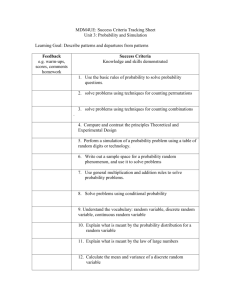

Handout 5

advertisement

Lecture Note 5

Discrete Random Variables

and Probability

Distributions

©

Random Variables

A random variable is a variable that

takes on numerical values determined

by the outcome of a random experiment.

Discrete Random Variables

A random variable is discrete if it

can take on no more than a

countable number of values.

Discrete Random Variables

(Examples)

1. The outcome of a roll of a die.

2. The number of defective items in a

sample of twenty items taken from a

large shipment.

Continuous Random Variables

A random variable is continuous if

it can take any value in an interval.

Continuous Random Variables

(Examples)

1.

2.

3.

4.

Heights of students in a class

Average temperature in November

The income in a year for a family.

The amount of oil imported into the

U.S. in a particular month.

Discrete Random Variables

We will study the fundamental concepts

of discrete random variables, namely (1)

Probability Distribution Function and (2)

Cumulative Probability Function.

First, we will learn the notation of the

Probability Distribution Function

Understanding the notation for

the probability distribution

function

Suppose you are about to roll a die. Then,

the number you would get after the roll is

a discrete random variable. Let X denote

this random variable.

Then this random variable X can take 6

possible outcomes from S={1, 2, 3, 4, 5, 6}.

Understanding the notation for the

probability distribution function, contd

Then, the probability that the random variable X

takes the value 1 (i.e., the probability that you

get 1 after rolling the die) is 1/6. This can be

conveniently expressed using the following

notation:

P(1)=P(X=1)=1/6

Similarly, we have

P(2)=P(X=2)=1/6

P(3)=P(X=3)=1/6

.

.

P(6)=P(X=6)=1/6

Understanding the notation for the

probability distribution function, contd

We can generalize the notation from the

previous slides to other discrete random

variables. Let X be any discrete random

variable which takes k possible values

from S={x1, x2, …, xk}

Conventionally, we use capital letter X

to denotes the random variable, and

small letter x to denote the possible

values that X can take.

Understanding the notation for the

probability distribution function, contd

Now, let x be any values from S={x1, x2, …, xk}

Then, the probability that the random variable X

takes the value x can be written as:

P(x)=P(X=x)

This notation is what it is called “Probability

Distribution Function”. The next slide re-iterates

this definition.

Probability Distribution Function

The probability distribution function, P(x),

of a discrete random variable expresses the

probability that X takes the value x, as a

function of x. That is

P( x) P( X x), for all values of x.

Probability Distribution Function

-Exercise 1Ex 1-1: Suppose you roll a die. Let X be

the random variable for this experiment.

Find the probability distribution function

P(x) by completing the table in the Excel

Sheet “Probability Distribution Function

Exercise”.

Ex 1-2: Plot the probability distribution

function.

Probability Distribution Function

-Exercise 2Consider the following game. You toss a coin. If

you get the heads, you receive \100. If you gets

the tails, you receive nothing.

The payoff for this game is a discrete random

variable. Let X denote this random variable.

Find the probability distribution of this random

variable by completing the table in “Probability

Distribution Function Exercise”.

Required Properties of Probability

Distribution Functions of Discrete

Random Variables

i.

ii.

Let X be a discrete random variable with

probability distribution function, P(x). Then

P(x) 0 for any value of x

The individual probabilities sum to 1; that is

P( x) 1

x

Where the notation indicates summation over

all possible values x.

Cumulative Probability Function

The cumulative probability function, F(x0),

of a random variable X expresses the

probability that X does not exceed the value

x0, as a function of x0. That is

F ( x0 ) P( X x0 )

Where the function is evaluated at all values x0

Cumulative Probability Function

-Example 33-1: Let X be the random variable for a roll

of a die. Find F(1), F(2), F(3), to F(6). Use

the Excel sheet, `Probability distribution

function exercise’.

