Express Scripts

advertisement

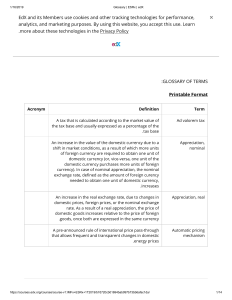

Pharmaceutical benefit managers (PBM) Specialty Prescription Management We manage prescription benefits for tens of millions of Americans on behalf of thousands of clients, including health plans and plan sponsors. Employers, unions and government organizations throughout the nation rely on our services. Our team of more than 30,000 employees expresses passion, expresses care and expresses enthusiasm for our mission. We are committed to our members achieving better clinical outcomes and dedicated to delivering better financial outcomes for plan sponsors. ~ George Paz, Chairman & CEO https://www.express-scripts.com/aboutus/index.shtml Benefit Design Consultation. Patient Care Contact Centers Formulary development Information Reporting and Analysis Programs Rebate Programs Electronic Claims Processing System Consumer Health and Drug Issues United Health Group CVS Caremark Omnicare Rite Aid Express Scripts’ wide moat gives it a great advantage over their competitors. This can be attributed to three main “pillars:” 1) Sticky client base 2) Strong foothold within pharmaceutical markets. 3) The company’s scale advantage. ESRX Revenue (in millions $) IV Quarter Dec. III Quarter Sep. II Quarter June I Quarter March FY FY 2014 26,312.60 25,778.50 25,111.00 23,685.00 FY 2013 25,781.40 25,915.60 26,425.00 26,063.00 FY 2012 27,410.70 26,999.40 27,692.50 12,132.60 FY 2011 12,101.40 11,571.00 11,361.40 11,094.50 100,887.10 104,098.80 93,858.10 46,128.30 http://csimarket.com/stocks/single_growth_rates.php?code=ESRX&rev George Paz: Chairman & Chief Executive Officer ◦ Salary: $1.07mil with a bonus of $2.02mil. He also receives stock gains of $34.99mil • Keith Ebling: Executive Vice President & General Counsel: • Salary: $660,385 and $662,540 was received as a bonus, & $900,000 was received in stock options • Jim Havel: Executive Vice President & Interim Chief Financial Officer. • Salary: $725,000 and a signing bonus of $110,000, • Christine Houston Senior Vice President - Operations • Steve Miller, MD Senior Vice President & Chief Medical Officer • Tim Wentworth: President • Salary: $815,303, Bonus:1,264,863, Profitability Ratio Profit Margin: Return on assets: Return on Equity: 2012 .014 .023 .056 2014_________________________ .019 (+) .037 (+) .100 (+) Asset Utilization: Receivables turnover: Total Asset turnover: NWC turnover: 16.08 1.74 -.025 Liquidity Ratio Current ratio: Quick ratio: NWC to total assets: .82 .68 -.04 .62 (-) .50 (-) -.61 (-) Leverage Ratio: Total Debt ratio: Equity multiplier: D/E ratio: .96 2.49 .64 .63 (+) 2.68 (-) .55 (+) 15.83 (-) 1.88 (+) -.064 (-) Value1 Weight Required rate of return2 Equity (fair value) 63,878,599 0.82 16.07% Long-term debt, including current maturities (fair value) 14,200,200 0.18 2.38% Calculation = 3.78% × (1 – 37.08%) USD $ in thousands Equity (fair value) = No. shares of common stock outstanding × Current share price = 729,291,000 × $87.59 = $63,878,598,690.00 Long-term debt, including current maturities (fair value). Required rate of return on equity is estimated by using CAPM. Required rate of return on debt. Required rate of return on debt is after tax. Estimated (average) effective income tax rate = (33.60% + 36.40% + 38.00% + 37.00% + 36.90%) ÷ 5 = 37.08% WACC = 13.58% https://www.stock-analysis-on.net/NASDAQ/Company/Express-Scripts-Holding-Co/DCF/Present-Value-of-FCFF 2009- Express Scripts Completes Acquisition of WellPoint’s NextRx Subsidiaries Hepatitis Cure Value Program The transaction includes a 10-year agreement under which Express Scripts, one of the largest pharmacy benefits management companies in North America, will provide pharmacy benefits management