The Neuroscience of Consumer Decision Making

advertisement

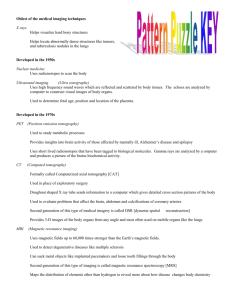

An Overview of Neuroeconomics Trial 1 T 3.5 3 2.5 2 1.5 1 0.5 0 Dante Monique Pirouz Doctoral Student Psychology and Capital Markets Workshop December 13, 2006 Some Neuroecon Humor… What is Neuroeconomics? • Studies how the brain interacts with the environment to produce economic behavior • Integrates economics, psychology, neuroscience, and cognitive science – – – – – – – Financial decision making Game theory strategy Influence of emotion, biases, etc. Social dynamics on economic behavior Developmental similarities and differences Addictive consumption Influence of cues such as advertising, brands, etc. Development of Neuroeconomics • Experimental Economics – Uses lab experiments to test economic models • Behavioral Economics – Combines economics and psychology • Behavioral Finance – Combines finance and psychology Development of Neuroeconomics • Cognitive Neuroscience – Seeks to understand the neural mechanisms underlying higher brain function • Language, learning, memory, attention, emotion, decision making, perception Why Combine Economics with Neuroscience? • Neoclassical economists ask “Given rational people, how do models behave?” – Rational choice theory, expected utility theory • Psychologists ask “Why do people behave the way they do?” – Prospect theory • Looking into the “black box” – At the neuronal and biochemical level – To understand what makes people happy, risk seeking or averse, trusting or trustworthy and what drives preference and choice Neuroscience Methods – Animal studies – Human studies – Lesion studies – Single and multiunit recordings – Measuring hormone levels, pupil dilation, galvanic skin response – Stimulation • Transcranial magnetic stimulation (TMS) – Imaging of brain activity Main Brain Regions Frontal Lobe Parietal Lobe Temporal Lobe Occipital Lobe Limbic System Thalamus Cingulate Gyrus Hippocampal Formation Striatum Corpus Callosum Hypothalamus Amygdala Pons Cerebellum Spinal Cord Brain Imaging Techniques Methodology What is imaged? How? Electroencephalography (EEG) Changes in electrical brain current Electrodes placed on scalp measure electrical brain waves Computed (Axial) Tomography Scan (CT or CAT) X-ray images of the brain Multiple images (tomograms) are taken by rotating X-ray tubes. Does not image function Positron Emission Tomography (PET) Emissions from radioactive chemicals in the blood Radioactive isotopes injected into the blood are detected like X-rays Magnetoencephalography (MEG) Changes in electrical brain current Similar to EEG but magnetic brain waves are measured instead of electrical waves Functional Magnetic Resonance Imaging (fMRI) Blood flow; oxyhemoglobin to deoxyhemoglobin ratio Relies on magnetic properties of blood. Shows brain function spatially and temporally EEG CT/CAT PET MEG Functional Magnetic Resonance Imaging (fMRI) • Uses strong magnetic fields to create images of biological tissue – Measures hemodynamic signals related to neural activity • Blood Oxygenation Level Dependent (BOLD) contrast • MR signal of blood is dependent on level of oxygenation • Changes in deoxyhemoglobin • Blood flow in the brain implies function Source: UC Irvine Center for Functional Onco-Imaging – Studies have shown regional brain activity when exposed to cues (Huettel et al. 2004) Why is fMRI so exciting? • Non-invasive • Better temporal resolution • Good and improving spatial resolution • Can be used in conjunction with other methods (Savoy 2005) Source: MGH/MIT/HMS Athinoula A. Martinos Center for Biomedical Imaging Visiting Fellowship Program in fMRI, 2005 Caveats of fMRI • Interpreting the results – Direct vs. indirect measure of brain activity – Inferring behavior • Experimental design • Statistical methods – Learning the procedure and statistical methods • Cost • Comfort/safety/cooperation of the subject The Neural Basis of Financial Risk Taking • Kuhnen & Knutson, Neuron, 2005 – Is individual investor deviation from optimal behavior due to emotion? • Brain imaging evidence that anticipation of gain vs. loss activate different regions – Nucleus accumbens (NAcc) of ventral striatum =gains – Anterior insula = loss – Examined whether anticipatory neural activity could predict optimal and suboptimal choices in financial choices • Event related fMRI with 1.5T scanner • 19 subjects (experts and non-experts) Stimuli • Behavioral Investment Allocation Task (BIAS) – 20 blocks 10 trials each – Randomly assigned one stock to be bad and other good Results • NAcc and MPFC activation related to anticipation of risk-seeking choices • Insula activation related to anticipation of risk-averse choices Investment