File

advertisement

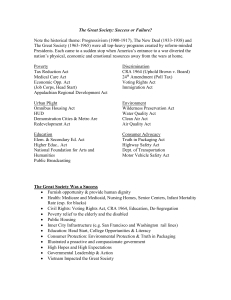

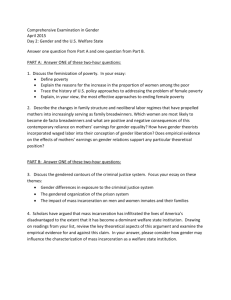

Social Welfare Policymaking Income Defining the Rich and the Poor Defining Government Involvement The Evolution of American Social Welfare Programs The Future of Social Welfare Policy Understanding Social Welfare Policy Democracy and Social Welfare Social Welfare Policy The U.S. has one of the largest income gaps in the world because income distribution is extremely unequal among different economic classes The degree of government involvement in issues of poverty has resulted in major political debate Definition: Policies that provide benefits to individuals, either through entitlements or means-testing Income: Defining the Rich and the Poor The rich have not only more income but also greater wealth in the form of stocks and other assets A small number of Americans- 1% of the total population –possess more than one-third of all wealth in the U.S. Americans overall are well-off, given their low cost of living and low taxes Debate The debate hinges on how people view the poor As receiving too much government money As “deserving” if a family has lost its breadwinner or has a legitimate reason, such as a disability, for not being able to work As “undeserving” if they abuse the system or have created conditions of poverty themselves Entitlement Programs Government benefits that certain qualified individuals are entitled to by law, regardless of need Most government funds are given through entitlement programs to people who are not poor Means-tested programs Government programs available only to individuals below a poverty line Eligibility for means-tested programs depends on how narrowly poverty is defined Poverty Defined by the government as a family income that falls below the poverty line Counts underestimate poverty because millions of people hover around the line and continually fall just below or rise just above it Income distribution The “shares” of the national income earned by various groups Income The amount of funds collected between any two points in time Wealth The value of assets owned Poverty line A method used to count the number of poor people It considers what a family must spend for an “austere” standard of living Feminization of Poverty The increasing concentration of poverty among women, especially unmarried women and their children Defining Government Involvement through Taxation Progressive the wealthy are taxed at a higher rate Current income tax Proportional Everyone is taxed at the same rate Flat tax Regressive People of lower incomes are taxed at a higher rate Sales tax or consumption tax Defining Government Involvement through Expenditures Transfer payments are given by the government directly to citizens Food stamps Student loans Social security and Medicare benefits NOTE: The elderly receive the MOST in transfer payments Evolution of American Social Welfare Programs The Great Depression proved that poverty can be beyond anyone’s control and encouraged the government to become more involved in welfare Social Security began under the New Deal; the poor became a part of the Democratic New Deal Coalition LBJ – initiated many Great Society programs to fight the War on Poverty Evolution of American Social Welfare Programs President Reagan cut the growth of many of these Great Society programs during the 1980s The system underwent a major overhaul during the Clinton administration Families receive small payments with a maximum of two years to find employment People have a lifetime max of five years on welfare States operate their own welfare programs Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) Official name of the “welfare reform” law of 1996 Temporary Assistance for Needy Families Name for public assistance to needy families Medicare Assistance with healthcare costs for the elderly Medicaid Assistance with healthcare costs for the needy Welfare Eligibility and Benefits In 1996, welfare reform legislation (The Personal Responsibility and Work Opportunity Reconciliation Act) ended federal entitlement to cash assistance (under the old Aid to Families with Dependent Children (AFDC) program). The 1996 law created a new welfare program, Temporary Assistance for Needy Families (TANF), which: limits the provision of cash assistance to families with a dependent child or pregnant woman imposes a 60 month lifetime limit on the receipt of benefits requires that a family's benefit be reduced if parents do not cooperate with child support officials denies assistance to individuals convicted of a drug felony denies assistance (for a period of 10 years) to any person convicted of fraud in the receipt of benefits in two or more states denies assistance to teen parents not living in an adult-supervised setting denies assistance to non-citizens who arrived in the United States after 1996. Criticisms of Welfare Discourages the poor from solving their own problems Make it profitable to be poor Discourages poor people from saving money The future of Social Welfare Policy Social programs have become a major component of government How they will continue to fare depends on future presidents, members of Congress, interest groups, and voters [you] Future of Social Security Highly likely that the system will go bankrupt during the twenty-first century More people will be of retirement age The cost of living is rising, so monthly payments will increase Either taxes will have to be raised or benefits will have to be cut Future of MeansTested Programs Their future is even more tenuous than Social Security Results of antipoverty programs show that poverty has not decreased Some argue that federal benefits encourage people to remain in poverty Others contend that other problems such as recessions have distorted the results Democracy and Social Welfare Influences voters’ decisions Is a factor in choosing party identification Interest groups for senior citizens are much better organized than groups for the poor (AARP) The size of the bureaucracy has grown in order to support such sweeping welfare programs