services, including home delivery and specialty pharmacy services, to members of the affiliated health plans of WellPoint, one of the nation’s largest health benefits companies. Express Scripts acquired the NextRx subsidiaries for $4.675 billion, which includes consideration for the value of a future tax benefit for Express Scripts based on the structure of the transaction. Merger with Medco Health Solutions "Our merger is exactly what the country needs now, It represents the next chapter of our mission to lower costs, drive out waste in healthcare and improve patient health. We remain focused on formulary management, channel management and closing gaps in care, which will allow us to further improve the health of people with chronic and complex medical conditions. ~ George Paz, CEO Ticker ESRX Company Express Scripts Holding Company Market Cap (Millions) $60,830.00 5-Year Sales Growth 36.50% Debt/Equity 0.73 1.90% Profit Margin Initial public offering in 1992 Express Scripts Holding Company (ESRX) -NasdaqGS 87.59 1.24(1.40%) Beta: .64 CVS Health Corporation (CVS) -NYSE 104.19 2.19(2.06%) Beta:1.17 Omnicare Inc. (OCR) -NYSE 94.55 0.06(0.06%) Beta:.47 Date Research Firm Action Current PT 12/04/14 Deutsche Bank Maintains Hold 88.0 1/08/15 JP Morgan Maintains Overweight 100.0 1/08/15 Barclays Maintains Overweight 102.0 1/28/15 FBR Capital Downgrades Market Perform 2/26/15 Deutsche Bank Maintains Hold 96.0 4/10/15 BMO Capital Maintains Market Perform 89.0 5/20/15 Baird Initiates Coverage on Neutral 94.0 6/01/15 Raymond James Downgrades Market Perform 6/15/15 Deutsche Bank Maintains Hold 6/17/15 Oppenheimer Initiates Coverage on Perform 95.0 http://www.benzinga.com/stock/esrx/ratings Transactions Date Shares 06/09/2015 1,644 06/01/2015 46,069 06/01/2015 06/01/2015 06/01/2015 06/01/2015 Transaction Disposition at $87.14 per share. Disposition at $86.15 per share. Value 143,259 3,968,845 4,799 Derivative/Nonderivative trans. at $77.15 per share. 370,242 3,557 Derivative/Nonderivative trans. at $53.05 per share. 188,698 16,356 Derivative/Nonderivative trans. at $53.05 per share. 867,685 9,078 Derivative/Nonderivative trans. at $58.17 per share. 528,06 “We are proud to provide world-class service and specialized pharmacy care to our men and women in uniform and military retirees, along with their dependents. ” Shareholder value is the sum of all strategic decisions that affect the firms ability to efficiently increase the amount of free cash flow over time. was downgraded by ZACKS from a “hold” rating to a “sell” rating in a research note issued to investors on Tuesday, 9,000,000 8,000,000 7,000,000 6,000,000 5,000,000 ESRX 4,000,000 CVS 3,000,000 UNH 2,000,000 1,000,000 0 Cash Flow '14 Cash flow '13 Cash flow '12 150,000 100,000 MKT CAP NET INCOME 50,000 P/E D/E 0 ESRX CVS UNH Competition http://www.benzinga.com/stock/esrx/ratings http://csimarket.com/stocks/single_growth_rates.php?code= ESRX&rev https://www.express-scripts.com/aboutus/index.shtml https://www.expressscripts.com/pressroom/informationresources/corporateoverv iew/corporateOverview.pdf http://fortune.com/fortune500/express-scripts-holding-22/ http://ir.antheminc.com/phoenix.zhtml?c=130104&p=irolnewsArticle&ID=1360094 https://www.stock-analysison.net/NASDAQ/Company/Express-Scripts-HoldingCo/DCF/Present-Value-of-FCFF http://www.forbes.com/lists/2012/12/ceo-compensation12_George-Paz_23R1.html http://www.reuters.com/finance/stocks/companyOfficers?symbo l=ESRX.O http://www.tricare.mil/overseas-pharmacy?p=1 http://www.wsj.com/articles/SB1000142405311190355490457 6460322664055328 http://blogs.wsj.com/pharmalot/2014/12/22/the-hepatitis-cprice-wars-begin-what-the-express-scripts-move-means/ http://www.wikinvest.com/stock/Express_Scripts_%28E SRX%29