Notable Pattern - KeeneOnTheMarket.com

advertisement

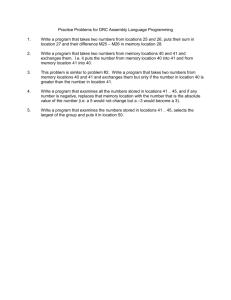

Web’s Weekly Roundup March 14, 2015 Twitter: @MarketWebs Presenter: Web Begole RISK DISCLAIMER Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. All trading operations involve serious risks, and you can lose your entire investment. No trades are recommendations or advice and we cannot be sued for losses of capital. All trades are for educational purposes only. Contact your broker or RAI for execution, margin, and other capital requirements. Everyone watching presentation adheres to ALL disclaimers on www.optionhacker.com and www.keeneonthemarket.com Web’s Weekly Roundup -- March 14, 2015 • Analysis of /ES (S&P 500 Futures) and forecast • Analysis of /DX (US Dollar Futures) and forecast • Hedging Long Stock Positions Using Options…. (and lowering cost basis) • Q&A Time /ES Futures (S&P 500) YTD 2015 Opening Price: 2055.00 Current Price: 2043.25 High: 2117.75 Low: 1970.25 O/C Change: -11.75pts H/L Range: 147.50 Notable Pattern: Resistance at top of March value, now trading at March’s value area low. Forecast: We could find support here returning to 2075, but feel like that support has played out this week already. I expect break of value and further downside below 2000. 4 /DX Futures (US Dollar Index) YTD 2015 Opening Price: 90.81 Current Price: 100.55 High: 100.785 Low: 90.80 O/C Change: +9.74pts H/L Range: 9.985pts Notable Pattern: Above monthly value areas the entire year. Opening the year on the lows, closing this week on the highs. Forecast: I expect 101 to be a short term top based on the yearly value area chart. 5 Looking Ahead • Overall: • The strength of the /DX is king throughout the market. /DX reached new 12 year highs on Friday. My upside target on /DX is at 101 and we are very close… • I find it interesting that /DX is near the “top” I’ve been looking for with FOMC Announcement coming on Wednesday of the coming week. The market expects the word “patient” to be removed from the announcement and an interest rate imminent as early as June. • With that…. Let’s discuss protecting long stock positions…. Hedging With Options • • • • • Many investors buy and hold equities – stocks, ETFs, etc. – but what happens if the market takes a turn for the worse? Options were created not only for speculation but also (and arguably more importantly) as hedging vehicles. Using options that have a built-in end date, the amount collected from the hedge as protection gets put towards my cost basis in the position lowering my initial investment going forward past the options expiration. Buying Puts: – allows me to buy “insurance” on a long position • I am buying the right to sell my shares at the strike price on or before the specified date. – I do not have to exercise the right, the put will increase in value as the stock price goes down and I can simply sell the put instead. – If the stock price moves down, the put value increases and I lose less on my overall position (the hedge) – If the stock price moves up, I lose the money I spent on the put but I continue gaining profits on the long stock. – (Conversely, buying calls gives me the same insurance on a short position.) Selling Calls: – I can sell someone else the right to buy my stock from me at the strike price on or before expiration. For this, I receive money. – If the stock price moves down, I keep all the money and the stock and the call sold expires worthless. – If the stock price moves up through the short call, I can allow the stock to be bought from me at that price, or I can buy back the call and close out my obligation to sell it. – (Conversely, selling puts gives me the same dynamic on a short position.) – Notably, as long as I sell no more calls than I have stock, I do not have any margin requirement for this Covered Call position (the stock covers the risk). • Ex: 1000 shares of stock: 10 Calls. 