What is GASB 45? - Kotzan CPA & Associates

advertisement

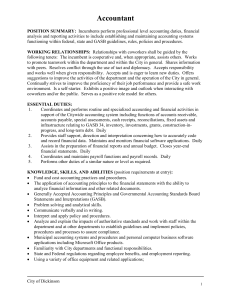

Hot Topics in School District Accounting and Auditing Dennis P. Kotzan, CPA, CFF Kimberly A. Dorchak, CPA, CGFM Brenda A. Pawlowski, CPA, CFE GASB Statement No. 45 Accounting and Financial Reporting by Employers for Postemployment Benefits Other than Pensions GASB 45 Background and Objectives What is GASB 45? It is an accounting standard issued by the Government Accounting Standards Board that applies to non-pension post-employment benefits. This standard requires the recognition of benefit costs that will be paid in the future for current retirees and for active employees when they retire. GASB 45 Background and Objectives Who must comply with GASB 45? All public employers that follow GASB accounting standards and that offer post-employment benefits to retired employees are subject to GASB 45 This affects: State governments Cities and towns Counties Boards of Education Public utilities Water districts And others GASB 45 Background and Objectives What benefits are covered by GASB 45? GASB 45 applies to non-pension benefits provided to retirees, including: Medical Dental Pharmacy Vision Hearing Life Insurance Long Term Care Insurance GASB 45 How does GASB 45 impact us? Financial reporting before GASB 45: This year’s financial statements reflect this year’s premium for retirees receiving benefits this year Financial reporting after GASB 45: In addition to the above, this year’s financial statements cover Value of postemployment benefits earned by active employees for this year’s service Amortization of post-employment benefits earned by current retirees for service done in previous years Amortization of post-employment benefits earned by active employees for service done in previous years GASB 45 Why did GASB create GASB 45? Post-employment benefits are part of compensation and need to be recognized as a cost when benefits are earned, not when the benefits are paid Consistent with accounting theory Consistent treatment with pension benefits GASB 45 How was the valuation done? Organization qualified for the simplified approach to GASB 45, (known as the Alternative Measurement Method or AMM) Used an online self-help tool created by Milliman to perform the valuation (GASBhelp.com) Saved about 70% of the cost of a full actuarial valuation GASB 45 Key Elements of GASB 45 Reporting Two key elements of GASB 45 financial reporting: Annual Required Contribution (ARC) Unfunded Actuarial Accrued Liability (UAAL) GASB 45 Annual Required Contribution (ARC) Components of ARC: Value of postemployment benefits by active employees for this year’s service Amortization of postemployment benefits earned by active employees and current retirees for service done in previous years Required to compute and report it, not to fund it (though funding affects the size of the ARC) GASB 45 Our ARC ARC for fiscal year 2009: $66,430 Compare to current cost for current year’s premium for current retirees: GASB 45 What gets done with the ARC? Reported as a balance sheet item on the organization’s financial statements Amount reported is the difference of the ARC over the amount actually contributed to cover the affected benefits Amount accumulates over time, each year adding the next year’s ARC reduced by the next year’s contributions GASB 45 Unfunded Actuarial Accrued Liability (UAAL) Components of UAAL: Value of postemployment benefits earned by active employees for this year’s service Value of postemployment benefits earned by active employees and current retirees for service done in previous years Required to compute and report it, not to fund it (though funding affects the size of the UAAL) GASB 45 Our UAAL UAAL as of 12/31/09: $668,107 Contributions: $0 Net UAAL: $668,107 GASB 45 What happens if we don’t recognize our GASB 45 liability? Qualified audit opinions Affect on bond ratings and borrowing rates Rating agencies are considering GASB reporting and management as part of their evaluation of government entities with respect to credit-worthiness GASB 45 How do we manage the liability? Funding or not? Funding approach affects the discount rate which affects the size of the ARC and UAAL Funding allows investment earnings to cover some of the future costs (as opposed to paying them out of future budgets) Revise benefit plan designs Change retiree contributions toward the cost of their benefits Change eligibility for retiree benefits for current actives and/or new hires GASB Statement No. 54 Fund Balance Reporting and Governmental Fund Type Definitions GASB 54 Effective Dates and Application Statement released in March 2009 Effective for periods beginning after June 15, 2010 Applies to Governmental Funds only Does not impact Proprietary and Fiduciary Funds Does not impact Government-wide statements GASB 54 Background and Objectives Why did we need GASB 54? The standards defining the current fund balance classifications and governmental fund type definitions were deemed vague resulting in considerable variation in how governments report this information. These inconsistencies led to reduced comparability. GASB 54 Background and Objectives What are the objectives of GASB 54? To improve the usefulness and comparability of governmental fund balance information by reporting fund balance in more meaningful components To clarify and update the definitions of the types of governmental funds eliminating