3-2: Plot F(x) and x.

Derived Relationship Between Probability

Function and Cumulative Probability

Function

Let X be a random variable with probability function

P(x) and cumulative probability function F(x0). Then

it can be shown that

F ( x0 ) P( x)

x x0

Where the notation implies that summation is over all

possible values x that are less than or equal to x0.

Expected Value

Expected value is a similar concept as the

average. More specifically, it is the weighted

average with the weight given by the

probability of each outcome.

For example, consider the following game. You

toss a coin. If you get the heads, you receive

\100. If you get the tails, you receive nothing.

Then the expected payoff for this game is

\100×(probability of getting \100)

+ \0×(probability of getting \0) = \50

More formally, expected value is defined as

follows:

See next slide.

Expected Value

The expected value, E(X), of a discrete random

variable X is defined

E ( X ) xP( x)

x

Where the notation indicates that summation

extends over all possible values x.

The expected value of a random variable is

called its mean and is denoted x.

Understanding the notation of

the expected value

Let X be the random variable which takes

a value in S={x1, x2,..,xk}.

Then the expected value of X is computed

as follows. See next slide

Random

variable X

P(x)

xP(x)

x1

P(x1)

x1P(x1)

x2

P(x2)

x2P(x2)

:

:

:

xk

P(xk)

xkP(xk)

μX=

k

x P( x )

i 1

k

k

Expected Value Exercise

-Exercise 4 Let X be the random variable that

shows the number of house purchase

contracts that a real estate agent can

achieve in a month. The probability

distribution of X is given by the

following.

Compute the expected number of

house purchase contracts that the real

estate agent can achieve in a month.

x

0

1

2

3

4

5

6

P(x)

0.05

0.07

0.12

0.2

0.3

0.2

0.06

Expected Value: Functions of

Random Variables

Let X be a discrete random variable with

probability function P(x) and let g(X) be

some function of X. Then the expected

value, E[g(X)], of that function is defined as

E[ g ( X )] g ( x) P( x)

x

Expected Value: Functions of

Random Variables

-Exercise 5Continue using the real estate agent example.

Suppose that the monthly salary for the real

estate agent is given by:

g(x) =$1000+ $1500*x

Ex 5-1: Find the expected monthly salary of the

agent. Use the “Probability Distribution

Function Exercise” Excel Sheet.

Variance and Standard Deviation

Let X be a discrete random variable. The

expectation of the squared deviation about the

mean, (X - x)2, is called the variance, denoted

2x and is given by

E ( X x ) ( x x ) P( x)

2

x

2

2

x

The standard deviation, x , is the

positive square root of the variance.

Often we use the Var(X) to denote the variance

and SD(X) to denote the standard deviation

Understanding the procedure to

compute the variance

The table in the next slide summarizes the

procedure to compute variance.

Variable P(x)

X

xP(x)

(x- μX)2P(x)

x1

P(x1)

x1P(x1)

(x1-μX)2P(x1)

x2

P(x2)

x2P(x2)

(x2-μX)2P(x2)

:

:

:

:

xk

P(xk)

xkP(xk)

(xk-μX)2P(xk)

Sum=μX Sum=σ2X

Variance and Standard Deviation

-Exercise 6Continue using the real estate

agent example. Using the table

in the “Probability Distribution

Function Exercises” Excel sheet,

answer the following questions:

Ex 6-1 Compute the variance

Ex 6-2 Compute the standard

deviation

x

0

1

2

3

4

5

6

P(x)

0.05

0.07

0.12

0.2

0.3

0.2

0.06

Summary of Properties for Linear

Function of a Random Variable

Let X be a random variable with mean x , and

variance 2x ; and let a and b be any constant fixed

numbers. Define the random variable Y = a + bX.