100 Shares of stock: 1 Call. 7 Hedging With Options • For the following examples, we will use XYZ Stock with an option chain that looks like the following: Call Mark Strike Price Put Mark $19.90 $80 $0.05 $14.00 $85 $0.50 $9.00 $90 $1.00 $7.50 $95 $2.50 $5.00 $100 $5.00 $2.50 $105 $7.50 $1.00 $110 $9.00 $0.50 $115 $14.00 Using the option chain alone, can you tell the current price of the underlying? 8 Hedging With Options – Buying Puts • • • • • Example: Buying ATM Puts to hedge Long Stock I have a long stock position of XYZ, 1000 shares bought at $100.00/share. Total investment $100,000.00 I decide to hedge my position with the 100 strike put (at the money), marking $5.00 each. By buying 10 puts at $5.00 my total investment is: $100,000.00 + $5,000.00 = $105,000.00 Stock Price Stock Value Put Value @ Exp Position Value @ Exp Profit/Loss @ Exp $85.00 $85,000.00 +$15,000.00 $100,000.00 -$5,000.00 $90.00 $90,000.00 +$10,000.00 $100,000.00 -$5,000.00 $95.00 $95,000.00 +$5,000.00 $100,000.00 -$5,000.00 $100.00 $100,000.00 $0.00 $100,000.00 -$5,000.00 $105.00 $105,000.00 $0.00 $105,000.00 $0.00 $110.00 $110,000.00 $0.00 $110,000.00 +$5,000.00 $115.00 $115,000.00 $0.00 $115,000.00 +$10,000.00 Pros: Protected downside loss at only the cost of the puts. Cons: Increases cost basis. 9 Hedging With Options – Selling Calls • • • • • Example: Selling ATM Calls to hedge Long Stock I have a long stock position of XYZ, 1000 shares bought at $100.00/share. Total investment $100,000.00 I decide to hedge my position by selling the 100 strike calls (at the money), marking $5.00 each. By selling 10 calls at $5.00 my total investment is: $100,000.00 - $5,000.00 = $95,000.00 Stock Price Stock Value Call Value @ Exp Position Value @ Exp Profit/Loss @ Exp $85.00 $85,000.00 $0.00 $85,000.00 -$10,000.00 $90.00 $90,000.00 $0.00 $90,000.00 -$5,000.00 $95.00 $95,000.00 $0.00 $95,000.00 $0.00 $100.00 $100,000.00 $0.00 $100,000.00 +$5,000.00 $105.00 $105,000.00 -$5,000.00 $100,000.00 +$5,000.00 $110.00 $110,000.00 -$10,000.00 $100,000.00 +$5,000.00 $115.00 $115,000.00 -$15,000.00 $100,000.00 +$5,000.00 Pros: Reduces cost basis and thus allows for profits in further upside or mild down moves. Cons: Limits upside potential, does not protect from further downside moves. 10 Hedging With Options – Buying Puts • • • • • Example: Buying OTM Puts to hedge Long Stock I have a long stock position of XYZ, 1000 shares bought at $100.00/share. Total investment $100,000.00 I decide to hedge my position with the 95 strike put (out of the money), marking $2.50 each. By buying 10 puts at $2.50 my total investment is: $100,000.00 + $2,500.00 = $102,500.00 Stock Price Stock Value Put Value @ Exp Position Value @ Exp Profit/Loss @ Exp $85.00 $85,000.00 +$10,000.00 $95,000.00 -$7,500.00 $90.00 $90,000.00 +$5,000.00 $95,000.00 -$7,500.00 $95.00 $95,000.00 $0.00 $95,000.00 -$7,500.00 $100.00 $100,000.00 $0.00 $100,000.00 -$2,500.00 $105.00 $105,000.00 $0.00 $105,000.00 +$2,500.00 $110.00 $110,000.00 $0.00 $110,000.00 +$7,500.00 $115.00 $115,000.00 $0.00 $115,000.00 +$12,500.00 Pros: Protected downside loss for less upfront cost, increasing upside profits. Cons: Increases cost basis. 