points of confusion that have diminished consistency in practice. Current Fund Balance Categories Reserved Unreserved – designated Unreserved - undesignated GASB 54 New Fund Balance Categories Nonspendable Restricted Committed Assigned Unassigned GASB 54 Nonspendable Fund Balance Generally corresponds to our current classification of “reserved fund balance” Amounts that literally cannot be spent either because of their physical form or because of legal or contractual requirements that prevent them from being spent. GASB 54 Nonspendable Fund Balance Nonspendable because of physical form include assets that are not expected to be converted into cash in the near term Inventory and prepaid expenditures Long-term receivables Property acquired for resale GASB 54 Nonspendable Fund Balance Nonspendable because of legal or contractual restrictions The corpus or principal included in a permanent fund – resources that must legally be maintained intact GASB 54 Restricted Fund Balance Amounts are spendable but must be used as directed by an external party or by a constitutional provision or enabling legislation External parties include creditors (through debt covenants/bond indentures), grantors, donors, other governmental units. GASB 54 Restricted Fund Balance Like nonspendable, restricted fund balance generally corresponds to our current classification of “reserved fund balance” The key to Restricted Fund Balance is “EXTERNAL” party (i.e. not school board). GASB 54 Committed Fund Balance Amounts can only be used as specified by the “formal action of the government’s highest level of decision-making authority”. School board resolution would commit fund balance GASB 54 Committed Fund Balance Amounts reported as committed can be redeployed for other purposes by using the same formal process that created the commitment – i.e. a school board resolution to change or remove the commitment To commit funds as of June 30th, a formal board action should be approved prior to year-end, however, the exact dollar amount can be determined at a later date. GASB 54 Committed Fund Balance Generally corresponds to our current classification of “unreserveddesignated fund balance” Committed funds, like restricted and nonspendable, are excluded from fund balance when determining compliance with Section 688 of the school code (8% limit on fund balance prior to raising taxes) GASB 54 Assigned Fund Balance Amounts that the government intends to use for a specific purpose Intent does NOT require formal action by the school board Likewise, redeploying assigned resources does NOT require formal action by the school board GASB 54 Assigned Fund Balance Resources can be assigned by a governing body or another body or person to whom the governing body gives the authority to do so Finance committee Business manager Superintendent Under the current classifications, these amounts were generally considered “unreserved – undesignated”. GASB 54 Assigned Fund Balance Resources accounted for in a governmental fund other than the general fund are assumed to be, at a minimum, intended for the purpose of that fund and therefore, the minimum fund balance classification would be “assigned” (except for a deficit fund balance which would be “unassigned”) GASB 54 Unassigned Fund Balance The residual fund balance category for the General Fund Resources are available for any purpose Reporting positive unassigned balances is permitted in the General Fund only GASB 54 Unassigned Fund Balance For governmental funds other than the general fund, the unassigned fund balance category is only used to report a deficit fund balance No fund should ever report a negative amount in the restricted, committed or assigned fund balance categories GASB 54 Encumbrances Contrary to Pre-GASB 54 reporting, encumbrances should not be reported separately within the fund balance categories Encumbrances should be classified as either committed or assigned as appropriate per the definitions of those categories GASB 54 Encumbrances While encumbrances will no longer be reported separately on the financial statements, governments may continue to employ encumbrance accounting internally Significant encumbrances should be disclosed in the notes to the financial statements along with other significant commitments. GASB 54 Fund Balance Questions Anticipated PSERS increase is currently recorded as “unreserveddesignated fund balance”. Under GASB 54 how would we record if: Board formally approves specific funds be used for this purpose? Business Manager makes the decision to use specific funds for this purpose? GASB 54 Fund Balance Answers Board formally approves funds for PSERS increase? Committed Business Manager makes the decision to use funds for PSERS increase? Assigned GASB 54 Fund Balance Questions Debt Service is maintained in your General Fund and recorded as “Reserved for Debt Service”. Under GASB 54 how would we record if: Debt covenants dictate that funds must be set aside to service debt? Finance committee establishes certain funds to be used for debt service? GASB 54 Fund Balance Answers Debt covenants dictate that funds must be set aside to service the debt? Restricted Finance committee establishes certain funds to be used for debt service? Assigned GASB 54 Example Fund Balance Classification Current Classification (Pre GASB 54) (10) General Fund (22) Capital Reserve (30) Capital Project (40) Debt Service Fund Balance Reserved for: