2. The Fisher Effect

advertisement

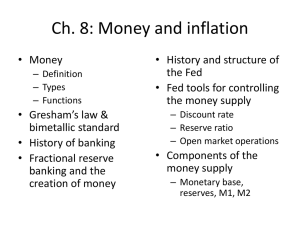

Parity Conditions in International Finance and Currency Forecasting Chapter 8 1 PART I. ARBITRAGE AND THE LAW OF ONE PRICE I. THE LAW OF ONE PRICE A. Law states: Identical goods sell for the same price worldwide. B. Theoretical basis: If the price after exchange-rate adjustment were not equal, arbitrage in the goods worldwide ensures eventually it will. 2 ARBITRAGE AND THE LAW OF ONE PRICE C. Five Parity Conditions Result From These Arbitrage Activities 1. 2. 3. 4. 5. Purchasing Power Parity (PPP) The Fisher Effect (FE) The International Fisher Effect (IFE) Interest Rate Parity (IRP) Unbiased Forward Rate (UFR) 3 ARBITRAGE AND THE LAW OF ONE PRICE D. Five Parity Conditions Linked by 1. The adjustment of various rates and prices to inflation. 2. The notion that money should have no effect on real variables (since they have been adjusted for price changes). 4 ARBITRAGE AND THE LAW OF ONE PRICE E. Inflation and home currency depreciation are: jointly determined by the growth of domestic money supply relative to the growth of domestic money demand. 5 PART II. PURCHASING POWER PARITY I. THE THEORY OF PURCHASING POWER PARITY is based on law of one price, and the no-arbitrage condition (internationally) 6 PURCHASING POWER PARITY II. ABSOLUTE PURCHASING POWER PARITY A. Price levels (adjusted for exchange rates) should be equal between countries B. One unit of currency has same purchasing power globally. 7 PURCHASING POWER PARITY III. RELATIVE PURCHASING POWER PARITY A. states that the exchange rate of one currency against another will adjust to reflect changes in the price levels of the two countries. B. Real exchange rate stays the same. 8 PURCHASING POWER PARITY 1. In mathematical terms: et e0 where et e0 ih if t = (1 + ih)t (1 + if)t = future spot rate = spot rate = home inflation = foreign inflation = time period 9 PURCHASING POWER PARITY 2. If purchasing power parity is expected to hold, then the best prediction for the one-period spot rate should be e1 = e0(1 + ih)1 (1 + if)1 10 PURCHASING POWER PARITY 3. A more simplified but less precise relationship is e1 - e0 = i h - if e0 that is, the percentage change should be approximately equal to the inflation rate differential. 11 PURCHASING POWER PARITY 4. PPP says the currency with the higher inflation rate is expected to depreciate relative to the currency with the lower rate of inflation. 12 PURCHASING POWER PARITY B. Real Exchange Rates: the quoted or nominal rate adjusted for it’s country’s inflation rate e’t = et (1 + if)t = e0 (1 + ih)t *real exchange rate remains constant 13 PURCHASING POWER PARITY C. Real exchange rates 1. If exchange rate adjust to inflation differential, PPP states that real exchange rates stay the same. 2. Competitive positions of domestic and foreign firms are unaffected. 14 PART III. THE FISHER EFFECT I. THE FISHER EFFECT states that nominal interest rates (r) are a function of the real interest rate (a) and a premium (i) for inflation expectations. R = a + i 15 THE FISHER EFFECT B. Real Rates of Interest 1. Should tend toward equality everywhere through arbitrage. 2. With no government interference nominal rates vary by inflation differential or rh - rf = ih - if 16 THE FISHER EFFECT C. D. E. According to the Fisher Effect, countries with higher inflation rates have higher interest rates. Due to capital market integration globally, interest rate differentials are eroding. Real interest rate differences can exists due to currency risk and country risk. 17 PART IV. THE INTERNATIONAL FISHER EFFECT I. IFE STATES: A. the spot rate adjusts to the interest rate differential between two countries. B. PPP & FE ---> IFE et e0 = (1 + rh)t (1 + rf)t 18 THE INTERNATIONAL FISHER EFFECT B. Fisher postulated 1. The nominal interest rate differential should reflect the inflation rate differential. 2. Expected rates of return are equal in the absence of government intervention. 19 THE INTERNATIONAL FISHER EFFECT C. Simplified IFE equation: rh - rf = e 1 - e 0 e0 interest rate differential is equal to change in the exchange rate 20 THE INTERNATIONAL FISHER EFFECT D. Implications if IFE 1. Currency with the lower interest rate expected to appreciate relative to one with a higher rate. 2. Financial market arbitrage insures interest rate differential is an unbiased predictor of change in future spot rate. 3. Holds if the IR differential is due to differences in expected inflation. 21 PART V. INTEREST RATE PARITY THEORY I. INTRODUCTION A. The Theory states: the forward rate (F) differs from the spot rate (S) at equilibrium by an amount equal to the interest rate differential (rh - rf) between two countries. 22 INTEREST RATE PARITY THEORY 2. The forward premium or discount equals the interest rate differential. F - S/S = (rh - rf) where rh = the home rate rf = the foreign rate 23 INTEREST RATE PARITY THEORY 3. In equilibrium, returns on currencies will be the same i. e. No profit will be realized and interest rate parity exits which can be written (1 + rh) = F (1 + rf) S 24 INTEREST RATE PARITY THEORY Interest rate parity is assured by the noarbitrage condition. B. Covered Interest Arbitrage 1. Conditions required: interest rate differential does not equal the forward premium or discount. 2. Funds will move to a country with a more attractive rate. 25 INTEREST RATE PARITY THEORY 3. Market pressures develop: a. As one currency is more demanded spot and sold forward. b. Inflow of funds depresses interest rates. c. Parity eventually reached. 26 INTEREST RATE PARITY THEORY C. Interest Rate Parity states: 1. Higher interest rates on a currency offset by forward discounts. 2. Lower interest rates are offset by forward premiums. Deviations from IRP are small and short-lived. Deviations may be caused by taxes, transaction costs, capital controls. 27 PART VI. THE RELATIONSHIP BETWEEN THE FORWARD AND THE FUTURE SPOT RATE I. THE UNBIASED FORWARD RATE A. States that if the forward rate is unbiased, then it should reflect the expected future spot rate. B. Stated as f0(t) = et C. Usually holds, at least in terms of the direction (not necessarily the magnitude). 28 PART VII. CURRENCY FORECASTING I. FORECASTING MODELS A. have been created to forecast exchange rates in addition to parity conditions. B. Two types of forecast: 1. Market-based 2. Model-based 29 CURRENCY FORECASTING 1. MARKET-BASED FORECASTS Derived from market indicators. A. the current forward rate contains implicit information about exchange rate changes for one year. B. Interest rate differentials may be used to predict exchange rates beyond one year. 30 CURRENCY FORECASTING 2. MODEL-BASED FORECASTS Employ fundamental and technical analysis. A. Fundamental relies on key macroeconomic variables and policies which most like affect exchange rates. B. Technical relies on use of 1. Historical volume and price data 2. Charting and trend analysis 31