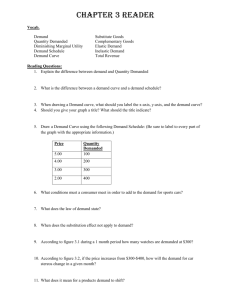

Chapter 3 DEMAND AND SUPPLY

advertisement

Chapter 3 DEMAND AND SUPPLY APPLICATIONS Chapter in a Nutshell 1. The price elasticity of demand measures how sensitive buyers are to a change in price. Depending on the response of buyers to a change in price, demand is characterized as elastic, inelastic, or unit elastic. 2. Demand tends to be more elastic for some products and less elastic for others. Among the major determinants of the price elasticity demand are the availability of substitutes, the proportion of buyer income spent on a product, and the time period under consideration. 3. If a firm’s price and total revenue move in opposite directions, demand is elastic. If the firm’s price and total revenue move in the same direction, demand is inelastic. If the firm’s total revenue does not respond to a change in price, demand is unit elastic. 4. Occasionally, the government will impose price controls on individual markets in which prices are considered unfairly high to buyers or unfairly low to sellers. When government imposes a price ceiling on a product, it establishes the maximum legal price a seller may charge for that product. Conversely, government establishes a price floor to prevent prices from falling below the legally mandated level. 5. Although price controls on individual markets attempt to make prices more “fair” for buyers and sellers, they interfere with the market’s allocation of resources. Price ceilings that are set below the equilibrium price level result in market shortages of a product. Price floors that are set above the equilibrium level entail market surpluses. Chapter Objectives After reading this chapter, you should be able to: 1. Explain the relationship between the responsiveness of quantity demanded to a change in price and the manner in which a firm’s total revenue is influenced by price changes. 2. Describe the nature and operation of the price elasticity of supply. 3. Assess the advantages and disadvantages of governmental price ceilings and price supports on individual markets. 20 Chapter 3: Demand and Supply Applications 21 Knowledge Check Key Concept Quiz 1. price elasticity of demand 2. elastic demand 3. inelastic demand 4. unit elastic demand 5. total revenue _____ a. percentage change in quantity demanded is greater than the percentage change in price _____ b. measures how sensitive buyers are to a change in price _____ c. =PxQ 6. price elasticity of supply _____ d. the maximum legal price a seller may charge for the product 7. price ceiling _____ e. a type of price ceiling 8. price floor _____ f. percentage change in quantity demanded is less than the percentage change in price 9. rent control _____ g. percentage change in quantity demanded equals the percentage change in price 10. usury 11. usury law 12. agricultural price floor _____ h. measures how quantity supplied responds to a change in the price _____ i. the minimum legal price a seller may charge for the product _____ j. all payments for the use of money _____ k. a legally mandated minimum price _____ l. interest-rate ceiling Multiple Choice Questions 1. Price elasticity of demand measures a. b. c. d. the responsiveness of quantity demanded to a change in the price the responsiveness of demand to a change in the price the responsiveness of price to changes in quantity demanded the responsiveness of price to changes in demand 2. Price elasticity of supply measures a. b. c. d. the percentage change in supply due to a percentage change in price the percentage change in price due to a percentage change in supply the percentage change in quantity supplied due to a percentage change in the price the percentage change in price due to a percentage change in the quantity supplied 3. Price elasticity of demand is always a. b. c. d. positive negative non-zero zero or negative 22 Chapter 3: Demand and Supply Applications 4. The supply curve must always assume a. b. c. d. non-negative values negative values non-positive values values close to infinity 5. Demand is relatively inelastic when a. b. c. d. Ed Ed Ed Ed =1 >1 <1 =0 6. Demand is relatively elastic when a. b. c. d. Ed = 1 Ed > 1 Ed < 1 Ed = 7. When the price of a product rises and Ed = 1, the total revenue a. b. c. d. remains unchanged increases decreases cannot be determined 8. When the Seattle Mariners decide to increase the price of their tickets to baseball games hoping to increase total revenues earned, they are working on the assumption that a. b. c. d. Ed = 1 Ed > 1 Ed < 1 Ed = 0 9. If Gateway cuts prices on all of its desktop computers on the prediction that total revenues will rise, then Gateway is assuming that a. b. c. d. Ed = 1 Ed > 1 Ed < 1 Ed = 0 10. All the following factors affect the price elasticity of demand except the a. b. c. d. availability of substitutes proportion of income spent on the product time to adjust to a change in the price change in the consumer’s income Chapter 3: Demand and Supply Applications 23 11. If a tax is placed on a life-saving drug that happens to be the only drug on the market a. b. c. d. consumers will pay most of the tax drug companies will pay most of the tax the drug companies will stop producing the drug the consumers will boycott the drug 12. If steel producers are successful in lobbying Congress for subsidies, we may expect all of the following except a. b. c. d. increase in the quantity supplied increase in the price of steel decrease in the price of steel reallocation of government funds 13. A gas tax is more effective for collecting revenues in the short run rather than the long run since a. b. c. d. governments