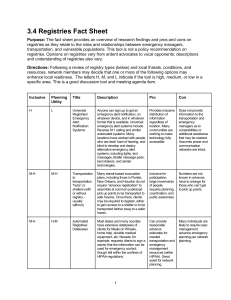

technical considerations in computer

advertisement

Assessing Infrastructure for Intermediation: Legal Framework and Credit Information Systems Thorsten Beck 1 Introduction Infrastructure is set of institutions and rules for functioning of financial system Legal infrastructure: laws and their enforcement, corporate governance Informational infrastructure: credit information sharing, accounting and auditing rules and practice Transactional infrastructure: retail and wholesale payment systems 2 Legal framework 3 The Importance of the Legal Framework for the Financial System Financial contracts depend on certainty of legal rights and predictability and speed of their fair and impartial enforcement Regulation and supervision of financial system requires legal and regulatory framework 4 0.00 0.50 1.00 1.50 2.00 Private Credit and Creditor Rights 0 2 4 6 Creditor Rights Index 8 10 5 0.00 0.50 1.00 1.50 2.00 Private Credit and contract enforcement 0 500 1000 Days to Enforce a Contract 1500 6 Legal framework - overview Financial sector legislation Corporate sector framework Collateral and creditor rights Insolvency framework Judicial system 7 Legal Framework: Financial Sector Legislation Central Bank, Bank Supervisory Authority Legislation Independence, objectives, accountability Banking/financial institutions legislation From cradle to grave, bank secrecy Payment system legislation and regulation Finality of payment, zero hour rule Anti-money-laundering (AML), Combating the financing of terrorism (CFT) legislation Government debt management legislation Capital markets legislation Insurance sector legislation 8 Legal Framework: Corporate Sector Framework Company law Regime for formation, registration and operation of companies Different types of companies (limited liability, joint stock, partnerships etc.) Corporate governance Relationship between stakeholders of companies Directors’ duties Shareholder rights Audit and accounting practices Laws and regulations Regulatory agencies enforcing legislation and regulations Business culture and practices 9 Legal Framework: Collateral and Creditor Rights Predictable, transparent and affordable enforcement of unsecured and secured claims outside the insolvency system Civil Code, laws on insolvency, land, pledge, mortgages, execution Registers for movable and immovable property, registration procedures Restrictions on ownership, transfer, pledge Loan documentation Role of Notary Public Court / non-court enforcement procedures 10 Legal Framework: Insolvency Framework Legal framework for corporate insolvency Provide for timely, efficient and impartial resolution Maximize value of assets and recoveries Efficient liquidation of nonviable and rehabilitation of viable businesses Equitable treatment of similarly situated creditors Transparent procedure Framework for cross-border insolvencies Informal out-of-court procedures for work-out Institutional framework 11 Legal Framework: Effective Insolvency and Creditor Rights Systems Principles and Guidelines for Effective Insolvency and Creditor Rights Systems Developed in 1999/2000 by WB and other organizations and experts 35 principles in four areas: Creditor rights and enforcement systems Corporate insolvency Credit risk management, debt recovery and informal enterprise workout practices Effective implementation of legal mechanisms 12 Legal Framework: Judicial System Courts are “slow, corrupt, incompetent and expensive”. Judges Appointment, dismissal, independence, salaries, promotion Infrastructure Location of courts, buildings, libraries, computerization, budget, administration Procedures Code of Civil Procedure, filing fees, appeal procedures, injunctions, case management, allocation of cases, execution of judgments Court Officials Prosecutors, bailiffs, police, court staff, lawyers, bar associations, discipline Arbitration, mediation, specialized courts 13 Legal framework: Cross-country comparisons Doing Business database; case study approach: Claim equals twice country’s income per capita, creditor (plaintiff) is 100% right, judicial process, which ends in favor of creditor: Number of procedures legally required between the parties Time (days) spent in dispute resolution until payment Cost (fees, duties etc.) of going through the court procedure, relative to debt value Transfer of land and building in a peri-urban area of the country’s most populous city, 50 times income per capita. Number of procedures legally required to register property Time (days) spent in completing procedures Cost (taxes, fees, duties etc.) relative to property, only official costs Insolvency: time (in days), cost (as percentage of estate) and recovery rate (cents on the dollar) 14 Legal framework: Cross-country comparisons South Africa South Africa M alawi M alawi Tanzania Tanzania Zambia Zambia Zimbabwe Zimbabwe M ozambique M ozambique 0 100 200 300 400 500 600 600 700 800 Days to Recover Debt Outside Insolvency Source: Doing Business project, http:\\rru.worldbank.org\doingbusiness 900 1000 1100 1200 1300 1400 Days to Resolve Insolvency 15 1500 Credit information systems 16 The Role of Credit Reporting Systems in Financial Markets Reduce asymmetric information between borrowers and lenders Allow lenders to more accurately evaluate risk and avoid adverse selection Strengthen incentives for borrowers to repay, reducing moral hazard Increase the cost of default Provide an incentive for good borrowers: Reputation Collateral Increase competitiveness, reduce segmentation 17 0.00 0.50 1.00 1.50 2.00 Private Credit and Credit Information Sharing 0 2 4 Credit Information Index 6 18 Credit information systems overview Institutions and sources of information Public vs. private registries Elements of a robust credit registry system 19 Financial Information Infrastructure: Primary Institutions & Sources of Data Consumer Credit Reporting Firms & Registries Commercial Credit Reporting Firms & Registries Corporate Registries Ratings Firms Microfinance Credit Bureaus Industry Specific Databases (insurance, property management, utilities, cell phones, agricultural commodities, etc.) Other Public Data (public databases, Chambers of Commerce / Better Business Bureau, media) 20 Information in credit reports The heart of the credit report is the detailed payment history it provides Positive payment history empowers good borrowers, creates reputation collateral Negative payment data encourages honoring obligations Lender B of A Account No. XXXX Date Opened & Date Reported 1-1-2000 6-1-2004 Credit Limit & Past Due $5,000 $0 Payment History 30 day - 1 21 Public vs. Private Credit Registries Feature Public Private Purpose Bank supervision & credit checks for lenders Supervised institutions (banks) Yes Credit checks for lenders Yes In some cases In some countries No No charge or minimal charge Government Regulation Yes Source of information Participation mandatory? Positive Info? Minimum loan size Fee for service Basis for operations Varied sources (banks, retailers, telecoms) No Contract 22 Advantages and Shortcomings of Public Credit Registries Advantages Public credit registries can compel banks to report, especially important in economies with concentrated financial systems Public credit registries can operate where the legal environment is inhospitable for private ventures Public credit registries may engender additional confidence, depending on country experiences Public credit registries provide data for bank supervision Shortcomings: Data sources and distribution of data are more limited for private credit registries Public credit registries have fewer resources (staff, funding, technology) Public credit registries do not offer value-added services such as credit scoring Public credit registries offer limited consumer attention 23 Elements of a Robust Credit Reporting System Providers and users of credit data Institutional arrangements Quality of the data collected Quality of the data distributed Legal framework for credit reporting Regulatory framework for credit reports Use of credit information for bank supervision Consumer outreach & education 24 Providers and users of credit data Commercial Banks and other regulated financial institutions (credit card issuers, insurance firms, automobile finance companies, mortgage lenders/guarantors) Retailers (appliance retailers, other stores) Firms providing business-to-business credit, trade credit Microfinance institutions Other businesses which provide goods or services on credit (utilities, cell phone providers, agribusiness, etc.) 25 Providers and users of credit data What is the financial market structure? How concentrated is the banking / financial sector? What are the main financial sector products? Are banks lending to a broad spectrum of the population? Do they offer varied products & services? What are the most important non-bank sources of finance? How are these changing? In the real sectors of the economy, what are the most important sources of financial services and credit? Are there special industry credit services? What role does microfinance play? 26 Institutional Arrangements for Private Credit Registries Institutional Type Private firm w/ no bank ownership Private firm w/ bank ownership Bank association Chamber of Commerce Commercial & credit insurance firms Industry-specific databases Pros Cons All types of data, independence All types of data, Special access to bank data Access to bank data, integrity Retail & non-bank data, broad cover, historical record In-depth data on commercial sector In-depth data on single sector No automatic access to data Independence may be questioned Only bank data, only bank access No bank data, Limited funds for modernization Limited coverage, High cost per entry Lmtd. Scope – can’t cross -check data 27 Quality of the Data Collected Collect both positive & negative information Maintain data for a reasonable time frame – 5 years minimum Do not delete negative data when debt is repaid Data should be inaccessible after a certain amount of time Credit reports should not include highly sensitive information such as political or religious affiliation, etc…. Other identifying information, such as gender, should be evaluated more carefully 28 Quality of the Data Distributed Integrity and transparency are paramount Special standing of any group, including owners or government, will discourage participation Open system preferable, reciprocity not necessary Access to more detailed information preferable Loans described individually, not aggregates Institutions providing credit identified Restrictions to prevent “cherry-picking” Distribution reflects privacy considerations 29 Legal framework for credit reporting Legal framework should encourage information sharing among lenders Provide legal clarity regarding acceptable information sharing practices Consideration of privacy issues important Broad privacy or data protection laws may unduly limit credit reporting – balance privacy with economic impact of limiting access to data Competition policy aspects of credit information 30 Legal framework for credit reporting: Consumer protection Borrowers should have access to their own data Notice of adverse actions based on report Record who has accessed data as part of report Consumer-friendly procedures in place to challenge erroneous information in reasonable time frame Clearly established privacy policy 31 Regulatory framework for credit reporting Regulatory framework usually weaker than legal framework in developing countries Regulatory framework with enforcement Can, and do, regulators effectively enforce laws and regulations, via: Audits Lawsuits Fines Reviewing industry codes of conduct Do consumers have the ability to bring complaints outside the judicial system? 32 Use of credit information for bank supervision Supervisors include financial institutions’ use of credit information as part of inspections, both on- and off-site Use data from PCRs to identify large problem borrowers, to fine-tune regulations and in analytical work to identify risk-categories of borrowers Require publicly (government) owned financial institutions to provide data to legitimate credit reporting firms, associations Encourage all financial institutions to participate in credit reporting 33 Consumer Outreach and Education Readily available information on managing credit and on the rights & responsibilities of borrowers regarding credit reporting Printed materials at appropriate level, language (internet, banks, retailers, government offices can all provide access) Radio or television public service ads Role of industry in providing consumer assistance Outreach to lenders on importance of credit information Outreach to other interested parties (judges, microfinance institutions, etc.) 34