Plant Assets & Intangibles

Chapter 10

Copyright © 2007 Prentice-Hall. All rights reserved

1

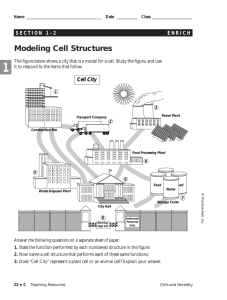

Long-lived Assets

Plant

Assets

Natural

Resources

Intangible

Assets

Depreciation

Depletion

Amortization

Copyright © 2007 Prentice-Hall. All rights reserved

2

Objective 1

Measure the cost of a plant asset

Copyright © 2007 Prentice-Hall. All rights reserved

3

Cost Principle

• Assets should be recorded at their

historical cost

• Cost of an asset – all costs necessary to

acquire the asset and get it ready for its

intended use

Copyright © 2007 Prentice-Hall. All rights reserved

4

Land and Land Improvements

Land

• Purchase price

• Legal fees

• Costs of grading and

clearing

• Additional permanent

improvements

• Not depreciated

Land Improvements Improvements with

limited life

• Driveways and

parking lots

• Sidewalks

• Fences

• Depreciated

Copyright © 2007 Prentice-Hall. All rights reserved

5

Buildings

•

•

•

•

Purchase price

Legal fees

Repairs and renovations

If self-constructed

–

–

–

–

–

–

Architectural fees

Building permits

Material

Labor

Overhead

Some interest costs

Copyright © 2007 Prentice-Hall. All rights reserved

6

Machinery and Equipment

•

•

•

•

•

•

Purchase price (less any discounts)

Transportation charges

Insurance while in transit

Sales tax

Installation costs

Cost of testing before asset is used

Copyright © 2007 Prentice-Hall. All rights reserved

7

Furniture and Fixtures

• Purchase price (less any discounts)

• Shipping charges

• Costs to assemble

Copyright © 2007 Prentice-Hall. All rights reserved

8

E10-14

• Land

Purchase price $380,000

Property tax

2,000

Title insurance

3,000

Remove and level

5,000

$390,000

Building and Land

Improvements are the

assets to be depreciated

• Building

Cost

$500,000

Land improvements

Fence

$50,000

Signage

10,000

Lighting

6,000

$66,000

Copyright © 2007 Prentice-Hall. All rights reserved

9

Lump Sum Purchases

• Assign cost to individual assets based on

relative sales values

Copyright © 2007 Prentice-Hall. All rights reserved

10

E10-15

Lot Appraised Percent of

Cost

Value

Cost

Allocated

Cost

1

$50,000 $50,000/$180,000

27.8% X $150,000

$41,700

2

60,000 $60,000/$180,000

33.3% X 150,000

49,950

3

70,000 $70,000/$180,000

38.9% X 150,000

58,350

$180,000

100%

Copyright © 2007 Prentice-Hall. All rights reserved

$150,000

11

Exercise 10-15

GENERAL JOURNAL

DATE

DESCRIPTION

REF

Land, Lot 1

Land, Lot 2

Land, Lot 3

Cash

Copyright © 2007 Prentice-Hall. All rights reserved

DEBIT

CREDIT

41,700

49,950

58,350

150,000

12

Capital Expenditures

Does the expenditure increase capacity

or efficiency or extend useful life?

YES

NO

Capital Expenditure

Debit asset

account

Expense

Debit repairs and

maintenance

expense

Copyright © 2007 Prentice-Hall. All rights reserved

13

E10-16

Capital Expenditures Expenditure benefits more

than one period. Debit an

– Purchase price

– Lubrication before machine is placed

assetin service

–

–

–

–

–

Major overhaul

Sales tax

Transportation and insurance

Expenditure that maintains

Installation

the asset in its current

Training of personnel

Expenses:

– Ordinary recurring repairs

– Periodic lubrication

– Income tax

working condition.

Debit an expense

Copyright © 2007 Prentice-Hall. All rights reserved

14

Objective 2

Account for depreciation

Copyright © 2007 Prentice-Hall. All rights reserved

15

Depreciation

• Process of allocating the cost of a plant

asset to expense over its useful life in a

rational and systematic way

Matching Principle

Copyright © 2007 Prentice-Hall. All rights reserved

16

Depreciation – Adjusting Entry

GENERAL JOURNAL

DATE

DESCRIPTION

REF

DEBIT

CREDIT

Depreciation Expense

Accumulated Depreciation

Partial balance sheet:

Building

Less Accumulated Depreciation

$120,000

(80,000)