Then, the mean and variance of Y are

and

Y E(a bX ) a b X

2

Y

Var (a bX ) b

2

so that the standard deviation of Y is

Y b X

2

X

Linear Function of a Random

Variable

-Exercise 7 Continue using the example of the real estate agent from

exercise 4, 5, and 6.

Suppose that the monthly salary for this agent, Y, is

determined in the following method:

Y=$1000+ $1500*X

Ex 7-1: Compute E(Y) using the formula in the previous

slide.

Ex 7-2: Compute the variance and standard deviation of

Y

Standardization of a Random

Variable

Let X be a random variable with mean X and

standard deviation X. Define a new random

variable Z as

Z

Then

E(Z)=0

Var(Z)=1

X X

X

Exercise 8

Continue using the real estate agent

example. Let X be the random variable for

the possible number of contracts the agent

can achieve in a month.

Standardize X using the formula in the

previous slide, and verify that it has mean

zero and variance 1.

Reviews of Combinatorics and

Common discrete distributions

Review of Combinatorics

1. Number of orderings

2. Number of combinations

3. Number of sequences of x Successes in n Trials

Common discrete distributions

1. Bernoulli Distribution

2. Binomial Distribution

Stock Price Movement Example

To motivate the study of combinatorics

and the discrete distributions, let us

consider a simple example of a stock price

movement. The example will utilize

combinatorics and distributions.

Stock Price Movement Example

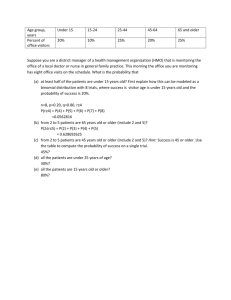

The price of Stock A today is $10. At the end of

each month the price of the stock A either goes

up by the factor of 1.2 with probability 0.4, or

goes down by the factor of 0.9 with probability

0.6.

This means that, if the price of the stock goes up

this month, then the price of the stock in the

second month will be $10×1.2 =$12. If the price

of the stock goes up this month, and goes down

in the second month, the price of the stock in the

third month will be $10×1.2×0.9 = $10.8.

Stock Price Movement Example, Contd

Suppose that you make the following contract

with a stock broker:

“You have the right to purchase a share of stock

A at the price equal to $37.61 at the beginning of

the 13th month.

Then, if the actual market price of stock A is

higher than $37.61, you purchase the stock and

immediately sell it to make a positive profit

(ignoring fees associated with the contract and

transaction fee). If the actual price is lower than

37.61, you do not have to exercise the right.

Then consider the following question:

See next slide

Stock Price Movement Example,

Contd

Question

What is the probability that you make some

strictly positive profit from this contract

(ignoring all the fees associated with the

contract and buying and selling of the share)?

Answer to this question requires tools such as

combinatorics and Binomial distribution.

In the following slides, we will review

combinatorics and some common distributions.

After studying these concepts, we will come

back to the question.

Review of Combinatorics

-Number of orderingsYou have n cards numbered from 1 to n.

The number of ways you can order this

card is given by

n!=n×(n-1) ×(n-2) ×…×3×2×1

n! reads n factorial

0! is defined to be 1.

Number of ordering example

There are 5 cards numbered from 1 to 5.

What is the number of ways you can

order this card?

Review of Combinatorics

-CombinationsSuppose there are n cards numbered from 1 to

n. If you take x cards out of n cards, the number

of possible combinations of the cards is given by

C

n

x

n!

x!( n x )!

Where n!=n×(n-1) ×(n-2) ×…×3×2×1

Cnx reads n choose x.

Combinations

-ExampleA personnel officer has eight candidate to

fill four similar positions. What is the total

number of possible combinations of four

candidates chosen from eight?

Review of combinatorics

- sequences of x Successes in n

TraialsConsider a random trial where there are

only two outcomes, “Success” or

“Failure”.

Then, if you make n independent trials,

the number of sequences that contains

exactly x successes is equal to Cnx.

