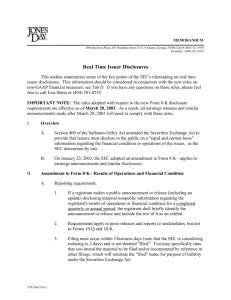

(Form-8-K-Full-Form-with-Instructions-Links

advertisement