$40,000

Book Value

Copyright © 2007 Prentice-Hall. All rights reserved

17

Factors in Computing

Depreciation

1. Cost

2. Estimated Residual Value

•

Depreciable cost = Cost – Residual Value

3. Estimated Useful Life

•

•

Physical wear and tear

Obsolescence

Copyright © 2007 Prentice-Hall. All rights reserved

18

Depreciation Methods

• Straight-line

• Units-of-production

• Declining balance

Copyright © 2007 Prentice-Hall. All rights reserved

19

Straight-Line Method

Depreciation

Expense per Year

=

Cost - Residual Value

Useful life in years

•Allocates an equal amount each year

•Depreciation is a function of time

•Appropriate for assets that generate revenues

evenly over time, like building

Copyright © 2007 Prentice-Hall. All rights reserved

20

E10-19

Straight-line

$15,000 – $3,000 / 4 years = $3,000 per yr

Year

Depr Exp for

Total

Year

Accum Depr

Year-End

Book Value

2006

$3,000

$3,000

$12,000

2007

3,000

6,000

9,000

2008

3,000

9,000

6,000

2009

3,000

12,000

3,000

Copyright © 2007 Prentice-Hall. All rights reserved

21

Units-of-Production Method

1: Compute depreciation per unit:

Cost - Residual Value

Total Units of Production

2: Compute depreciation expense:

Depreciation

is a function

of use. of units produced

Depreciation

Number

×

Thisper

is anunit

appropriate method for

asset

that

inan

the

period

depreciates due to wear and tear, like a vehicle

Copyright © 2007 Prentice-Hall. All rights reserved

22

E10-19

Units of Production

($15,000 - $3,000) / 3,000 jobs = $4.00 per job

Year

Depr Exp for

Total

Year

Accum Depr

Year-End

Book Value

$1,200

$13,800

2007

$4 x 300=

$1,200

$1,200

$4 x 900=

3,600

4,800

9,000

2008

4,800

9,600

5,400

2009

2,400

12,000

3,000

2006

Copyright © 2007 Prentice-Hall. All rights reserved

23

Double-Declining Balance Method

• Accelerated method – writes off a greater

amount of the cost of an asset in earlier

years of asset’s useful life.

• Amount of depreciation expense

recognized declines each year

Depreciation is a function of time.

This method is appropriate for assets that produce

more revenues in their early years (match higher

depreciation expense with higher revenues)

Copyright © 2007 Prentice-Hall. All rights reserved

24

Double-Declining-Balance

Method

1: Compute straight-line rate and multiply it by 2

1

Useful life in years

X2

2: Multiply beginning book value by rate

Depreciation

Double-decliningBeginning period

=

×

expense

balance rate

book value

Ignores residual

value

Copyright © 2007 Prentice-Hall. All rights reserved

25

Switchover to Straight Line

• A method employed by some companies

• Change from double-declining balance to

straight-line during the next-to-last year of

asset’s life

• Eliminates the need to use a plug figure

for depreciation expense in last year

Copyright © 2007 Prentice-Hall. All rights reserved

26

E10-19

Switch to Straight line.

Double declining

Balance

$3,750

– 3,000 / 2 years

Rate = 2/4 or 50%

Year

Depr Exp for

Total

Year

Accum Depr

Year-End

Book Value

x 50%

2006 $15,000

$7,500

$7,500

$7,500

x

50%

2007 $7,500

3,750

11,250

3,750

3,000)/2 11,625

2008($3,750 –375

3,375

2009

3,000

375

12,000

Copyright © 2007 Prentice-Hall. All rights reserved

27

E10-19

• The units-of-production method tracks the

wear and tear on the equipment most

closely

Copyright © 2007 Prentice-Hall. All rights reserved

28

Use of Depreciation Methods

10%

5%

84%

1%

Straight-line

Accelerated

Copyright © 2007 Prentice-Hall. All rights reserved

UOP

Other

29

Objective 3

Select the best depreciation

method for tax purposes

Copyright © 2007 Prentice-Hall. All rights reserved

30

Depreciation for Tax Reporting

• Modified Accelerated Cost Recovery

System (MACRS)

• Assets are classified into categories by

asset life

• Depreciation method is specified

according to category

Copyright © 2007 Prentice-Hall. All rights reserved

31

E10-20

Double-declining balance

Year 1:($140,000 x 2/10)

$28,000

Year 2:($140,000–28,000) x 2/10 22,400

$50,400

Straight-line

Year 1: ($140,000 – 40,000)/10

Year 2:

