Carbaugh, International Economics 9e, Chapter 11

advertisement

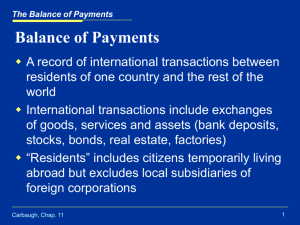

International Economics By Robert J. Carbaugh 9th Edition Chapter 10: The Balance of Payments Copyright ©2004, South-Western College Publishing The Balance of Payments Balance of Payments A record of international transactions between residents of one country and the rest of the world International transactions include exchanges of goods, services or assets “Residents” means businesses, individuals and government agencies, including citizens temporarily living abroad but excluding local subsidiaries of foreign corporations Carbaugh, Chap. 11 2 The Balance of Payments Double-entry accounting in the BOP All transactions are either debit or credit transactions Credit transactions result in receipt of payment from abroad Merchandise exports Transportation and travel receipts Income received from investments abroad Gifts received from foreign residents Aid received from foreign governments Local investments by overseas residents Carbaugh, Chap. 11 3 The Balance of Payments Double-entry accounting (cont’d) Debit transactions lead to payments to foreigners Merchandise imports Transportation and travel expenditures Income paid on investments of foreigners Gifts to foreign residents Aid given by home government Overseas investments by home country residents Each credit transaction has a balancing debit transaction, and vice versa, so the overall balance of payments is always in balance Carbaugh, Chap. 11 4 Structure of the Balance of Payments Current account Goods and services balance Merchandise trade balance Services balance Investment income (net) Unilateral transfers Private transfer payments Governmental transfers Carbaugh, Chap. 11 5 Structure of the Balance of Payments Capital and financial account All purchases or sales of assets, including: Direct investment Securities (debt) Bank claims and liabilities Official settlements transactions Carbaugh, Chap. 11 6 Current account Current account surplus and deficit Current account and capital & financial account balance each other; when one is in surplus the other must be in deficit Current account surplus means exports of goods and services, investment income and transfers exceed imports and outflows Current account deficit means imports of goods and services, and outflows are greater than exports and inflows; must be financed by borrowing (capital account inflows) Carbaugh, Chap. 11 7 Balance of Payments US Balance of Payments, 2001 ($ bill.) Current account Merchandise trade exports $720.8 imports -1,147.4 Net Services Travel & transport recpts. 13.4 other services, net 65.4 All services, net Balance on goods & services Carbaugh, Chap. 11 -426.6 78.8 -347.8 Cont’d. 8 Balance of Payments US Balance of Payments, 2001 ($ bill.) Current account (cont’d) Income receipts & payments investment income, net -13.7 employee compensation -5.4 All income, net -19.1 Unilateral transfers, net -50.5 Balance on current account Carbaugh, Chap. 11 $-417.4 9 Balance of Payments US Balance of Payments, 2001 ($ bill.) Capital & financial account Capital account transactions, net 0.7 Financial account transactions, net 455.8 Statistical discrepancy -39.1 Balance on capital & financial account $417.4 Carbaugh, Chap. 11 10 Balance of Payments US Balance of Payments 1970-2001 Carbaugh, Chap. 11 11 Balance of Payments Current account deficit a problem? Current account deficit has little to do with foreign trade practices or competitiveness Determined mostly by domestic macroeconomic conditions that cause demand to exceed supply and increase imports (paid for with borrowing) Whether a current account deficit is good or bad depends on whether the borrowed funds are used to pay for consumption or investment Carbaugh, Chap. 11 12 Balance of Payments Balance of international indebtedness Summarizes one nation’s overall quantity of assets and liabilities against the rest of the world Shows whether the nation is a net debtor or a net creditor Indicates sensitive items, such as short term debt held by foreigners which could be liquidated quickly, straining finances Carbaugh, Chap. 11 13