Losses

advertisement

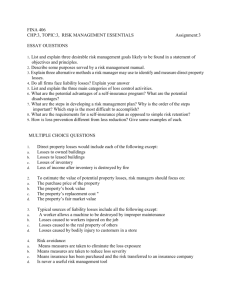

Chapter 7 Losses - Deductions and Limitations Kevin Murphy Mark Higgins ©2008 South-Western Definition of Losses Annual (Activity) Losses result when an entity’s deductions for the period exceed its income Transaction Losses result from the disposition of an asset © 2008 South-Western Transparency 7 -2 Concept Review Losses may result from the disposition of an asset because of the capital recovery concept. © 2008 South-Western Transparency 7 -3 Concept Review Most of the classification rules for deductions also apply to losses, because losses also result when deductions exceed income. © 2008 South-Western Transparency 7 -4 Concept Review The deductibility of losses is a matter of legislative grace and is based on the ability-to-pay concept. © 2008 South-Western Transparency 7 -5 General Scheme for Treatment of Losses Figure 7-1 Realized loss Annual loss Transaction loss Trade or business loss Passive Activity Trade or business loss Investmentrelated loss Personal use loss NOL deduction Loss allowed or loss deduction suspended Ordinary loss Capital loss limitations Nondeductible © 2008 South-Western Transparency 7 -6 Annual Losses: Net Operating Loss Incurred in trade or business operations Caused by business expenses May not be caused by investment or personal expenses Treatment No tax in year NOL occurs Carry-back 2 years Carry-forward unused NOL 20 years May elect to forego carry-back © 2008 South-Western Transparency 7 -7 Annual Losses: Tax Shelter Losses Tax shelters are activities designed to minimize the effect of tax on wealth accumulation. Dominant business purpose is lacking Primary motivation is tax reduction Are often vehicles for tax law abuse © 2008 South-Western Transparency 7 -8 Tax Shelter Losses At-Risk Rules At-Risk Rules disallow the deduction of artificial losses Loss deduction limited to amounts actually “atrisk” To determine amounts actually at-risk, take the amount of cash or other assets contributed and Add debts for which taxpayer is responsible Adjust for share of income (loss) from the activity Reduce by amount of withdrawals © 2008 South-Western Transparency 7 -9 Tax Shelter Losses Passive Activity Loss A passive activity is any trade or business in which the taxpayer does not materially participate. Passive Activity Loss Rules disallow the deduction of passive activity losses from other forms of income © 2008 South-Western Transparency 7 -10 Passive Activity Loss Definition Three classifications for activities: Portfolio income: unearned income derived from holding investments Active income: earned income Passive income: earned or unearned income from a trade or business in which a taxpayer does not materially participate © 2008 South-Western Transparency 7 -11 Passive Activity Loss Taxpayers subject to the limitations: All non-corporate taxable entities Conduit entity passive losses flow-through to owners Taxpayers not subject to the limitations: Publicly held corporations PAL can offset active and portfolio income Closely held corporations PAL can offset active income, but not portfolio © 2008 South-Western Transparency 7 -12 Passive Activity Loss General Rules for Limitations Passive activity losses must be netted against passive activity income Net passive losses are not deductible Net passive gains are reported with other income © 2008 South-Western Transparency 7 -13 Passive Activity Loss Exception for Rental Real Estate By definition, all rental activities and limited partnership interests are passive But, taxpayers who materially participate in rental real estate business are allowed to offset any losses against other active or portfolio income © 2008 South-Western Transparency 7 -14 Passive Activity Loss Exception for Rental Real Estate And, taxpayers who are active participants in rental real estate business may offset a portion of losses Must own at least 10% interest in the activity Must have significant and bona fide involvement © 2008 South-Western Transparency 7 -15 Active Participants in Real Estate Active Participation Exception permits up to $25,000 of rental real estate loss to be deducted annually Deduction amount is reduced by $0.50 for each dollar of AGI over $100,000. For AGI over $150,000, no allowed loss deduction remains. © 2008 South-Western Transparency 7 -16 Passive Activity Loss Disposition of Passive Activities Excess (suspended) losses must be accounted for in the year of disposition Disposition by sale frees the suspended loss to offset income of any other activity First, offsets other passive income Second, offsets gain from disposal Third, any remaining PAL offsets ordinary income © 2008 South-Western Transparency 7 -17 Disposition of Passive Activities Disposition upon death leaves the passive activity in the decedent’s estate Passive activity with unrealized gain Beneficiary takes passive activity with steppedup basis Released excess loss is deductible against other income, but Any unrealized gain on activity decreases amount of suspended loss to release Passive activity with unrealized loss No suspended loss is released © 2008 South-Western Transparency 7 -18 Transaction Losses Transaction losses result from the disposition of business, investment or personal-use assets. © 2008 South-Western Transparency 7 -19 Transaction Losses: Trade or Business Losses Business casualty and theft losses result from damage caused by a sudden, unexpected and/or unusual event For property fully destroyed, deduct the adjusted basis less insurance recovery For property partially destroyed, deduct the lesser of the property’s adjusted basis, or the decline in the property’s value © 2008 South-Western Transparency 7 -20 Transaction Losses: Investment-Related Losses Net capital losses result from netting short-term and long-term capital gains and losses Individual taxpayers may deduct only $3,000 annually Corporate taxpayers may not deduct any net capital loss Carry-back for 3 years, then forward for 5 © 2008 South-Western Transparency 7 -21 Transaction Losses: Investment-Related Losses Losses on Small Business Stock may be deducted up to $50,000 per person ($100,000 per married couple) per year Small business = a corporation with capitalization of less than $1 million Stock must have been bought directly from corporation Excess over $50,000 ($100,000) is netted with other capital gains and losses © 2008 South-Western Transparency 7 -22 Transaction Losses: Investment-Related Losses Losses on Related Party Sales are disallowed because they generally fail the arm’s length transaction concept Loss is carried forward with the property Gain from later sale may be offset by deferred loss Loss cannot be created or increased by using the deferred loss © 2008 South-Western Transparency 7 -23 Transaction Losses: Investment-Related Losses Wash Sale losses are disallowed because the sale violates the substance-over-form doctrine A wash sale occurs when a security is sold at a loss, and during +/- 30 days of the sale the seller buys substantially identical securities Disallowed loss amount is added to the basis of the replacement security © 2008 South-Western Transparency 7 -24 Transaction Losses: Personal Use Losses Losses from the disposition of personal use assets are generally not deductible Exception exists for personal casualty and theft losses © 2008 South-Western Transparency 7 -25 Transaction Losses: Personal Casualty and Theft Losses Loss is the lesser of The property’s adjusted basis, or The decline in the value of the property (repair cost) Loss is reduced by Insurance proceeds received, $100 per event (Administrative convenience), and 10% of AGI per year © 2008 South-Western Transparency 7 -26