$10,000

10,000

20,000

$30,400

Copyright © 2007 Prentice-Hall. All rights reserved

32

Partial Year Depreciation

• When plant asset is acquired during the

year, compute full year’s depreciation and

multiply that by the fraction of the year the

asset is owned

Copyright © 2007 Prentice-Hall. All rights reserved

33

Revising Depreciation

• Depreciation is an estimate

– Estimated residual value

– Estimated useful life

Book value – New residual value

Remaining life in years

Copyright © 2007 Prentice-Hall. All rights reserved

34

E10-21

Cost

Residual value

Depreciable base

Depreciation expense per year

Copyright © 2007 Prentice-Hall. All rights reserved

$500,000

100,000

$400,000

/40 years

$10,000

35

E10-21

Depreciation expense per year

Accumulated depreciation

after 15 years

Copyright © 2007 Prentice-Hall. All rights reserved

$10,000

X 15 years

$150,000

36

Exercise 10-8

Book value after 15 years

Cost

Accumulated depreciation

Cost left to depreciate

Residual value

New depreciable base

Life (25 years – 15 years taken)

New depreciation per year

Copyright © 2007 Prentice-Hall. All rights reserved

$500,000

(150,000)

$350,000

(100,000)

$250,000

/10 year

$25,000

37

Exercise 10-8

GENERAL JOURNAL

DATE

Yr

Yr

DESCRIPTION

REF

DEBIT

15 Depreciation Expense

Accumulated Depreciation

10,000

16 Depreciation Expense

Accumulated Depreciation

25,000

Copyright © 2007 Prentice-Hall. All rights reserved

CREDIT

10,000

25,000

38

Fully Depreciated Assets

• If still useful, a company will continue to

use it

• Report book value on balance sheet

• Record no more depreciation

Copyright © 2007 Prentice-Hall. All rights reserved

39

Objective 4

Account for the disposal of a plant

asset

Copyright © 2007 Prentice-Hall. All rights reserved

40

Disposing of a Plant Asset

• Sell

• Exchange

• Discard

Copyright © 2007 Prentice-Hall. All rights reserved

41

Disposing of a Plant Asset

• Bring depreciation up to date

• Compare assets received with book value

of asset being disposed of to determine if

there is a gain or loss

– Gain increases net income – credit balance

– Loss decreases net income – debit balance

• Record entry to remove asset from books

Copyright © 2007 Prentice-Hall. All rights reserved

42

E10-22

Depreciation for 2006:

10,000 x 2/5 = $4,000

Depreciation for 2007 (through Sept 30)

(10,000 – 4,000) x 2/5 x 9/12 = $1,800

Accumulated Depreciation

4,000

1,800

5,800 balance

Copyright © 2007 Prentice-Hall. All rights reserved

43

E10-22

Cash Received

$6,200

Book Value of Fixtures:

Cost

$10,000

Accumulated Depreciation 5,800 4,200

Gain on Sale

$2,000

A gain is similar to a revenue and

appears on the income statement as

an “Other revenues and expenses”

Copyright © 2007 Prentice-Hall. All rights reserved

44

E10-22

GENERAL JOURNAL

DATE

DESCRIPTION

Sep 30 Depreciation Expense

Accumulated Depreciation

30 Cash

Accumulated Depreciation

Fixtures

Gain on Sale of Assets

Copyright © 2007 Prentice-Hall. All rights reserved

REF

DEBIT

CREDIT

1,800

1,800

6,200

5,800

10,000

2,000

45

Exchanging Plant Assets

Market value

of new asset

>

Book value of

old asset +

cash given

“Cost” of the new asset =

Copyright © 2007 Prentice-Hall. All rights reserved

46

Exchanging Plant Assets

Market value

of new asset

<

Book value of

old asset +

cash given

“Cost” of the new asset =

Recognize a loss for the difference

Copyright © 2007 Prentice-Hall. All rights reserved

47

E10-23

Old fixtures:

Cost

Accumulated depreciation

Book value

Cash paid

Cost of new fixtures

Copyright © 2007 Prentice-Hall. All rights reserved

$90,000

(75,000)

$15,000

100,000

$115,000

48

E10-23

GENERAL JOURNAL

DATE

1.

DESCRIPTION

REF

Fixtures (new)

Accumulated Depreciation,

Fixtures

Fixtures (old)

Cash

Copyright © 2007 Prentice-Hall. All rights reserved

DEBIT

CREDIT

115,000

75,000

90,000

100,000

49

E10-23

Old fixtures:

Cost

Accumulated depreciation

Book value

Cash paid

Cost of assets given up

Market value of new fixtures

Loss

Copyright © 2007 Prentice-Hall. All rights reserved

$90,000

(75,000)

$15,000

100,000

$115,000

110,000

$5,000

50

E10-23

GENERAL JOURNAL

DATE

1.

