Matias Vernengo

advertisement

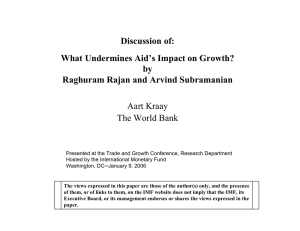

Monetary Policy for Aid-Receiving Countries Matías Vernengo Introduction Most people would recognize the moral imperative of the world’s rich to help the world’s poor. Even the anti-aid lobby accepts the notion that humanitarian aid flows are important and useful in averting crisis, but they believe it should not be used for long-term economic development. Over the last decade an intense debate on the effects of aid has led to a more critical view of its effects on long term economic development. Rajan and Subramanian (2005) suggest that aid inflows lead to overvaluation of domestic currencies, and reduce external competitiveness. In this view, a type of financial Dutch Disease is behind the poor correlation between aid inflows and growth. Monteray Policy: Theoretical Problems There is a consensus that aid inflow may lead to an overvaluation of the currency, but there is a clear disagreement about what countries should do in that case. Historically aid inflows are very volatile and monetary policy must be used to minimize the effects of aid volatility on foreign exchange markets and the balance of payments. Rajan and Subramanian (2005) argue that aid inflows, which increase the supply of foreign exchange, lead to an appreciation of the currency, and, thus, foreign aid can hurt the traded sector and lead to lower rates of growth (Dutch Disease). Conventional View An increase in aid inflows leads to an increase in money supply. This situation is associated to a worsening of the trade balance, since the increase in money supply reduces interest rates and stimulates consumption. Consumption, in turn, promotes higher imports and a negative impact on the trade balance. In this view, if the central bank sells bonds to sterilize the increase in money supply, it would undo the negative effects of aid inflows. Also, foreign aid can be given as budgetary support, and fiscal spending can be delayed, maintaining or even improving fiscal balances. In other words, fiscal policy should be contractionary and complement the contractionary monetary stance. Alternative View Aid inflows lead to an appreciation of the exchange rate. In contrast to the conventional model, contractionary monetary policy, by raising the rate of interest leads to an appreciation of the exchange rate. In particular, if sterilization leads to lower prices for bonds and higher rates of interest, then it leads to an appreciation of the currency. In other words, contractionary monetary policy compounds the appreciation caused by aid inflows, and further reduces the external competitiveness of the economy. It is possible that aid inflows go hand in hand with a depreciation of the currency, if the effect of inflows on the exchange rate is relatively small, and if money supply is not completely sterilized and, more importantly, the central bank is not concerned about possible inflationary pressures. In that case, a more loose monetary policy may be pursued in spite of aid inflows, and lower rates of interest would lead to depreciation. Policies Compared There might be a policy dilemma in the situation that monetary laxity is required to maintain a depreciated exchange rate, and monetary contraction is required because the economy is over-heated. In the alternative model, an expansionary monetary policy, rather than a contractionary one, is needed to maintain a competitive exchange rate. This is probably the most significant difference in the two models. This implies that one possible policy alternative would be to try to maintain the exchange rate as depreciated as possible without leading to inflationary pressures, what has been termed a stable but competitive real exchange rate (SCRER) strategy (Frenkel and Taylor, 2006). Aid and Overvaluation: Empirical Relation Rajan and Subramanian (2005) studied the relation between aid and overvaluation, and found that there was a strong correlation. Also, they tested the strength of the correlation and concluded that it becomes stronger over time, in particular, the correlation was stronger in the 1990s than in the previous two decades. We find similar effects for a set of 74 countries in a cross country regression. We find that an increase of 1 percent in the aid-to-GNI inflow leads to an overvaluation of almost 1.6 percent of the domestic currency. It is important to note, however, that an increase in 1 percent of the aid-to-GNI inflow is sizeable whereas an appreciation of 1.6 percent is relatively small. 400 Real Overvaluation = 104.7 + 1.6 Aid (20.8) (2.6) 300 32 200 73 59 646952 58 61 0 100 47 4349 66 48 63 35 62 27 68 29 20 39 22 41 26 74 51 45 34 65 44 42 33 30 6 46 55 70 18 40 60 28 5 19 56 21 25 15 388 71 54 7 53 57 1731224 37 13 36 1 9 14 50 31 23 164 11 2 10 72 67 0 10 20 aid overvalue 30 Fitted values 40 Problems with the empirical analysis However, the correlation vanishes when we break it by regional sets. There is no correlation between aid and real overvaluation in Asian and African cross-country data. The negative correlation suggests that the opposite might be the case, and that aid inflows are associated with real depreciation. However, the correlations are not significant in statistical terms. It seems that the general positive correlation is fundamentally associated to the Latin American experience. One possible conjecture about the strong correlation between real exchange rate overvaluation and aid inflows in Latin America may be associated to a greater concern with high inflation in the region. The long history of high inflation might have produced an environment in which central banks are overly cautious about inflationary pressures. In that case, it is likely that relatively contractionary policies might have been pursued more often in the region. If this is the case the Latin American experience cannot be extended to other regions. 120 Asian Countries ISR IRN 100 KOR SYR JOR TURIND PHL 80 SGP MYS BHR LKA PAK NPL THA IDN 60 BGD 0 5 10 aid overvalue Fitted values 15 200 ZMB COG CMR EGY 150 NGA SLE MRT CIV NER SDN DZAZWE GAB 100 BFA RWA TCD GMB BDI TZA SEN CAF ZAR KEN TGO MAR BWA LSO TUN MWI GHAMDG GIN ETH UGA ZAF 50 Real Overvaluation 250 African Countries MOZ 0 10 20 Foreign Aid %GNI overvalue 30 Fitted values 40 400 Latin American Countries 200 300 NIC HND BOL SUR HTI 0 100 SLV CHL ECU PER PAN JAM ARG BRA VEN BRB DOM CRI URY TTO MEX COL 0 5 10 aid overvalue Fitted values 15 Conclusions If one is concerned with the effect of scaling up aid inflows to finance the HIV/AIDS pandemic it seems that Sub-Saharan Africa is the main region that one must be concerned with, as indicated by the HIV prevalence rates. It would be particularly problematic if contractionary monetary policy is used to control inflation, and restrict the possible effects on the exchange rate in a region in which there is no evidence for overvaluation. The HIV/AIDS pandemic may very well have significant effects on productivity and human development. Human capital development would have a positive impact on productivity, which in turn would translate into lower unit labor costs and higher competitiveness. Thus, an expansionary monetary policy that supports fiscal expansion associated with the combat of the pandemic may actually increase labor productivity and reduce the risks of inflation and currency overvaluation, which are often cited as reasons for monetary contraction.