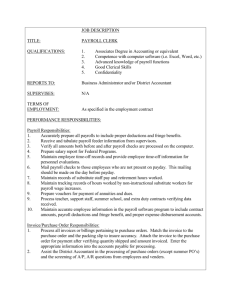

Chapter 11 production and payroll cycle including audit of inventory

advertisement

• Chapter 11 production and payroll cycle including audit of inventory valuation and capital assets 1 production 2 1. Production cycle typical activities (1)production planning(inventory planning). (2)produce goods and services. (3)cost accounting(cost accounting allocations, unit cost determinations, physical cost calculations). (4)determine cost of goods sold. • Authorization custody • recordingkeeping periodic reconciliation 3 Start here Cost of goods sold Reconciliation (analysis) Determine cost of goods sold Production planning Acquisition cycle Authorization Amortization schedule Inventory planning recordkeeping Cost accounting custody Periodic physical count Sales forecast Purchase labour, materials, and overhead Receive goods and services Produce goods and services (physical quantity) Payroll cycle Pay wages Revenue and collection cycle Inventory Orders Deliveries Deliver to customers (valuation) Accounts/Records Inventory Cost of goods sold Amortization Production cost analysis Production reports Quality control test reports Production orders Inventory plan Production plan Sales forecast 4 (1)Authorization Sales forecast production planning (inventory planning to production orders) Material, labour,timing Production orders Managers(s,p) Sign off the approval 5 Production report A Quality control test report Finished goods A Inventory record files 6 (2)custody MOVING inventory (materials into finished goods) Production order Completion of Production Good cost accounting and analysis Quality control test Supervisors and workers 7 (3)recordkeeping Production order, record of material and labour used Separation (inventory custodian, payroll department) Cost accounting department Overhead Depreciation amortization Cost-per-unit standard cost variances Cost of goods sold 8 (4)periodic reconciliation • ACTUAL asset and liability TO RECORDED account A. Physical count of inventory , perpetual inventory records B. vendors`s monthly statement, recorded accounts payable C.product Cost, prior experience or standard cost • lower-of-cost-or-market 9 Start here Cost of goods sold Reconciliation (analysis) Determine cost of goods sold Production planning Acquisition cycle Authorization Amortization schedule Inventory planning recordkeeping Cost accounting custody Periodic physical count Sales forecast Purchase labour, materials, and overhead Receive goods and services Produce goods and services (physical quantity) Payroll cycle Pay wages Revenue and collection cycle Inventory Orders Deliveries Deliver to customers (valuation) Accounts/Records Inventory Cost of goods sold Amortization Production cost analysis Production reports Quality control test reports Production orders Inventory plan Production plan Sales forecast 10 2.audit evidence in management reports Sales forecast Production plans and reports Amortization schedule 462 11 3.control risk assessment • • • • • • • Account balance (1)general control considerations (2)internal control questionnaire (3)production management--jit (4)detail test of controls audit procedures (5)direction of the test of controls procedures (6) summary:control risk assessment 12 Account balance • • • • • • • • Inventory: raw materials work in process finished goods cost of goods sold: amortization: amortization expense accumulated amortization 13 (1)general control considerations • A.Segregation of responsibility • B.Detail control checking procedures 14 (1)general control considerations • Segregation of responsibility • authorization • (pro,inv planning) • Custody cost accounting • reconciliation 15 Segregation of responsibility • A.authorization (production and inventory planning). • Custody, recording, reconciliation • B. Custody of inventory (raw materials, work in process, finished goods) • .authorize, purchase, cost accounting recordkeeping, prepare cost analyses (reconciliation) 16 Segregation of responsibility • C.cost accounting (recording) • Authorization, Custody • But prepare various analyses and Reconciliation • combination of 2 or more 17 Detail control checking procedures A.Production orders (a list of materials and the quantity, approved by planner) B. materials requisitions( compared with the list, signed by production operator and storeskeeper) 18 Detail control checking procedures • C.labour time record ON JOBS (signed by production supervisor; the cost accounting department should reconcile these cost amounts with the labour report from the payroll department) 19 Detail control checking procedures • D.production report(signed by production supervisor and finished goods inventory custodian, to cost accounting) computer (manual signatures and paper production orders, be imbedded in computer-controlled systems) 20 (2)internal control questionnaire • appendix 11A-1 21 (3)production management--jit • Just-in-time manufacturing • implemented in many companies • appendix 11B 22 (4)detail test of controls audit procedures • Exhibit 10-2 • detail test of control procedure: • A.