DESCRIPTION

REF

Fixtures (new)

Accumulated Depreciation,

Fixtures

Loss on Exchange of Assets

Fixtures (old)

Cash

Copyright © 2007 Prentice-Hall. All rights reserved

DEBIT

CREDIT

110,000

75,000

5,000

90,000

100,000

51

Objective 5

Account for natural resources

Copyright © 2007 Prentice-Hall. All rights reserved

52

Natural Resources

• Plant assets extracted from the natural

environment

• Expensed through depletion using the

units of production method

• Reported on balance sheet at cost less

accumulated depletion

Copyright © 2007 Prentice-Hall. All rights reserved

53

Depletion

• Compute depletion rate per unit:

Cost – Residual Value

Estimated total units of natural resource

• Compute depletion expense:

Number of units

Depletion

× extracted this

rate per unit

period

Copyright © 2007 Prentice-Hall. All rights reserved

54

E10-25

Mine:

Filing fee

License

Survey

Total cost

Divided by

$428,500

500

1,000

70,000

$500,000

200,000 tons = $2.50 per ton

Depletion: 30,000 tons @ $2.50/ton = $75,000

Copyright © 2007 Prentice-Hall. All rights reserved

55

E10-25

GENERAL JOURNAL

DATE

a)

b)

DESCRIPTION

REF

DEBIT

Mineral Asset

Cash

428,000

Mineral Asset

1,500

Cash

To record filing and license

fees

Copyright © 2007 Prentice-Hall. All rights reserved

CREDIT

428,000

1,500

56

E10-25

GENERAL JOURNAL

DATE

b)

c)

DESCRIPTION

REF

Mineral Asset

Cash

Paid for geological survey

Depletion Expense, Mineral

Asset

Accumulated Depletion,

Mineral Asset

Copyright © 2007 Prentice-Hall. All rights reserved

DEBIT

CREDIT

70,000

70,000

75,000

75,000

57

Objective 6

Account for intangible assets

Copyright © 2007 Prentice-Hall. All rights reserved

58

Intangible Assets

•

•

•

•

Noncurrent assets with no physical form

Provide exclusive rights or privileges

Acquired to help generate revenues

Expensed through amortization using the

straight-line method

• Written off the asset directly

Copyright © 2007 Prentice-Hall. All rights reserved

59

Patents

• Exclusive 20-year right to produce and sell

an invention

• Granted by federal government

Copyright © 2007 Prentice-Hall. All rights reserved

60

Copyrights

• Exclusive right to reproduce and sell

artistic works or intellectual property

• Issued by federal government

• Legal life – 70 years beyond life of the

creator

Copyright © 2007 Prentice-Hall. All rights reserved

61

Trademarks, Brand Names

• Represent distinctive identifications of a

product or service

Copyright © 2007 Prentice-Hall. All rights reserved

62

Franchises, Licenses

• Franchises - privileges granted by private

business or government to sell goods or

services

• Acquisition cost is capitalized and

amortized

Copyright © 2007 Prentice-Hall. All rights reserved

63

E10-26

GENERAL JOURNAL

DATE

a)

b)

DESCRIPTION

REF

Patent

Cash

DEBIT

CREDIT

600,000

600,000

Amortization Expense,

Patent

Patent

($600,000 / 8 years)

Copyright © 2007 Prentice-Hall. All rights reserved

75,000

75,000

64

E10-26

Cost

Less amortization for 4 years

(75,000 x 4)

Carrying value of patent

$600,000

300,000

$300,000

GENERAL JOURNAL

DATE

Yr 5

DESCRIPTION

REF

Amortization Expense,

Patent

Patent

($300,000 / 2 years)

Copyright © 2007 Prentice-Hall. All rights reserved

DEBIT

CREDIT

150,000

150,000

65

Goodwill

• Goodwill - excess of purchase price of a

company over the market value of the net

assets acquired

• Goodwill can only be recorded in the

purchase of another company

• Goodwill is not amortized

• Measure value of goodwill each year

– If value has increased – record nothing

– If value has decreased – recognize loss and

decrease carrying value of goodwill

Copyright © 2007 Prentice-Hall. All rights reserved

66

E10-27

Goodwill

Purchase price

Market value of net assets:

Assets

$12,000,000

Liabilities (10,000,000)

Cost of goodwill purchased

$8,000,000

2,000,000

$6,000,000

Copyright © 2007 Prentice-Hall. All rights reserved

67

E10-27

GENERAL JOURNAL

DATE

DESCRIPTION

REF

DEBIT

CREDIT

(in millions)

Other Assets

Goodwill

Liabilities

Cash

Copyright © 2007 Prentice-Hall. All rights reserved

12

6

10

8

68

Research & Development

Costs

• Expense them as they are incurred

Copyright © 2007 Prentice-Hall. All rights reserved

69

End of Chapter 10

Copyright © 2007 Prentice-Hall. All rights reserved

70