Play Chapter 11

advertisement

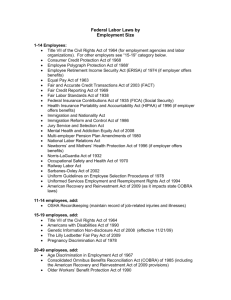

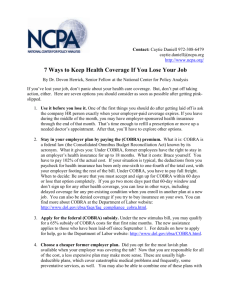

Chapter Eleven Discretionary Benefits Origins of Discretionary Benefits World War II & Korean War, 1940s-1950s; governmentmandated salary freezes led to increases in benefits – welfare practices. National Labor Relations Act of 1935, which legitimized union bargaining for employee benefits: Mandatory: health insurance, disability, retirement, pay for time not worked. Permissive: funds administration, retiree benefits, workers’ comp. Illegal: none related to benefits as of today. Recent tax laws that provide tax incentives to employers (and employees) for contributions to benefit plans Income Retirement Protection Plans: Employee Retirement Income Act (ERISA) of 1974 Goal: provide protection of employee benefit rights Disclosure: updates, changes, annual synopsis. Funding: ensure sufficient funding when employees reach retirement age. Fiduciary: Forbid transactions with parties that have interests adverse to those of employees and transactions in their own interests. Vesting: employees’ acquisitions of non-forfeitable rights by specified timeframe (e.g., partially vested after 3 years; fully vested after 5 years). Income protection programs Disability insurance (supplements disability benefits mandated by SSA of 1935 & Employee Retirement Income Security Act of 1974): Short term (<6 months): inability to perform any and every duty of one’s occupation; 50-100% of pre-tax salary. Long term (6 months to lifetime), more stringent definition: inability to engage in any occupation for which the individual is qualified; 50-75% of pretax salary. Income protection programs Life insurance: Typically a multiple of salary or a fixed amount. Typically include accidental death dismemberment claims. Term coverage: protection during employee’s work years, Life coverage: lifetime coverage. Premiums increase exponentially with age; therefore employer-provided group rates are usually better than those that individuals may find for themselves. Income protection programs Pension Plans (have considerable growth lately out of concerns re the future of Social Security): Contributory vs. noncontributory: whether or not they require employee contributions. Qualified vs. Nonqualified: whether or not they qualify for favorable tax treatment of contributions (for both employers and employees) –see characteristics. Defined contribution or defined benefits: whether or not they guarantee specified retirement benefits. Most plans (401(k), employee stock ownership plans –ESOP, etc.) are defined contribution plans. Characteristics of Qualified Retirement Plans Eligibility: No initial eligibility criteria concerning age or service. Nondiscrimination: No preferential treatment to highly compensated employees –unless employer contributions are solely based on compensation level or years of service. Vesting Requirements: Nonforfeitable right to contributed funds after (typically) 5 years. Penalty (typically 10%) for early withdrawal before early retirement age (59.5 years-old). Income protection programs Economic Growth & Tax Relief Reconciliatory Act (EGTRRA) (signed by President Bush in June 2001) : »Increased employee contribution limits »Catch-up contributions for workers 50 and older ($1,000 a year until reaching $5,000 in 2006) »Tax credit on contributions up to $2,000 to retirement plans and IRAs »Speeded-up vesting. »New contributions can be rolled over to ANY plan type, not just a same-type plan or IRA. Health Protection Plans: Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) •Provide employees with an opportunity to temporarily continue receiving their employer-sponsored health insurance after change in employment status. Continued coverage for up to 18 months; extension to 36 months for spouses and dependents due to qualifying events. Companies permitted to charge COBRA beneficiaries a premium of 102% of the costs of plan coverage (extra 2% due to administrative costs. COBRA violations subject to excise tax & civil penalty (includes notices to employees) COBRA Administration Case An employee was terminated and later sued his former employer for failing to notify him