样本总体 (population) • B.取证方法(action) • action: vouching, tracing, observing, scanning, recalculating • Exhibit 11-2 23 (5)direction of the test of controls procedures • Exhibit 11-3 • Exhibit 11-4 • Exhibit 11-5 • why? 24 Cost accounting Production planning department Production orders Issue slips Bill of materials Material used report Labour reports Manpower needs Production cost report Production cost report 5-b Match 5-c Trace Sample Trace 5-d Authorized 5-a 25 Production Materials requisitions and bills of materials Cost accounting Issue slips, Materials used reports Production cost reports Overhead analysis Labour reports 2-d Sample Vouch labour Vouch materials 2-e Compare materials General ledger (inventory) Same sample 2-b Compare labour 2-c Vouch overhead recalculate 2-e,f 2-a 26 (6) summary:control risk assessment • CONTROL RISK IS LOW • CONTROL RISK IS high 27 3.audit cases: substantive audit procedures Casette 11.1 unbundled before its time 28 problem • Production “sold” as finished goods before actual unit completion. • Understated inventory • overstated cost of goods sold • overstated revenue • overstated income 29 Method • Western corporation • assembled and sold computer system A system Production order After finished installation Hardware equipment software contract pay the price for the entire package 30 Unbundled • Work-in-process inventory account hardware Sales revenue cost of goods sold software Other Revenue, cost A billing statement Unbilled contract revenue Accounts receivable 31 Paper trail • Customer orders contracts Hardware and software production orders Production cost accumulation work-in-process inventory record production report production cost report 32 Amount • Overstatement • 3 years • 12%,15%,19% • of • Income before taxes 33 Audit approach • Objective • occurrence of cost • completeness of recorded inventory 34 control 1.production planning department approval of orders as a total unit. 2.cross-referenced , • Can see them as same order unit 35 Test of controls • 200-250 production orders • vouched to the underlying customer orders and contracts, validity, proper period. • Enquiry the standard procedures for the time of revenue and cost of goods sold recognition. • 36 Audit of balance • A.dual purpose test • B.points: the dollar amounts accounts accumulated as cost of contracts and proper cutoff for recording the cost. • C.red flag:unbilled contract revenue. 37 Discovery summary • audit firm • Purchasing complete software packages from other developers. 38 Break:5 minutes • 39 4.Part 2:payroll cycle • Activities Personnel hiring/firing Compensation determination Supervision attendance and work Payroll accounting Payroll distribution Cash distribution 40 Acquisition payment cycle Start here and Cash disbursemte nt Cash disbursement (reconciliation) Payroll cheques Production cycle Payroll distributio n Authorization Custody Payroll accounting Personnel hiring/firing Compensation determination Recordkeepin g Payroll register Yearto-date Earning s records Timekeepin g records Government tax reports Termination notice Union contract Other approval Deduction authorizations Employee benefits Supervisionl, affendance, and work Cost accounting Labour cost analyses ere Employment application Personnel files Employees’ T-4 forms Accounts/Records Wages expense and accrual Payroll tax expense and liability Pension expense and liability Accrued employee benefits Expensea and Liability Cash disbursements 41 (1)Separate people or department • • • • • Personnel and labour relation---hiring/firing supervision--approval of work time timekeeping and cost accounting payroll accounting payroll distribution 42 (2)authorization Personnel or labour department • • • • Add new employees to payroll delete terminated employee obtain authorization for deduction transmit authority for pay rate changes to payroll department. SUPERVISOR Approve all pay base data (hours, job number, absence, time off allowed). 43 (3)custody • Paycheques ,cash, electronic transfer codes • payroll distribution function: control the delivery of pay to employees, not be returned to persons involved in other-fun. • timekeeping function: • supervisors access to time cards or time sheets. • the timekeeping devices, the employee. 