11 Hedging With Options – Buying Puts • • • • • Example: Buying OTM Puts to hedge Long Stock I have a long stock position of XYZ, 1000 shares bought at $100.00/share. Total investment $100,000.00 I decide to hedge my position with the 95 strike put (out of the money), marking $2.50 each. By buying 20 puts at $2.50 my total investment is: $100,000.00 + $5,000.00 = $105,000.00 Stock Price Stock Value Put Value @ Exp Position Value @ Exp Profit/Loss @ Exp $75.00 $75,00.00 +$40,000.00 $115,000.00 +$10,000.00 $80.00 $80,000.00 +$30,000.00 $110,000.00 +$5,000.00 $85.00 $85,000.00 +$20,000.00 $105,000.00 $0.00 $90.00 $90,000.00 +$10,000.00 $100,000.00 -$5,000.00 $95.00 $95,000.00 $0.00 $95,000.00 -$10,000.00 $100.00 $100,000.00 $0.00 $100,000.00 -$5,000.00 $105.00 $105,000.00 $0.00 $105,000.00 $0.00 $110.00 $110,000.00 $0.00 $110,000.00 +$5,000.00 $115.00 $115,000.00 $0.00 $115,000.00 +$10,000.00 Pros: The position can actually profit from large downmoves. Cons: Small downmoves may amplify losses. Note: This is a synthetic long straddle and not really a “hedge”. 12 Hedging With Options – Selling Calls • • • • • Example: Selling OTM Calls to hedge Long Stock I have a long stock position of XYZ, 1000 shares bought at $100.00/share. Total investment $100,000.00 I decide to hedge my position by selling the 105 strike calls (out of the money), marking $2.50 each. By selling 10 calls at $2.50 my total investment is: $100,000.00 - $2,500.00 = $97,500.00 Stock Price Stock Value Call Value @ Exp Position Value @ Exp Profit/Loss @ Exp $85.00 $85,000.00 $0.00 $85,000.00 -$12,500.00 $90.00 $90,000.00 $0.00 $90,000.00 -$7,500.00 $95.00 $95,000.00 $0.00 $95,000.00 -$2,500.00 $100.00 $100,000.00 $0.00 $100,000.00 +$2,500.00 $105.00 $105,000.00 $0.00 $105,000.00 +$7,500.00 $110.00 $110,000.00 -$5,000.00 $105,000.00 +$7,500.00 $115.00 $115,000.00 -$10,000.00 $105,000.00 +$7,500.00 Pros: Reduces cost basis and thus allows for profits in further upside or mild down moves. Higher upside profits than the ATM calls. Cons: Limits upside potential, does not protect from further downside moves. 13 Hedging With Options – Cashless ATM Straddle Collar • • • • • • Example: Selling ATM Calls to Buy ATM Puts to hedge Long Stock I have a long stock position of XYZ, 1000 shares bought at $100.00/share. Total investment $100,000.00 I decide to hedge my position by selling the 100 strike calls (at the money), marking $5.00 each. AND I will buy the 100 strike puts (at the money), marking $5.00 each. By selling 10 calls at $5.00 and buying 10 puts at $5.00 my total investment is: $100,000.00 - $0,00.00 = $100,000.00 Stock Price Stock Value Collar Value @ Exp Position Value @ Exp Profit/Loss @ Exp $85.00 $85,000.00 $15,000.00 $100,000.00 $0.00 $90.00 $90,000.00 $10,000.00 $100,000.00 $0.00 $95.00 $95,000.00 $5,000.00 $100,000.00 $0.00 $100.00 $100,000.00 $0.00 $100,000.00 $0.00 $105.00 $105,000.00 -$5,000.00 $100,000.00 $0.00 $110.00 $110,000.00 -$10,000.00 $100,000.00 $0.00 $115.00 $115,000.00 -$15,000.00 $100,000.00 $0.00 Pros: Stock volatility has zero effect on P&L. Cons: (See Pros) 14 Hedging With Options – Cashless Strangle Collar • • • • • • Example: Selling OTM Calls to Buy OTM Puts to hedge Long Stock I have a long stock position of XYZ, 1000 shares bought at $100.00/share. Total investment $100,000.00 I decide to hedge my position by selling the 105 strike calls (Out of the money), marking $2.50 each. AND I will buy the 95 strike puts (Out of the money), marking $2.50 each. By