usually realize their mistakes over the long run demand is more elastic in the long run consumers always get used to the idea of a tax over the long run producers are very responsive to a tax in the short run but not the long run 14. If cigarettes are subject to price ceilings, all of the following may happen, except a. b. c. d. the price of cigarettes falls an underground market for cigarettes develops a surplus develops in the market for cigarettes the quality of the product may deteriorate 15. If a tax is imposed on handguns and the demand and supply for handguns are both elastic a. the tax will be shared by the sellers and buyers, and the quantity of handguns sold will decrease b. the tax will be borne entirely by the buyers c. the tax will be borne entirely by the sellers d. the tax will have no effect on the market for handguns 16. When the price of oil is $20 a barrel, 25 million barrels are demanded each day, but when the price of oil is $30 a barrel, only 20 million barrels are demanded. We can conclude that the demand for oil is a. b. c. d. perfectly inelastic relatively inelastic relatively elastic perfectly elastic 17. The supply of wheat will be more inelastic the a. b. c. d. shorter the time period under consideration greater the number of farmers growing wheat easier it is to substitute capital for labor in farming greater the number of buyers in the wheat market 24 Chapter 3: Demand and Supply Applications 18. The burden of a tax on gasoline is born entirely by consumers if the demand for gasoline is a. b. c. d. perfectly elastic relatively elastic relatively inelastic perfectly inelastic Interest Rate Quantity of Money Supplied Quantity of Money Demanded 4% $1million $5 million 8% $2 million $4 million 12% $3 million $3 million 16% $4 million $2 million 20% $5 million $1 million 19. The table above shows the market for mortgage loans. If the government imposes a ceiling on interest rates at 8 percent, the ceiling: a. b. c. d. does not protect borrowers from the interest rate set by the market results in borrowers paying an interest rate higher than the market equilibrium rate leads to an excess demand for mortgage funds increases profits that lenders make on mortgage loans 20. If the federal government levied an effective ceiling on interest rates charged by MasterCard and Visa, we would anticipate a decrease in the: a. b. c. e. annual credit card fees paid by households prices charged by merchants who accept credit cards for payment amount of credit made available by banks issuing credit cards fee that banks charge merchants for processing credit card sales 21. If the University of Wisconsin increases tuition which results in rising total tuition revenue, student demand for education at the university is a. b. c. d. inelastic elastic unit elastic all of the above 22. In 1997, the U.S. government levied a 10-percent excise tax on the sale of domestic airline tickets, yet airlines increased fares by 4 percent. Apparently, the demand for tickets was a. perfectly inelastic b. perfectly elastic c. somewhat elastic d. all of the above Chapter 3: Demand and Supply Applications 25 23. In 2002, the Pittsburgh Pirates increased season ticket prices to generate additional revenue. However, fan attendance at baseball games fell more than that anticipated by the team’s management, resulting in decreases in revenue. Apparently, the demand for tickets was a. b. c. d. relatively inelastic relatively elastic perfectly inelastic perfectly elastic 24. Health care would become more expensive if a. b. c. d. the increase in the demand curve for health care is more than the increase in supply the increase in the demand curve for health care is less than the increase in supply the decrease in the demand curve for health care is more than the decrease in supply the decrease in the demand curve for health care is the same amount as the decrease in supply. 25. Below-equilibrium rent controls are plagued by all of the following problems except: a. b. c. e. discrimination may occur in the rationing of apartments rent controls encourage the production of more apartments the quality of apartments may deteriorate landlords my develop under-the-table markets to collect extra income 26. If federal ceilings were imposed on the interest rate you pay on your Master Card, the bank that issued your credit card would have the incentive to a. b. c. d. lengthen your interest-free grace period reduce the annual fee that you pay on your credit card raise the fee they charge merchants for processing credit card sales provide more services with your credit card, such as discounts on motels True-False Questions 1. T F Elasticity of supply decreases when price increases. 2. T F If demand is elastic, the demand curve shifts to the right when price increases. 3. T F Elasticity of demand and total revenue are unrelated. 4. T F Unit elasticity implies that total revenue is unresponsive to changes in price. 5. T F If a firm increases total revenue by raising prices, it must be experiencing inelastic demand. 6. T F When a product has many substitutes, its elasticity is relatively high. 7. T F The price elasticity of demand is insensitive to time. 8. T F Buyers and sellers will always share a gas tax equally. 9. T F When the demand curve is vertical and the supply curve is positively sloped, a new tax will be borne entirely by the sellers. 26 Chapter 3: Demand and Supply Applications 10. T F Price ceilings are always higher than the equilibrium price. 11. T F Price floors are always lower than the equilibrium price. 12. T F Farm subsidies provide an example of price floors. 