Your Church and California

advertisement

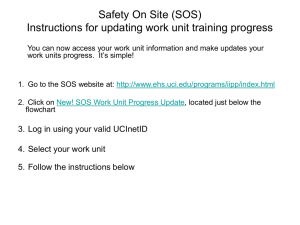

Your Church and the Secretary of State, California Governance and Taxes California Has Requirements, too • • • • Tougher than the IRS CA can’t print money Churches are low hanging fruit “Go, sin no more!” is CA attitude Statement of Information • Updates your church office address • Updates your Principal Officers; Pastor (CEO), Secretary, Chief Financial Officer (Treasurer in small church) • Must be done biennially, unless Welfare Status http://www.sos.ca.gov/business/corp/pdf/so/corp_so100.pdf • Cost: $20 • Penalty for not doing so: possible Corporate Status Suspension • To see your status: http://kepler.sos.ca.gov/ Penalties • $50 penalty • When FTB or SOS suspends an organization, it cannot legally transact business, defend or initiate an action in court, protest assessments, or file a claim for refund of paid amounts. Your organization also loses the right to use the entity name. • Your organization will remain suspended by SOS until all revivor requirements are met • https://www.ftb.ca.gov/businesses/Exempt_organizati ons/Suspended.shtml Franchise Tax • Every church or ministry that incorporates in the state of California has to pay a minimum tax of $800.00 per year unless the church or ministry files for an exemption. The exemption is not automatic! • Churches get these notices because they never filed for the exemption. In order to apply for the exemption, you need to file Form FTB-3500A. If you have recently incorporated (within the last 4 years), and have not filed for the exemption, we encourage you to do it immediately. Penalties • Suspension (see previous penalties) • $800.00 tax every year DE-9 (CA) - Quarterly Wage & With holding Report • • • • Can be done online at www.edd.ca.gov State version of IRS 941 DE-9C Employee Information Both must be sent in each Quarter Form DE-542 (CA)– Independent Contractors-EDD • WHO MUST REPORT: • Any business or government entity (defined as a “ServiceRecipient”) that is required to file a Federal Form 1099MISC for service performed by an independent contractor (defined as a “Service-Provider”) must report. You must report to the Employment Development Department within twenty (20) days of EITHER making payments of $600 or more OR entering into a contract for $600 or more with an independent contractor in any calendar year, whichever is earlier. This information is used to assist state and county agencies in locating parents who are delinquent in their child support obligations. Withholding on Out of State Guest Speakers • California requires all churches and ministries to withhold 7% of all honorariums over $1,500.00 paid to guest speakers that live outside the state • Report to the state on form 592-B the amount of earnings and the amount of withholdings. • Beginning January 1st, 2010 the limit is $600.00. Therefore, it may be safer to automatically withhold the 7%. The penalty for not withholding is at least 10% of the entire honorarium. This is a penalty against the church. Penalties • $50 for each payee statement not provided by the due date • $100 or 10% of the amount required to be reported (whichever is greater), if the failure is due to intentional disregard of the requirement. DE-34 (CA) - REPORT OF NEW EMPLOYEE(S)-EDD • WHO MUST BE REPORTED: • Federal law requires all employers to report all newly hired or rehired workers to EDD within 20 days of their start-of-work date. State and county agencies use this information to assist them in locating parents who are delinquent in their child support obligations. • An individual is considered a new hire on the first day in which he/she performs services for wages. An individual is considered a rehire if the employer/employee relationship has ended and the returning individual is required to submit a W-4 form to the employer. DE-1NP (CA)– Employment form for Non-Profits-EDD • An employer is required by law to file a registration form with the Employment Development Department (EDD) within fifteen (15) calendar days after paying over $100 in wages for employment in a calendar quarter, or whenever a change in ownership occurs. Excise taxes-BOE • If a church in California purchases something from an out of state vendor, the church is usually not charged sales tax because the vendor is from another state. However, in California tax code 165.0014 excise taxes are to be imposed upon churches and religious organizations that purchase tangible personal property from out-of-state sellers for use in California. • FORM 401-DS by January 31st of each year • When the church gets products and begins to use them, it is required to report the purchase and pay an excise tax equal to the regular California sales tax. Useful California Government Websites • http://www.ca.gov/ Home page for California Government • http://www.ca.gov/Apps/Agencies.aspx All California Agencies • http://www.sos.ca.gov/ Secretary of State • http://www.edd.ca.gov/ Employment Development Department • https://www.ftb.ca.gov/ Franchise Tax Board • http://www.boe.ca.gov/ Board of Equalization EDD DOL INSURANCE IRS BOE CA FTB Homeland Security What Questions can I answer for You? Rod Wiltrout Church Finance Specialist (559) 256-0858 direct line (559) 287-7840 cell phone rwiltrout@csbc.com www.csbc.com/financialmatters 16