Graham Stokoe - How do Private Equity Investors Create Value in

advertisement

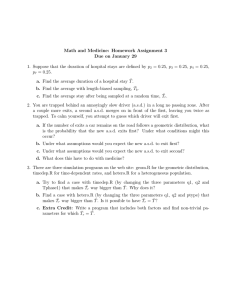

How do private equity investors create value in South Africa? A joint study of private equity exits in Africa by EY and AVCA Presentation at SAVCA/FT/EMPEA Conference | 11 February 2014 About the study ► Annual study of African exits in partnership with AVCA, now in its 2nd year ► Looks at how PE firms create value in portfolio companies in Africa that have now been fully exited ► EY has done similar studies in Europe, North America, Australasia and Latin America South Africa: ► Identified 85 exits from 2007-2013 across South Africa ► Interviewed 13 PE firms on 41 exits in South Africa Page 1 Special thanks to SAVCA members who have given their time and energy to provide information for this Study. Exit activity in South Africa Exit route, by exit year, exit population in South Africa Number of PE exits in South Africa, 2007–13 2013 20% 40% 40% 2012 33% 25% 42% 2011 17% 8% 8% 67% 2010 7% 14% 29% 50% 2009 25% 75% 17 16 2008 18% 18% 14 55% 12 2007 7% 14% 14% 13 64% 8 Creditors/banks Government/DFIs IPO PE Private Stock sale on public market Trade 4 2007 Source: How do private equity investors create value?: 2014 Africa Study, EY and AVCA, 2014. Based on preliminary data. Page 2 2008 2009 2010 2011 2012 2013 Exit activity in South Africa – by sector Industrial goods is the most active sector for exits Food & beverage 5% 19% Industrial goods Retail 5% 16% Technology Automobiles & Parts 2% 12% Construction & materials Mining and metals 2% 11% Business services Media 1% 7% Financial services Personal & household 1% 6% Healthcare Travel & leisure 1% 6% Telecom Utilities / Oil & Gas 1% 5% Agriculture / Forestry Source: How do private equity investors create value?: 2014 Africa Study, EY and AVCA, 2014. Based on preliminary data. Page 3 Exit activity in South Africa – by size Number of exits in South Africa, by entry EV (US $m) >75 22% 1-10 48% 30-75 15% 10-30 15% Source: How do private equity investors create value?: 2014 Africa Study, EY and AVCA, 2014. Based on preliminary data. Page 4 5 key findings 1.5x 53% 82% 1.5x relative to market return 53% had access to PE firm’s network 82% had governance changes Source: How do private equity investors create value?: 2014 Africa Study, EY and AVCA, 2014. Based on preliminary data. Page 5 85% 56% 85% deals where 56% sold to trade incumbent buyers management teams backed Exit enablers Leverage networks and relationships – most exits are proprietary and exclusive 1. “The exit came via referral from intermediaries who said there was some interest from a strategic. It had to be the right price to get the sponsor to exit” 2. Start exit preparation early “Two years prior to sale, we re-positioned and re-branded the company, and built the momentum carefully” 3. Ensure continuity of management teams or clear succession planning – it gives buyers confidence “The management team typically have golden handcuffs for 3 years after we exit” 4. Take advice on currency exposure/ risks “How a deal is structured is key. With currency fluctuations and other external events, a pure vanilla equity exposure can be risky" Page 6