Everything You Need to Know About Cost Segregation Studies A

advertisement

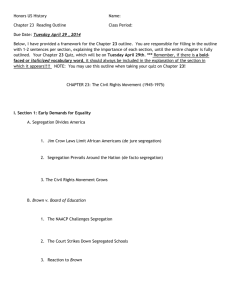

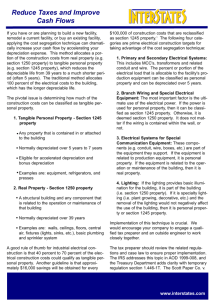

Everything You Need to Know About Cost Segregation Studies A Special Report from Gerber & Co. What Are Cost Segregation Studies? Cost segregation is the process of separating the costs of tangible personal property, other tangible property, indirect costs and land improvements from building and improvement costs. Why Do a Cost Segregation Study? • Current tax law dictates utilizing depreciable lives of 39 years for commercial real estate and 27 ½ years for residential real estate. • A cost segregation study allows taxpayers to pull out different components of total building cost which will enable them to utilize much shorter depreciable lives as follows: • Land Improvements • Furniture and Fixtures • Machinery & Equipment 15 yr 7 yr 5 yr Does the Building Need to be “New” in Order to Justify a Study? No. A Cost Segregation study could be performed on a building acquired after 1986 which is when the Tax Reform Act of 1986 changed depreciable lives on real property If the Building Was Placed in Service in the Past, How do You Change Prior Years’ Depreciation? The correction of depreciation qualifies as a change in accounting method for IRS purposes. In addition to changing the depreciation on a go forward basis, on the next tax return filed, you can take the deduction for prior years in 1 year. If It Is a New Building, What Is the Process? A coordination of effort with the client, the general contractor and the architect. • Plans and blueprints are reviewed to highlight specific areas for considerations. • Cost budget sheets are reviewed and reconciled to actual amounts spent. If It Is a New Building, What Is the Process? (continued) • • A physical walk through of the property during construction helps document specific items to be considered. Cost allocation of indirect costs such as labor and general conditions. CLIENT CPA GENERAL CONTRACTOR ARCHITECT The Hospital Corporation of America Challenges the IRS In this 1997 case, the Tax Court concluded: Certain assets in the hospital facilities could be considered personal property and depreciated over a 5-year period The IRS Response to the HCA Ruling 1. 2. Action on Decision (September 3, 1999) “We acquiesce in this decision….The issue as to whether the various disputed items are structural components or tangible personal property is a factual question.” Memorandum (April 1, 1999) “…the use of cost segregation studies must be specifically applied by the taxpayer.” Different Types of Property Are Depreciated at Different Rates Type of Property Commercial Residential Land Improvements Tangible Personal Depreciation Rate 39 years 27.5 years 15 years 5 or 7 years Which Properties Are Candidates for Cost Segregation Studies? • Commercial properties (offices, retail, warehouses) or apartment buildings with construction cost or purchase price over 1 million • New construction Remodels/rehabilitations after 1986 Purchase of existing facility after 1986 Types of Facilities That Can Benefit from Cost Segregation Studies • • • • • • • • • • • • Warehouses Grocery Stores Retail Banks Restaurants Apartments Offices Hospitals Manufacturing Sports/Recreation Hotels Leaseholds Average Percentage of Reclassified Costs Benefits of Cost Segregation Cost segregation studies enable owners to: • Increase cash flow through a reduction in federal income tax liability • Justify accelerated depreciation of certain improvements • Write off the amount of allowable past accelerated depreciation over 1 year by filing Form 3115 How Much Have Local Property Owners Saved? Representative recent studies: Facility Office Building Retail Center Art Gallery Cost Cumulative Present Value $ 5.1 million $18.0 million $ 3.0 million $ 150,000 $1,200,000 $ 90,829 The average return is approximately $11 for every $1 invested in a study. Bonus Depreciation Means Greater Savings • 50% of the cost of qualifying assets purchased after May 6, 2003 and placed in service before 2005 can be depreciated in the first year. 30% of the cost of qualifying assets placed in service between September 10, 2001 and May 5, 2003 can be depreciated in the first year. Qualifying assets are generally assets with a depreciable life of 20 years or less. Bonus depreciation applies only to original use of the asset. • Watch out for used equipment! Which Elements Are Considered Structural? • • • • • • • • • Walls partitions, floors, ceilings Windows and doors Central air conditioning and heating units Plumbing and plumbing fixtures Electrical wiring and fixtures Chimneys Stairs, escalators, and elevators Sprinkler systems, fire escapes Other components relating to building maintenance Personal Property Must Meet Specific Criteria • Is the property capable of being moved, and has it in fact been moved? • Is the property designed or constructed to remain permanently in place? • Are there circumstances which tend to show that the property may or will have to be moved? Personal Property Must Meet Specific Criteria (continued) • How substantial a job is removal of the property and how time consuming is it? • How much damage will the property sustain upon its removal? What is the manner of affixation of the property to the land? Source: Hospital Corporation of America v. Commissioner Examples of Personal Property • • • • • • • • • • • • Architectural millwork Carpeting and padding Electrical wiring to personal property Plumbing service to personal property Moveable partitions Security systems Exhaust equipment Decorative lighting Emergency generators Land improvements Signage Wall coverings and window treatments Methodology Is Crucial to IRS Acceptance In its memorandum of April 1, 1999 regarding the HCA case, the IRS notes: “An accurate cost segregation study may not be based on non-contemporaneous records, reconstructed data, or taxpayer’s estimates or assumptions that have no supporting records. Thus cost segregation studies should be closely scrutinized by the field.” What Qualifications Are Needed to Prepare a Supportable Study? The cost segregation study preparer must: Understand applicable Internal Revenue Code, Tax Court rulings, IRS Actions on Decisions, Chief Counsel’s Advisories, Technical Action Memoranda, and other documents relating to depreciation of personal and real property What Qualifications Are Needed to Prepare a Supportable Study (con’t) • Understand the procedures necessary to develop a report that can withstand IRS scrutiny • Understand architectural documents • Understand construction methods and materials Which Properties Are Not Candidates for Cost Segregation? • • • Properties that will be sold within two years Properties with construction cost or purchase price below $1 million Properties owned by entities that do not have taxable income Passive Activity Losses • If the beneficial owner that holds the property generates a passive loss, this loss may not be deductible in the current year unless there is also passive income. A loss is considered passive if the taxpayer does not meet “material participation” standards. The passive activity loss may be carried forward indefinitely to offset passive income generated in future years. At-Risk Loss Rules • The difference between the net loss and the owner’s basis will be non-deductible if a loss generated for the current year exceeds the owner’s basis in the company. Example: A loss creates a negative capital account in a partnership or LLC, and the partner has no basis in underlying debt on the property. The at-risk loss may be carried forward indefinitely to offset future income in the property. Why Select Gerber & Co. for Cost Segregation Studies Our firm's accounting professionals - working closely with our specially trained engineers - have reviewed over $5 billion worth of property for Cost Segregation. Our client base includes a broad spectrum of industries that can benefit and have obtained benefits from these studies We have personnel who understand construction methods and documents.