and pharmacy, these warriors stand ready to fight. Brand Category: Men’s Beauty and Scented Hygiene products Methods of Distribution: Hygiene and Beauty products (Old Spice included) are sold in almost every retail and department store around the world. Major Players: AXE and Right Guard (Unilever) Seasonal Factors: N/A at present Regional Factors: Scent may change vary from region to region Legal Factors: FDA, Drug and Medicine safety testing Major Trade Organizations: N/A at present Beauty and Personal Care: Top Global Companies Proctor and Gamble 1 1 1 1 1 1 11% L’Oreal 2 2 2 2 2 2 9.7 Unilever 3 3 3 3 3 3 7.8 ColgatePalmolive Co 4 4 4 4 4 4 3.8 Avon Products 6 7 7 5 5 5 3.2 Newly Added Warriors of Smell: NEW PRODUCT INTRODUCTIONS: Recently, Old Spice has launched a new line of “Pure Sport” products which are targeted toward heavily active men and male athletes. NEW PACKAGES: The products feature a slicker, more simple packaging design. APPEALS OF NEW PRODUCT: Puts your odor on 24 hour lockdown. Features a controlled scent release throughout night and day. Like one of those scent things you plug into the wall. Only this “plugs” into your armpits. 2011 2010 2009 huge fireplaces, unpublished manuscripts and gold-plated hot tubs. Old Spice Classic envelops you in a clean, manly scent that has served mankind for decades. And it fights odor all day, turning your armpit house into an armpit home. Decimates odor-causing bacteria without remorse.” 2008 “Welcome to a home filled with deer heads, 2007 What does Swagger look like? (Product-form description) Company 2006 This graph depicts the market share held by the top 5 companies in the Beauty and Personal Care segments. P&G (Old Spice) has held the top market share for the past 7 years. Unilever (AXE), Old Spices arch-nemesis, has consistently held the 3rd spot. The furthest column to the rights lists each companies market share in 2011. % Compa ny Share 2011 Store/Point of Sale Price of Old Spice Classic Body Spray Price of AXE Anarchy for Him Bodyspray Walmart $3.77 $3.97 CVS $5.29 $5.99 Walgreens $4.89 $5.29 Category Share by Region: N/A at present Fresh News of Freshness Old Spice: “Old Spice, the "Official Deodorant and Body Wash of the NFL," today debuted its "Unnecessary Freshness" advertising campaign, which humorously chronicles the stories of Denver Broncos wide receiver Wes Welker and New England Patriots linebacker Jerod Mayo being swept away...” AXE: “Eight students were hospitalized, and two others were taken to their own doctors, after someone released the especially pungent body spray in a sixth grade classroom at 1 p.m. Emergency crews rushed to Medgar Evers College Preparatory School in Brooklyn…” Demographics: - Men, age 16-26 - Men looking for relationships, men with active social lives - Recently, male athletes Frequency of Purchase: - Depending on activity level, men typically purchase a new deodorant stick or body wash once every 1-3 months Place of Purchase: -Major retails or pharmacies. (Walmart, CVS, Walgreens, etc) Purchase Cycle: - 1-3 months Loyalty: - Old Spice users tend to have high loyalty due to the image and off-beat culture marketing. Heavy User Profile: - Men, age 18 - 26 - Loyal customers who enjoy the scent and appreciate the humor in the marketing and packaging. Awareness and Attitude: - Through an extensive and successful marketing campaign, the Old Spice brand is a household name, although its ads and marketing style alienate it from an older audience and individuals who do not appreciate the humor depicted. Decision-Makers vs Purchasers: - On average, the target market are the decision makers, except in the case of the younger users, in which case the parents make the purchase. Old Spice creative marketing strategies appeal only to those with the most refined of humors and those with the seed of greatness in them only waiting for Old Spice products to fertilize it. Old Spice uses an off-beat and absurd sense of humor to leave lasting impressions and appeals to the more masculine side of champions, the side that excels at taming sharks and making harps from scratch, rather than pandering to more prepubescent lusts and physical urges. AXE strategies employ more of a direct sex appeal. Its ads and marketing provide more of a message of how AXE will make women attracted to you. Right Guard’s creative marketing are more down to earth and feature more celebrity endorsements. Its ads are targeted primarily toward physically active, older, “serious” men. Specific Promises: N/A at Present Appeals Claims: N/A at Present Old Spice’s Movie Sorceries (Special Effects): “The Man your Man Could Smell Like” campaign ads were universally acclaimed and praised at the time of their release due to their use of practical effect, complex sets, and utilization of the dark arts; its “behind the scenes” video garnering almost as much attention as the commercials themselves. Evolution of a Champion (Past Executions): 1937 Old Spice originally marketed as women’s beauty product. 