Household debt - Banca d'Italia

BANCA D’ITALIA

E U R O S I S T E M A

Household debt: a cross-country analysis

Massimo Coletta, Riccardo De Bonis and Stefano Piermattei

Bank of Italy’s Analysis of Household Finances

3 – 4 December 2015

Objective

The paper studies the determinants of household financial debt in a set of countries.

In most of the countries household financial debt has reached unprecedented levels.

Source : OECD and Eurostat flow-of-funds database

The growing debt…

In many countries household debt began to increase in the mid-1990s and accelerated in the first years of the new millennium until the outbreak of the financial crisis.

In many cases the Great Recession resulted in the stabilization or reduction of indebteness.

Ratio of household financial debt to GDP (percentages)

Source : OECD and Eurostat flow-of-funds database

…and the rising heterogeneity

Despite similar trends, differences in the level of household debt across countries increased considerably between 1995 and 2013.

Standard deviation of household financial debt/GDP ratio (33 countries)

Source : OECD and Eurostat flow-of-funds database

A change in the perspective

Before the subprime crisis and the global recession economists had regarded debt as an instrument for smoothing the inter-temporal allocation of consumers’ resources and for productive investment.

After the crisis academic analysts and international organisations began to point out the risks of excessive private debt .

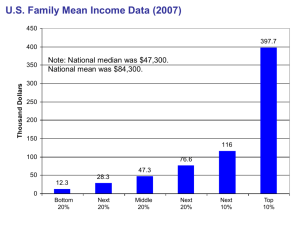

• Palumbo and Parker (2009) showed that during the years before subprime crises US household switched from being net lenders to being net borrowers.

Data signalled imbalances that should have been monitored.

Net lending (+)/Net borrowing (-) by US households

Source : Palumbo and Parker (2009)

Glancing over the literature

• Countries that experienced relatively fast household debt growth also had larger increases in insolvency rates ( T. Jappelli, M.

Pagano, M. Di Maggio 2013 ).

• The most extreme academic positions treat over-indebtedness in the same way as pollution. A tax on excessive debt would produce a better allocation of resources ( Jeanne and Korinek

2010, Bianchi and Mendoza 2010 )

• The common view is that an excessive debt is not a direct source of negative shocks to the economy, but it can worsen recession and hinder recovery (IMF 2012, Barnes and Young 2003, Tudela and Young 2005, Debelle 2004, Dynan and Kohn 2007 ).

In our paper

• Understanding the determinants of household debt is important.

• There are many works on the macro-economic determinants of household indebtedness ( e. g. T. Jappelli,

M. Pagano, M. Di Maggio 2013, Isaksen et al 2011, Zinni

2013)

• The novelty of this paper is to study 33 nations (27 countries of EU plus Japan, South Korea, Canada,

Australia, New Zealand and the US) over a long time span

(1995-2013).

A simple econometric equation

Where is household financial debt, are demand side factors and are supply side factors.

•

•

We refer to two major fields:

The life cycle hypothesis (Modigliani 1986, Davies et al 2011, Zinni 2012)

Institutional and comparative economics (La Porta et al 1997, Djankov et al 2007,

Jappelli et al 2010)

The life cycle hypothesis

The life cycle hypothesis looks at variables that can influence household demand for debt

• Per capita GDP

• GDP growth

• Financial and real assets

• Life expectancy

• Saving

Institutional and comparative economics

At least four variables can influence the supply of debt to households

• Legal origin (Anglo-Saxon vs the others)

• Quality of bankruptcy laws

• Quality of credit registers

• Time to resolve insolvencies

The data

• Annual data for 33 countries, from 1995 to 2013

• The dependent variable is taken from the flow of funds collected by the OECD and Eurostat

• The sources of the national account variables are the

OECD and Eurostat

• Legal origin (La Porta et al 1997)

• The other institutional variables are available on the World

Bank website (available from 2004)

The econometric results

Baseline Specification (1995 – 2013)

The role of institutional factors

[2004-2013]

The role of saving: a sample split

[1995-2006]

The role of saving: a sample split

[2007-2013]

What if public debt had a role?

•

We studied household debt without taking into account the indebtedness/balance sheets of other sectors.

• Given the implications of government debt consolidation for taxation and asset prices one could argue that household indebtedness and public finances are not independent:

High public debt could induce higher expectations (or lower benefits) of future taxation an hence could increase household saving (Ricardian equivalence) and reduce demand for loans.

A higher public debt could induce banks to be regular holder of government securities, implying a crowding out effects on loans to private sectors.

Specification with public debt

Main conclusions

1. Household debt is greater in richer countries, i.e. where

GDP per capita, financial and real wealth are greater.

2. Efficiency of institutional settings – bankruptcy laws and efficiency of recovery procedures – are powerful determinants of household debt.

3. The relationship with saving is significant only in periods of deleveraging.

4. Higher public debt is associated with lower household debt.

Future agenda

1.

Control for the effects of other factors such as tax treatment of interest payments, house price increases, financial innovation and openness, bank competition.

2.

Scrutinise better the endogeneity links between debt, saving, real and financial wealth.

3.

Sample splits.

4.

Investigate the nexus between household debt and inequality.

Thank you for your attention !

•

•

•

•

•

•

•

•

•

•

•

References

Bianchi J. and Mendoza E.G. (2010), “Overborrowing, financial crises and macroprudential taxes”, NBER Working Paper No. 16091

Davies J. B., S. Sandstrom, A. Shorrocks and E. Wolff (2011), “The Level and

Distribution of Global Household Wealth”, The Economic Journal , March, 223-254

Bouis R. (2015), “Household develeveraging and saving rates: a cross-country analysis”,

IMF draft.

Djankov, S., C. McLiesh and A. Shleifer A. (2007), “Private Credit in 129 Countries”,

Journal of Financial Economics , Vol. 84(2), 299-329

IMF (2012),

“Dealing with Household Debt”,

World Economic Outlook , Chapter 3, April

Isaksen J., Kramp P.L., Sorensen F., and Sorensen S.V. (2011),

“Household balance

Sheets and Debt – an international country study”, Denmark Nationalbank Monetary

Review 4 th Quarter, Part 2

Jappelli T., M. Pagano and M. di Maggio (2010), "Households’ Indebtedness and

Financial Fragility,", CSEF Working Papers 208, Centre for Studies in Economics and

Finance (CSEF), University of Naples

La Porta, R., F. Lopez de Silanes, A. Shleifer and R W. Vishny (1997), “Legal

Determinants of External Finance”, Journal of Finance , Vol. 52(3), pp. 1131-50

Modigliani F. (1986), “Life Cycle, Individual Thrift, and the Wealth of Nations”, American

Economic Review , 76 (2), 297-313

Palumbo M. and Parker J. (2009), “The integrated financial and real system of accounts for the united states: does it presage the financial crises?”, NBER Working Paper No.

14663

Zinni M. B. (2012),

“Essays in Household Financial Balance Sheets”, Ph.D. Thesis, Tor

Vergata University