Managerial Accounting Syllabus - ACCT 2133 Course Outline

advertisement

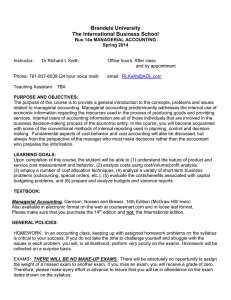

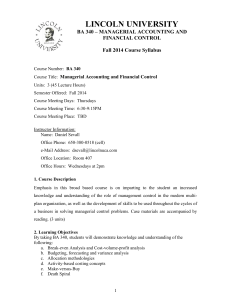

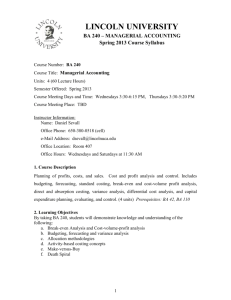

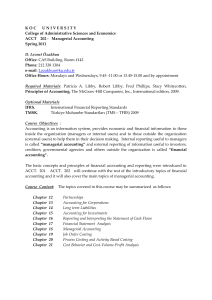

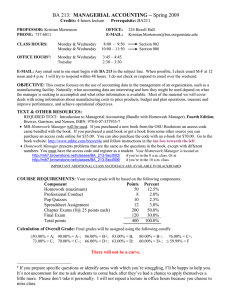

Introduction to Managerial Accounting (ACCT 2133-007) T-TH 2:00 – 3:15 BU224 Instructor: Mr. Brian Laird Office: BU 210 Email: blaird@astate.edu Phone: 972-3038 Office Hours: Wednesday 9:00 – 3:00 Tuesday and Thursday by appointment Required Text: Financial and Managerial Accounting: Wild, Shaw and Chiappetta, 5th Edition Required Access: McGraw Hill Connect Homework Manager (May come with new book) Required: A basic 4 function calculator; no other calculators will be allowed during quizzes or exams. Managerial Accounting Primary Objectives: The student should be able to explain the concepts of managerial and cost accounting. (Business Knowledge) The student should be able to solve problems involving cost accounting. (Critical Thinking) The student should be able to plan, organize, and compose short written responses to cost accounting problems. (Written Communication) The student should understand the role of business ethics when solving problems and making decisions. (Critical Thinking, Ethics) Homework Assignments: Homework assignments will be completed through the McGraw-Hill Connect homework manager. The class Connect site can be accessed through Blackboard/Learning Units by clicking on a homework assignment. If you purchase a new text book, it should come with Connect access. You should make sure your book contains a Connect access code. Otherwise you will need to purchase as access code. A two week free trial is available, to those needing time to secure funds. In addition to homework problems, Connect assignments will be used as revised problems on an exam. It is essential to realize that doing your homework is vital part of learning accounting. Homework may not be turned in late; no due dates will be extended. We will discuss Connect in detail on the first day of class. Exam Policy: Four exams will be given during the semester, three regular exams and one comprehensive final. The exams will test your ability to solve accounting problems and explain accounting concepts. Your lowest exam score on the first three regular exams will be dropped. The comprehensive final grade cannot be dropped. If you miss a regular exam, the missed exam will be used as your drop grade. If you miss an exam due to a university sponsored event, you must make arrangements to make up the exam with the instructor prior to the scheduled exam dat. Class Project: A written project will be due during the semester. The project will include some business/company research, such as evaluating a large corporation’s performance and financial position. The project will include work in MS Word and MS Excel. The project will be graded on content, neatness, and grammar. Course Grade: The course grade is determined as follows: 3 Exams - 3 @ 100 each – 200pts (Drop Lowest of the three) Final Exam – 1 @ 100 each - 100pts Class Project - 1 @ 90 each – 90pts 12 Connect Homework - 12 @ 5 each – 60pts 450 points 90 to 100% = A; 80 - 89% = B; 70 - 79% = C; 60 - 69% = D; Below 60% = F. Introduction to Managerial Accounting (ACCT 2133-007) T-TH 2:00 – 3:15 BU224 Attendance: In keeping with University policy, students are required to attend classes. Students with more than 4 absences may receive an “F” for their semester grade regardless of exam scores. University sanctioned absences will be excused. This policy will be enforced and attendance will be taken every day with a sign in sheet. It is your responsibility to make sure you sign the sheet. See the instructor if you foresee problems with attendance. Academic policies: Students who require academic adjustments in the classroom due to a disability must first register with ASU Disability Services. Students with disabilities or special needs should contact the instructor immediately after the first class in order to make any necessary accommodations. The university policy concerning academic dishonesty will be followed. Electronic devices must be turned off during class. Tardiness and behavior disruptive to fellow students is neither appreciated nor allowed. Assignments and dates may be changed at the discretion of the instructor. Check your ASU email regularly for class updates. Class slides and grades are available on Blackboard. Date 1/21 1/23 1/28 1/30 2/4 2/6 2/11 2/13 2/18 2/20 2/25 2/27 Chapter 13 13 14 14 15 15 16 16 Topic Homework and Class Notes Class Introduction and Syllabus Review of Financial Accounting Analysis of Financial Statements Introduce Class Project Managerial Accounting Concepts Review Financial Accounting Read Ch13 Practice Quick Study Problems HW 1 Due; Read Ch14 Practice Quick Study Problems HW 2 Due; Prepare for Exam Read Ch 15 Practice Quick Study Problems HW 3 Due; Read Ch16 Practice Quick Study Problems HW 4 Due; Read Ch17 Exam 1 – Fin Acct Review, Ch 13 & 14 Job Order Costing Process Costing No Class - Project on Analysis of Financial Statements Due in Dropbox 11:00pm 3/4 3/6 3/11 3/13 3/18 3/20 3/25 3/27 17 17 4/1 19 4/3 4/8 4/10 4/15 4/17 4/22 19 20 20 21 21 4/24 4/29 5/1 5/6 22 23 24 Ch 22 - Select topics Ch 23 - Select topics Ch 24 - Select topics No Class – University Study Day HW 10 Due; Read Ch 23 HW 11 Due; Read Ch 24 HW 12 Due; Prep for Final 5/12 Monday Comprehensive Final Exam – All MC 12:30 pm – 2:30 pm 18 18 Activity Based Costing Exam 2 Study Session During Class Exam 2 Ch 15, 16, 17 Cost Behavior and Analysis Practice Quick Study Problems HW 5 Due; Prepare for Exam This is still class! Study Session! Read Ch 18 Practice Quick Study Problems HW 6 Due; Read Ch19 Spring Break – No Class Spring Break – No Class Variable Costing & Performance Reporting Master Budgets and Performance Planning Flexible Budgets & Standard Costs Exam 3 Ch 18, 19, 20, 21 Practice Quick Study Problems HW 7 Due; Read Ch20 Practice Quick Study Problems HW 8 Due; Read Ch21 Practice Quick Study Problems HW 9 Due; Study for Exam Read Ch 22