Excel Project #4 - FacStaff Home Page for CBU

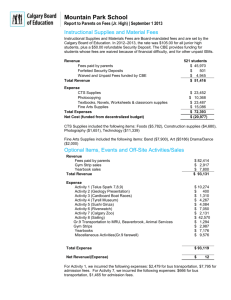

advertisement

Excel Project #4 Breakeven Analysis Patty’s Pie Shop • Patty is an excellent baker and she often makes pies for local caterers. • Patty is now thinking of opening her own store and selling pies to the general public. • She knows that there are additional costs she’ll have to incur to keep a store open. There will be monthly bills to pay such as a lease payment, equipment rental, and utilities. Can Patty make a profit? • To answer this question, she needs to estimate what her monthly revenues and expenses will be. • To estimate revenues, expenses, and profits, she should develop a pro-forma income statement. • Patty would also like to calculate a break-even point. A break-even point is the number of pies she has to sell each month just to cover her monthly expenses (to breakeven). Estimating income (profit) using scenario analysis • Patty is not sure how many pies she will be able to sell each month so she tries to imagine all possible scenarios. • Here are the scenarios that she believes could reasonably occur: – – – – – She could sell an average of 100 pies/month She could sell an average of 200 pies/month She could sell an average of 300 pies/month She could sell an average of 400 pies/month She could sell an average of 500 pies/month Estimating Revenues for each scenario • To estimate the revenue that she would realize for each of the five scenarios, she must decide on a price that she will charge for a pie. • The price is the revenue-per-pie. • In the past, has charged $10 - 20 a pie so she decides to use $15 as her average pie price. • To estimate monthly revenues under each scenario, she would have to multiply the $15 price times each estimated monthly sales volume. Estimating monthly expenses for each scenario • To estimate the expenses that she would incur for each of the five scenarios, she must know (1) the cost of making a pie (materials and labor costs) and (2) the recurring monthly expenses (rent, utilities, and other overhead). • The costs that are directly associated with making pies are called variable expenses and the recurring monthly expenses are called fixed expenses. Estimated expenses • The (variable) costs of making one pie: Material costs (sugar, flour, eggs, and fillings): $2.53 Labor costs (chef’s assistant who gets paid $10/hour and makes 2 pies/hour): $5.00 • The (fixed) monthly expenses of the store: Rent: Utilities: Equipment leasing: Manager’s salary: $500.00 $150.00 $200.00 $2000.00 Variable expenses are expressed “per pie”; Fixed expenses are expressed “per month”. Estimating expected profit and the breakeven point • To calculate expected income/profit, Patty must make up a pro-forma income statement that shows the estimated revenue, expenses, and profit for each of the five scenarios. • A starter template for the pro-forma income statement already exists and you can download it from the course syllabus web page. The file name is: PIES1.XLS Pies1.xls • Download “Pies1.xls” form the course syllabus web page • You may continue to use the Office 2003 format or save as the 2007 format (xlsx) The template for the pro-forma income statement we will complete. To enter the per-unit-revenue, in cell B7, type: 15 To enter the per-unit-expenses, type the following values into the cells indicated. To calculate the monthly revenue for the first scenario, multiply the per-unit-price (in cell b7) times the monthly sales volume (in cell C4) by entering the following formula into cell C7: =B7 * C4 See $1,500.00 appear in the cell when you press <enter>. This would be the monthly revenue for the first scenario. To calculate the monthly revenue for the remaining four scenarios, we must copy that formula across to cells D7:G7. Before copying the formula, make B7 (per-unitprice) an absolute address by positioning the cursor over the address on the formula bar and pressing the F4 key one time. After editing the formula, press <enter>. Then copy the formula out to cell G7. . To calculate what the materials expense would be for the first scenario, multiply the per-unit-materials expense (in cell B11) times the monthly sales volume (in cell C4) by entering the following formula into cell C11: =B11 * C4 See $253.00 appear in the cell when you press <enter>. This would be the monthly materials expense for the first scenario. To calculate the monthly material expense for the remaining four scenarios, we must copy that formula across to cells D11:G11. Before copying the formula, make B11 (per-unitprice) an absolute address by positioning the cursor over the address on the formula bar and pressing the F4 key one time. After editing the formula, press <enter>. Then copy the formula out to cell G11. To calculate what the direct labor expense would be for the first scenario, multiply the per-unit-direct labor (in cell B12) times the monthly sales volume (in cell C4) by entering the following formula into cell C12: =$B$12 * C4 (Notice, we can add the $ to ‘absolute’ the address as we ‘build’ the formula.) See $500.00 appear in the cell when you press <enter>. This would be the direct labor expense for the first scenario. To calculate the direct labor expense for the remaining four scenarios, we must copy that formula across to cells D12:G12. Since we have already applied absolute addressing where appropriate, just copy the formula as is out to cell G12. To calculate what the rent (a fixed expense) would be for the first scenario, copy the per-month-rent (in cell B13) to cell C13 by entering the following formula into cell C13: =B13 See $500.00 appear in the cell when you press <enter>. This would be the rent for the first scenario. To “calculate” (actually carry-forward) the rent expense to the remaining four scenarios, we must make absolute the (only) cell address in that formula and then copy that “formula” across to cells D13:G13. Edit the formula in cell C13 so that the (only) cell reference in that formula (B13) is absolute: =$B$13 