Behavior and the Negative Side of Emotion • Shiv, Loewenstein, Bechara, Damasio, & Damasio, 2005, Psychological Science – Do emotions cause poor investment decisions? • Compared subjects with stable focal brain lesions disabling emotional regions with control patients with no impairment • 19 normal subjects, 15 lesion patients with damage in emotional regions, 7 lesion controls with damage in non-emotion related regions • Endowed with $20 play money (exchange for gift certificate) Investment Game • Participants told they would making several rounds of investment decisions – Choose between 2 options: invest or don’t invest • If invest, give $1 to researcher; if not, keep $1 – Researcher will flip coin • If heads, then lose $1 • If tails, then get $2.50 • Rational choice: Always invest!! – EV of investing is higher than not investing Results • Lesion patients with emotional neural damage make more advantageous investment decisions than normal subjects – Target patients invested consistently across rounds; controls/normal subjects increasingly declined to invest The Neurobiology of Trust • Zak, Kurzban & Matzner, Annals of New York Academy of Science, 2004 – Do hormones, such as oxytocin, regulate trust behavior? • Oxytocin – Neuropeptide involved in social recognition and bonding • Trust game – Subjects arranged into DM1-DM2 dyads – DM1 asked to split $10 – Decision will determine how much they earn • 28 mL of blood drawn after each decision • 2 conditions: Intention and random draw Trust Game A: Investor B: Trustee $0 $10 $15 $15 $0 $30 • At node A, the investor has the option of either path • Moving left ends the game with the outcomes: $0 to player 1 and $10 to player 2 • Moving right allows trustee to move (after investment is increased) • Trustee can choose either path at node B • Once trustee moves the game ends and payoffs are distributed (McCabe 2003a) Results • Oxytocin (OT) levels were higher (2x) with an intentional trust signal from DM1s in DM2s than in random draw condition • Also, behavior changed with an intentional trust signal – DM2s returned 53% of the money they received vs. 18% in the random draw condition Oxytocin Increases Trust in Humans • Kosfeld, Heinrichs, Zak, Fishbacher & Fehr, 2005, Nature – 194 subjects • Conducted in Switzerland • Subjects received OT via nasal spray or placebo • 4 rounds with randomly assigned partners – Trust game • 2 conditions: Trust and risk (random trustee decision) Results • OT increased trusting behavior in investor • OT did not increase trustworthy behavior in trustee • Trustee behavior dominated by principle of reciprocity: OT had no effect • OT also modulates neural networks to enhance trusting behavior Neuronal Substrates for Choice Under Ambiguity, Risk, Gains, and Losses • Smith, Dickhaut, McCabe, Pardo, Management Science, 2002 – – – – Positron Emission Tomography (PET) 9 subjects Initial endowment $190 cash Presented with Ellsberg Paradigm • Asked to indicate from which of 2 containers containing 90 red, blue and yellow marbles they wanted draw a marble ‘ • 4 task conditions – – – – Risk gains Risk losses Ambiguity gains Ambiguity losses Task Results Results • Activation of ventromedial and dorsomedial network only with gain – loss difference in the risky gambles – Not activated in ambiguous gambles (Row A) – Tied to amygdala and hypothalamus – Dorsomedial system more involved with loss • Study shows that belief (ambiguity vs. risk) interacts with payoff structure (gain vs. loss) to affect brain activity during choice Criticisms • • • • • Theory? Preference for existing models Press coverage Consumer concern Commercial ventures Resources & Labs • Center for the Study of Neuroeconomics – George Mason: Kevin McCabe & Vernon Smith • Stanford Neuroeconomics Lab – Stanford: Antonio Rangel • Human Neuroimaging Lab – Baylor: Read Montague • Center for Neuroeconomics Studies – Claremont: Paul Zak • The Camerer Lab – Caltech: Colin Camerer • Society for Neuroeconomics • Neural Systems of Social Behavior Conference Other Key Researchers • • • • • • • Antoine Bechara - USC Baba Shiv – Stanford George Loewenstein – Carnegie Mellon Antonio Damasio – USC John Dickhaut – University of Minnesota Camelia Kuhnen – Northwestern Paul Glimcher - NYU Recommended Reading • “Neuroeconomics: How Neuroscience Can Inform Economics.” – Colin F. Camerer, George Loewenstein, and Drazen Prelec, 2005, Journal of Economic Literature 43(1): 9. • “Behavioral Economics: Past, Present, Future” – Colin F. Camerer and George Loewenstein, 2002 – In Advances in Behavioral Economics • Functional Magnetic Resonance Imaging – Scott A. Huettel, Allen W. Song, and Gregory McCarthy, 2004 • The Secret Life of the Brain, PBS