International Financial System

advertisement

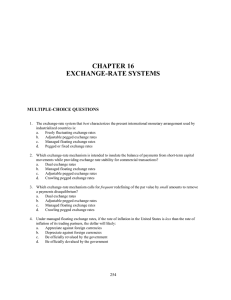

International Financial System The Gold Standard Gold Standard 1880-1914 Currencies valued in terms of their gold equivalent Mid 1870’s most major economies pegged to gold All currencies linked together in a system of fixed exchange rates Gold Standard Example Currency A worth 0.10 ounce gold Currency B worth 0.20 ounce gold 1 unit of B worth twice as much as 1 unit of A. Gold Standard pros and cons To achieve long run price stability Prices may rise and fall with swings in gold output National money supplies constrained by growth of stock of gold As long as gold stock steady prices steady Countries with balance of payments deficits outflows of gold , msreduce. The Interwar Period 1918-1939 WW 1 ended the gold standard Europe experienced rapid inflation USA little inflation so returned to gold standard in 1919. War ended Britain’s financial preeminicence USA World’s dominent banker country Interwar Period 1930’s depression years. Trying to stimulate domestic economies by increasing exports country after country had to devalue. Period of competitive devaluations. Run on US gold holdings at the end of 1931. USA abandoned the gold standard. The Gold Exchange Standard 1944-1970 Desire to reform the international monetary system led to an international conference at Bretton Woods , New Hampshire. US dollar key currency in the system. 1$= 1/35 ounce gold. Primary architects Harry White of US and Keynes of UK. Bretton Woods For countries experiencing difficulty maintaining their parity value new institution created. The International Monetary Fund International Monetary Fund Headquartered in Washington D.C Had 30 original member now 180. Given the task of promoting the growth of world trade, setting rules for maintenance of fixed exchange rates.making loans to countries facing balance of payments difficulties. Collecting and standardizing int economic data. IMF oversees the international monetary system promotes exchange stability and orderly exchange relations among its member countries assists all members--both industrial and developing countries--that find themselves in temporary balance of payments difficulties by providing short- to medium-term credits IMF supplements the currency reserves of its members through the allocation of SDRs (special drawing rights); to date SDR 21.4 billion has been issued to member countries in proportion to their quotas draws its financial resources principally from the quota subscriptions of its member countries has at its disposal fully paid-in quotas now totaling SDR 145 billion (about $215 billion) has a staff of 2,300 drawn from 182 member countries World Bank seeks to promote the economic development of the world's poorer countries assists developing countries through long-term financing of development projects and programs provides to the poorest developing countries whose per capita GNP is less than $865 a year special financial assistance through the International Development Association (IDA) World Bank encourages private enterprises in developing countries through its affiliate, the International Finance Corporation (IFC) acquires most of its financial resources by borrowing on the international bond market has an authorized capital of $184 billion, of which members pay in about 10 percent has a staff of 7,000 drawn from 180 member countries 1960’s In 1960 USA ; dollar crises due to run large balance of payments deficits By the late 1960’s foreign dollar liabilities of USA much larger than the US gold stock. Pressures of this dollar glut terminated Nixon declared 1971 dollar incovertible Close to the Bretton Woods era fixed exchange rates and convertible currencies. Transition Years 1971-73 Dec 1971 Smithsonian agreement dollar devalued by about 8% , surplus countrie’s curriencies revalued upward. June 1972 countries like Germany and Switzerland experiencing large inflows of speculative capital. They applied legal control to slow further movements of money. Transition Years Dollar still inconvertible. Speculative capital flows of 1972 further devaluation of dollar. An ounce of gold rose from $38 to $42.2 still speculative capital flows from weak to strong curr persisted. March 1973 major currencies began to float. Floating Exchange Rates 1973-to the Present System best described as managed float. Exchange rate systems; Flexible (floating),Managed Floating, Fixed Exchange Rate Systems. Exchange Rate Systems Floating -Flexible Flexible (floating) ; Value of the currency determined by the market. By the interactions of banks , firms other institutions.Seeking to buy , sell currency for purposes of transactions clearing, hedging, arbitrage and speculation Most OECD countries , US, Canada, Britain , Australia , European Monetary Union. Managed Float Hybrid of fixed exchange rate and flexible exchange rate system. Central Bank holds stocks of foreign currency. Intervenes in forex market by buying and selling foreign currency to keep exch rate at desired implicit target values. Fixed (Pegged) Exchange Rates Prior to 1970’s most countries operated under fixed exchange rate system. Exchange Rate of member countries fixed against US dollar , with the dollar in turn worth a fixed amount of gold. Why exch rates kept fixed?????? Fixed Exch Rates To facilitate trade Reducing fluctuations in relative prices. Reducing uncertainty Adjustable Pegged Exchange Rate Crawling Peg Central Bank fixes the value of the currency when it desires Crawling peg ; Fixed exchange rate system where fixed rate changes in a pre-determined manner . Floating Exchange Rates SDR SDR’s are special international reserve assets created by IMF. If trade is not heavily concentrated with USA diversified across several countries. More sensible to alter the currency value to a weighted average of foreign currencies. SDR Some countries choose to peg to the SDR (special drawing rights) A basket peg is choosen. Basket of currencies consisting of yen, euro , sterling , dollar.(today) The Choice Of an Exchange Rate System Country size in terms of economic activity or GDP important for choosing floating or pegging exchange rates. Large countries more independent , foreign trade constitutes smaller part of GDP.. Choice Of Exchange Rate System Openess of economy ; the degree to which country depends on international trade. The greater the fraction of tradable goods in GDP the more open the economy will be. The more open economy tends to follow a pegged exchange rate. Choice of Exc Rate Inflation rates ; Countries inflation experience above average tend to choose floating exch rates. Where exch rate is adjusted at short intervals to compensate for inflation differentials. Countries that trade with one single currency pegs their exchange rate to that currency. Conclusion Peggers ; small size , open economy,Harmonious inflation rate, concentrated trade. Floaters; Large Size , Closed economy , Divergent inflation rate , diversified trade.