Sequences of Successes

-ExerciseConsider tossing a coin 10 times. Find the

number of ways the head appears exactly

4 times.

Number of sequences

-ExerciseSuppose that the figure below is a road

map of a certain area. If you start from

point A and walk to point B, how many

possible routes can you take? (Suppose

you do not walk back.)

B

A

Bernouli Trial

Bernouli Random Trial with success

probability .

This is a random experiment with two

possible outcomes, “success” or “failure”,

where the probabilities are given by

P(Success) =

P(Failure) = 1-

Bernouli Random Variable

Consider a Bernouli Trial with P(Success)= .

Define a random variable X in the following

way.

X=1 if the Bernouli random trial turn out to be success

X=0 if the Bernouli random trial turns out to be a

failure.

Then, X is called a Bernouli Random Variable with

success probability .

Bernouli Distribution

Consider a Bernouli random variable X

with success probability . Then the

probability distribution function for X is

called Bernouli Distribution with success

probability . This is given by

P(0)=(1- ) and P(1)=

Bernouli Distribution

-ExampleConsider the following game. You toss a

coin. If you get the heads, you receive $1.

If you get the tails, you receive nothing.

Let X be the random variable for the

payoff of this game.

X has the Bernouli distribution with

success probability 0.5.

Mean and Variance of a

Bernoulli Random Variable

The mean is:

X E ( X ) xP( x) (0)(1 ) (1)

X

And the variance is:

X2 E[( X X ) 2 ] ( x X ) 2 P( x)

X

(0 ) (1 ) (1 ) (1 )

2

2

Binomial Distribution

-ExampleI use an example to illustrate Binominal

Distribution.

You inspect a production line by randomly

checking the items. It is known that 5% of the

products from this production line are defect

items.

Suppose you randomly choose 4 items from the

production line. Then, the number of defect

items you would find is a discrete random

variable.

Binomial Probability

-Examples, ContdLet X be the number of defect items in the

4 randomly picked items. What is the

probability that exactly 2 of them are

defect items?

To answer to this question, first, consider

the possible sequences that 2 defect items

are picked.

The number of

possible sequences

you pick 2 defect

items is given in the

table. D denotes the

defect item, and G

denotes the good

item.

Note that the number

of sequences is given

by C42=6.

The possible sequences

you pick 2 defect items

Sequence 1 DDGG

Sequence 2 DGDG

Sequence 3 GDDG

Sequence 4 GGDD

Sequence 5 GDGD

Sequence 6 DGGD

Now, what is the probability of

getting Sequence 1? That is, what is

the probability that you first get D,

second you get D, third you get G

and fourth you get G?

The answer to this question: since the

probability of getting D is 0.05, and

the probability of getting G is (10.05)=0.95, the probability of getting

this sequence is 0.05*0.05*0.95*0.95

=0.002256.

In fact, the probability of getting any

of the 6 sequences is the same; since

each sequence contains exactly 2

defective items and 2 good items, the

probability of getting each sequence

is 0.0520.952=0.002256.

Since there are 6 sequences, the

probability that you get exactly 2

defect items is given by

(0.002256)×6=0.013536.

This is equal to C42(0.05)2(1-0.05)2

We can generalize this problem. Consider a

production line. The probability that an item

from this production line is a defect item is .

Suppose that you pick n products from this

production line. Then, the probability that the

number of defect items is exactly x is given by

P( x) C (1 )

n

x

x

n x

•This probability distribution function is called

Binomial Distribution with “success” probability .

Next slide summarizes the binomial distribution.