Inventory Encumbrances Unreserved-Designated (PSERS) Unreserved-Undesignated 50,000 9,581 600,000 1,848,467 4,131,786 392,300 2,768,447 GASB 54 Example Fund Balance Classification New Classification per GASB 54 (10) General Fund (22) Capital Reserve (39) Capital Project (40) Debt Service Fund Balance Nonspendable Inventory 50,000 Restricted: Capital reserve purposes 4,131,786 Construction project 392,300 Debt service Committed: PSERS Increases 2,768,447 600,000 Assigned: Encumbrances Unassigned 9,581 1,848,467 GASB 54 Account Code Changes 0810 0820 0830 0840 0850 – – – – – Nonspendable fund balance Restricted fund balance Committed fund balance Assigned fund balance Unassigned fund balance Note that 0840 and 0850 are considered when determining compliance with Section 688 of the school code (8% limit on fund balance prior to raising taxes) GASB 54 Required Note Disclosures Highest level of decision-making authority and the formal action required to establish, modify or rescind a commitment of fund balance The bodies or persons having the authority to assign resources, as well as the policy, resolution or other legislation that delegates such authority GASB 54 Required Note Disclosures Policy regarding the order in which resources will be spent when resources for a specific purpose are available in more than one fund balance classification The required detail of the nonspendable, restricted, committed and assigned fund balance amounts, if not fully displayed on the face of the balance sheet GASB 54 New Fund Balance Categories A helpful mnemonic: Nobody Really Cares About Us Nonspendable Restricted Committed Assigned Unassigned GASB 54 Governmental Fund Type Definitions GASB Statement 54 states: “The general fund should be used to account for and report all financial resources not accounted for and reported in another fund.” “Special revenue funds are used to account for and report the proceeds of specific revenue sources that are restricted or committed for specific purposes other than debt service and capital projects.” GASB 54 Special Revenue Funds Note that debt service expenditures cannot be made from special revenue funds. Note that capital expenditures cannot be made from special revenue funds. GASB 54 Special Revenue Funds GASB Statement 54 further states: “One or more specific restricted or committed revenue sources should be the foundation for each special revenue fund and comprise a substantial portion of the fund’s inflows on an ongoing basis.” GASB 54 Special Revenue Funds Special Revenue funds must have a dedicated revenue stream Transfers from other funds are NOT considered revenue Specific revenue source should comprise a substantial portion of the fund. GASB 54 Athletic Fund Many districts currently report their Athletics Fund as a special revenue fund (Fund 29) Under GASB 54, in most cases, the Athletic Fund will no longer meet the definition of a special revenue fund. GASB 54 Athletic Fund Most Athletic Funds are not selfsustaining and are largely funded by General Fund transfers Consequently, beginning with the 2010-11 year, many districts’ Athletic Fund information will be reported in the General Fund Revenue code 6710 for Admissions Expenditures coded to 3250 series GASB 54 Athletic Fund You are permitted to continue reporting the Athletic Fund separately for internal purposes Regardless of the internal reporting method, in most cases the Athletic Fund will need to be combined with the General Fund for budgeting purposes, on the AFR and the financial statements in the audit report A board resolution is NOT required to dissolve the Athletic Fund GASB 54 Capital Projects Funds GASB 54 broadens the usage of capital project funds Instead of using a capital project fund to account for “major capital facilities”, GASB 54 states that capital projects funds can be used to account for capital outlays in general GASB 54 What about Capital Reserve Funds? Capital Reserve Funds should be reclassified as Capital Project Funds beginning in 2010-11 fiscal year Current Fund 21 (per School Code 690) and Fund 22 (Municipal Code 1431) should be reclassified to Capital Project Funds 31 and 32, respectively, under GASB 54 GASB 54 Capital Projects Funds Your current Capital Project Fund – Fund 30 will become Fund 39 with the implementation of GASB 54 Fund 31, 32 and 39 are expected to be separate columns on AFR On audited financial statements, Funds 31, 32 and 39 will be aggregated and reported as one major capital project fund GASB 54 Debt Service Fund GASB 54 makes clear the existing requirement that debt service funds must be used whenever legally mandated or when financial resources are being accumulated to pay off principal and interest maturing in future years Debt Service fund remains Fund 40 GASB 54 Fund Dimension Changes Capital Reserve (21) – Eliminated Capital Reserve (22) – Eliminated New: Capital Project (31) Funds established pursuant to sections 690 and 1850.1 of PA School Code – Former Capital Reserve Fund 21 New: Capital Project (32) Funds established pursuant to section 1431 of Municipal Code – Former Capital Reserve Fund 22 GASB 54 Fund Dimension Changes New: Capital Project (39) Former Fund 30 used primarily for major construction projects funded with debt Athletics Fund (29) Fund 29 will still exist, however, most schools will be required to combine into Fund 10. Although, Fund 29 may continue to be used for internal reporting purposes. GASB 54 