selling 10 calls at $2.50 and buying 10 puts at $2.50 my total investment is: $100,000.00 - $0,00.00 = $100,000.00 Stock Price Stock Value Collar Value @ Exp Position Value @ Exp Profit/Loss @ Exp $85.00 $85,000.00 +$10,000.00 $95,000.00 -$5,000.00 $90.00 $90,000.00 +$5,000.00 $95,000.00 -$5,000.00 $95.00 $95,000.00 $0.00 $95,000.00 -$5,000.00 $100.00 $100,000.00 $0.00 $100,000.00 $0.00 $105.00 $105,000.00 $0.00 $105,000.00 +$5,000.00 $110.00 $110,000.00 -$5,000.00 $105,000.00 +$5,000.00 $115.00 $115,000.00 -$10,000.00 $105,000.00 +$5,000.00 Pros: Protected from unlimited downside losses. Retain potential for profit to the upside. Cons: Upside potential is capped. 15 Hedging With Options • • • • • I’ve busied myself looking for an “insurance policy” that I only pay for if I need it. Imagine, if I’m healthy and I sign up for insurance and I pay a premium monthly and never use it, I’m putting money into the system (that’s the way insurance works). But what if I didn’t pay a dime to insurance unless I become unhealthy, then I simply pay the insurance premium and I get the protection I want….. That’s a dream isn’t it? It is…. Let’s look at how the option market proves it to be a pipe-dream… 16 Hedging With Options – Cashless Put Ratio Spread v1 • • • • • • Example: Selling OTM Puts to Buy ATM Puts to hedge Long Stock I have a long stock position of XYZ, 1000 shares bought at $100.00/share. Total investment $100,000.00 I decide to hedge my position by buy the 100 strike puts, marking $5.00 each. AND I will sell 2x 95 strike puts, marking $2.50 each. By buying 10 of the 100 strike puts at $5.00 and selling 20 of the 95 puts at $2.50 my total investment is: $100,000.00 - $0,00.00 = $100,000.00 Stock Price Stock Value Limited Collar Value @ Exp Position Value @ Exp Profit/Loss @ Exp $85.00 $85,000.00 -$10,000.00 $75,000.00 -$25,000.00 $90.00 $90,000.00 -$5,000.00 $85,000.00 -$15,000.00 $95.00 $95,000.00 +$5,000.00 $100,000.00 $0.00 $100.00 $100,000.00 $0.00 $100,000.00 $0.00 $105.00 $105,000.00 $0.00 $105,000.00 +$5,000.00 $110.00 $110,000.00 $0.00 $110,000.00 +$10,000.00 $115.00 $115,000.00 $0.00 $115,000.00 +$15,000.00 Pros: No cap on upside potential, if the stock moves up I have spent nothing on the insurance. In small downward moves, I get free insurance and lose nothing on my position. Cons: Losses can be amplified in large downside moves. 17 Hedging With Options – Cashless Put Ratio Spread v2 • • • • • • Example: Selling ATM Puts to Buy OTM Puts to hedge Long Stock I have a long stock position of XYZ, 1000 shares bought at $100.00/share. Total investment $100,000.00 I decide to hedge my position by selling the 100 strike puts, marking $5.00 each. AND I will buy 2x 95 strike puts, marking $2.50 each. By selling 10 of the 100 strike puts at $5.00 and buying 20 of the 95 puts at $2.50 my total investment is: $100,000.00 - $0,00.00 = $100,000.00 Stock Price Stock Value Limited Collar Value @ Exp Position Value @ Exp Profit/Loss @ Exp $85.00 $85,000.00 +$10,000.00 $95,000.00 -$5,000.00 $90.00 $90,000.00 +$5,000.00 $95,000.00 -$5,000.00 $95.00 $95,000.00 -$5,000.00 $90,000.00 -$10,000.00 $100.00 $100,000.00 $0.00 $100,000.00 $0.00 $105.00 $105,000.00 $0.00 $105,000.00 +$5,000.00 $110.00 $110,000.00 $0.00 $110,000.00 +$10,000.00 $115.00 $115,000.00 $0.00 $115,000.00 +$15,000.00 Pros: No cap on upside potential, if the stock moves up I have spent nothing on the insurance. In large downside moves, my losses are capped at a certain amount. Cons: Small downside moves can amplify position losses. 