13. T F A price ceiling on gas will always benefit consumers. 14. T F Imposition of interest rate ceilings amounts to market interference. 15. T F A price floor typically causes a shortage. 16. T F A price ceiling may lead to improvement of the quality of the product or service. 17. T F When demand increases in a market experiencing a price ceiling, a shortage develops in the market. 18. T F When demand is elastic and a firm raises the price of its product, it does so because it correctly predicts an increase in total revenue. 19. T F Inelastic supply curves may become elastic given enough time. 20. T F Unit elasticity implies that a rise in price leads to a one-unit decline in the quantity demanded. 21. T F Rent controls and minimum wage laws provide examples of price floors. 22. T F If the price elasticity of demand for first-class letters is 0.3, an increase in price will result in additional revenues for the U.S. Postal Service. 23. T F 24. T F The rising significance of email results in the demand for letter mail delivered by the U.S. Postal Service becoming more elastic. If the demand for airline tickets is perfectly elastic, a 10 percent increase in the excise tax on tickets will entirely be absorbed by passengers in the form of a higher price. 25. T F If the increase in the supply of health care exceeds the increase in demand, health care becomes more expensive. 26. T F If the federal government imposes a ceiling on the interest rate that banks could charge users of VISA, a bank would have the incentive to tighten credit standards so as to decrease collection costs and write-offs of bad debt. 27. T F An increase in the minimum wage will result in an increase in total wages paid to workers if the demand for labor is inelastic. Chapter 3: Demand and Supply Applications 27 Application Questions 1. The following table shows Homer Simpson’s demand for comedy show tickets. Price ($/ticket) Quantity Demanded $10 20 $20 15 $30 10 $40 5 $50 0 Use the following midpoint formula to calculate the price elasticities of demand. P2 P1 Ed %Q Q2 Q1 P2 P1 Q2 Q1 Qaverage Paverage (Q1 Q2) 2 (P1 P2) 2 %P a. Calculate the price elasticity of demand between the prices of $10 and $20. b. Calculate the price elasticity of demand between the prices of $20 and $40. c. Calculate the price elasticity of demand between the prices of $40 and $50. d. Is Homer Simpson more sensitive to price increases when the price is $10 than when it is $40? e. Let’s assume that the price of a comedy show ticket is $40 and everyone in the community has a demand schedule that is identical to Homer Simpson’s. If the organizers raise the ticket prices, will they succeed in increasing their revenues? 28 Chapter 3: Demand and Supply Applications 2. The following table shows the demand and supply for comedy show tickets in the Simpson neighborhood. Price ($/ticket) Quantity Demanded Quantity Supplied $10 40 20 $20 30 30 $30 20 40 $40 10 50 $50 0 60 a. What is the equilibrium price? What is the equilibrium quantity? Draw the supply and demand curves for comedy show tickets. b. Assume that a $10 tax is imposed on each ticket. Draw the new supply curve. c. What is the new equilibrium price? What is the new equilibrium quantity? Chapter 3: Demand and Supply Applications 3. The following table represents a new demand schedule for the suburb of Consistent, which borders the Simpson’s neighborhood. Price ($10/ticket) Quantity Demanded $10 40 $20 40 $30 40 $40 40 $50 40 Assume that the supply schedule of tickets is identical to the one described in question 2. a. Draw demand and supply curves of tickets and identify the equilibrium. b. What is the equilibrium price and quantity? c. Assume that a tax of $10/ticket is imposed. Draw a new supply curve of tickets. d. Who pays for the tax? e. Are the effects of the tax in this market different from the effects in the market described in question 2? Why? Answers to Knowledge Check Questions 29 30 Chapter 3: Demand and Supply Applications Key Concept Answers 1. b 7. d 2. a 8. i 3. f 9. e 4. g 10. j 5. c 11. l 6. h 12. k Multiple Choice Answers 1. a 6. b 2. c 7. a 3. d 8. c 4. a 9. b 5. c 10. d 11. 12. 13. 14. 15. a c b c a 16. 17. 18. 19. 20. b a d c c 21. 22. 23. 24. 25. a c b a b 26. c True-False Answers 1. F 6. 2. F 7. 3. F 8. 4. T 9. 5. T 10. 11. 12. 13. 14. 15. F T F T F 16. 17. 18. 19. 20. F T F T F 21. 22. 23. 24. 25. F T T F F 26. T 27. T T F F F F Application Question Answers 1. a. Ed = 0.43 b. Ed = 1.5 c. Ed = 9 d. No. Homer is less sensitive to price increases when the price is $10 than when it is $40. e. No. Because the price elasticity of demand is greater than one, total revenue will decrease when price is increased. Chapter 3: Demand and Supply Applications Market for Comedy Show Tickets Price of Ticket 60 ($) 50 40 S´ Post-tax Supply Curve 30 S 20 10 10 2. a. c. 20 Pre-tax Supply Curve D 30 40 Equilibrium price = $20 Equilibrium quantity = 30 tickets New equilibrium price = $25 New equilibrium quantity = 25 tickets 50 60 Quantity 31 32 Chapter 3: Demand and Supply Applications Market for Comedy Show Tickets Price of Ticket 60 ($) D Post-tax Supply Curve 50 40 30 20 10 0 3. a. 10 20 S´ S 30 Pre-tax Supply Curve 40 50 60 Quantity The new demand curve is vertical. b. Equilibrium price = $30 Equilibrium quantity = 40 tickets c. Yes. In this market suppliers do not share the tax burden. Also, the same quantity of tickets (40 tickets) is bought and sold in this market before and after the imposition of the tax. In the neighborhood in which the Simpsons reside, the suppliers share part of the tax and less is bought and sold after the tax is imposed.