Then copy that “formula” out to cell G13. To calculate what the utility expense (another fixed expense) would be for the first scenario, copy the monthly per-month utility expense (in cell B14) to cell C14 by entering the following formula into cell C14: =$B$14 See $150.00 appear in the cell when you press <enter>. This would be the utilities expense for the first scenario. To “calculate” (actually carry-forward) the utilities expense to the remaining four scenarios, copy that “formula” across to cells D14:G14. To calculate what the debt service expense (another fixed expense) would be for the first scenario, copy the monthly per-month debt service expense (in cell B15) to cell C15 by entering the following formula into cell C15: =$B$15 See $200.00 appear in the cell when you press <enter>. This would be the debt service expense for the first scenario. To “calculate” (actually carry-forward) the debt service expense to the remaining four scenarios, copy that “formula” across to cells D15:G15. To calculate what the manager’s salary expense (another fixed expense) would be for the first scenario, copy the monthly manager’s salary expense (in cell B16) to cell C16 by entering the following formula into cell C16:=$B$16 See $2000.00 appear in the cell when you press <enter>. This would be the manager’s salary expense for the first scenario. To “calculate” (actually carry-forward) the manager’s salary expense to the remaining four scenarios, copy that “formula” across to cells D16:G16. To calculate what total revenues would be for the first scenario, enter (carry-forward) the following “formula” into cell C8: =C7 See $1500.00 appear in the cell when you press <enter>. This would be the total revenues for the first scenario. To calculate total revenues for the remaining four scenarios, copy that formula across to cells D8:G8. To calculate what total expenses would be for the first scenario, enter the following formula into cell C17: =sum(C11:C16) See $3603.00 appear in the cell when you press <enter>. This would be the total revenues for the first scenario. Copy that formula across to cells D17:G17 to calculate total expenses for the other four scenarios. To calculate what earnings before tax would be for the first scenario, enter (carry-forward) the following “formula” into cell C19: =C8-C17 See ($2103.00) appear in the cell when you press <enter>. This would be the earnings before tax for the first scenario. Copy that formula across to cells D19:G19 to calculate earnings before tax for the other four scenarios. To calculate what tax expense would be for the first scenario, enter the following “formula” into cell C21: =if(C19 <= 0, 0, C19 * .33) Note: 33% is the tax rate See $0 appear in the cell when you press <enter>. This would be the tax expense for the first scenario. Copy that formula across to cells D21:G21 to calculate tax expense for the other four scenarios. To calculate what earnings after tax would be for the first scenario, enter (carry-forward) the following “formula” into cell C23: =C19-C21 See ($2103.00) appear in the cell when you press <enter>. This would be the earnings after tax for the first scenario. Copy that formula across to cells D23:G23 to calculate tax expense for the other four scenarios. Press ctrl~ to see all the formulas on the worksheet. Now for the break-even part. How many pies does Patty have to sell each month to breakeven? Change one of the values in row 4 until its earnings after tax approaches $0 If she increases her price to $20, then how many pies does Patty have to sell each month to breakeven? Change the price to $20…. … and recalculate the breakeven point. If she sets the price at $15, lays off the manager, then how many pies does Patty have to sell each month to make $3000 a month? If she sells 250 pies a month, has a part-time manager (for $500/month) and has to pay rent of $600/month, how much money will she make? Re-save the file as: pies2.xls or in 2007 format (xlsx) What advice do you have for Patty? Homework • Excel Practice tests • HW 8 – see following slides Homework #8 • • • • • • • • • • • • • • You decide that you want to go into the office cleaning business. You want to start up your own company and call it Merry Maids Cleaning Company. Before you invest your time and money, you need to estimate the profitability of this business venture. Here is the information you need: Your fee that you charge for one office cleaning: $85.00 Your monthly expenses: Fixed expenses per month: Your mortgage payment: $600.00 Utilities 80.00 Advertising 50.00 Variable expenses per office: Direct labor (2 maids @ $10.00/hr * 2 hours) $40.00 Additional payroll expenses (FICA & SS) 6.00 Cleaning supplies 26.00 Tax Rate on earnings: 33% (If earnings<=0, taxes due is 0.) HW Instructions • • • • • • • • • • Download the file MMAIDS1.XLS from the course syllabus web site Using the information provided above, complete the spreadsheet by entering formulas to calculate the revenues, expenses, and earnings before tax, and earnings after tax that would be realized for each of five different scenarios. The five scenarios are: your employees clean 25, 50, 75, 100 and 125 offices on average each month. Use absolute addressing where appropriate. Type each formula only once for each scenario and copy the formula across to obtain formulas in the adjacent columns. Save the worksheet as: MMAIDS2.XLS (on your hard drive and FTP to your server) Answer the following questions (in your e-mail or on the spreadsheet): a. How many offices do you need to clean each month just to break even? _________________________________________ b. Assume you have a “sale”. You increase advertising expense to $100.00/month and you decrease your price to $79.00 per office. Now, what is your breakeven point? (expressed as: number of offices cleaned) __________________________________________ c. If your monthly office cleaning volume turns out to be 125 offices during the month you have the sale, what will be your profit-after-tax be for that month?