of his right to continue health coverage under COBRA. The employer had contracted with a third-party administrator (TPA) to send COBRA notices, and argued that it complied with COBRA by providing the TPA with the necessary information and by instructing the TPA to send a COBRA election notice to the employee. The court held that the employer had not met its COBRA obligations. Did contracting with an agent to send COBRA notices like this employer did constitute Good Faith Compliance? What are the lessons learned regarding the content of contracts with TPAs? COBRA Administration Case (continued) ANSWER COBRA does not require actual receipt of notification by the plan participant; to the contrary, only a good faith attempt to notify is required. The courts consider (1) evidence of the plan's regular COBRA notification procedures; (2) the COBRA coordinator's testimony that the election notice was mailed to the participant's most recent address on file in accordance with the plan's usual practice; and (3) a computer entry in the plan's records indicating when the notice was sent. Contracting with an agent or Third Party Administrator (TPA) might have alleviated the workload for the employer’s staff but in fact, it does not constitute Good Faith Compliance with COBRA. COBRA Administration Case (continued) ANSWER (continued) Some recommendations are as follows: •The employer should conduct research before contracting a TPA to assure them that they have not had problems of such nature in the past and that they are a secure and serious company. •Make sure that standards are set between the employer and the TPA as to how COBRA notices should be sent, the time frame, the procedures, etc. •The TPA should keep their own records as to when (date/time) the notice was sent to the qualified employees. Bottom line is that the ERISA Plan Administrator is responsible for COBRA notices. The norm is that the COBRA Third Party Administrator does not accept to become the plan administrator. Cost-shifting in Health Care Raising healthcare costs Advances in medicine, technology, and life expectancy. Cost sharing: Increase in premiums, deductibles, & coinsurance/co-payment Cost containment: Reduced choices –Primary Care Physician in HMOs acts as gatekeeper; pre-negotiated charges; limited list of healthcare providers & hospitals. Types of Health Protection Plans Commercial insurance (fee-for-service): usual, customary, and reasonable charges; deductible, coinsurance, out-of-pocket maximum. Self-funded insurance. HMOs: pre-paid medical services for a set premium, rather than fee-for service. Primary Care Physician acts as a gatekeeper of referrals to the more costly specialists. It restricts the patient’s options to a very limited choice of providers. PPO (preferred provider organization): providers agree to provide services at a higher level of reimbursement; do not provide benefits on a pre-paid basis; wide choice of providers. Table 11-4 U.S. Health Care Expenditures, 1960 to 1999 (1 of 3) TOTAL YEAR 1960 1965 1970 1971 1972 1973 1974 1975 1976 TOTAL HEALTH SERVICES AND SUPPLIES (BILLIONS OF DOLLARS) TOTAL PER (BILLIONS OF CAPITA DOLLARS) (DOLLARS) 27.1 41.6 74.3 82.2 92.3 102.4 115.9 132.6 151.9 143 204 346 379 421 464 521 591 671 PRIVATE PRIVATE 19.8 29.9 44.0 48.1 53.9 59.7 65.9 74.1 85.7 5.7 8.3 25.0 28.2 31.8 35.9 42.8 50.2 56.9 Table 11-4 U.S. Health Care Expenditures, 1960 to 1999 (2 of 3) TOTAL YEAR 1977 1978 1979 1980 1981 1982 1983 1984 1985 TOTAL HEALTH SERVICES AND SUPPLIES (BILLIONS OF DOLLARS) TOTAL PER (BILLIONS OF CAPITA DOLLARS) (DOLLARS) 172.6 193.2 218.3 251.1 291.4 328.2 360.8 396.0 434.5 755 836 937 1,068 1,227 1,369 1,490 1,620 1,761 PRIVATE PRIVATE 96.6 109.7 124.0 141.3 164.3 186.5 205.3 228.0 252.9 64.7 73.6 84.0 96.1 113.9 126.9 139.5 151.6 165.2 Table 11-4 U.S. Health Care Expenditures, 1960 to 1999 (3 of 3) TOTAL YEAR 1990 1995 1996 1997 1998 1999 (est.) TOTAL HEALTH SERVICES AND SUPPLIES (BILLIONS OF DOLLARS) TOTAL PER (BILLIONS OF CAPITA DOLLARS) (DOLLARS) 699.4 993.3 1,039.4 1,088.2 1,149.1 1,228.5 2,689 3,637 3,772 3,912 4,094 ----- PRIVATE PRIVATE 416.2 537.3 559.0 586.0 626.4 ----- 283.2 456.0 480.4 502.2 522.7 ----- Source: US Health Care Financing