Lecture 20

advertisement

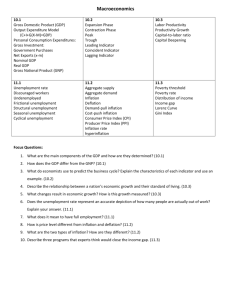

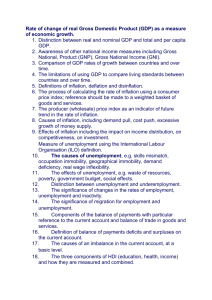

ECONOMIC POLICY • What are the problems or goals? • What are the Solutions? • Solutions generally take on incremental changes • Exceptions: War (increased spending); Recession/Depression: New Deal; TARP; Financial Bailout Macro economic goals • Economic Growth • Low Unemployment • Low Inflation I. ECONOMIC GROWTH A. How do we define and measure economic growth? 1) Supply-side or demand side GDP: Supply-side: production of durable goods (e.g., refrigerators, cars, computers, 16%), non-durable goods (consumer products, food, 22%), services (53%), and structures (homes, commercial buildings, 9%). Demand side, and divide up into what is demanded for consumption (68%), investment (15%), government (16%),and trade (12% export, 13% imports). D = C + I + G + X - M 2) Real GDP: Adjust for the fact that the value of the monetary unit may vary from one period to another. 3) Per Capita GDP: per-capita refers to dividing real GDP by the population. Rough way of comparing stand of living across times and places. 1998 world GDP of $28 trillion / world population 6 billion = per capita GDP of $6,500. U.S. GDP of $10 trillion / 290 million = GDP of $36,300 per person. B. Strengths and Weaknesses of using GDP to measure economic well-being. 1) GDP is the size of the economy, so it is by no means identical with human well being 2) leisure, the environment, health, and the presence of poverty or inequality. Other things included in GDP, like protection against crime or fixing up after a natural disaster. Basically, GDP mans only what is bough and sold. 3) Societies with higher real GDPs tend to have higher quality of life (standard of living) C. How to stimulate Growth 1. Increase Savings to stimulate investment 2. In recent years we have tried special savings incentives like IRA ad 401(k). easy (but expensiv) credit have largely offset any saving gains. 3. Reducing the government budget deficit D. Sources/Causes of Economic Growth – productivity 1) Physical Capital: ¼ real growth 2) Human Capital: 3) Technology: accounts for ½ of real growth II. LOW UNEMPLOYMENT A. Survey Definition: Bureau of Labor Statistics – Survey of people 20 and 64 years of age. Must be looking for work. In 1998 about 1/3 of the population was considered out of the labor force B. Economist Definition: Supply and demand. willing to work but can't find a job. C. Why is unemployment bad? It reduces the size of the economy, GDP and raises the need for gov't spending on welfare, unemployment. Lowering the unemployment rate by 1% would add 1% (or $100 billion dollars to the U.S. GDP) D. History of unemployment rates: low from the 1950s to 1970s, rose mid 1970s, peaked at about 12% in 1982, but have since dropped back to the earlier range of around 4-5%. When someone is E. Explanations of unemployment and policy implications: 1. Frictional: the first cause is frictional. the ebb & flow of markets, firms closing. Leads to unemployment of about 1-2% 2. Structural: laws that provide disincentives to firms to hire people and disincentives to people to find work. 1) min. wage laws, taxes on employment, mandatory health benefits, etc. 2) generous welfare/unemployment benefits. Solution? 3. Cyclical unemployment: recession and depressions. Low consumer Demand. Policy solution - government spending? Pump up the economy with temporary spending and tax cuts to create more disposable income and consumer demand and investment. F. Jobs vs. "good jobs and good wages": G. Productivity: one could argue that wages are based on productivity of workers. III. LOW INFLATION 1. What is inflation? overall increase in the level of prices, not the increase in anyone price. 2. Consumer Price Index – Bureau of Labor statistics. Consumer surveys conducted every three months help adjust the “basket” over time. VCRs, camcorders, Xbox etc. 2. Causes of Inflation: inflation caused by supply side (higher costs) called “cost-push” or from the demand side (too many dollars chasing too few goods), termed “demand-pull” i.e. war-production lows or too high wages. 4. Cycle of expectation: as opposed to a one-time rise in prices, a “cycle of expectation” becomes established in which everyone expects prices to rise, and thus acts in a way which helps them to keep rising. The expectation becomes self-fulfilling. 5. History of inflation rates: Up until 1964 typically 1-3% a year. after the war high level of demand and few non-military goods prices shoot up from 8% in 1946 to 14%. Great depression, prices drop because of low demand (deflation). In the 70s inflation rose again – maybe because of the cost of funding the great society and also fighting the Vietnam war. 6. Why is inflation bad: Some things are indexed for inflation. Adjustable rate mortgage, cost of living adjustments. unpredictability. Lending money becomes precarious. Less incentive to save money in the bank. Affects the economy by limiting the amount of capital out there to invest and borrow. Decreases productivity. 7. Hyper inflation: Germany 1920s – led to National Socialist German Workers’ Party. Argentina, Israel, Boliva in the 1980s. 400% inflation; 14% a month.