44 (4)recordkeeping • • • • Prepare individual paycheques, pay envelopes. Year-to-date earnings records tax reports payroll tax returns federal T-4 summary. Authorization and custody //prepare the payroll 45 (5)Periodic reconciliation • Payroll bank account ,bank statement • Comparing “real payroll” to recorded wages. • Sent supervisor a copy of the payroll register, showing the employees paid under the authority and responsibility. Reapprove the payroll after it is completed. Notice whether any persons not approved. • Payroll report, the labour records used. 46 (6)Employees on fixed salary • The system is simplified • even nonexistent. 47 5.audit evidence in management reports and file • • • • • • • Personnel files timekeeping records payroll register labour cost analysis governmental and tax reports year-to-date earnings records employee T-4 reports. 48 6.control risk assessment • THE MAJOR RISKS • PAYING fictitious “employees” • overpaying for time or production • incorrect accounting for costs and expenses. 49 6.control risk assessment • • • • • • • (1)general control considerations (2)computer-based payroll (3)internal control questionnaire (4)detail test of control audit procedures (5)direction of the test of controls procedures (6)computerized payroll processing (7)summary:control risk assessment 50 (1)general control considerations • Segregation of responsibility • authorization • Custody cost accounting • reconciliation 51 Segregation of responsibility • A.authorization//payroll preparation, paycheque distribution, reconciliation. • B. payroll preparation// authorization, payroll cheques • C.recordkeeping// // authorization,distribute pay. 52 Detail control checking procedures • (1)periodic comparison of the payroll register to the personnel department files to check hiring and terminated employees not deleted. • (2)periodic rechecking of wage rate and deduction authorizations 53 Detail control checking procedures • (3) reconciliation of time and production paid to cost accounting calculations • (4) reconciliation of YTD earning records with tax returns • (5)payroll bank account reconciliation . 54 (2)computer-based payroll • Various paper records and approval signatures may not exist. • they may all be imbedded in computerized. • 嵌入 • chapter 19 55 (3)internal control questionnaire • Appendix 11A-2 56 (4)detail test of control audit procedures • A.样本总体 (population) • B.取证方法(action) • action: vouching, tracing, observing, scanning, recalculating • Exhibit 11-7 57 (5)direction of the test of controls procedures • 2 directions:completeness, validity • understand • why? • E11-9 E11-8 58 Personnel files Payroll department Authorization files Payroll registers Trace rates, deductions Sample A-1-c Review, trace to authorization A-1-a A-1-b B-1-a or B-1-a Vouch rates, Sample deductions 59 (6)computerized payroll processing • Reference files • dynamic files • the test of controls procedures 60 (7)summary:control risk assessment • Control risk is low or high 61 Casstte 11.3 time card forgeries Nurse jane Time card shift supervisor work paid Leasing agency bills M hospital 62 method • Agency time card showed approval signatures of a county nursing shift supervisor. • The shift supervisor had been terminated. • 1-2 days, 40-hour work week. • Claim payroll hours on the false time card. 63 Paper trail • (1)ward shift logs. • (2)personnel records( the own nurses, supervisors, and other employees). 64 amount • 24 e.h × $22/h=$528 • 15 weeks, $7900 • friends, $24000 65 Audit approach • Objective • valid employees • actual time worked • authorized pay rate 66 control • Authorization: contract for nursing time,rate • ward shift log • supervisors approve time card. • Agency billings( contract, time card) • prepare paycheques. 67 Test of control • weakness • Nobody compared the card shift logs to time card. • Nobody examined the supervisory signatures for their validity. • Auditor • Enquiry about error-checking procedures, follow. 68 Audit of balance • (1)Vouch rates billed to the contract. • (2)vouch time claimed to the ward shift logs • (3)compare handwriting example to the approval signatures on the time cards. • (4)using personnel records to determine the supervisors were actually employed. • (5)using the work attendance records to determine the supervisors were on duty. 69 discovery • (1)Had not signed in on the ward shift logs. • (2) supervisors were not employed at the time. • (3) signatures were not written by the supervisors. • $32,900 WAS REFUNDED. 70 Auditing assignments(13) • • • • 1. prepare chapter 12. 2.下列各题,每人自我练习,不交。 11.3, 11.4, 11.10, 11.17,11.21,11.22,11.36 3.下列各题,每人均做,书面完成 ,提交。 11.40--11.50, • 11.61,11.63, 11.64,11.69 • 4.小组完成案例:11.2, 11.4 71