1938 1 year after its introduction, Old Spice products targeted at older/elder males 1990 Old Spice brand acquired by Proctor & Gamble and aimed at profitable, young male segment Father Smell’s Allowance (Company Ad Spending): 26 million on Old Spice ads in 2012 -By Region: N/A at Present -By Season: N/A at Present Media Employed by Top Brands: -Television -Radio -Internet -Billboards -Social Media -Product Placement Market Share: P&G to cut back on advertising spending Share price currently at 82.37, the #1 spot in the category. Promotions Used in Category: N/A at present Major Brand Promotions: -Official NFL sponsor promo -P&G BrandSaver Coupons Success Rate of Promotions: N/A at Present Web-Castle: www.oldspice.com Ecommerce Activities: - Supply Chain Mission: To list and make available to all the world our entire arsenal of smell fighting warriors. Whether they be used to end world suffering or to return your fatherin-laws ladder he keeps asking you about, we offer descriptions and details on any product you need. Internet Civilizations Diplomacy: -Online order processing -Internet Marketing -Online Video Production (Social Media Activities) Created: September 29, 2009 Likes: 2.5 Million Activity: Keeps up brand awareness through consistent statuses and promotes events and specials Created: N/A at Present Followers: 218,229 Activity: Promotes products and builds equity through Twitter specific events entertaining followers. Created: January 1, 2006 Subscribers: 380,994 Views: 247 million Activity: Plays ads and promotions Personal Interviews: N/A at Present Additional information can be found at: http://www.pg.com/en_US/company/global_structure_operations/index.shtml http://www.sec.gov/Archives/edgar/data/80424/000119312510188769/dex21 .htm http://www.pginvestor.com/GenPage.aspx?IID=4004124&GKP=209707 In 2012, P&G’s sales from deodorant fell 2%. But, since acquiring Old Spice in 1990, P&G’s market share price has increased 90% and does not appear to be verging on a downward trend. Old Spice’s successful revival was due to a highly effective repositioning, rebranding, and marketing campaign. We are still in a time period of introduction to this new, re-positioned Old Spice, and its rise in brand value is in large part due to new interest and attention from consumers due to its off-beat ad campaigns. During 2013, I think this trend will continue as Old Spice continues to appeal to it target audience using this marketing technique. But, not too long after this year, I believe there will be a fading of interest and jaded feelings toward the brand as a whole unless a new marketing technique is employed. Brand Evaluation Swag 12 participants aged 20 – 41 were asked to give 5 deodorant brand a rating on two different scales. The first scale was on a basis of “Basic” to “Swag” and the other scale was on a basis of “Uneffective” to “Fresh.” The terms of scale were defined in the following way: Ineffective Fresh Swag – the brand features an appealing look an style, both in packaging and marketing. Fresh – the brand is highly effective at what it promises to do (i.e. prevent body odor) and meets expectations. Ineffective – the brand does not accomplish what it promises adequately (i.e. prevent body odor) and fails to meet expectations. Basic – the brand’s look and image are simple and/or unappealing and does not encompass a certain style Basic Conclusion: Old Spice definitely creates an appealing culture and style with which consumers like to associate themselves. But, Old Spice was generally rated lower on terms of making effective products or meeting promises. Brands such as Degree and Right Guard, with their “clinical strength” products were rated much higher on the “Fresh” scale. Q1: What brand deodorant do you Q1: What brand deodorant do you use? use? Q1: What brand deodorant do you prefer? A1: Degree for Men A1: Old Spice A1: Old Spice Q2: Why do you use it? Q2: Why do you use it? Q2: Why do you use it? A2: Its cheap. At least, the cheapest A2: I like their commercials. Terry where I buy deodorant. Crews is a boss. Plus, it smells good. Q3: What would cause you to switch brands? Q3: What would cause you to switch brands? A2: The youtube videos. Q3: What would cause you to switch brands? A3: I would never switch. A3: A raise in price, or if they started doing AXE-like ads. A3: If it became really expensive, or if their ads started being boring. Q1: What brand deodorant do you use? Q1: What brand deodorant do you use? A1: Right Guard A1: Right Guard Q2: Why do you use it? Q2: Why do you use it? A2: I have really sweaty pits. It’s the only one that I’ve found works for me A2: I like the gel kind. I don’t think any other brand has a gel deodorant. Q3: What would cause you to switch brands? A3: I suppose if like Axe or Old Spice made a really strong antiperspirant, I would buy that. Q3: What would cause you to switch brands? A3: Another brand came out with a gel stick. Old Spice’s strength lies in its advertising campaign and culture it has created. It holds high brand equity and brand awareness and appeals to a very profitable market segment. It offers a variety of different scents and styles of their deodorant/antiperspirant and body wash products all of which can be bought within five miles of everyone’s house. But, Old Spice products do not have a very low appeal to those outside the demographic at which they are aiming for. Old Spice appeals mostly to young adults who appreciate the “entertainment value” provided by the brand. People buy Old Spice because the commercials or ads made them laugh and/or they buy into the image Old Spice sells. Although they have successfully captured the “Axe” market, Old Spice does not as of now does not capture the audience looking for a strong, more effective body odor/sweat prevention. If Old Spice wanted to increase market share, it would have to maintain some of its current image while releasing products along with marketing designed to appeal to older, “serious” consumers. The release of a “clinical strength” line of products would be beneficial. Old Spice also holds the opportunity to embark on a campaign which draws upon its brand history. They could act on an “Old Spice Classic” campaign, focusing on drawing the interest of older consumers by designing marketing more reminiscent of its earlier image as a “father’s hygiene” product. It will be interesting to see where Old Spice chooses to take its brand in the next couple of years as it already has a reputation for adaptation.