Binomial Distribution

Suppose that a random experiment can result in two possible

mutually exclusive and collectively exhaustive outcomes, “success”

and “failure,” and that is the probability of a success resulting in a

single trial. If n independent trials are carried out, the distribution

of the resulting number of successes “x” is called the binomial

distribution. Its probability distribution function for the binomial

random variable X = x is:

P(x successes in n independent trials)=

n!

x

( n x)

P( x)

(1 )

x!(n x)!

for x = 0, 1, 2 . . . , n

Mean and Variance of a Binomial

Probability Distribution

Let X be the number of successes in n independent

trials, each with probability of success . The x follows

a binomial distribution with mean,

X E( X ) n

and variance,

E[( X ) ] n (1 )

2

X

2

Binomial Probabilities

- An Example

A sales person randomly visits houses to sell a certain

product. He believes that for each visit, the probability of

making a sale is 0.40.

If the sales person visits 5 houses, what is

the probability that he makes at least 3

sales?

Answer

Let X be the random number for the number of sales. Then,

P(At leaset 3 sale) = P(X ≥ 3) = P(X =3) + P(X = 4)+P(X=5)

5!

P(X 3) P(3)

(0.4) 3 (0.6) ( 53) 0.2304

3!(5 - 3)!

5!

P(X 4) P(4)

(0.4) 4 (0.6) ( 5 4 ) 0.0768

4!(5 - 4)!

5!

P(X 5) P(5)

(0.4) 5 (0.6) ( 55) 0.01024

5!(5 - 5)!

P(makes at least 3 sales)=P(3)+P(4)+P(5)

=0.2304+0.0768+0.01024=0.31744

Computing Binomial Distribution

using Excel

Let n be the total number of trials. Let x be the number

of success, and be the success probability. The Excel

function to compute binomial probabilities is

P(X=x)= BINOMDIST(x, n, , FALSE)

P(X≤x)=BINOMDIST(x,n, , TRUE)

Note that if you put FALSE at the end, it computes the

binomial probability distribution. If you put TRUE at

the end, it computes the cumulative binomial

distribution.

Binomial Distribution

-ExerciseOpen “Binomial Distribution Exercise”

Find the Binomial Distribution Function

for n=50 and =0.3. Then, graph the

Binomial Probability Distribution.

Binomial Distribution Function

with n=50 and =0.3.

Binimial Distribution With n=50 and Success prob=0.3

0.14

P(x): Probability Distribution

0.12

0.1

0.08

0.06

0.04

0.02

0

x: Number of successes

Stock Price Movement Example

Now, we come back to the Stock Price

Movement example that we saw at the

beginning.

First, take a look at how the stock price

may move in the first three months. See

the next slide

Stock price movement for the first three months

Third month

x1 = $14.4

This

month

$10

Second

month

$12

x2 = $10.8

$9

x3 = $8.1

As it can be seen, there are three possible values for

the stock price in the third month. Now answer the

questions in the next slide.

Q1: In the 13th month, how many possible values

for the stock price are there?

Q2. Show that the 4th highest price is $37.61

Q3. What is the probability that the stock price at

the beginning of 13th month is equal to the 4th

highest price, $37.61?

Q4. Remember the contract. The contract is “You

have the right to purchase a share of the stock A

in the 13th month at the price equal to $37.61”.

Then, what is the probability that you get some

positive profit from this contract (ignoring all

the fees associated with buying and selling the

stock).

Joint Probability Functions

Consider two stocks, Stock A and Stock B. Let X

denote the random variable for the return of

stock A. Let Y denote the random variable for

the return of Stock B.

Suppose that X takes 4 possible values 0, 0.05,

0.1, and 0.15.

Further, suppose that Y takes 4 possible values,

0, 0.05, 0.1 , and 0.15.

The joint probabilities of X and Y are given in

the table in the next slide.

Joint Probability Function

-ExampleY return

X return

0

0.05

0.1

0.15

0

0.02

0.1

0.05

0.01

0.05

0.03

0.1

0.1

0.05

0.1

0.1

0.12

0.01

0.01

0.15

0.15

0.13

0.01

0.01

Joint Probability Functions

Let X and Y be a pair of discrete random variables.