Admin., Health Care Financing Review (Winter 1994); Table 150. U.S. Health Care Financing Administration, Office of the Actuary: National Health Statistics Group (1999). [Online] http://www.hcfa.gov/stats. Pay for Time-Not-Worked Practices in Medium and Large Private Establishments, 1997 BENEFIT PERCENT OF FULL-TIME EMPLOYEE RECIPIENTS Holidays 96 11 days per year Vacation 96 Depends on tenure Personal leave 14 3.5 days per year Jury duty 90 No stated maximum Funeral leave 85 3.7 days per year Military leave 57 15.3 days per year AVERAGE AMOUNT Source: US Bureau of Labor Statistics, Employee benefits in medium and large private establishments, 1997 (Washington, D.C.: US Government Printing Office, 1999). Employer-Provided Services Employee Assistance Programs Family Assistance Programs Flexible schedule. Telecommuting. Day care. Wellness management & facilities –weight control & nutrition, smoking cessation, stress management, gym. Tuition reimbursement (typically less than full tuition). Disaster relief –tangible and/or socio-emotional support. Designing A Benefits Program Strategic choice: differentiation or cost. Becoming an “employer of choice” (talent is in short supply): turnover & employee morale. Identify beneficiaries: part and/or full time employees, retirees (medical benefits to retirees no longer taxdeductible), probationary employees. Financing: contributory vs. non-contributory. Communication plan: wise usage (cost containment), understanding & appreciation of benefits (retention). Employee choice. Cafeteria plans: » flexible spending accounts –FSA (employees pay for certain expenses with pre-tax dollars) » core plus option (some benefits are mandatory). Example: Designing a Cafeteria-style Benefits Package Employees have various needs, and therefore it is often costeffective to let them choose among a number of benefit options. In this kind of cafeteria-style benefits plan, each benefit is priced according to two factors: (1) how much the benefit is valued by employees, and (2) the cost associated with the benefit. The value that employees place on each benefit item is typically determined through an employee survey. Each employee is asked to answer a benefits survey like the one on the next slide. Then, the average rating for each benefit and its corresponding weight are computed. Next, points are allocated to each benefit. Typically, employees would be allowed to choose benefits from this list to a maximum of, for instance, 50 points. Cafeteria-style Benefits Survey Indicate your interest in the following benefits: Rating: 1 = not interested at all, 2 = not interested, 3 =undecided, 4 = interested, 5 = very interested Benefit Term life insurance of 1-year salary Health coverage (HMO) Health coverage (PPO) Disability insurance Dental insurance Vision insurance Child care Tuition reimbursement Wellness program Your rating Avg. Group Rating (A) Weight = 6 - A Allocating points to benefit items Benefit Cost (C) Term life insurance of 1-year salary $40 Health coverage (HMO) $250 Health coverage (PPO) $400 Disability insurance $20 Dental insurance $15 Vision insurance $10 Child care $350 Tuition reimbursement $200 Total $1,285 Weight (W) CxW [(CXW) / T]x100 Points Total (T) 100 Discussion Question 11-1 1. 2. The cafeteria-style system is predicated on the assumption that the employer should “subsidize” those benefits in which employees are most interested. Describe the pros and cons of these “subsidies” for the organization. Will the interest in each benefit will vary as a function of demographic categories such as age, number of dependents, gender, ethnicity and type of industry? Please provide examples of such variation. Discussion Question 11-2 The Pros and Cons of the privatization of retirement benefits Concerns about the future of the Social Security have led the Federal Government to stimulate the creation of individual retirement funds, e.g., 401(k) plans, through favorable tax treatment. Do some online or library research the pros and cons of this privatization process, as well as the administrative measures that would minimize its social and financial risks. Pros Cons Administrative Measures that minimize social and financial risks.