Required Note Disclosures The purpose of each special revenue fund, identifying which revenues and other resources are reported in each special revenue fund Internal Controls, Fraud Prevention and Other Hot Button Areas Improvements in financial reporting Improvements in internal controls Compliance issues Other issues Improvements in Financial Reporting Reconciliation of bank accounts Ensures revenues and expenditures are recorded Differences could indicate a payroll or other error, requiring a change to a filed report Improvements in Financial Reporting Material audit adjustments Recording all grants receivable at year end Recording all liabilities at year end Balancing interfunds and transfers Ensuring supporting documentation for balance sheet items agree to ledger Improvements in Financial Reporting Use of funding source dimensions – federal source codes AFR reporting – federal expenditures reported separately Social security and retirement subsidy reimbursements Recording of grants receivable at year end Accurate reporting on quarterly reports and final completion reports Auditor testing of expenditures charged to major federal program(s) Improvements in Financial Reporting Not recording purchase orders as expenditures in year of issue, but in year invoice is received Software vendor gave district 3 choices for rolling forward open P.O.’s at year end Roll them into the new year as open P.O.’s for old year Roll them into the new year as P.O.’s for new year Record them as expenditures in the year closing – NO! Improvements in Financial Reporting Decrease reliance on spreadsheets to improve efficiency Some track cash on manual or Excel spreadsheets Some track smaller funds on spreadsheets or not at all (Debt Service, Capital Reserve, Athletics) Enter batches of checks or each check Enter deposits at end of month Provide the auditor with investment statements to derive a TB Provide the auditor with a spreadsheet in lieu of a TB Weigh the time it takes for manual vs automated Improve Internal Controls Segregation of duties and crosstraining Reduce instances of error or fraud Coverage for illness, injury, etc. Often staff limitations Business manager by default Improve Internal Controls Controls over disbursements - limit how much one person does Facsimile signatures Mailing checks Reconciling accounts Use of an imprest account Monitor old outstanding checks Escheat Reissue Improve Internal Controls Reconciliation of Tax Collectors Tax collectors are required to use the DCED-approved monthly report Required to reconcile by Jan. 15th District should monitor amounts received during collection period Delays in remittances could indicate a problem Be cautious of changes in collectors’ behavior Taxpayers tend to pay same time each year Comparison of monthly collections by year Monitor new collectors Overwhelmed Confused County training? Compliance Issues Purchases > $4,000 Government pricing Quotes Purchases > $10,000 Government pricing Bids Compliance Issues Recording only ½ retirement to federal programs Reporting federal wages for social security subsidy reimbursement Problem areas Federal source codes not used Federal expenditures reclassified at year end Business manager not aware of requirement Potential to under-spend grant Inaccurate reports filed Compliance Issues Tracking payments to vendors for Form 1099-MISC reporting (Athletic Fund) More likely to occur when: Accounting is not centralized Fund not maintained in G/L software Always try to avoid IRS issues! Other Issues Student Activities Need a good “gate keeper” Avoid booster groups, parent groups, elementary accounts Proper documentation for checks written Original invoice Proper approval - student and advisor Proper control over receipts Ticket counts Tracking of sales for candy, subs, etc. 2 people counting cash and signing off Other Issues ARRA funding Auditor required to test all ARRA money spent (basically) ARRA grant follows other federal requirements (Title I, IDEA-B, etc.) Caution on IDEA-B MOE expenditures Special Ed costs only 50% of IDEA-B additional spent Compliance Supplement for auditors to use is still in draft form 1512 report will need audited in some fashion Controls over ARRA monies evaluated Increase audit costs? Apply to ARRA? Other Issues Antifraud Program Control environment - basic building block for an organization Organizational style Ethical values Trustworthiness of an organization Working Antifraud Program Establish a “Tone at the Top” o Portray a reputation of integrity Deal fairly with employees o Discourage unethical behavior Other Issues Working Antifraud Program (continued) Adopt and distribute a formal program o o o o o Outline internal controls Provide guidelines for reporting fraud or suspected fraud, including steps to investigate Develop a Code of Conduct Post the Code and Program prominently Advise current and new employees of both and provide a copy of each Other Issues Working Antifraud Program (continued) Adopt and distribute a formal program o Establish a Fraud (Whistle-Blower) Hotline Available for employees to report suspicions of fraud or misconduct Demonstrate the district’s serious intent to prevent and detect fraud Internal hotline (or external) - Superintendent - PA Department of Education - PA Ethics Commission - PA Auditor General Questions? Contact Information www.kotzancpa.com dkotzan@kotzancpa.com kdorchak@kotzancpa.com bpawlowski@kotzancpa.com