Their joint probability function expresses the

probability that X takes the specific value x and

simultaneously Y takes the value y, as a function of

x and y. The notation used is P(x, y) so,

P ( x, y ) P ( X x Y y )

Marginal Probability Functions

Let X and Y be a pair of jointly distributed random

variables. In this context the probability function of the

random variable X is called its marginal probability

function and is obtained by summing the joint

probabilities over all possible values; that is,

P ( x ) P ( x, y )

y

Similarly, the marginal probability function of the

random variable Y is

P ( y ) P ( x, y )

x

Exercise

Open “Joint Probability Exercise”. This

sheet contains the joint probability

example of stock A return (X) and Stock B

return (Y) in the previous example.

Find the Marginal distribution.

Conditional Probability

Functions

Let X and Y be a pair of jointly distributed discrete random

variables. The conditional probability function of the random

variable Y, given that the random variable X takes the value x,

expresses the probability that Y takes the value y, as a function of

y, when the value x is specified for X. This is denoted P(y|x), and

so by the definition of conditional probability:

P( x, y )

P( y | x)

P( x)

Similarly, the conditional probability function of X, given Y = y

is:

P( x, y )

P( x | y )

P( y )

Exercise

Continue using the same example.

Compute the following conditional

probabilities.

P(X=0|Y=0.1)

P(Y=0.15|X=0.1)

Independence of Jointly

Distributed Random Variables

The jointly distributed random variables X and Y are

said to be independent if and only if their joint

probability function is the product of their marginal

probability functions, that is, if and only if

P( x, y ) P( x) P( y ) for all possible pairs of values x and y.

And k random variables are independent if and only if

P( x1 , x2 ,, xk ) P( x1 ) P( x2 ) P( xk )

Exercise

Using the example in the “Joint

Distribution Exercise” check to see if X

and Y are statistically independent.

Definition

Let X and Y be jointly distributed discrete

random variables with joint probability

distribution function P(x,y). Then, the

expectation of a function of X and Y,

g(X,Y) is defined as

E[ g ( X , Y )]

x

y

g ( x, y ) P ( x, y )

Covariance

Let X be a random variable with mean X , and let Y be a

random variable with mean, Y . The expected value of (X

- X )(Y - Y ) is called the covariance between X and Y,

denoted Cov(X, Y).

For discrete random variables

Cov( X , Y ) E[( X X )(Y Y )] ( x x )( y y ) P( x, y )

x

y

An equivalent expression is

Cov( X , Y ) E ( XY ) x y xyP( x, y ) x y

x

y

Correlation

Let X and Y be jointly distributed random variables.

The correlation between X and Y is:

Corr ( X , Y )

Cov( X , Y )

XY

Covariance and Statistical

Independence

If two random variables are statistically

independent, the covariance between them is 0.

However, the converse is not necessarily true.

Exercise

Consider the following joint distribution of X

and Y

Value of Y

3

Value 1 0.1

of X

2 0.3

4

0.2

0.4

Exercise: Cov(X,Y), Var(X), Var(Y) and

CORR(X,Y).

Portfolio Analysis

The random variable X is the price for stock A and the

random variable Y is the price for stock B. The market

value, W, of the portfolio is given by the linear function,

W aX bY

Where, a, is the number of shares of stock A and, b, is the

number of shares of stock B.

Portfolio Analysis

The mean value for W is,

W E[W ] E[aX bY ]

a X bY

The variance for W is,

a b 2abCov( X , Y )

2

W

2

2

X

2

2

Y

or using the correlation,

a b 2abCorr ( X , Y ) X Y

2

W

2

2

X

2

2

Y

Exercise

Consider Stock A and Stock B. Let X and

Y denote the market price of stock A and

B, respectively. It is known that E(X)=10,

E(Y)=20, Var(X)=2, Var(Y)=4, and

Cov(X,Y)=‒1. Now consider the following

portfolio.

W=5X +4Y.

Find E(W), Var(W).