Redistributive policy

advertisement

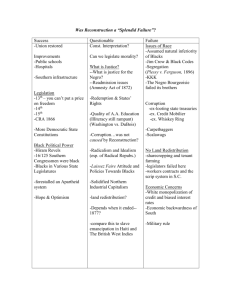

The Moral Implications of Redistributive Economic Policies Ethics LS 707 Team Members: Allison Pyle, Lou Maynus, Sonya White and Leatha Williams Key Terminology • Market Economy - An economy that operates by voluntary exchange in a free market and is not planned or controlled by a central authority; a capitalistic economy. • Mix-market Economy- A mixed economy is an economy that includes a variety of private and government control; reflecting characteristics of both capitalism and socialism. – The United States is a mixed marketed economy, because of substantial market regulation, agricultural subsidies, extensive government-funded research and development, Medicare/Medicaid. Present Status of the United States as an Economic System • The United States is a mixed marketed economy, because of: • substantial market regulation, • agricultural subsidies, • extensive government-funded • research and development and • Medicare/Medicaid. Source: Gordon, D. (n.d.). Justice and redistributive taxation: james buchanan versus lugwig von mises. Retrieved from https://mises.org/journals/rae/pdf/rae8_1_5.pdf Key Terminology- Policies of a Mixed Market Economy • Policy – this is a statement of what the government tend to do or not to do, enforce or not enforce in regards to laws, decisions or orders or any combination of the three (examples of policies are constitutional, statutory and regulatory) $ 3 major types of policies: $ Distributive – these policies primarily benefit a small group and is considered a political process because of logrolling and pork-barrel spending that is associated with it. $ Regulatory – governs the conduct of business and market to protect the welfare and interest of the population. $ Redistributive – the transference of resources in terms of wealth, property, various rights or other valued items from one group in the population to another group (i.e. social classes and racial groups). Source: Lending, B. (2001). Four systems of policy, politics and choice by theodore j. lowi. Retrieved from http://filebox.vt.edu/b/blending/vap-lowi-bl.htm Philosophical Underpinning of the United States Mixed Market Approach • Anglo-Saxon Model – Developed in the 1970s… out of Chicago School of Economics • Chicago School of Economic Thought: – Postwar – development – Root in John Maynard Keynes • Macroeconomics are rooted in Keynesian thoughts • Microeconomics are rooted in neoclassical thoughts • Major characteristics: – Low rates of taxation, open financial markets, low labor market protection and collective bargaining • Neoclassical Thoughts: Adam Smith, David Hume and John Stuart Mills – Free Trade: Laissez-faire – Labor vs. Mercantilism Source: Richter, E. (2004). Rhine capitalism, anglo-saxon capitalism and redistribution. Retrieved from https://publish.indymedia.org.uk/uk/servlet/OpenMir?do=getpdf&id=299588&forIE=.pdf Key Understandings: Present Status of Policies $ The United States government imposes taxes at all levels of government in order to finance spending programs intended to benefit citizens. $ The questions for this project regarding fiscal policies are: $ What is the cost verses the benefits of these fiscal policies? $ How are the cost and benefits of these fiscal policies distributed across social classes, age groups and racial classes? $ How much do people pay in taxes verses how much is spent on them by the government? Source: Prante, G. and Hodge, S. (2013). The distribution of tax and spending policies in the united states. Retrieved from http://taxfoundation.org/article/distribution-tax-and-spending-policies-united-states Present Status of Fiscal Policies Distribution vs. Redistribution 2012: Collected $4.2 Trillion, Spent $5.5 Trillion for a Deficit of $1.3 Trillion The chart is illustrating fiscal policy by income cohort and government levels Source: Prante, G. and Hodge, S. (2013). The distribution of tax and spending policies in the united states. Retrieved from http://taxfoundation.org/article/distribution-tax-and-spending-policies-united-states Spending Ratios by Income Cohort Pre/post-Redistribution Status of Government Redistribution Major Theorists What do they say about redistribution of wealth? John Rawls Adam Smith Immanuel Kant Ayn Rand Friedrich Nietzsche John Rawls' Method (Stanford, 2008) Original Position Veil of Ignorance Choosing principles that will govern the world All generations have the same rights to resources, future as well as present. Building a Better America One Wealth Quintile at a Time Harvard Business School Study – followed Rawls Surveyed to answer two questions – •Is there consensus among Americans? •Preferences of “regular Americans” John Rawls, 1971 Adam Smith Capitalism’s Founding Father “The great object of the political economy of every country is to increase the riches and power of that country.” Smith also argued that capital for the production and distribution of wealth could work most effectively in the absence of government interference. Such a laissez-faire—that is, “leave alone” or “allow to be”—policy (a term popularized by Wealth of Nations) would, in his opinion, encourage the most efficient operation of private and commercial enterprises. He was not against government involvement in public projects too large for private investment, but rather objected to its meddling in the market mechanism. Immanuel Kant Kant would say redistribution is immoral because the maxim on which it is based could not be universally applied without running into the law of non-contradiction. The welfare state is immoral also because it allows the recipient to make demands on the taxpayer with out providing the taxpayer with an equivalent value. Redistribution is immoral, more generally, because it allows one person to treat another as a means to the first person’s ends. Ayn Rand: Queen of the Universe Rand believed that a government that taxed billionaires to help pay for healthcare and education for impoverished children was not just unwise economically, it was also immoral. Ayn Rand considered government and democracy – systems of mob rule. Thursday, 07 February 2013 By The Daily Take, The Thom Hartmann Program Ayn Rand continued… They don’t want the 21st Century to be “America’s Century.” They want it to be the “Billionaire’s Century.” And if they succeed, then the middle class in America - and through most of the developed world will go extinct Friedrich Nietzsche (Moral Philosophy, 2009) • All creation is motivated by “will to power” • We seek to flourish and dominate as an element of survival • Hampered by Christianity which causes “slave morality”. • …we will see that the whole edifice of slave morality must crumble and with it the notion of equal worth. Redistributive Policies • Redistributive Policies: The government taxes one group of people to provide benefits to another group • Types of Redistributive Policies: Income stabilization (Unemployment/Retirement), Welfare (Head Start, TANF, Food Stamps, School lunch programs), Health Care (Medicare/Medicaid), Housing (Fair housing, FHA, Section 8), Income distribution (Tax Code) http://cbapp.csudh.edu/depts/adjunct/ehuntington/pub304/chapt_4_public_policy.htm Redistribution through taxation o Progressive taxation (increasing equality)personal income taxes, property taxes o Regressive taxation (indirect)- taxes on services/goods and international trade o Corporate taxation Taxes should not distort incentives to work, invest, and create work. Prasad, (2008) Taxation o Income, profits, and capital gains: based on the net income of individuals, profits of corporations and enterprises, and capital gains on land, securities, and other assets o Goods and Services: sales tax, taxes on services or the use of goods or property o International trade: import/export duties, profits of import/export monopolies, exchange profits/taxes Prasad, (2008) Redistribution through social transfers o Contributory-contributions made by beneficiaries (and their employers) determine entitlement to benefits o Non-contributory-require no direct contribution from beneficiaries or their employers as a condition of entitlement to receive benefits; usually financed through taxes or other state revenues. http://www.ilo.org/gimi/gess/ShowTheme.do?tid=11 Types of Social Transfers o Social assistance benefits o provide cash benefits to those less advantaged usually based on some form of means-test. They may also provide or facilitate access to benefits in kind, such as access to health care and other social services o Social insurance o grant access to health care and other social services or pay periodic cash benefits throughout the specific time period.(ex. old age, unemployment, employment injury, maternity, sickness, etc.) Conditional Cash Transfers (CCTs) What is it? The main idea is to provide cash to poor families on certain conditions that are linked to education, health, and nutrition. Pros of CCTs: Directly reaches poorest families, improves human capital, reduces poverty and income inequality, and breaks the inter-generational poverty cycle. CCT criticism: Exclusive focus on poor households, contrary to universal and egalitarian systems Redistribution through social expenditures o Education o Health Care o Social Services o o o o Medical Care Unemployment Retirement/ Survivor Pensions Social Security Prasad, (2008) Redistribution and Poverty Sharing and Redistribution • 2 examples of how this does not work • Pilgrims at Plymouth, Massachusetts – Community Garden – no one took responsibility they almost starved – Productivity improved when every family was responsible for their own garden • Chinese Government’s failure – Farmers were given land and told what to grow. Crop production was minimal and of poor quality – Farmers were given a choice of what to grow and were allowed to keep a proportion of the profits from the crops. Increased output from the farms and additional income for the families. Taxes – The foundation for redistribution • Tax increases usually have a negative effect on the economy – Less money for consumers to spend, invest and decreases revenue • Inflation eventually brings income up to the point that the middle class are hit by taxes originally meant for “the rich” – Tax laws do not include adjustments for inflation • Taxing the rich shifts money from the private sector to the government – People can invest and spend their money efficiently – The government spends the money based on lobbying by special interests or wastes the money in bureaucracies Taxes – The foundation for redistribution • By taxation, the government has little motive to reduce spending or control waste • Increasing the tax rates on the rich may make them leave the country or move their assets elsewhere thus reducing the tax revenue and tax base • Creates animosity between the classes by blaming rich for excesses and the poor for being lazy • Increased taxes means smaller profits and revenue to start new businesses • Efficiently run private charities receive less money with more funds going to bureaucracy that waste money and a much smaller percentage makes it to the people in need Milton Friedman’s Thoughts on Redistribution • Friedman proposed the replacement of the existing U.S. welfare system with a negative income tax – This gives the poor a basic living wage above what they earn • Friedman also argued that most government programs benefited the middle class and not the rich or poor – Higher Education – Social Security Poverty Rate and Spending On Poverty Share of Federal Taxes by Quintile Quintiles and Mean Income • • • • • • Lower Quintile $11,239 Second Quintile $29,204 Third Quintile $49,842 Fourth Quintile $80,080 Upper Quintile $178,020 Top 5% $318,052 Range $0 - $20,262 Range $20,263 - $38,520 Range $38,521 - $62,434 Range $62,435 - $101,582 Range $101,583 - ?? A Plan for Change Things that Redistribution can change • • • • Healthcare Retirement Empowerment of Workers Public Infrastructure – Roads – Schools • Pathways out of Poverty – Public Education – Universal Healthcare – Adequate Housing • Work and Family Pathways out of Poverty • Public Education – According to the United Nations education of poor children and especially females has the potential to reduce poverty by 12% – Economically disadvantaged children need approximately 40 – 100 percent more funding per child • In the United States $1,307 less is spent on the education of each economically disadvantaged child – 591 Billion will be spent for public education this year • Over $11,000 per child – this amount includes all aspects of the school system – facilities, transportation, materials and personnel this amount includes federal, state and local spending Pathways out of Poverty • Public Education – Increasing the funding for economically disadvantaged children (Approximately 23 Million) by $1,500 each would cost 34.5 billion dollars annually. (a 6% increase in funding) – If this additional funding were used fore the sole purpose of hiring teachers, 345,000 new teachers could be added to the teaching force (Assuming $100,000 per year for salary and benefits) – This would be a 10% increase in the teaching force. – For a school with approximately 350 elementary students in WV, this would mean an addition of two teachers to the ranks and reduce the average class size from 22 to 19. Pathways out of Poverty • Healthcare – Provide basic healthcare for children with site based clinics in schools – Provide low cost healthcare for adults – Provide health and wellness education to parents of children in poverty – Reduce the bureaucracy needed to run these programs to keep costs down Pathways out of Poverty • Adequate Housing – Characteristics • • • • Running water Bathrooms Safe heating and cooling systems Free of harmful materials (lead, asbestos etc.) Redistribution schemes to pay for these objectives • Eliminate bureaucratic waste by direct funding to school districts from the federal and state governments. Per pupil amounts sent to districts based on enrollment. • Remove the cap on Social Security taxes to provide additional revenue for social security to keep it solvent and free up money for other projects. – This however would compound the problem later since the no cap measure would also mean that these higher paid workers would collect higher benefits when they retire – • Eliminate many of the tax breaks for the wealthy. These in essence are a redistribution to the wealthy –(give examples from the article in the notes section. Taxation solutions Indirect taxes (regressive)- poor tend to spend higher proportion of income on goods and services than do the rich. Make indirect taxes more progressive by: • Targeting taxation on goods and services consumed at different rates by the rich and the poor. • Lower or eliminate the Value Added Tax on products which make up a large proportion of the poor household’s consumption, such as food, while increasing taxes on products generally consumed by the rich, such as luxury goods. Taxation solutions The US tax system is becoming less progressive as marginal income tax rates have decreased from 91% in the 1960s to 35% in 2003. Payroll taxes funding social security have increased from 6% to 15% with a cap at $90,000 meaning people above this income level enjoy lower tax rates. To return to a more progressive system, the US could increase funding for social expenditures by removing the income cap requiring those above the $90,000 cap to pay taxes based on their full income. References Behrendt, C. & Hagemeyer, K. (2012). Global Extension of Social Security. Retrieved from http://www.ilo.org/gimi/gess/ShowTheme.do?tid=11 Economic Policy Institute, (2010). Agenda for Shared Prosperity. Retrieved from http://www.sharedprosperity.org/ Norton, M. & Ariely, D. (2011). Building a Better America – One Wealth Quintile at a Time. Retrieved from http://www.people.hbs.edu/mnorton/norton %20ariely%20in%20press.pdf Pojman, L. & Tramel, P. (2009). Moral Philosophy, Friedrich Nietzshe: Beyond Good and Evil. Prasad, N. (2008). Policies for redistribution: The use of taxes and social transfers. Geneva, Switzerland: International Institute Welch, W. (2013). Adam Smith: Capitalism’s Founding Father. Retrieved from http://www.vision.org/visionmedia/biogra adam-smith/868.aspx phy- Template Provided By www.animationfactory.com 500,000 Downloadable PowerPoint Templates, Animated Clip Art, Backgrounds and Videos