18 Hedging With Options • • • • • It’s all rather limiting… how can I know if we’ll have a small downside move or a large one? It’s like insurance that is only cheap if I have a health disaster, but a simple cold may cost me my life savings… Nothing I really like here… So I guess I can’t get insurance that costs nothing and only costs me money if I need it… would have been nice. What about an insurance policy that is FREE, but if I decide to cancel it for what ever reason, I have to buy my way out of it (sounds like a cell phone plan)… • Hmm…. Something is starting to sound familiar…. 19 Hedging With Options – Cashless LimitedRR Collar • • • • • • • Example: Selling Call Spreads to Buy OTM Puts to hedge Long Stock I have a long stock position of XYZ, 1000 shares bought at $100.00/share. Total investment $100,000.00 I decide to hedge my position by selling the 100 strike calls, marking $5.00 each. AND I will buy the 105 strike calls, marking $2.50 each. AND I will buy the 95 strike puts, marking $2.50 each. By selling 10 of the 100-105 call spreads at $2.50 and buying 10 puts at $2.50 my total investment is: $100,000.00 - $0,00.00 = $100,000.00 Stock Price Stock Value Limited Collar Value @ Exp Position Value @ Exp Profit/Loss @ Exp $85.00 $85,000.00 +$10,000.00 $95,000.00 -$5,000.00 $90.00 $90,000.00 +$5,000.00 $95,000.00 -$5,000.00 $95.00 $95,000.00 $0.00 $95,000.00 -$5,000.00 $100.00 $100,000.00 $0.00 $100,000.00 $0.00 $105.00 $105,000.00 -$5,000.00 $100,000.00 $0.00 $110.00 $110,000.00 -$5,000.00 $105,000.00 +$5,000.00 $115.00 $115,000.00 -$5,000.00 $110,000.00 +$10,000.00 Pros: No cap on upside potential. Loss limitation is free on any move to the downside, small or large. Cons: If the stock moves up, I will have to buy my way out of the protection. 20 Hedging With Options • Recap: • • • • There are many ways to hedge long stock positions using options. Some are best if I can expect only a small downward move in the underlying – perhaps near an ExDiv date Others are best if I can expect a large downward move in the underlying – perhaps near an earnings date Sometimes I’m just looking for protection in a downward market, I may not know how fully the market pressure will act on my stock but I don’t want to lose on the position. • • Notably, all options positions (in this case hedges) are limited by the expiration date. Once the hedge expires it is no longer in play. If the option hedge protects my downside loss in the stock by expiration, I am pocketing that hedged amount and effectively lowering my cost basis on the position. – EX: The stock moves down from $100 to $85. At expiration Cashless LimitedRR Collar discussed previously is worth $10,000. I pocket that amount at expiration and now my cost basis on the stock moving forward is $100,000 - $10,000 = $90,000. I am still down $5,000 on the position with the stock at $85, but it does not have to recover back to $100 for me to break even, now it only has to recover to $90 for break even, or above for profits. – Notably, if the stock moves lower, the hedge gives me the benefit of further reducing my cost basis. EX: Stock moves from $100 to $60 Collar is worth $35,000. $100,000-$35,000 = $65,000.00 21 Q & A With Web Follow me on Twitter: @MarketWebs Live YouTube channel with /ES Levels and Market Internals Every Day the Market is Open From 9am EST – 5:15pm EST Other videos include a further discussion of value area and a demystification of the “VooDoo Lines” Search YouTube for MarketWebs and Look for this icon: