Remittances

advertisement

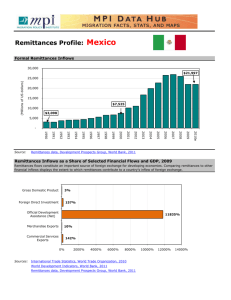

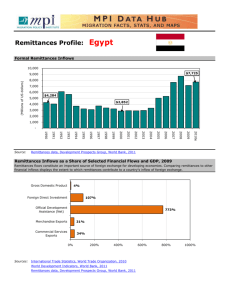

REMITTANCES Econ 490 Professor Castillo Ivan Camacho Arthur Cho What Is Remittance? The transfer of money by a foreign worker to his/her home country. Overview Major roles of remittances Microeconomic Determinants Key statistics Macroeconomic Determinants Global Impact Macroeconomic Impacts Advantages/Disadvantages Microeconomic Impacts Policymaking Trend of Remittance flows Causes of Remittances Major roles of remittances Count as the 2nd largest source of capital inflow to many developing countries. Only foreign direct investment account for more sources of external finance. Remittances exceeds inflows that come from international aid. Receiving countries become more dependent on global economies rather than sustaining their own local economies. Promotes economic growth in developing countries. Key Statistical Data Developing countries receive the highest amount of remittances. One-third of remittances to the developing world go to India, China, and Mexico. Share of remittances in GDP Tajikistan 50% Moldova 31% Lebanon 25% Top recipient countries 2008 India $51.5 billion China $48.5 billion Mexico $26.3 billion Philippines $19.1 billion Statistical Map Global Impact In the past, remittances received little attention from governments and financial markets because they were usually sent in small amounts. Now they are large in the aggregate and are important to developing countries. World Bank estimates $240 billion in total remittances in 2007, a staggering jump from only $31.2 billion in 1990. Remittances exceed all other imports of private and public capital in 36 developing countries. Advantages Finance much needed investment in recipient countries to contribute to increased productivity. Believed to reduce poverty. Mainly due to the poor that migrate and send back remittances. Increase of income in households also increase consumption. Remittances do not have to pay interest. More stable than foreign direct investment or foreign portfolio investments. These are highly volatile in developing countries. Unskilled workers may return to their home countries with useful skills acquired abroad. Recipients have a higher propensity to own bank accounts. Disadvantages Promotes idleness among the recipients. May cause appreciation of receiving country’s currency. Thus leading to lower net exports and negative economic growth. Some emigrants may be educated or highly skilled causing what commonly known as “brain drain”. Loss of human capital lowers productivity and economic growth. Home country invested time, effort and money on their education. Migration of skilled workers worsens the distribution of income between rich and poor countries. Policymaking Policymakers in developed host countries have become interested in the large flow of remittances. Channel remittances into productive investments Encourage banks to offer remittance services to migrants in host countries Supervise and push remittances to be sent through official channels. Increases in remittances have spawned many private money transfer businesses. MoneyGram Western Union Trend of Remittance Flows Most of the developing world has been increasing flows of remittances by double digits annually between 1990-2005. Source: Global Economic Prospect 2006, and World Development Indicators, 2007, Washington DC: World Bank. Remittances by region (US$ billions) 1990 1995 2000 Eastern Europe and Central Asia 3.2 8.1 13.4 East Asia and Pacific Region 3.3 9.7 16.7 South Asia 5.6 10 17.2 Latin America and Caribbean 5.8 13.4 20.1 Middle East and North Africa 11.4 13.6 13.2 Sub-Saharan Africa 1.9 3.2 4.6 2005 Annual growth 30.8 15.1% 43.9 17.3% 34.9 12.2% 47.6 14.0% 23.5 4.8% 7.4 9.1% Causes of Remittance Growth 15.1% growth in Eastern Europe and Central Asia 1990s changed to free market economies Permitted labor migrations to oil-rich Middle East and industrialized Western Europe 17.3% growth in East Asia and Pacific Region Expansion of economic activity caused labor shortages in Japan, South Korea, Hong Kong, Taiwan and Singapore in the 1990s Increased migrant labor originating from Thailand, the Philippines and Indonesia Causes of Remittance Growth (cont.) 12.2% growth in South Asia Implementation of an economic liberalization program in India. Lifted regulations to foreign exchange and travel abroad for work Explosion of information technology industry in the US attracted large numbers of South Asians, mostly Indians. 14.0% growth in Latin America and Caribbean The implementation of NAFTA and the economic boom of the 1990s sharply increased the demand for workers in the US and Canada. Microeconomic Determinants Migrants care about the households well being and remit to improve living conditions (Altruism). Ex: Household Consumption Self interest motives. Ex: Investment in home country Insurance purposes. Ex: Emigrant/Household income risk. Implicit loan arrangement. Ex: Emigrant is paying back to the household for the investment made. Macroeconomic Determinants Depreciations of the home currency can increase the purchasing power of remittances in the home country. Ex: Migrants who settle in the U.S. earn money in U.S. dollars, but their transfers to family and others back home are usually converted into the domestic currency. Take of advantage of the depreciation by investing more in the home country if the immigrant has investments in both countries, but plans to return eventually to the home country. Macroeconomic Impacts Augmentation of the capital stock through financing investment are conducive to growth. Decrease in labor supply and a negative impact on the tradable sector have adverse consequences for the receiving country. Economic development is that remittances are often used for investment in the home country. Inflationary pressures or cause a phenomenon. This can appreciate the local currency and crowd-out exports. Distribution of income increases inequality. Microeconomic Impacts Increase in remittances shifts the receiving household’s budget constraint outward by the amount of the transfer and therefore should have a positive impact on household consumption. Remittance receiving households spend more on education, health, and housing. Remittance-receiving households devote a larger proportion of current expenditures to investment and savings, and have lower income elasticities for current consumption and for durable goods. Microeconomic Impacts It is possible that after receiving remittances the labor supply of some household members decreases. Remittances can give the household the initial capital necessary to start a small business. May increase the education of children in the household. Impact of Economic Downturn http://www.youtube.com/watch?v=7IdufxY0wLg Sources GRABEL, ILENE. "Remittances: Political Economy and Developmental Implications." International Journal of Political Economy 38.4 (2009): 86-106. Business Source Premier. EBSCO. Web. 1 Mar. 2011. Pradhan, Gyan, Mukti Upadhyay, and Kamal Upadhyaya. "Remittances and economic growth in developing countries." European Journal of Development Research 20.3 (2008): 497-506. Business Source Premier. EBSCO. Web. 1 Mar. 2011. Ruiz, Isabel, and Carlos Vargas-Silva. "To Send, or Not to Send: That is the Question. A Review of the Literature on Workers' Remittances.“ Journal of Business Strategies 26.1 (2009): 73-98. Business Source Premier. EBSCO. Web. 1 Mar. 2011. Solomon, Blen. "The Impact of Risk and Uncertainty on Remittances into Latin American Economies." Journal of Business Strategies 26.1 (2009): 99-117. Business Source Premier. EBSCO. Web. 1 Mar. 2011 Zarate-Hoyos, German A. "CONSUMPTION AND REMITTANCES IN MIGRANT HOUSEHOLDS: TOWARD A PRODUCTIVE USE OF REMITTANCES." Contemporary Economic Policy 22.4 (2004): 555-565. Business Source Premier. EBSCO. Web. 1 Mar. 2011. Questions?